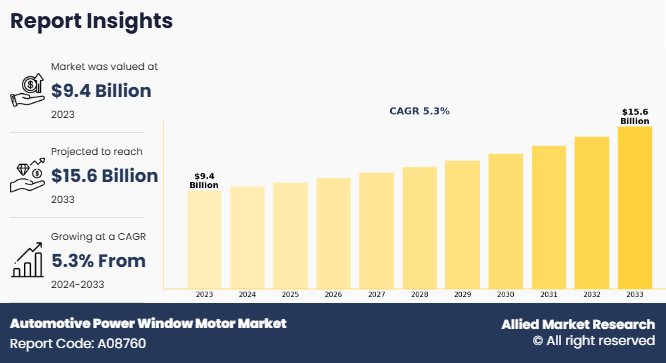

The global automotive power window motor market size was valued at $9.4 billion in 2023, and is projected to reach $15.6 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

Report Key Highlighters:

- The automotive power window motor industry study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the automotive power window motor industry are Denso Corporation, Robert Bosch GmbH, Mitsuba Corp., Brose Fahrzeugteile GmbH & Co. KG, Continental AG, Aisin Corporation, Johnson Electric Holdings Limited, Inteva Products, Nidec Corporation, Mabuchi Motor Co., Ltd., Surabhi Automotive Private Limited, and Valeo. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An automotive power window motor is a critical component of a vehicle's power window system, responsible for enabling the automated opening and closing of windows with minimal effort. This motor is typically a compact electric device integrated within the door panel of a vehicle, designed to convert electrical energy into mechanical motion to control the window's movement. The motor is part of a broader assembly that includes regulators, switches, and wiring, all working together to ensure smooth and reliable operation. Power window motors are engineered to meet specific requirements of durability, efficiency, and noise reduction, making them suitable for frequent use over the vehicle's lifespan.

Modern power window motors come in three primary types: brushed DC motors, brushless DC motors, and stepper motors, each suited to specific vehicle needs. Brushed DC motors are cost-effective and widely used in budget and mid-tier vehicles for their simplicity and reliability. Brushless DC motors, favored in premium and electric vehicles, offer enhanced efficiency, quieter operation, and longer lifespan. Stepper motors, used in niche applications, provide precise control and are typically found in high-end vehicles requiring fine-tuned adjustments. These motor types reflect the growing innovation and diversity in automotive power window systems. Advanced features such as anti-pinch functionality, designed to detect obstructions and prevent injury, are increasingly integrated into these motors, particularly in high-end vehicles. In addition, the design and specifications of power window motors vary based on factors such as vehicle size, window weight, and regional safety regulations.

Automotive power window motors are predominantly used in passenger cars, light commercial vehicles, and electric vehicles. The market growth is driven by surge in adoption of comfort and convenience features in modern vehicles.

The growth of the global automotive power window motor market is driven by rise in adoption of electric vehicles (EVs), surge in demand for comfort & convenience features, and increase in vehicle production. However, factors such as cost pressures impacting profit margins and the high costs of advanced motors restrain market growth. On the contrary, the integration with smart and connected vehicles and the rise in penetration of electric vehicles in developing markets are expected to provide lucrative growth opportunities for the market.

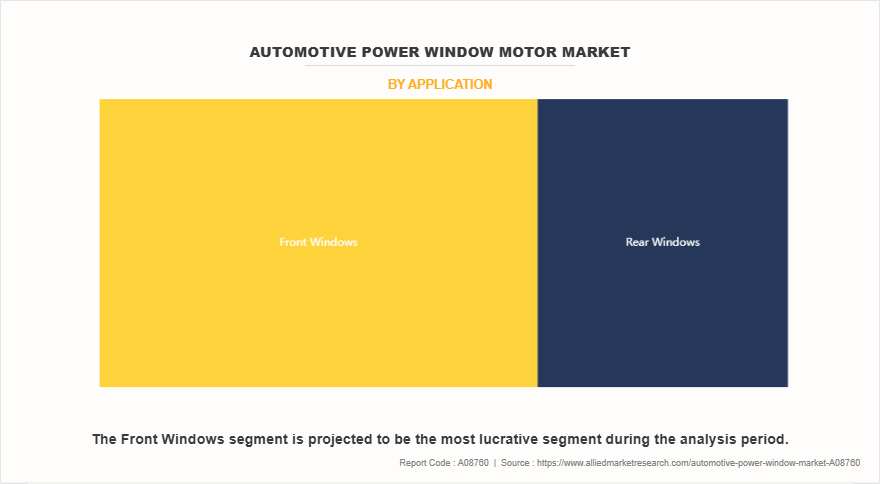

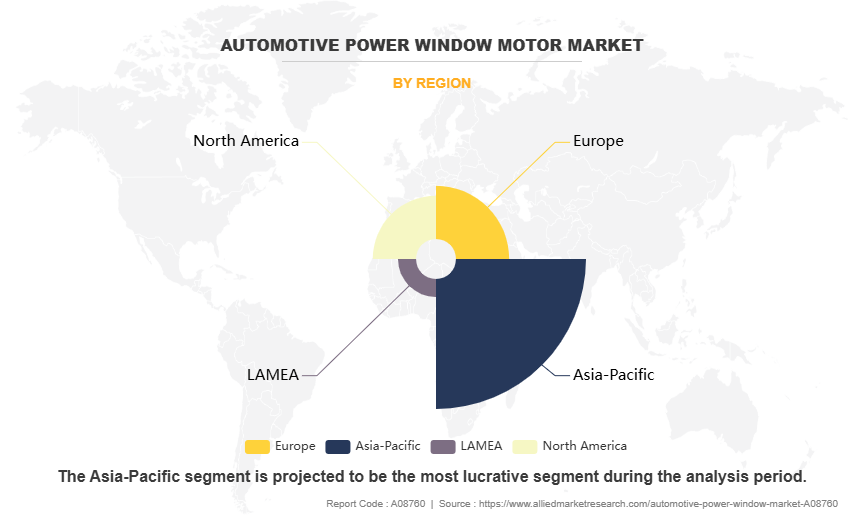

The automotive power window motor market is segmented on the basis of vehicle type, motor, distribution channel, application, and region. By vehicle type, the market is categorized into passenger cars, commercial vehicles, and electric vehicles. By motor, it is divided into DC brushed motors, DC brushless motors, and stepper motors. By distribution channel, it is bifurcated into OEM and aftermarket. By application, the market is classified into front windows and rear windows. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include Denso Corporation, Robert Bosch GmbH, Mitsuba Corp., Brose Fahrzeugteile GmbH & Co. KG, Continental AG, Aisin Corporation, Johnson Electric Holdings Limited, Inteva Products, Nidec Corporation, Mabuchi Motor Co., Ltd., Surabhi Automotive Private Limited, and Valeo.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In November 2024, Inteva Products opened its manufacturing facility in Pune, India with $3.3 million investment. This strategy helps to enhances its production capacity and operational efficiency to meet the increasing demand from India’s rapidly growing automotive sector. This expansion project will increase the plants production space by 70 per cent, expanding to a total of 85,000 square feet.

- In May 2022, Aisin Corporation launched window regulator line for Asian, domestic and European applications. Through this strategy, it focuses on manufacturing high-quality window regulators designed for smooth, reliable, and efficient operation in vehicles. These regulators cater to a wide range of vehicle models, emphasizing safety, ease of installation, and enhanced user comfort.

Segmental analysis

The automotive power window motor market is segmented on the basis of vehicle type, motor, distribution channel, application, and region. By vehicle type, the market is categorized into passenger cars, commercial vehicles, and electric vehicles. By motor, it is divided into DC brushed motors, DC brushless motors, and stepper motors. By distribution channel, it is bifurcated into OEM and aftermarket. By application, the market is classified into front windows and rear windows. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

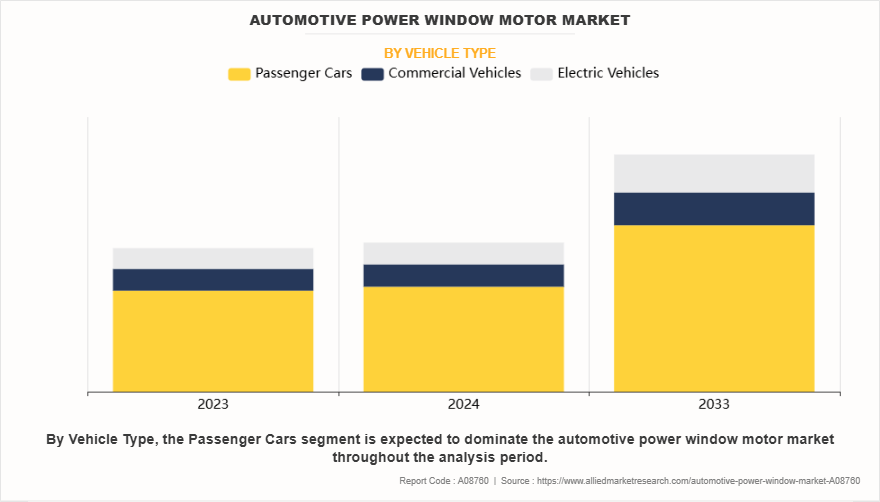

By Vehicle Type

By vehicle type, the market is categorized into passenger cars, commercial vehicles, and electric vehicles. The passenger cars segment accounted for the largest automotive power window motor market share in 2023, driven by the increasing demand for comfort and convenience features in personal vehicles. As urbanization and disposable incomes rise globally, consumers are prioritizing vehicles with advanced amenities, including power windows.

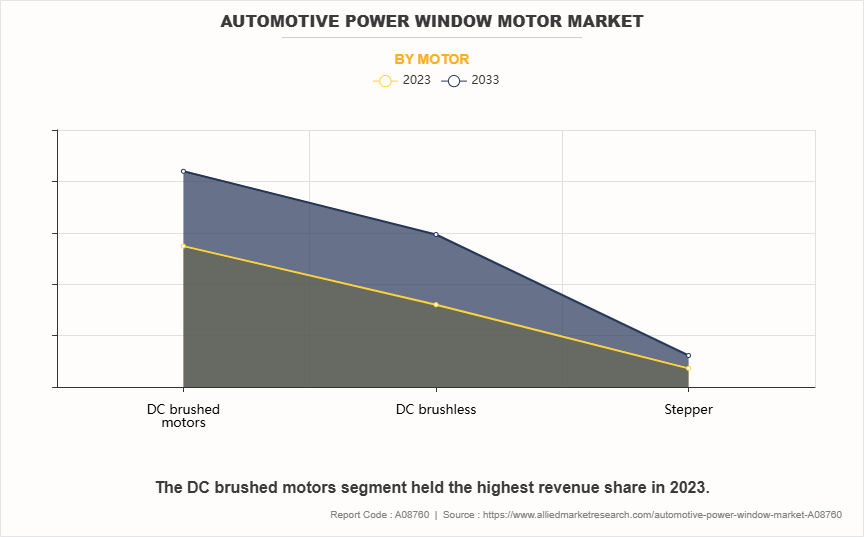

By Motor

By motor, it is divided into DC brushed motors, DC brushless motors, and stepper motors. The DC brushed motors segment accounted for the largest market share in 2023, due to their low cost and widespread adoption in budget and mid-tier vehicles. These motors are simple in design and easy to produce, making them ideal for price-sensitive markets and high-volume production. These motors are widely used in budget and mid-range vehicles, especially in developing regions such as Asia Pacific and Latin America, where cost-effective solutions are preferred.

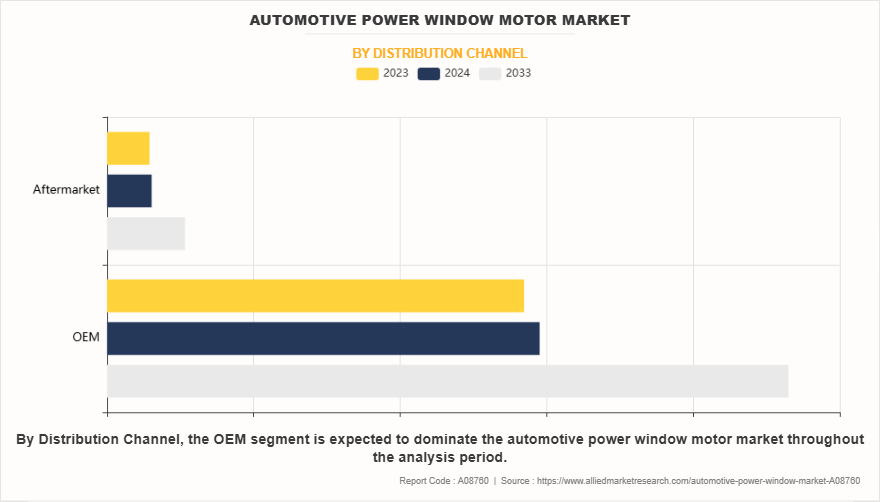

By Distribution Channel

By distribution channel, it is bifurcated into OEM and aftermarket. The OEM segment accounted for a dominant market share in 2023, as these components are primarily installed during vehicle production. The growth of this segment is closely tied to global vehicle production trends. According to OICA, global vehicle production reached approximately 93 million units in 2023, with passenger cars and commercial vehicles driving demand. Automakers are increasingly standardizing power windows across all vehicle models, even in emerging markets, to meet consumer expectations.

By Application

By application, the market is classified into front windows and rear windows. The front windows segment accounted for a dominant market share in 2023, due to their higher usage frequency and the critical role, they play in enhancing driver and passenger convenience. The motors used in front windows are often larger and more robust than those for rear windows, as they need to support frequent operation and, in many cases, more advanced features. Anti-pinch technology, which prevents injury or damage by detecting obstructions, is commonly integrated into front window systems, especially in mid-tier and premium vehicles.

By Region

Region wise, Asia-Pacific held the largest market share in 2023, due to its large vehicle production volume, growing consumer base, and increasing demand for advanced vehicle features. Countries such as China, Japan, India, and South Korea are major contributors to this growth, driven by a mix of robust domestic manufacturing, rising disposable incomes, and government initiatives supporting automotive development.

Increasing adoption in electric vehicles (EVs)

Increase in adoption of electric vehicles (EVs) significantly drives the automotive power window motor market growth of the automotive power window motor market. This trend is closely tied to the global shift toward sustainable transportation, with governments and consumers prioritizing reduced carbon emissions. For instance, the International Energy Agency (IEA) reported that global EV sales surpassed 14 million units in 2023, accounting for 18% of total car sales, up from 4% in 2020. This rapid growth directly increases demand for EV-specific components, including power window motors, which are integral to modern vehicle design.

EVs come equipped with advanced features such as power windows as standard, regardless of whether they are budget or premium models. EV manufacturers often prioritize advanced motor technologies, such as brushless DC motors, to enhance energy efficiency and align with the high-performance requirements of electric drivetrains.

Therefore, the EV boom acts as a catalyst for the power window motor market through regulatory mandates, technological advancements, and evolving consumer expectations, supported by quantifiable growth in EV adoption rates and component-specific automotive power window motor market demand.

Growing demand for comfort and convenience features

Surge in demand for comfort and convenience features in vehicles is a key driver of the automotive power window motor market, fueled by shifting consumer preferences and competitive differentiation strategies among automakers. Modern buyers increasingly prioritize vehicles equipped with advanced interior amenities, such as power-adjustable seats, automated climate control, and one-touch power windows, which enhance driving and passenger experiences. For instance, Hyundais 2023 Creta and Kias Sonet, popular in Asia-Pacific markets, include power windows as standard across all trims, compared to only high-end variants previously.

Thus, the increase in demand for comfort and convenience features is a key driver of the automotive power window motor market expansion. This trend is supported by consumer preferences, technological advancements, and regulatory standards, all of which are contributing to the widespread adoption of power window systems across vehicle segments and regions.

Increased vehicle production

The automotive power window motor market is experiencing significant growth primarily due to the rising global vehicle production volumes. After the initial setbacks during the pandemic, vehicle production has shown strong recovery signs. In 2023, global vehicle production reached approximately 93 million units.The global automotive power window motor market forecast suggests steady growth due to increasing vehicle electrification and consumer demand for advanced comfort features.

This growth is particularly notable in regions such as Asia-Pacific, which accounts for a significant share of global vehicle production. Countries such as China, India, and Japan are leading contributors, driven by rising urbanization, increasing disposable income, and growing middle-class populations. The production of passenger cars and light commercial vehicles, which are the primary users of power window systems, is especially robust in these regions.

Furthermore, the integration of power windows is becoming standard even in mid-level and entry-level vehicles, expanding the automotive power window motor market size. For instance, in August 2024, Mahindra & Mahindra Ltd., a major SUV manufacturer in India, introduced the Thar ROXX an SUV designed to stand out and reshape the SUV market in the country. It features power windows for both the front and rear, with a one-touch up/down function for the driver's window. As automakers continue to scale up production to meet rising consumer demand, the need for reliable and cost-effective power window motors will continue to grow, driving market expansion globally.

Integration with smart and connected vehicles

Surge in integration of smart and connected vehicle technologies provides automotive power window motor market opportunity for the growth of the automotive power window motor market. As vehicles become more advanced, features like remote window control, automatic closure based on weather conditions, and anti-pinch functionality are becoming standard in mid-tier and premium vehicles. These systems often rely on intelligent power window motors that can communicate with the vehicle's electronic control units (ECUs) for seamless operation.

For instance, in September 2024, Tata Motors launched the updated Punch in the Indian market. Built on the ALFA (Agile Light Flexible Advanced) platform and a five-star Global NCAP safety rating, the updated five-seater comes with new features. These include a segment-first 10.25-inch touchscreen infotainment system with wireless Apple CarPlay and Android Auto, along with a driver one-touch up window with an anti-pinch function. Therefore, an increase in adoption of advanced features such as remote window control, and anti-pinch functionality provides lucrative growth opportunities for the automotive power window motor market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive power window motor market analysis from 2023 to 2033 to identify the prevailing automotive power window motor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive power window motor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive power window motor market trends, key players, market segments, application areas, and market growth strategies.

Automotive Power Window Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 15.6 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 467 |

| By Vehicle Type |

|

| By Motor |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | AISIN CORPORATION, Continental AG, Valeo, DENSO Corporation, Robert Bosch GmbH, Inteva Products, LLC., NIDEC CORPORATION, Brose Fahrzeugteile GmbH & Co. KG, Mitsuba Corporation, Mabuchi Motor Co., Ltd., Surabhi Automotive Private Limited, Johnson Electric Holdings Limited |

The key players in the automotive power window motor market are Denso Corporation, Robert Bosch GmbH, Mitsuba Corp., Brose Fahrzeugteile GmbH & Co. KG, Continental AG, Aisin Corporation, Johnson Electric Holdings Limited, Inteva Products, Nidec Corporation, Mabuchi Motor Co., Ltd., Surabhi Automotive Private Limited, and Valeo. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

The global automotive power window motor market was valued at $9.4 billion in 2023, and is projected to reach $15.6 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

The leading application of Automotive Power Window Motor Market is front windows.

The largest regional market for Automotive Power Window Motor is Asia Pacific.

The upcoming trends of Automotive Power Window Motor Market in the globe are the integration with smart and connected vehicles and the rise in penetration of electric vehicles in developing markets

Loading Table Of Content...

Loading Research Methodology...