The global automotive torque actuator motor market was valued at $8.9 billion in 2021, and is projected to reach $14.9 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031.

An automotive torque actuator motor, known as a torque motor, is a specialized form of DC electric motor. The torque actuator motor finds its major application in vehicle turbocharger. The torque actuator motor creates rotational energy force and controls the throttle of the turbocharger. It controls the air flow in the turbocharger and manages the speed & fuel use of the vehicle. Moreover, the torque motor of the automotive actuator is used in direct drive system that consists of automotive direct current (DC) motors with turbochargers and exhaust gas recirculation (EGR).

Factors such as increase in vehicle production in developing countries and surge in demand for engine performance & fuel efficiency are anticipated to boost the growth of the global automotive torque actuator motor market during the forecast period. However, increase in demand for battery electric vehicles of torque actuator motors is expected to hinder the growth of the global market during the forecast period. Moreover, engine downsizing to reduce vehicle weight and increase in demand for commercial vehicles are projected to create an opportunity for the automotive torque actuator motor industry in near future.

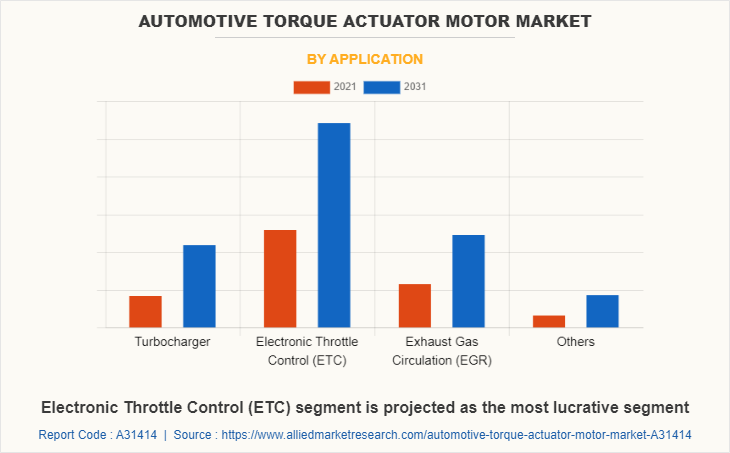

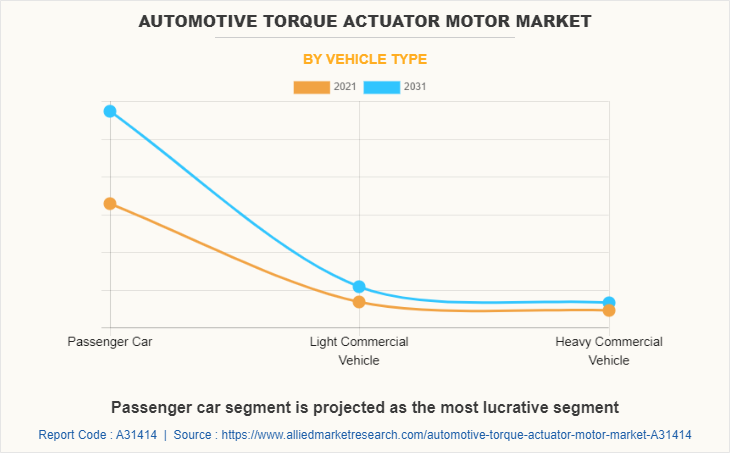

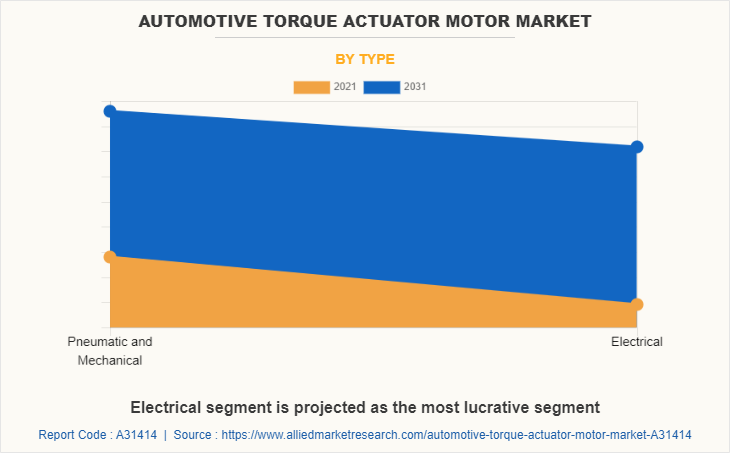

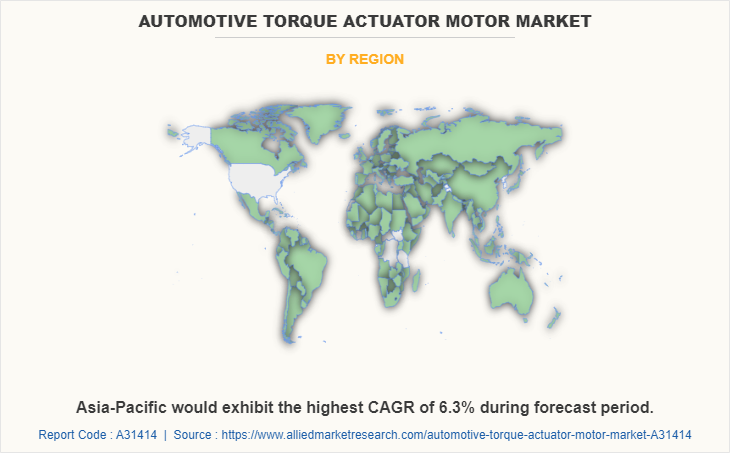

Automotive torque actuator motor market is segmented on the basis of distribution channel, application, vehicle type, type, and region. On the basis of distribution channel, it is divided into OEM and aftermarket. By application, it is segmented into turbocharger, electronic throttle control (ETC), exhaust gas circulation (EGR), and others. By vehicle type, it is divided into passenger car, light commercial vehicle, and heavy commercial vehicle. By type, it is divided into electrical, pneumatic, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in this automotive torque actuator motor market are Bray International, Continental AG, CTS Corporation, Electrocraft, Inc., Emerson Electric Co., HIWIN Technologies Corp., Igarashi Motors India Limited, Johnson Electric, Mabuchi Motor Co., ltd., Mitsuba Corporation, NSK, Rheinmetall, Siko-Global, Sonceboz, and Val-Matic Valve & Mfg. Corporation.

Increase in vehicle production in developing countries

The demand for automobiles in emerging countries is expected to expand dramatically in the future years as a result of urbanization and increased industrial activity. Manufacturers are increasingly building production plants in emerging countries due to rise in demand for automobiles in the region. Developing nations have observed an increase in the production of automobiles owing to factors such as favorable government policies, increasing GDP, and rising consumer spending. Emerging companies and market leaders in many industries throughout emerging nations, such as e-commerce, the food industry, and others, have boosted demand for delivery and transportation solutions, therefore boosting the production of vehicles even further. Increased manufacturing of heavy-duty vehicles raises demand for automotive torque actuator motors significantly. Furthermore, the surge in demand for passenger vehicles in developing countries has considerably increased automobile production in the area. Customers in developing countries such as India, Brazil, and others have shown considerable growth in their adoption of fuel-efficient systems, resulting in increased demand for automotive torque actuator motor in the region. Vehicle production in emerging nations is anticipated to increase considerably during the forecast period, providing an opportunity for the automotive torque actuator motors market to grow.

Surge in demand for turbocharger performance and fuel efficiency

Governments all over the world have enforced the use of fuel-efficient vehicles to reduce pollution and the climatic impact of automobiles. For instance, the European Union (EU) has mandated that average fuel efficiency across manufacturer fleets achieve 57 U.S. miles per gallon (mpg) by 2021, up from 41.9 U.S. miles per gallon in 2015, and 92 U.S. miles per gallon by 2030. Increased government measures to improve automobile fuel efficiency have prompted automakers to integrate advance technology into their vehicles to reduce vehicle weight and increase the vehicle efficiency. Performance of vehicle depends upon Turbocharger. Hence, vehicle manufacturers are forced to manufacture efficient Turbochargers, which can satisfy both the requirements and can deliver improved performance & fuel efficiency at the same time. The torque actuator motors are used with electronic throttle control (ETC), exhaust gas recirculation (EGR) and), turbochargers which are specifically designed to increase fuel efficiency in compliance with the Corporate Average Fuel Economy and Euro VI standards. In addition, these systems offer several advantages, for instance, high Turbocharger performance, and reduce the load on Turbocharger. Hence, improved Turbocharger performance and fuel efficiency are considered as the prime drivers for the global automotive torque actuator motor market growth.

Increase in demand for battery electric vehicles

The electric vehicles market is growing exponentially, owing to factors such as climate change and efforts to achieve net zero emissions. Moreover, favorable incentives and policies introduced by governments of different countries to promote electric vehicles boost growth of the EV industry. For instance, in 2021, in California, Clean Vehicle Rebate Project (CVRP) promoted clean vehicle adoption in California by offering rebates ranging from $1,000 to $7,000 for purchases or leases of new zero-emission vehicles. In addition, in 2021, New Zealand proposed clean car discount in which new car buyers received a $8,625 rebate for electric vehicles (EVs) less than $80,000, including GST and road costs. Rise in awareness regarding climate change and surge in demand for electric cars lead to increase in production of electric vehicles. For instance, according to a report by the IEA organization, 2022, EV vehicles globally reached 6.7 million units in 2021, a 3.7 million units over 2020, accounting for 4.1% of the market share. In 2020, the Aftermarket percentage of automobile income was about 2.4%, increasing from about 2% in 2019. Moreover, some countries announced policies banning and phasing out gasoline and diesel cars. Such measures taken by various governments encourage automakers and other market players to adopt new electric vehicle trend. For instance, in 2022, Ford Motor plans to invest $20 billion in an effort to expand electrification of its lineup with an investment of 20 billion dollars. The rise in production and sales of electric vehicles hinder the growth of exhaust heat recovery system as these vehicles are zero emission vehicles and do not require exhaust system which in turn expected hamper the torque actuator motor market.

Turbocharger downsizing to reduce vehicle weight

Turbocharger downsizing is the technique of using smaller combustion Turbochargers over bigger ones of the same power capacity when manufacturing vehicles in the automotive industry. It is the outcome of automakers' efforts to offer more efficient vehicles with lower emissions, which are frequently enforced by government regulations. Turbocharger downsizing includes reducing the number of cylinders to lower the Turbocharger's overall size. By reducing the number of cylinders, the amount of friction in the Turbocharger is reduced. Advancements in exhaust heat recovery system technology, such as the use of turbocharger, exhaust gas recirculation, have resulted in a decrease in total Turbocharger size while retaining or increasing power output. Moreover, persistent growth of exhaust heat recovery system technology is predominantly driven by heightened demand for vehicle manufacturers to encounter environmental emission regulations. In addition, Turbocharger downsizing trend is on a rise, owing to the increasing concern of vehicle weight. Currently, increase in fuel economy standards along with rise in demand for enhanced vehicle performance boost the growth of the turbochargers. The automotive torque actuator motors are used with the turbochargers and EGR system in order to enhance the fuel efficiency of the vehicle. Owing to this, the increase use of exhaust heat recovery system technology for Turbocharger downsizing is expected to fuel the demand for automotive torque actuator motor market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive torque actuator motor market analysis from 2021 to 2031 to identify the prevailing automotive torque actuator motor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive torque actuator motor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive torque actuator motor market trends, key players, market segments, application areas, and market growth strategies.

Automotive Torque Actuator Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14.9 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 344 |

| By Distribution Channel |

|

| By Application |

|

| By Vehicle Type |

|

| By Type |

|

| By Region |

|

| Key Market Players | Electrocraft, Johnson Electric, HIWIN, CONTINENTAL AG, CTS Corporation, Igarashi Motors, Siko-Global, Rheinmetall, Sonceboz, Mitsuba Corporation, Bray, Valmatic, MABUCHI MOTOR CO., LTD., NSK |

Analyst Review

The automotive torque actuator motor market is expected to witness significant growth, due to increase in penetration of front wheel drive, all-wheel drive (AWD), and 4WD vehicles. Moreover, increase demand for fuel efficient vehicles is anticipated to propel the demand for advanced torque actuator motors, which is expected to propel the demand for torque actuator motors market during the forecast period.

Factors such as increase in vehicle production in developing countries and increase in demand for engine performance & fuel efficiency are anticipated to boost the growth of the global automotive torque actuator motor market during the forecast period. However, surge in demand for battery electric vehicles of torque actuator motors are expected to hinder the growth of the global automotive torque actuator motor market during the forecast period. Moreover, engine downsizing to reduce vehicle weight and increase in demand for commercial vehicles are expected to create an opportunity for the automotive torque actuator motor market in near future

To fulfil the changing demand scenarios, market participants are concentrating on product launch strategy to expand their product portfolio and meet new business opportunities. For instance, in August 2022, ElectroCraft Inc. launched the ElectroCraft RapidPower Enhanced series (RPE series) that is an innovative, new brushless DC (BLDC) motor design that combines performance, flexibility and affordability, offering original equipment manufacturers (OEMs) the perfect platform for a wide range of motion applications. Moreover, in March 2022, Johnson Electric launched ECI-043 brushless DC motor platform. This platform aims at high torque low speed applications and delivers a stable torque output with a high level of controllability, which is suited to robotic lawn mower traction, cutter, and autonomous vehicle traction systems. In addition, market participants are continuously focusing on product development strategy to improve the product and customer reach. For instance, in January 2020, Rheinmetall developed a new generation of rotary and linear turbo actuators suitable for turbochargers with wastegate or variable turbine geometry (VTG).

The key players that operate in this market are Bray International, Continental AG, CTS Corporation, Electrocraft, Inc., Emerson Electric Co., HIWIN Technologies Corp., Igarashi Motors India Limited, Johnson Electric, Mabuchi Motor Co., ltd., Mitsuba Corporation, NSK, Rheinmetall, Siko-Global, Sonceboz, and Val-Matic Valve & Mfg. Corporation.

The global automotive torque actuator motor market was valued at $8.86 billion in 2021, and is projected to reach $14.88 billion by 2031, registering a CAGR of 5.6% from 2022 to 2031.

The key players that operate in this automotive torque actuator motor market are Bray International, Continental AG, CTS Corporation, Electrocraft, Inc., Emerson Electric Co., HIWIN Technologies Corp., Igarashi Motors India Limited, Johnson Electric, Mabuchi Motor Co., ltd., Mitsuba Corporation, NSK, Rheinmetall, Siko-Global, Sonceboz, and Val-Matic Valve & Mfg. Corporation.

Electronic Throttle Control (ETC) is the leading application of automotive torque actuator motor market.

Asia-Pacific is the largest regional market for automotive torque actuator motor.

Engine downsizing to reduce vehicle weight and increase in demand for engine performance and fuel efficiency are the upcoming trends of automotive torque actuator motor market.

Loading Table Of Content...