Automotive Starting Battery Market Research, 2033

The global automotive starting battery market was valued at $23.5 billion in 2023, and is projected to reach $36.2 billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033.

Market Introduction and Definition

Automotive starting batteries are designed primarily for starting internal combustion engines in vehicles. These batteries, typically lead-acid, provide a surge of electrical power necessary to start an engine and ensure its reliable operation. The key properties of automotive starting batteries include high cranking power, which is the ability to deliver a large amount of current in a short period, and robust cold-cranking performance to function effectively in low temperatures. They are also designed for vibration resistance to withstand the mechanical stresses encountered during vehicle operation. Lead-acid batteries dominate this market due to their cost-effectiveness, well-established technology, and sufficient power output.

However, advancements in battery technology are leading to increased interest in alternatives such as absorbed glass mat (AGM) and enhanced flooded batteries (EFB) , which offer improved performance and durability. The automotive starting battery market is driven by factors such as vehicle production rates, technological advancements, and increasing demand for reliable and efficient vehicle start-up solutions. As automotive technology evolves, there is a growing trend towards integrating batteries with advanced features to meet modern automotive needs.

Key Takeaways

- The Automotive starting battery market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Automotive starting battery industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising demand for electric vehicles (EVs) is significantly boosting the growth of the automotive starting battery market. As the automotive industry undergoes a transformative shift towards electrification, EVs are becoming increasingly popular due to their environmental benefits and advancements in battery technology. This surge in EV adoption is driving the need for high-performance automotive starting batteries, which are essential for efficient vehicle operation and energy storage. The automotive starting battery market is witnessing robust growth as manufacturers focus on developing advanced battery technologies to meet the demands of modern vehicles. Innovations in battery chemistry and design, aimed at enhancing energy density, longevity, and charging speed, are key drivers of market expansion. Additionally, government policies and incentives supporting clean energy and electric mobility are further accelerating market growth. As a result, the automotive starting battery market is poised for substantial expansion, driven by the growing shift towards electric vehicles and the continuous evolution of battery technologies.

The growth of the automotive starting battery market faces a significant challenge due to the high cost of advanced batteries. As automakers and consumers increasingly shift towards advanced battery technologies, such as lithium-ion and solid-state batteries, the substantial costs associated with these innovations are a major hurdle. Advanced batteries, while offering superior performance, longevity, and efficiency compared to traditional lead-acid batteries, come with higher price tags. This increased cost is driven by the use of advanced materials, complex manufacturing processes, and extensive research and development required to produce these cutting-edge technologies. Consequently, the elevated prices can limit their accessibility and adoption, particularly among cost-sensitive consumers and markets. As a result, while the automotive industry continues to push for advancements in battery technology, the high cost remains a critical factor that hampers widespread growth and integration within the Automotive Starting Battery market. Addressing these cost challenges is essential for accelerating market expansion and making advanced battery solutions more economically viable for a broader range of applications.

Government incentives and support are poised to offer significant opportunities for the growth of the automotive starting battery market. Many governments worldwide are implementing policies to encourage the adoption of electric vehicles (EVs) and reduce carbon emissions, which includes providing financial incentives for purchasing EVs and investing in EV infrastructure. These policies often include subsidies, tax credits, and grants for both consumers and manufacturers, fostering market expansion. For instance, initiatives aimed at enhancing battery technology and production capabilities can lead to advancements in automotive starting batteries, promoting higher performance and longer lifespans. Furthermore, governments may also invest in research and development programs to accelerate innovations in battery technologies. Such support not only stimulates demand for advanced starting batteries but also encourages manufacturers to invest in new technologies and improve production efficiency. As a result, these incentives and supports are expected to drive substantial growth and profitability in the automotive starting battery sector.

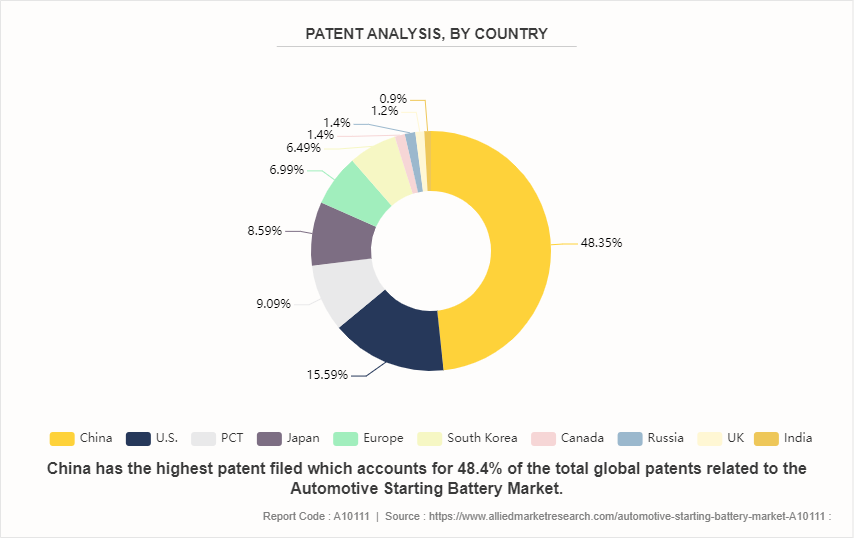

Patent Analysis of the Global Automotive Starting Battery Market

The automotive starting battery market is heavily dominated by China, which holds 48.4% of the patents, showcasing its strong innovation and manufacturing capabilities. The U.S. follows with 15.6%, reflecting significant research and development activities. The Patent Cooperation Treaty (PCT) applications account for 9.1%, indicating a substantial amount of international patent filings. Japan and Europe contribute 8.6% and 7.0%, respectively, highlighting their robust automotive sectors. South Korea, Canada, Russia, the UK, and India collectively hold smaller shares, ranging from 6.5% to 0.9%, suggesting their growing but still developing roles in this competitive market.

Market Segmentation

The automotive starting battery market is segmented into battery type, vehicle type, and region. By battery type, the market is classified into lead-acid batteries, enhanced flooded batteries, absorbent glass mat (AGM) batteries and lithium-ion batteries. By vehicle type, the market is divided into passenger vehicles, commercial vehicles, and heavy commercial vehicles. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the automotive starting battery market include Johnson Controls Inc, Exide Technologies LLC, GS Yuasa Corporation, Panasonic Corporation, East Penn Manufacturing Company Inc, Robert Bosch GmbH, Crown Battery Manufacturing CO, Leoch International Technology Limited Inc, Hitachi Chemical Company, and FIAMM Energy Technology.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The increasing automotive production in the Asia-Pacific region is significantly driving the growth of the Automotive Starting Battery market. As countries like China, India, and Japan ramp up their vehicle manufacturing to meet rising consumer demand and economic development, the need for reliable starting batteries is growing. The surge in automotive production in these countries is fueling the demand for advanced automotive starting batteries, which are essential for vehicle ignition and performance. This trend is expected to continue, boosting market growth and fostering innovations in battery technology.

- According to the Society of Indian Automobile Manufacturers (SIAM) , the number of two-wheelers sold rose from 1, 35, 70, 008 units to 1, 58, 62, 087 units in FY-2022-23, showing a significant increase compared to the previous fiscal year.

- The Society of Manufacturers of Electric Vehicles reports that sales of electric two-wheelers surged from 53, 258 units in April 2022 to 86, 194 units by March 2023, indicating substantial growth in this segment.

- Driven by the high demand for two-wheelers in India, several automotive brands are focusing on launching new models featuring advanced technologies, improved fuel efficiency, and enhanced security. For instance, Ducati announced plans in January 2024 to introduce eight new motorcycle models to the Indian market and open two new showrooms in the country. The upcoming models include the Multistrada V4 RS, DesertX Rally, Panigale V4 Racing Replica 2023, Diavel for Bentley, Monster 30° Anniversario, and Panigale V4 SP2 30° Anniversario 916.

- Hero MotoCorp, an Indian two-wheeler manufacturer, began commercial production trials for flex-fuel motorcycles in January 2023. These motorcycles are set to be launched in the 100-125 cc mass market segment.

- In 2023, electric vehicle sales in India saw a significant jump of 49.25% year-on-year, reaching 15, 29, 947 units, as reported by the Federation of Automobile Dealers' Association (FADA) .

- The Indian government has introduced various initiatives to promote electric vehicle manufacturing and adoption, aiming to cut emissions and foster e-mobility amid rapid urban growth. Programs like the National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) have laid the groundwork for initial interest in electric mobility.

- During COP26, India set an ambitious roadmap for decarbonization, with targets for 2030 including a 50% reduction in carbon emissions from the energy sector and achieving a renewable energy capacity of 500 GW. The country aims to triple its current renewable energy capacity to meet these goals and has pledged to the global EV30@30 campaign, targeting that electric vehicles will make up at least 30% of new vehicle sales by 2030.

- By March 2023, India had 6, 586 operational public charging stations for electric vehicles, with Delhi hosting the highest number at nearly 1, 900 stations, followed by Karnataka with 704 stations. Electric two-wheelers and three-wheelers account for most electric vehicles in the country.

- To encourage the growth of the domestic electric vehicle industry, the Indian government has offered tax breaks and subsidies to both manufacturers and consumers. According to the phased manufacturing plan, a 15% customs duty is applied to parts used for electric vehicle production, and a 10% duty is levied on imported lithium-ion cells.

- Therefore, Asia-Pacific is projected to emerge as a dominant force in the Automotive starting battery market throughout the forecast period.

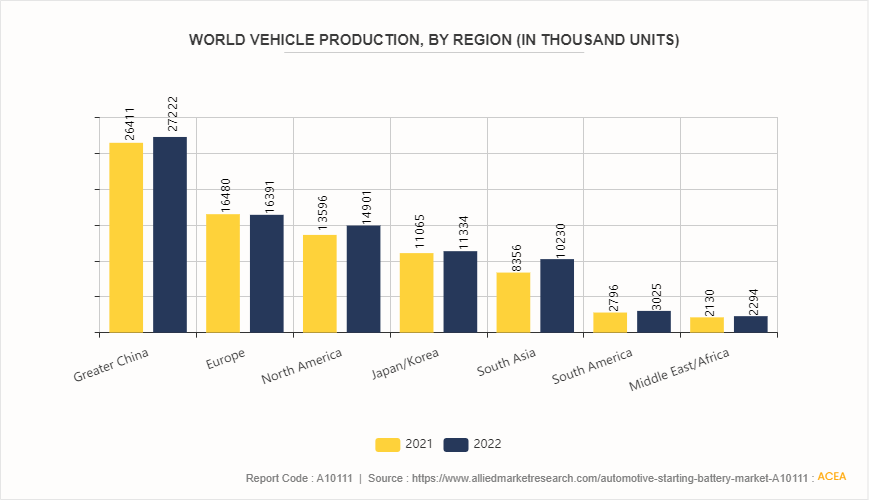

The Growing Global Vehicle Production is Expected to Boost the Automotive Starting Battery Market

The automotive starting battery market is poised for growth as global vehicle production continues to rise. With increasing demand for new vehicles driven by economic development and consumer preferences, the need for reliable starting batteries is escalating. These batteries are crucial for vehicle ignition and electrical system functionality, making them essential components in both conventional and electric vehicles. As automotive production ramps up, manufacturers are expected to boost output to meet the expanding market needs, driving innovation and competition within the industry. This trend highlights the critical role of starting batteries in supporting the automotive sector's growth.

Industry Trends

- The automotive starting battery market has experienced dynamic shifts driven by technological advancements, changing consumer preferences, and regulatory changes. One prominent trend is the increasing adoption of advanced battery technologies, such as Lithium-Ion (Li-ion) batteries, which offer superior performance, longer life, and reduced weight compared to traditional Lead-Acid batteries. For example, many high-end and electric vehicles are now equipped with Li-ion batteries due to their higher energy density and efficiency, as seen in brands such as Tesla and BMW.

- Another trend is the growing emphasis on sustainability and environmental regulations. The automotive industry is under pressure to reduce its carbon footprint, leading to a push for more eco-friendly battery solutions. Companies like Johnson Controls and Exide Technologies are investing in recycling programs and developing more sustainable battery technologies to align with stricter environmental standards.

- The rise of electric and hybrid vehicles is also influencing the market. As the demand for electric vehicles (EVs) increases, there is a parallel growth in the need for high-performance starting batteries that can support EV functionalities. This shift is driving innovation in battery design and performance, with companies like LG Chem and Panasonic leading advancements in battery technology.

- Additionally, there is a trend towards integrating smart technology into batteries, enhancing their functionality and reliability. Modern automotive batteries are now equipped with sensors and monitoring systems that provide real-time data on battery health and performance, improving maintenance and longevity. This trend is exemplified by the advanced battery management systems used in vehicles by manufacturers like Ford and General Motors.

Key Sources Referred

- Ericsson Mobility Report

- IEA

- Our World in Data

- Society of Indian Automobile Manufacturers (SIAM

- The Federation of Automobile Dealers' Association (FADA)

- National Electric Mobility Mission Plan (NEMMP)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive starting battery market analysis from 2024 to 2033 to identify the prevailing automotive starting battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive starting battery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive starting battery market trends, key players, market segments, application areas, and market growth strategies.

Automotive Starting Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 36.2 Billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Battery Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Johnson Controls, Inc., East Penn Manufacturing Company, Inc., Crown Battery Manufacturing Co., leoch International Technology Limited Inc, Robert Bosch GmbH, FIAMM Energy Technology, Panasonic Corporation, GS Yuasa Corporation, Exide Technologies, LLC, Hitachi Chemical Company |

include Johnson Controls Inc, Exide Technologies LLC, GS Yuasa Corporation, Panasonic Corporation, East Penn Manufacturing Company Inc, Robert Bosch GmbH, Crown Battery Manufacturing CO, Leoch International Technology Limited Inc, Hitachi Chemical Company, and FIAMM Energy Technology are the top companies to hold the market share in Automotive Starting Battery.

The automotive starting battery market was valued at $23.5 billion in 2023 and is estimated to reach $36.2 billion by 2033, exhibiting a CAGR of 4.4% from 2024 to 2033.

Asia-Pacific is the largest regional market for Automotive Starting Battery.

The automotive starting battery market is segmented into battery type, vehicle type, and region. By battery type, the market is classified into lead-acid batteries, enhanced flooded batteries, absorbent glass mat (AGM) batteries and lithium-ion batteries. By vehicle type, the market is divided into passenger vehicles, commercial vehicles, and heavy commercial vehicles. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growing demand for electric and hybrid vehicles and increasing vehicle production are the drivers of Automotive Starting Battery Market in the globe.

Loading Table Of Content...