Automotive OEM Telematics Market Insights, 2032

The global automotive OEM telematics market size was valued at $88.1 billion in 2022, and is projected to reach $321.3 billion by 2032,, registering a CAGR of 15.1% from 2023 to 2032.

Report Key Highlighters:

- The automotive OEM telematics market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive OEM telematics market share is highly fragmented, into several players including Continental AG, Maruti Suzuki, Verizon, BMW AG, Toyota Motor Corporation, Renault Group, Mercedes-Benz Group, Ford Motor Company, Nissan Motor Co., Ltd., General Motors, among others. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Telematics technology is used to monitor a wide range of information related to an individual vehicle or an entire fleet, which is majorly used by fleet management and automobile insurance companies. Telematics systems gather vehicle’s location, driving pattern, engine diagnostics, and vehicle activity, and this data is visualized on software platforms, which helps fleet managers to take decisions and manage resources accordingly.

Technological advancements followed by adoption of various technologies such as in-car infotainment, in-vehicle connected features and advanced driver assistance systems in vehicles will positively influence the growth of the automotive OEM telematics market demand. In addition, the introduction of telematics in vehicles has increased the performance of GPS and diagnostic systems, through which the speed and internal behavior of the vehicle are recorded. Auto insurance companies and fleet companies use telematics systems primarily to monitor the location and behavior of vehicles. Automakers choose between mutually exclusive connectivity options such as built-in telematics, connected devices and integrated smartphones, increasing system performance accordingly. All these factors are propelling the growth of automotive OEM telematics industry.

Significant factors impacting the automotive OEM telematics market growth include integration of real-time fleet monitoring systems in vehicles, ease in integration of vehicle diagnosis, and rise in trend of connectivity solutions. In addition, intelligent transport systems, better driver, and vehicle safety present significant opportunities for market expansion.

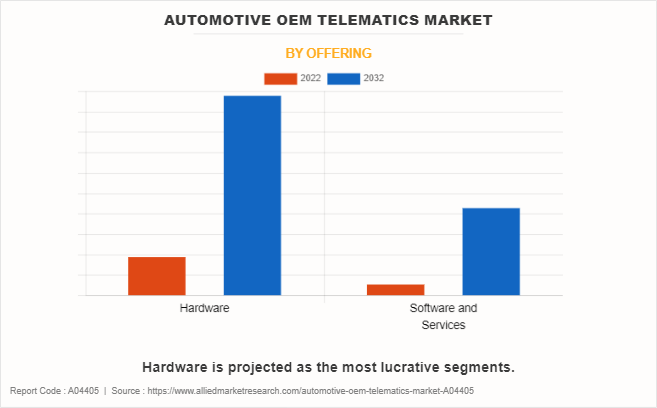

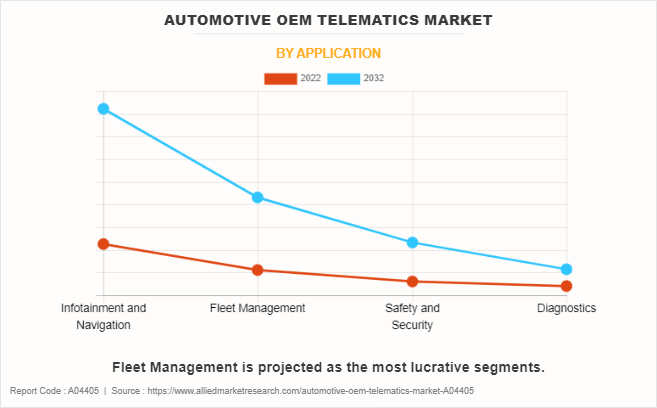

The automotive OEM telematics market is segmented into offering, vehicle type, application, and region. On the basis of offering, the market is segmented classified into hardware, software, and services. On the basis of vehicle type, it is categorized into passenger vehicle and commercial vehicle. By application the market is divided into infotainment and & navigation, fleet management, safety and & security, and diagnostics. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The North American automotive telematics market is expected to grow at a considerable rate during the forecast period, owing to rise in need to manage fleet in a more efficient way, technological advancements, and increase in concerns over safety of vehicle & driver. Increased demand for smart fleet management systems, smart technologies, government initiatives, and advent & integration of IoT & information, communication, & technology particularly into automobiles are the factors responsible for the market growth. Increase in demand for smart transportation and concern of users toward environments are the major factors for which the automotive OEM telematics manufacturers are focusing to bring more advanced systems in the market. Investment in emerging areas of smart cities and innovation in fleet management in different transportation modes are expected to provide lucrative opportunities for the automotive OEM telematics market.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In January 2020, Samsung partnered with BMW to bring first 5G TCU (Telematics Control Unit) in the market. The BMW iNEXT is the world's first automobile to be outfitted with 5G technology from HARMAN and Samsung.

Integration of real-time fleet monitoring systems in vehicles

Fleet operators can track their vehicles in real-time and check if drivers are following the suggested path or any diversions on road. For such fleet management, cloud-based solutions such as AI, IoT, and big data, are used to collect primary data. In addition, Techwave Consulting Inc., is using sensors that can be embedded in vehicles to monitor high-value goods, as they connect to the cloud and transmit the data in real time.

Furthermore, activities that are crucial in smart fleet management include vehicle & driver tracking, asset management, two-way communication, driver safety & time management, rescheduling the delivery task, and others. Moreover, introduction of innovative products and advantages of using smart fleet management services such as quick access & response, wide-area coverage, and cost reduction, help vendors to increase their productivity and efficiency, which boost the demand for smart fleet management services used for automotive OEM telematics.

Ease in integration of vehicle diagnosis

Advanced diagnostic system is expected to boost the growth of the automotive telematics market. In advanced diagnostics, the system in the car is expected to supply data of the vehicle to both the automobile dealer and the customer, which can help predict potential automobile issues before they take place.

In fleet management, it is easy to track vehicle records and decide which vehicle has travelled the most and accordingly offer service with the help of connectivity solutions. The diagnostic service offered is an efficient way to know the status of the vehicles. It allows the consumers to manage the maintenance of their vehicle, thus saving money and time by avoiding unwanted expenses & breakdowns. The system provides a maintenance schedule and timely reminders to the consumer. The diagnostic system keeps a track of the smoke emission and fuel consumption of the vehicles, thereby monitoring its engine health. This service sends a detailed report about the vehicle to decide the service schedules for the automobile. Thus, ease of vehicle diagnosis with the help mobile applications is expected to fuel the growth of the market.

High installation cost

The additional costs incurred while providing connectivity in the vehicle is expected to restrict the growth of the automotive telematics market. Providing connectivity solutions in the vehicle incurs additional expenses to the consumers in the form of hardware, connectivity solutions, and telecom service charges. These additional costs bestowed upon the consumer have a significant impact on the automotive telematics market. Thus, high installation cost of telematics systems in vehicles is expected to hinder the market.

Intelligent transportation system

The safety services offered in vehicles with OEM telematics solutions are an appropriate example of cutting-edge aftermarket technology, which involves sharing data between the vehicle and the humans.

Safety is a combination of telecommunication and automobile technology used to improve vehicle efficiency, reduce fuel consumption & maintenance cost, enhance security & safety measures, and assist the driver to enhance his overall driving experience. Features such as live traffic updates, automatic toll transactions, insurance telematics, road-side assistance in case of accidents or breakdowns, and smart routing & tracking, are expected to provide an exponential growth opportunity for the key players operating in the automotive OEM telematics market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive oem telematics market analysis from 2022 to 2032 to identify the prevailing automotive oem telematics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive oem telematics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive oem telematics market trends, key players, market segments, application areas, and market growth strategies.

Automotive OEM Telematics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 321.3 billion |

| Growth Rate | CAGR of 15.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 276 |

| By Offering |

|

| By Application |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Ford Motor Company, General Motors, Nissan Motor Co. Ltd., BMW AG, Maruti Suzuki India Limited, Continental AG, Verizon, Mercedes-Benz Group AG, TOYOTA MOTOR CORPORATION, Renault Group |

Software and services development upcoming trends of Automotive OEM Telematics Market in the world

Fleet Management is the leading application of Automotive OEM Telematics Market.

North America is the largest regional market for Automotive OEM Telematics

$88.1 billion is the estimated industry size of Automotive OEM Telematics

Continental AG is the top companies to hold the market share in Automotive OEM Telematics

Loading Table Of Content...

Loading Research Methodology...