Automotive Tire Market Insights, 2033

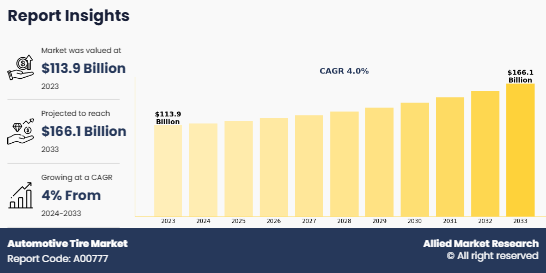

The global Automotive Tire Market Size was valued at USD 113.9 billion in 2023, and is projected to reach USD 166.1 billion by 2033, growing at a CAGR of 4% from 2024 to 2033.

Automotive tires are circular vehicle components made of rubber that are used to cover the wheel’s rim externally. The major function of the tire is to protect the wheel rim and offer tractive force between the road surface and the vehicle. Since it is manufactured from rubber, it also provides a flexible cushion, thereby reducing the impact of the vibrations and absorbing the shock of the vehicle. Rubber tire consists of tread, jointless cap piles, beads, and other materials, which include synthetic rubber, carbon black, and fabric. There is an exponential increase in the demand for tires, due to rise in demand for vehicle production to cater to the surge in requirement of vehicles across all segments. Thus, the tire demand is ultimately governed by automobile production.

Key Takeaways

- The automotive tire market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

The global Automotive Tire Market Size is driven by increase in vehicle production in developing countries and rise in competition among tire manufacturers. However, factors such as volatile prices of raw materials and increase in demand for tire remolding are expected to hamper the Automotive Tire Market Growth. Further, advancements in technology and fuel efficiency and rise in the adoption of electric vehicles are expected to create numerous opportunities for the expansion of the market.

Increase in vehicle production in developing countries

The global automotive tire market is expected to witness significant growth, driven by rising automobile demand in developing economies such as India, Brazil, and ASEAN countries. Rapid urbanization, increased industrial activity, and rising disposable incomes have fueled vehicle ownership and transportation needs. According to the International Organization of Motor Vehicle Manufacturers (OICA), India alone produced over 5.4 million vehicles in 2023, marking an 8% year-on-year growth. Similarly, Brazil's automobile production exceeded 2.5 million units in 2023, supported by favorable government incentives such as tax reductions and subsidies for electric and fuel-efficient vehicles. Southeast Asian nations offer substantial incentives, including up to 300% tax benefits for R&D activities and investment subsidies for automotive manufacturing, further boosting regional automobile production.

Additionally, the surge in logistics and last-mile delivery services, driven by the expansion of e-commerce and the food industry, has escalated demand for commercial vehicles, including trucks, tractors, and trailers. Heavy-duty vehicle production directly contributes to increased tire demand due to higher replacement cycles and durability requirements. Passenger vehicle demand, including sedans and SUVs, continues to surge in emerging markets, with SUV sales in India growing by 20% in 2023 alone.

Therefore, the automotive tire market is expected to benefit from advancements in tire technology, including sustainable and fuel-efficient tires. Companies are investing in tire innovation, focusing on low rolling resistance, durability, and eco-friendly materials. With rising vehicle production and supportive government policies, the automotive tire market is projected to witness robust growth in the coming years.

Increase in demand for tire remolding

The process of retreading, also known as remolding or recap, involves replacing the worn tread on used tires, offering an environmentally friendly and cost-effective alternative to manufacturing new ones. According to the Tire Retread & Repair Information Bureau (TRIB), retreading saves up to 70% of the materials used in producing a new tire, including rubber, steel, and fabric. Additionally, retreading reduces carbon emissions by 24% and water consumption by 19%, making it a sustainable option for commercial fleets and logistics companies. A single tire can be retreaded two to three times, extending its service life and significantly reducing landfill waste. With tire prices increasing by nearly 15% over the past five years due to rising raw material and energy costs, retreading has gained traction as a cost-efficient solution, saving fleet operators up to 40% per tire compared to purchasing new ones. Innovations in tire casings, advanced rubber compounds, and modern remanufacturing technologies have enhanced the durability and performance of retreaded tires, allowing them to function reliably across multiple lifecycles. The global tire retreading market is projected to grow at a CAGR of 5.2% over the next five years, driven by rising environmental regulations and cost pressures in the transportation sector. While retreading addresses aftermarket cost concerns, it simultaneously slows down the demand for new automotive tires, impacting the overall growth of the automotive tire market. As sustainability and cost optimization remain key priorities, the adoption of retreaded tires is expected to rise significantly in both developed and emerging markets in the coming years.

Advancement in Technology

Most manufacturing companies are using automation to increase productivity and profitability due to rapid technological advancements. The automotive tire market is expected to witness growth as a result of technological advancements in the global tire industry, such as the introduction of rimless tires, green tires, and the use of lightweight elastomers and metals such as alloys and carbon fiber or composites such as manganese bronze and nickel aluminum bronze to manufacture tires.

In addition, major tire manufacturers are employing nanotechnology and other innovations or software to create a variety of advanced tire types. For instance, Bridgestone Tires, a leading tire and rubber manufacturer uses Contact Area Information Sensing (CAIS), which collects and analyses the tire contact area to sense road conditions. Shared and autonomous vehicles will shape the future of mobility.

Ride-sharing and ride-hailing are becoming more popular, supporting urban mobility as well as cargo and service transportation. Bridgestone, Michelin, Goodyear, and Continental, among others, are testing software platforms and Internet of Things (IoT)-connected sensors to monitor and evaluate tire quality. Tire manufacturers are concentrating their efforts on the development of smart tires that rely on IoT connectivity to provide improved safety, enhanced fuel efficiency, lower maintenance costs and efforts, and longer tire life. All of these elements are projected to open plenty of new Automotive Tire Market Opportunity expansion.

Segmental Overview

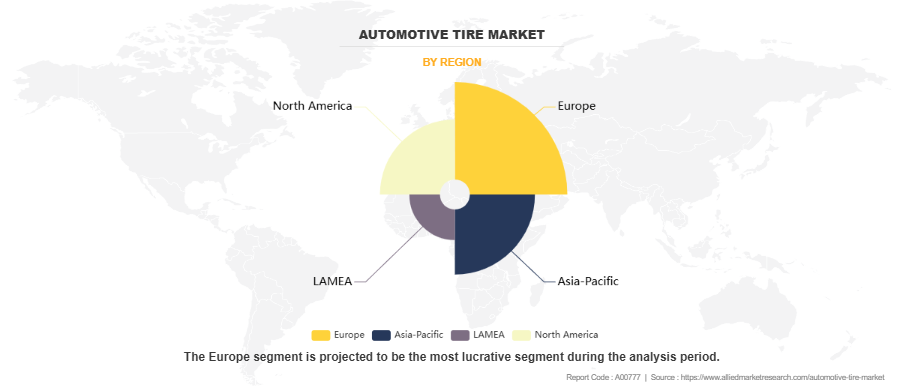

The automotive tire market is segmented on the basis of season type, vehicle type, rim size, distribution channel, load index and region. By season type, it is divided into summer, winter and all-season tires. By vehicle type, it is divided into passenger car, commercial vehicle, and electric vehicle. The commercial vehicles segment is further divided into light & heavy commercial vehicles. By rim size, the Automotive Tire Industry is categorized into less than 15 inch, 15 to 20 inch, and more than 20 inch. By distribution channel, it is bifurcated into OEM and aftermarket. On the basis of load index, it is divided into up to 100, and above 100. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on Season Type

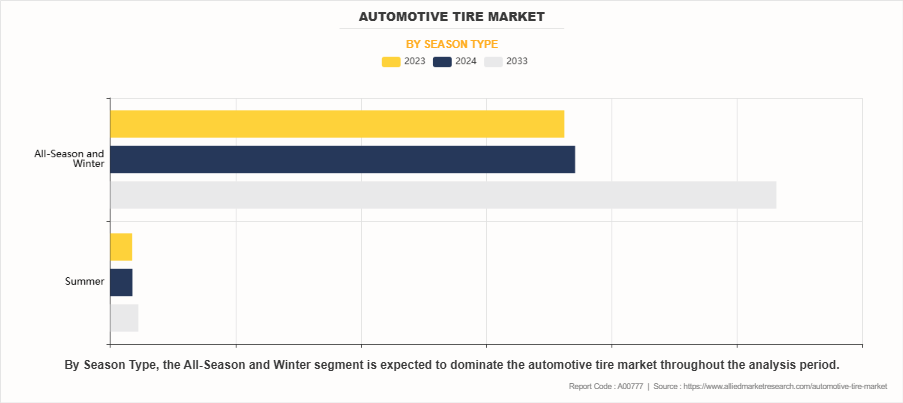

The All-Season and Winter tire segment dominated the global Automotive Tire Industryin 2023, driven by the high Automotive Tire Market Demand for versatile and durable tires suitable for varying weather conditions. All-season tires are particularly popular due to their ability to perform well in moderate climates, reducing the need for seasonal replacements. Winter tires, on the other hand, are essential in regions with harsh winters, providing superior grip and safety on icy and snowy roads. With increasing awareness of road safety and weather-related performance, this segment is expected to remain dominant throughout the forecast period, catering to diverse consumer needs globally.

Based on Rim Size

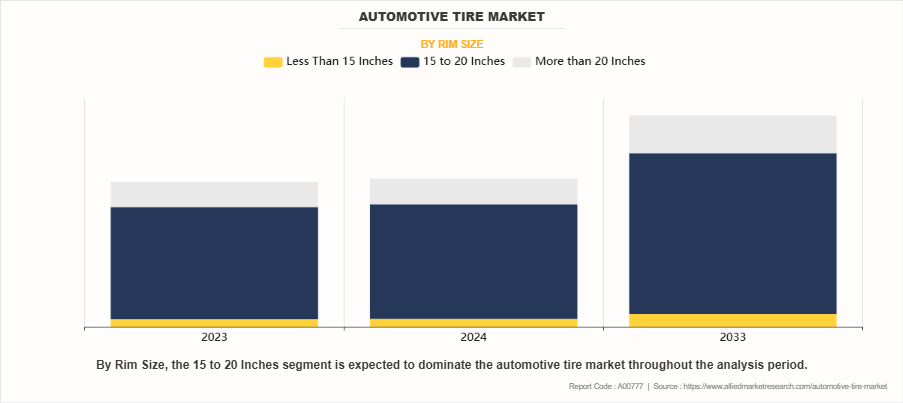

The 15 to 20 Inches rim size segment led the global market in 2023, primarily due to its compatibility with a wide range of passenger cars, SUVs, and light commercial vehicles. This size range offers a balance between performance, comfort, and affordability, making it the preferred choice for both original equipment manufacturers (OEMs) and the aftermarket. With the growing adoption of SUVs and crossover vehicles, which often require larger rim sizes within this range, demand is anticipated to remain strong. Advancements in tire technology and aesthetics further contribute to the segment's sustained dominance during the Automotive Tire Market Forecast period.

Based on Vehicle Type

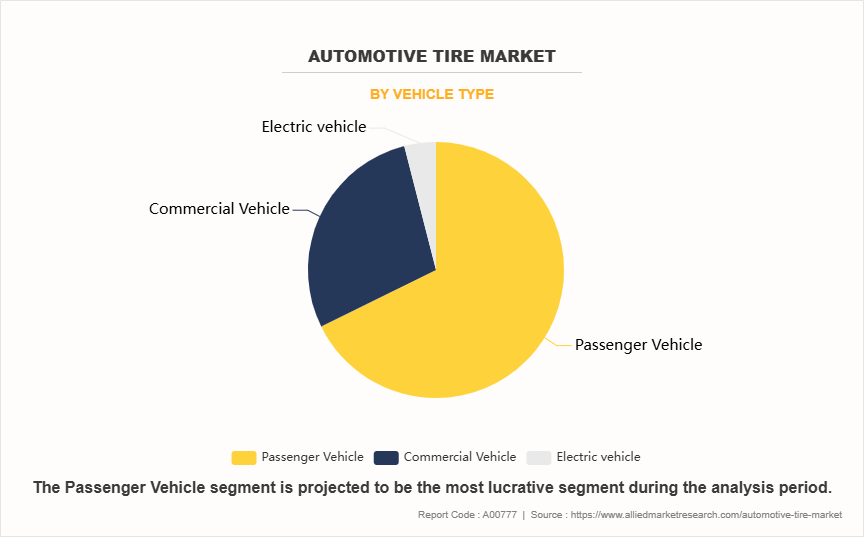

The Passenger Vehicle segment dominated the global automotive tire market in 2023, accounting for the largest share due to the rising number of passenger cars worldwide. Factors such as increasing urbanization, higher disposable incomes, and consumer preference for personal mobility have fueled demand in this segment. Passenger vehicle tires are designed to provide optimal performance, comfort, and safety, catering to a broad customer base. Additionally, the growing popularity of electric and hybrid passenger vehicles has further boosted the demand for specialized tires. This segment is expected to retain its dominance, supported by steady growth in passenger vehicle production and ownership.

Based on Region

The Asia-Pacific region emerged as the leading market for automotive tires in 2023, driven by rapid economic development, urbanization, and a booming automotive industry in countries like China, India, and Japan. This region's dominance is attributed to high vehicle production and sales, along with a large population base with rising income levels. Additionally, increased infrastructure development and expanding middle-class populations are propelling vehicle ownership, further fueling tire demand. The region also benefits from the presence of major tire manufacturers and a robust aftermarket sector. Asia-Pacific is expected to remain dominant during the forecast period, contributing significantly to global market growth.

Competition Analysis

The global key players profiled in the report are Apollo Tyres Ltd, Bridgestone Corporation, CEAT Limited, Continental AG, Hankook & Company Co., Ltd., JK Tyre & INDUSTRIES LTD., Michelin, MRF Limited, Nokian Tyres PLC, Pirelli & C. S.p.A, Sailun Group Co., Ltd., Salsons Impex Pvt. Ltd, Shandong Linglong Group Co. Ltd., Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Triangle Tire Co., Ltd., Toyo Tire Corporation, Wanli Tire Co., Ltd., and Zhongce Rubber Group Co., Ltd.

In December 2024, Business Expansion, Continental AG – Continental AG announced plans to list its automotive unit on the Frankfurt Stock Exchange by the end of 2025. This strategic move aims to enhance agility and value amid evolving market dynamics and technological transformations. Additionally, Continental intends to make its Original Equipment Solutions (OESL) business independent, with the sales process commencing in the first quarter of 2025. In July 2024, Acquisition, Yokohama Rubber Co. – Yokohama Rubber Co. agreed to acquire Goodyear Tire & Rubber's Off-the-Road (OTR) tire business for $905 million in cash. This acquisition includes facilities in Japan and Australia, aiming to strengthen Yokohama's product portfolio in non-agricultural segments such as mining and construction. The transaction is expected to close by early 2025.

In March 2024, Business Expansion, Autoneum – Autoneum announced the expansion of its production capacities in Asia with new plants in Jilin, China, and Pune, India. These facilities aim to meet the growing demand for acoustic and thermal management solutions in the automotive industry, reinforcing Autoneum's presence in key growth markets.

August 2023, Partnership, Pirelli & National Auto Parts (NAP) – Pirelli selected National Auto Parts (NAP) as its new distributor in Saudi Arabia. This partnership aims to enhance Pirelli's market presence in the region by leveraging NAP's extensive distribution network, ensuring better availability of Pirelli tires to meet the increasing demand in the Saudi market.

February 2024, Acquisition, Titan International – Titan International acquired specialty tire and wheel manufacturer Carlstar Group for $296 million in a cash and stock transaction. The acquisition includes facilities in the U.S. and China, expanding Titan's product offerings and manufacturing capabilities in the specialty tire market.

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive tire market analysis from 2023 to 2033 to identify the prevailing automotive tire market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive tire market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive tire market trends, key players, market segments, application areas, and market growth strategies.

Automotive Tire Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 166.1 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Season Type |

|

| By Rim Size |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | jk tyre & industries ltd., Sailun Group Co., Ltd, Pirelli & C. S.p.A., Nokian Tyres plc., Hankook & Company Co., Ltd, Apollo Tyres Ltd., CEAT Limited, Continental AG, Bridgestone Corporation (Bandag LLC), MRF Limited. |

Analyst Review

The automotive tire market is expected to witness significant growth, due to rise in production and sales of automobiles across the globe. Automotive tire manufacturers are concentrating on providing innovative, lightweight, and long-lasting tires. The automotive tire market is expected to grow at a remarkable rate in the future, owing to the booming e-commerce and logistics industries. The global automotive tire market is driven by increasing vehicle production in developing countries and rise in competition among tire manufacturers. However, factors such as volatile prices of raw materials and growth in the market for remolding tires are expected to hamper the growth of the market. Further, advancement in technology and rise in demand for electric vehicles are expected to create numerous opportunities for the expansion of the automotive tire market.

To deal with the changing demand scenarios, market participants are entering into contracts and agreements to secure long-term commercial opportunities. In addition, market participants are continuously focusing on product development efforts to match changing end-user requirements and improve vehicle operational efficiency.

The automotive tire market is undergoing significant transformations driven by technological advancements, sustainability initiatives, and strategic business moves by key industry players. Companies are focusing on enhancing their market presence through mergers, acquisitions, and partnerships while simultaneously expanding production capacities to meet evolving consumer demands. For instance, Continental AG's plan to list its automotive unit on the Frankfurt Stock Exchange by the end of 2025 signals a strategic shift to unlock value and improve operational agility amid global market uncertainties. Similarly, Yokohama Rubber Co.'s acquisition of Goodyear's Off-the-Road (OTR) tire business for $905 million highlights the industry's emphasis on consolidating resources and diversifying product portfolios to strengthen their foothold in niche segments like mining and construction tires.

Autoneum's investment in new plants in China and India highlights the increasing importance of the Asia-Pacific region as a key manufacturing center, fueled by the growing demand for acoustic and thermal management solutions in vehicles. This expansion is in line with the broader industry trend of establishing regional production clusters to minimize supply chain disruptions and optimize costs. Additionally, strategic partnerships, such as Pirelli's collaboration with National Auto Parts (NAP) in Saudi Arabia, emphasize the role of localized distribution networks in improving market penetration and ensuring product availability in emerging markets.

The acquisition of Carlstar Group by Titan International further showcases the industry's focus on strengthening product offerings in specialty tire markets, particularly in regions such as North America and Asia-Pacific. As tire prices continue to rise due to escalating raw material and energy costs, businesses are increasingly exploring retreading and remanufacturing solutions to ensure cost efficiency and sustainability.

Furthermore, sustainability remains a critical driver in the tire industry, with regulatory frameworks pushing companies to adopt environment-friendly practices such as retreading and use of sustainable raw materials. Innovations in tire technology, including advanced rubber compounds and enhanced tread designs, are addressing the growing demand for fuel efficiency and reduced carbon footprints.

The global automotive tire market was valued at $113,934.5 million in 2023, and is projected to reach $166,133.1 million by 2033, registering a CAGR of 4.0% from 2024 to 2033.

From 2024-2033 would be forecast period in the market report.

$113,934.5 million is the market value of Automotive Tire Market in 2022. The market is studied across North America, Europe, Asia-Pacific, and LAMEA.

2023 is base year calculated in the Automotive Tire Market report. The leading companies adopt strategies such as product launch, partnership, acquisition, expansion, and collaboration to strengthen their market position.

Apollo Tyres Ltd, Bridgestone Corporation, CEAT Limited, Continental AG, Hankook & Company Co., Ltd., JK Tyre & INDUSTRIES LTD., Michelin, MRF Limited, Nokian Tyres PLC, Pirelli & C. S.p.A, Sailun Group Co., Ltd., Salsons Impex Pvt. Ltd, Shandong Linglong Group Co. Ltd., Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Triangle Tire Co., Ltd., Toyo Tire Corporation, Wanli Tire Co., Ltd., and Zhongce Rubber Group Co., Ltd. are the top companies hold the market share in Automotive Tire Market.

Loading Table Of Content...

Loading Research Methodology...