Automotive Logistics Market Insights, 2031

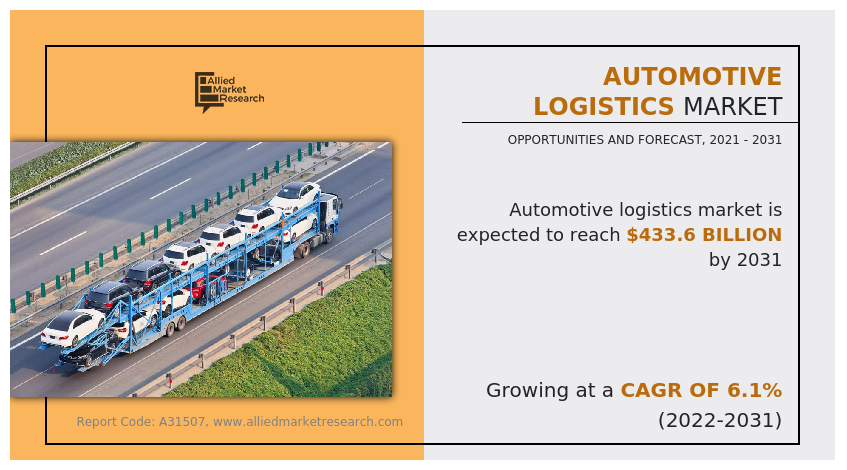

The global automotive logistics market was valued at USD 241.7 billion in 2021, and is projected to reach USD 433.6 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.

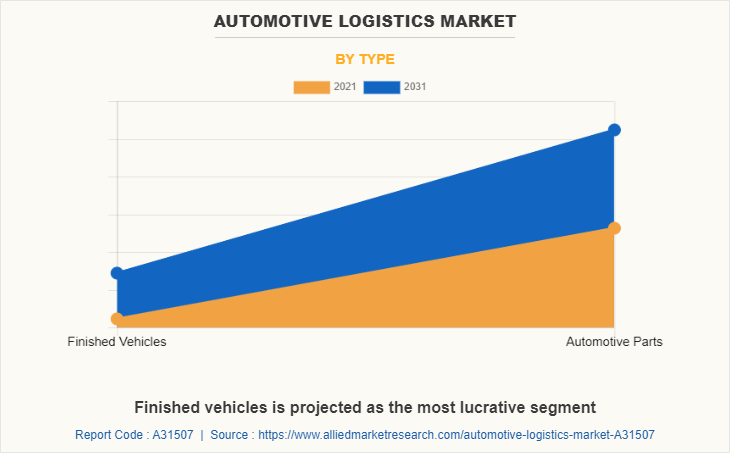

Automotive logistics is widely known as the process of coordinating and moving resources, such as equipment, inventory, and materials associated with finished vehicles and automotive parts from one location to the desired destination. It is the management of the flow of goods from one point of origin to the point of consumption, to meet the requirement of customers. Logistics management focuses on the efficiency and effective management of daily activities concerning the production of the company’s finished goods and services. This type of management forms a part of the supply chain management; and plans, implements, & controls the efficient, effective forward, reverse flow, and storage of goods.

Growth of the global automotive logistics market is propelling, owing to growth in international trade, expansion of the e-commerce industry globally, and rise in the free trade agreements between nations. However, stringent emission regulations restrain the growth of the market. Furthermore, technological advancements are factors expected to offer growth opportunities during the forecast period.

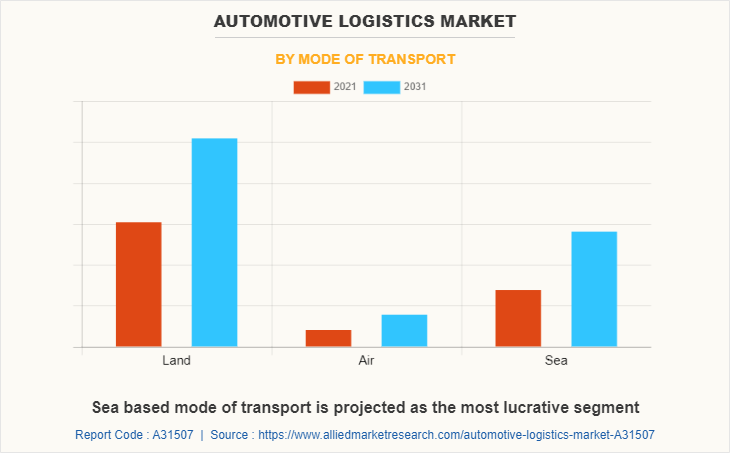

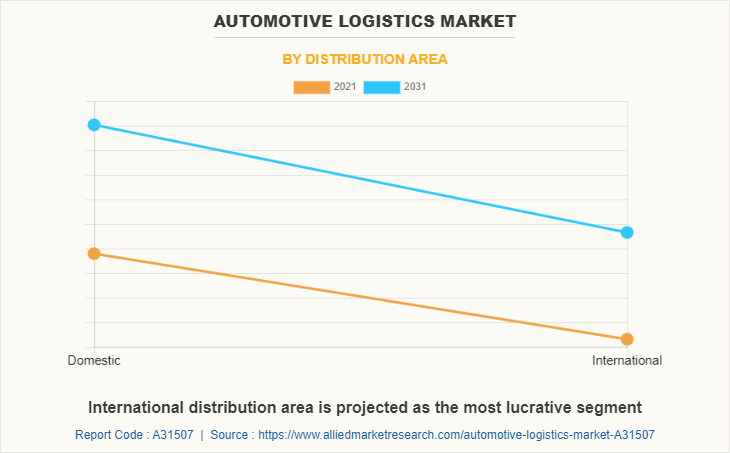

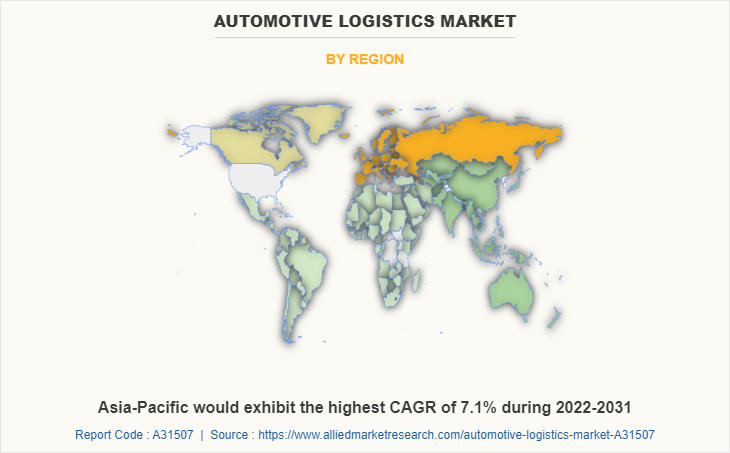

The automotive logistics market is segmented on the basis of service, mode of transport, type, distribution area, and region. By service, it is segmented into warehousing, and transportation. By mode of transport, it is segmented into land, air, and sea. By type, it is classified into finished vehicles and automotive parts. By distribution area, the market is categorized into domestic and international. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the automotive logistics market report comprises A.P. Moller-Maersk, CEVA Logistics AG, C.H. Robinson Worldwide, Inc., DB Schenker, Deutsche Post AG, DSV A/S, FedEx Corporation, Hellmann Worldwide Logistics, Kuehne+Nagel International AG, Nippon Express Co., Ltd, Schenker Deutschland AG, and United Parcel Service of America, Inc.

Growth in international trade

International trade is the exchange of goods and services between countries and continents. It has an important share in GDP in different countries. Recently, COVID-19 affected the international trade across the globe and resulted in slowdown of economic activities among countries. The COVID-19 pandemic brought global economy to a standstill and decline in international trade activities was observed. Emerging countries, such as China and India also faced temporary suspension of manufacturing and logistics activities, owing to government enforced lockdown.

However, as the COVID-19 vaccine was introduced and lockdown restrictions were lifted, international trade activities started to resume. Several major trading economies observed rise in exports and imports levels in 2021. In addition, as per the United Nations Conference on Trade and Development (UNCTAD), the global trade has reached a record level of $28.5 trillion in 2021, which is an increase of 25% as compared to 2020 and 13% as compared to 2019.

Moreover, rise in e-commerce activities also contributed toward the growth of international trade and is expected to continue to contribute in upcoming years. Thus, growth in international trade is the major factor that drives the growth of the automotive logistics market during the forecast period.

Expansion of e-commerce industry globally

E-commerce refers to buying and selling of goods by using internet. E-commerce is a virtual store where goods & services do not require any physical space and are sold through websites. The e-commerce industry utilizes logistics services to manage and oversee supply chain of e-commerce companies, thus, allowing these companies to focus on marketing and other business operations. Easy accessibility, convenient shopping experiences, and heavy discounts & offers make e-commerce a popular medium for purchase of a wide variety of products. These factors have collectively contributed toward the growth of the automotive logistics market for e-commerce services.

Moreover, rise of the e-commerce industry has forced automotive logistics to adopt digital technologies to address the increasing demand from customers. They have also started to use artificial intelligence, internet of things (IoT), and other technologies to ensure timely delivery of goods or products to customers. Thus, expansion of the e-commerce industry globally propels the growth of the automotive logistics market.

Rise in free trade agreements between nations

A free trade agreement (FTA) is an agreement between two or more countries, under which countries agree on certain terms & conditions that affect trade in goods and services. The signing of free trade agreements facilitates better trade between two parties and results in rise in import–export activities, which boosts development of the entire logistics ecosystem. Reduction or elimination of tariffs, intellectual property protection, and fair treatment of investors are some of the important advantages of free trade agreements.

In addition, the U.S. currently has 14 free trade agreements with 20 countries in force. For the U.S., the main aim of trade agreement is to reduce barriers to the U.S. exports, protect the U.S. interests competing abroad, and enhance rule of law in the FTA partner country or countries.

Similarly, in Asia-Pacific, China, Singapore, and India have 47, 44, and 44 FTAs, respectively, which offer lucrative opportunities for logistics to thrive and support the economy of the nations. Moreover, in December 2021, a new Asia-Pacific free trade agreement was introduced, which was set to enter into force on January 1, 2022.

The Regional Comprehensive Economic Partnership (RCEP) includes 15 East Asian and Pacific nations of different economic sizes. The RCEP will become the largest trade agreement globally as measured by the GDP of its members; eliminate 90% of tariffs among 15 East Asian and Pacific countries; and is expected to boost intraregional exports by $42 billion. Thus, such types of free trade agreements are expected to increase the import and export activities, which in turn are expected to drive the growth of the automotive logistics market during the forecast period.

Stringent emission regulations

Automotive logistics use ships, aircrafts, and commercial vehicles to transport goods or products from one place to another. All modes of transportation utilize fossil fuels to run vehicles, which produce harmful emission and contribute in increasing the level of pollution. Therefore, several environmental and sustainability policies targeted at improving fuel efficiency and cutting harmful emissions are being implemented across the globe.

For instance, in February 2020, International Maritime Organization (IMO) introduced new regulations to reduce the emission from ships. As per the new regulation, the limit for sulphur in fuel oil used on board ships operating outside designated emission control areas was reduced to 0.05% m/m (mass by mass). In addition, in 2020, the U.S. Environmental Protection Agency (EPA) confirmed the greenhouse gas emission criteria for airplanes used in commercial applications.

Ships are used in seaborne trade, which contributes about 80% of total international trade as it costs less as compared to other modes of transportation. Moreover, air freight is crucial for faster delivery of time-sensitive and expensive goods, especially for long-distance consignments. Therefore, introduction of stringent emission regulations force shipping companies to adopt new technologies and solutions, which in turn is expected to result in increase in freight cost and other operational cost. Thus, stringent emission regulations restrain the growth of the automotive logistics market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive logistics market analysis from 2021 to 2031 to identify the prevailing automotive logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive logistics market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive logistics market trends, key players, market segments, application areas, and market growth strategies.

Automotive Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 433.6 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 308 |

| By Mode of Transport |

|

| By Distribution Area |

|

| By Service |

|

| By Type |

|

| By Region |

|

| Key Market Players | Kuehne+Nagel International AG, Nippon Express Co., Ltd., C.H. Robinson Worldwide, Inc., geodis SA, Deutsche Post DHL Group, A.P. Moller – Maersk A/S, Hellmann Worldwide Logistics, United Parcel Service of America, Inc., CEVA Logistics AG, DSV A/S, FedEx Corporation, Schenker Deutschland AG |

Analyst Review

The global automotive logistics market is expected to witness significant growth due to increase in international trade, expansion of the e-commerce industry globally, and rise in free trade agreements between nations.

Several technological advancements have been taking place in the freight industry, which directly contributes in the expansion of the freight industry. Artificial intelligence integration is gaining traction in the automotive logistics market. Artificial intelligence compile real-time data, enter it into a transport management system (TMS), and trigger a set of activities, which in turn provides updates about the container or shipment status. In a similar manner, internet of things (IoT) enables the freight industry to track shipments and their status efficiently by making use of sensors, databases, and cloud systems.

Moreover, technologies such as advanced machine learning and cloud-based solutions that are being developed are expected to contribute in increasing freight transportation performance and efficiency. Thus, technological advancements are expected to offer lucrative opportunities for the automotive logistics market during the forecast period.

Key players operating in the market include A.P. Moller – Maersk A/S, CEVA Logistics, C.H. Robinson Worldwide, Inc., DB Schenker, Deutsche Post DHL Group, DSV Panalpina A/S, FedEx Corporation, Hellmann Worldwide Logistics, Kuehne+Nagel International AG, Nippon Express Co., Ltd., and United Parcel Service of America, Inc.

The global automotive logistics market was valued at $241.7 billion in 2021, and is projected to reach $433.6 billion by 2031,

The global automotive logistics market is projected to grow at a compound annual growth rate of 6.1% from 2022 to 2031.

Growth of the global automotive logistics market is propelling, owing to growth in international trade, expansion of the e-commerce industry globally, and rise in the free trade agreements between nations. However, stringent emission regulations restrain the growth of the market. Furthermore, technological advancements are factors expected to offer growth opportunities during the forecast period.

The largest regional market is Asia-Pacific.

The top companies in the market include A.P. Moller-Maersk, CEVA Logistics AG, C.H. Robinson Worldwide, Inc., DB Schenker, Deutsche Post AG, DSV A/S, FedEx Corporation, Hellmann Worldwide Logistics, Kuehne+Nagel International AG, Nippon Express Co., Ltd, Schenker Deutschland AG, and United Parcel Service of America, Inc.

Loading Table Of Content...