Automotive Upholstery Market Insights:

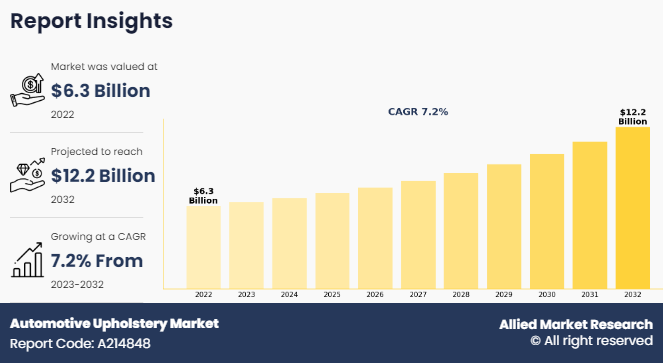

The global automotive upholstery market size was valued at USD 6.3 billion in 2022 and is projected to reach USD 12.2 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

An increase in production and sales of automobiles, along with the growing popularity of lightweight car’s upholstery materials drive the growth of the market. In addition, rising demand for customization of vehicle’s interior is also expected to fuel the growth of the automotive upholstery industry. However, the high cost of raw materials, coupled with the stringent government regulation and standards for environmental safety is projected to limit the growth of this market. On the other hand, technological advancements and innovations in bio-degradable materials, along with the surge in preference for synthetic leather are anticipated to provide numerous opportunities for the expansion of the automotive upholstery market growth during the forecast period.

Report Key Highlighters:

- The automotive upholstery market study covers 18 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the automotive upholstery market.

- The key players in the automotive upholstery market are Adient plc, BASF SE, FORVIA Faurecia, Freudenberg Group, Grupo Antolin Irausa S.A, MarvelVinyls, Sage Automotive Interiors, SEIREN Co., Ltd., The Acme Group, and Toyota Boshoku Corporation. These companies have adopted strategies such as product launches, product development, and others to improve their market positioning.

Automotive upholstery is primarily defined as the materials and fabrics used to cover the interior of vehicles, such as cars, trucks, and vans. It includes everything from the seats, headliners, door panels, and carpets, to the dashboard covers and trim panels. Automotive upholstery serves both functional and aesthetic purposes, delivering comfort, and protection, and improving the overall look and feel of the vehicle’s interior. From luxurious leather seats to durable vinyl covers, automotive upholstery includes a wide range of materials and techniques designed to improve the interior functionality and visual appeal of automobiles. The selection of upholstery materials can vary depending on factors, such as the vehicle's intended use, budget, and preferred style.

The global automotive upholstery market analysis is also driven by the rapid growth in the adoption of lightweight upholstery materials, which creates significant prospects for automakers to improve environment sustainability, fuel efficiency, and vehicle performance. According to the preliminary data from the Environmental Protection Agency (EPA), the fuel efficiency for vehicle models in 2022 is estimated to be 26.4 mpg, with an increase of 35.4% from 19.5 mpg across 2002 models. Therefore, automotive manufacturers are turning their interest towards advanced and lightweight upholstery rather than traditional materials, as these materials facilitate improved fuel efficiency, as well as meet regulatory requirements, and reduce costs. This, in turn, contributes to the automotive upholstery market growth.

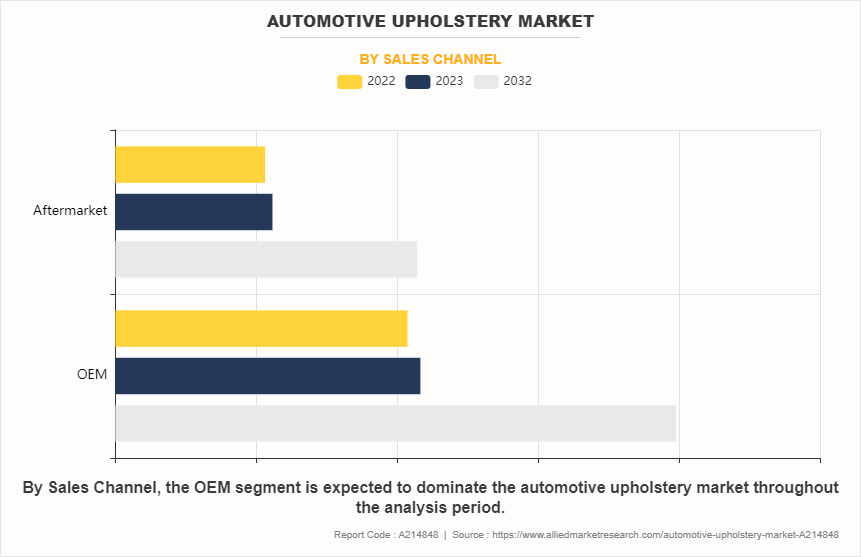

The automotive upholstery market is segmented into material type, application, sales channel, vehicle type, and region. Depending on the material type, it is categorized into leather, vinyl, polyester, nylon, and others. Depending on the application, it is categorized into seat cover, carpet, dashboard, and others. By sales channel, it is divided into OEM and aftermarket. By vehicle type, it is fragmented into passenger cars and commercial vehicles. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

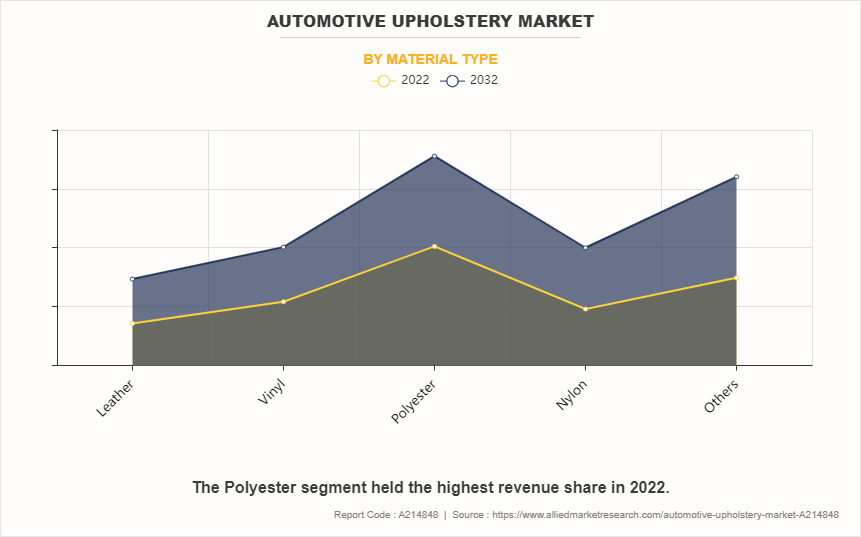

By material type, the polyester segment captured the largest automotive upholstery market share in 2022 and is expected to continue this trend during the forecast period. This is attributed to several advantages such as durability, cost-effectiveness, versatility, and stain resistance, which have increased the demand for polyester materials in the automotive upholstery industry. Furthermore, the growing consumer preference and demand for durable and easy-to-maintain polyester upholstery, along with the increasing advancements in high-performance polyester materials are anticipated to fuel the growth prospect of the polyester segment across the globe. However, leather is expected to grow at the fastest CAGR during the forecast period, due to the rise in demand for improved in-vehicle aesthetics and the increase in preference for leather seats in automobiles.

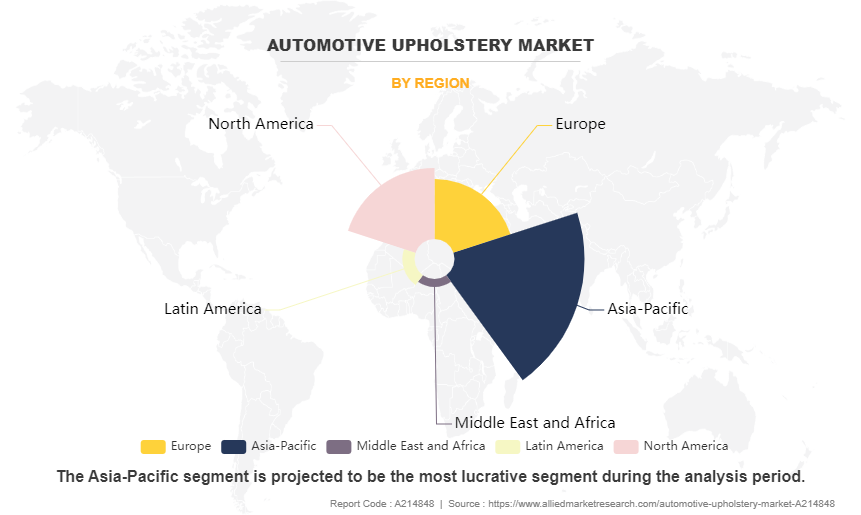

Region-wise, the automotive upholstery market was dominated by Asia-Pacific in 2022 and is expected to retain its position during the forecast period, owing to the increasing focus on comfort and aesthetics among automakers, along with the rise in demand for passenger cars and commercial vehicles in this region. Moreover, governments in this region are implementing numerous policies and standards regarding the use of airbags and safety belts, which fuels the growth of the automotive upholstery market. However, Europe holds a considerable automotive upholstery market share, owing to the rising usage of automotive textiles in upholstery applications with growing industrialization and urbanization in the region.

Recent Developments in the Automotive Upholstery Industry:

- In October 2023, Sage Automotive Interiors completed the partnership agreement with U.S.-based startup, NFW, a producer of a plastic-free, plant-based leather alternative for car interiors. This strategic partnership enables a major step to uphold global automotive OEMs in minimizing the environmental burden of the automobile lifecycle.

- In March 2023, BASF and Toyota together launched new automotive interior trims made with Ultramid Deep Gloss grade. This mold-in-color technology used to yield the new grade is more sustainable, as it enhances the production efficiency of automotive parts.

- In July 2023, FORVIA and BYD rev up their partnership with the development of a new seat assembly plant in Thailand. This strategic step strengthens the global technical partnership extended with Chinese electric vehicle manufacturer BYD, propelling both companies further into the Asia-Pacific market.

Top Impacting Factors:

Increase in Production and Sales of Automobiles across the Globe

The robust growth of automotive market, especially in emerging economies, leads to a higher demand for vehicles. This expansion creates a wider customer base requiring high-quality upholstery, including both original equipment manufacturers (OEMs) and aftermarket consumers. Automotive markets are often becoming increasingly diverse, with consumers in varied regions exhibiting varying preferences for vehicle interiors. The use of upholstery enables automakers to provide these distinct preferences by delivering a broad range of materials, colors, and designs to suit local tastes and cultural preferences. According to the International Organization of Motor Vehicle Manufacturers (OICA), around 67.13 billion units of cars were produced in 2023, representing an increase of almost 8.9% from 2022 which accounts for 61.59 billion units of production. This considerable rise in the production of cars is expected to pave the demand for automotive interiors, resulting in significant automotive upholstery market growth.

With the increasing availability of vehicles across the world, consumers often seek customization options to personalize their vehicles. This trend further extends to automotive upholstery, where consumers appeal to exceptional materials, colors, and designs to suit their tastes. The availability of customization options may drive the widespread adoption of the automotive upholstery market.

High Cost of Upholstery Raw Materials

With the considerable shift towards the aesthetic appearance of automobiles, automakers are broadly paving the adoption of upholstery material as an integral part of auto components. Automotive upholstery materials, such as fabric, leather, and vinyl, provide a range of benefits such as improving comfort, durability, and ease of maintenance. However, this transition includes challenges, such as the high cost associated with upholstery materials in the automotive industry. Factors that contributed to a significant increase in the cost of upholstery raw materials include global supply chain disruptions, including fluctuations in commodity prices and transportation challenges. For example, polyurethane foam was subject to product shortages in late 2020 and is now only accessible at a record-high price. Thus, the volatility and high price of upholstery raw materials are expected to be the major restraining factors for the automotive upholstery market forecast.

In addition, rising material costs may often incentivize automotive manufacturers to explore alternative materials or manufacturing processes. This could involve the use of innovative synthetic materials, sustainable alternatives, or manufacturing efficiencies to mitigate cost pressures without compromising quality. Such factors are acting as hindrances to the growth of the automotive upholstery market.

Surge in Preference for Synthetic Leather

In recent years, the automotive industry has observed a notable rise in the preference for synthetic leather as a primary material for upholstery in vehicle interiors. Synthetic leather, also known as leatherette or faux leather, has emerged as a compelling substitute for genuine leather owing to its durability, cost-effectiveness, and versatility. This trend reflects evolving consumer preferences, technological advancements, and sustainability considerations within the automotive sector, contributing to significant growth prospects for the automotive upholstery market.

Furthermore, synthetic leather delivers unparalleled design versatility, enabling automakers to produce customized upholstery solutions modified to specific vehicle models and consumer preferences. With a wide range of colors, textures, and patterns available, synthetic leather enables automotive designers to experiment with innovative interior concepts and aesthetic themes. Hence, this flexibility empowers automakers to differentiate their products in a competitive market landscape while catering to diverse consumer tastes and lifestyle needs, resulting in significant market growth.

In addition, the continual advancements in synthetic leather manufacturing technology have improved the quality and performance of synthetic leather materials. Modern synthetic leather materials deliver improved softness, suppleness, and breathability, providing a comfortable and luxurious experience for vehicle occupants. This, in turn, is anticipated to contribute to the automotive upholstery market growth during the forecast period.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the automotive upholstery market segments, current trends, estimations, and dynamics of the automotive upholstery market analysis from 2022 to 2032 to identify the prevailing automotive upholstery market opportunities.

- The automotive upholstery market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive upholstery market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as the automotive upholstery market trends, key players, market segments, application areas, and market growth strategies.

Automotive Upholstery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.2 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Material Type |

|

| By Application |

|

| By Sales Channel |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Freudenberg Group, Toyota Boshoku Corporation, BASF SE , Adient plc, FORVIA Faurecia, Grupo Antolin Irausa S.A, SEIREN Co., LTD., MarvelVinyls, Sage Automotive Interiors , The Acme Group |

Analyst Review

According to the leading CXOs, the automotive upholstery market is expected to witness considerable growth globally during the forecast period, due to the growing advancements in materials and technology driving innovation in automotive upholstery. The industry is also observing the development of materials with improved durability, comfort, and aesthetic appeal. This includes the use of smart fabrics, sustainable materials, and advanced manufacturing processes. Further, the continual rise in focus on the comfort and aesthetics of vehicles is expected to fuel the growth outlook of the automotive upholstery market. With consumers seeking more customizable and luxurious interiors, auto manufacturers better respond by developing high-quality, aesthetically pleasing upholstery options. In addition, the market growth is accompanied by many developments carried out by top electric water pump manufacturers, such as Adient plc, Faurecia, Sage Automotive Interiors, and Toyota Boshoku Corporation, which has led to the market's growth.

With larger requirements for automotive upholstery, automakers introduced various strategies, such as product launch and development, partnership, acquisition, collaboration, and business expansion, to strengthen their market position capabilities. Among these, product launch and partnership are significant strategies used by prominent players such as Sage Automotive Interiors and Toyota Boshoku Corporation. For instance, in November 2022, Toyota Boshoku Corporation developed products, including seats and interiors for use on the all-new Lexus RX, which was introduced in November 2022 by Toyota Motor Corporation. This strategic initiative contributes to the growing luxury segment, technological innovation, customization options, sustainability initiatives, and regional growth opportunities.

Similarly, in July 2022, Sage-ONF introduced serial production of Silicone Synthetic leather. The Sage-ONF plant has begun manufacturing silicone synthetic leather in Shanghai, China. This significant step remains to strengthen the demand for improved sustainability commitments, delivering innovative petroleum-free, non-carbon-based product solutions for mobility interiors. This development will further meet the demanding requirements of the mobility interior without leather’s known extra weight, fragility, environmental impact, and short lifespan. Such novel developments and innovations are projected to pave the market demand for automotive upholstery.

Region-wise, Asia-Pacific is expected to account for the highest CAGR in the global market during the forecast period, followed by North America and Europe. This growth rate is driven by robust economic growth, rising government support & incentives to promote the adoption of electric vehicles, and increasing focus on passenger comfort and vehicle customization. In addition, emerging countries such as China, Japan, and India are projected to witness significant demand for automotive upholstery in the future, owing to the increasing innovation in material technology to develop sustainable & eco-friendly materials and advanced textile technologies. This is likely to boost the Asia-Pacific market for automotive upholstery.

The automotive upholstery market is segmented into material type, application, sales channel, vehicle type, and region. Depending on the material type, it is categorized into leather, vinyl, polyester, nylon, and others. Depending on the application, it is categorized into seat cover, carpet, dashboard, and others. By sales channel, it is divided into OEM and aftermarket. By vehicle type, it is fragmented into passenger cars and commercial vehicles. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

The global automotive upholstery market size was esteemed at $6,267.90 million in 2022 and is estimated to reach $12,237.88 million by 2032, exhibiting a CAGR of 7.2% from 2023 to 2032.

Top key players in the automotive upholstery market are Adient plc, BASF SE, FORVIA Faurecia, Freudenberg Group, Grupo Antolin Irausa S.A, MarvelVinyls, Sage Automotive Interiors, SEIREN Co., Ltd., The Acme Group, and Toyota Boshoku Corporation.

Region-wise, the automotive upholstery market was dominated by Asia-Pacific in 2022 and is expected to retain its position during the forecast period.

By material type, the polyester segment captured the largest market share in 2022 and is expected to continue this trend during the forecast period.

Increase in production and sales of automobiles, rising demand for customization of vehicle’s interior, and the growing popularity of lightweight car’s upholstery materials drive the growth of the market.

Loading Table Of Content...

Loading Research Methodology...