Automotive Wheel Speed Sensor Market outlook - 2025

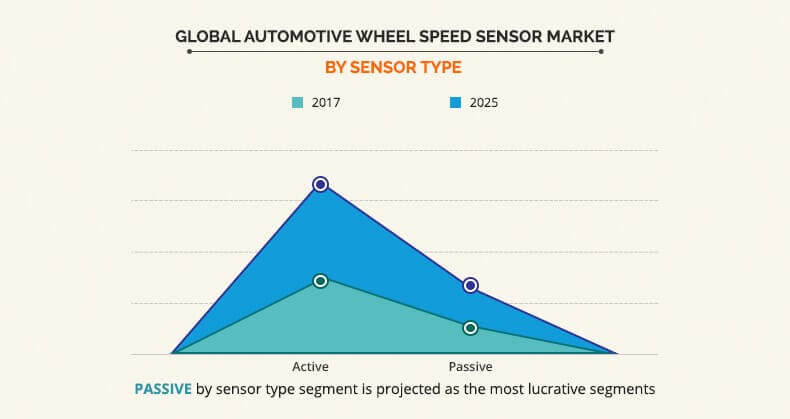

The global automotive wheel speed sensor market size was valued at $6,400.0 million in 2017, and is projected to reach $8,475.4 million by 2025, registering a CAGR of 3.6% from 2018 to 2025. The active segment was the highest contributor to the market, with $4,611.2 million in 2017, and is estimated to reach $6,003.5 million by 2025, at a CAGR of 3.4% during the forecast period. In 2017, Asia-Pacific accounted for the highest share in the global automotive wheel speed sensor market.

The anti-lock braking system uses wheel speed sensor as a main component. The automotive wheel speed sensor market analysis is totally depend on the type & material used for its construction. A speed sensor is used to determine the acceleration or deceleration of the wheel. These sensors use a magnet, hall-effect sensor, a toothed wheel, and an electromagnetic coil to generate a signal. The rotation of the wheel or differential induces a magnetic field around the sensor. The fluctuations of this magnetic field generate a voltage in the sensor and passed on to the electronic control unit for the operation.

The automotive wheel speed sensor market segmentation is done by considering sensor type and vehicle type. The latest automotive wheel speed sensor market trends decides the growth. The automotive wheel speed sensor market forecasted from year 2018-2025 by considering all the driving deciding factors that influence to automotive wheel speed sensor trends.

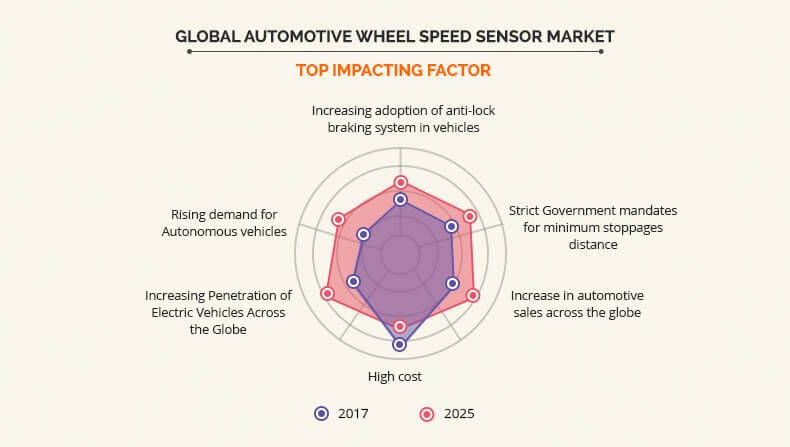

Increase in adoption of anti-locking breaking system for vehicles, rise in concern of consumer toward safety & security features, and governments legislation to mandate the ABS system in cars are the main factors that boost the growth of the automotive wheel speed sensor market. In addition, growth in production and sales of vehicles in developing countries of Asia-Pacific is also influencing the growth of automotive wheel speed sensor market. The automotive wheel speed sensor market growth directly depends on the advancement and expansion of the ABS system.

Key players operating in the global automotive wheel speed sensor market are Continental AG, Robert Bosch GmbH, HELLA GmbH & Co. KGaA, ZF Friedrichshafen AG, DENSO CORPORATION, Hitachi Metals, Ltd., Melexis, NTN-SNR, NXP Semiconductors, and WABCO.

Increase in Adoption of Anti-lock Braking System in Vehicles

The automotive industry has evolved from conventional braking systems, which use only mechanical linked brake systems. The conventional braking system has limitations regarding minimum stoppage distance and high weight & complexity due to number of components used. However, the anti-lock braking system has hydraulics and electronic components due to accurate reading property. The increase in adoption of anti-lock braking is responsible for rise in demand for wheel speed sensor in the automotive industry. Furthermore, the increase in adoption of safety features such as electronic stability unit (ESU), hydraulic braking and advanced braking system in the low to medium segment vehicles of developing countries has been widely accepted across the globe. The growth in demand for safety, comfort, and aesthetic features have led to several technological advancements, such as installation of ABS sensor, in vehicles. For instance, Continental has added two new production lines at the India (Gurgaon) plant to assemble anti-lock braking system (ABS) and electronic stability control (ESC). They increased their capacity to address the market requirements due to governments legislation for ABS entry in April 2019 for passenger cars. One of the major factors that driving the automotive wheel speed sensor market share is increase in demand for automotive sensors and autonomous vehicles with major advanced safety & security features.

Strict Government Mandates for Minimum Stoppages Distance

The automotive market is positively affected by safety regulations implemented by government for installation of power window, airbags, and anti-lock braking systems (ABS) in every vehicle. Europe and North America have been witnessed to follow these regulations more stringently as compared to Asia-Pacific and rest of the world. However, in developing countries, OEMs are providing anti-lock braking systems (ABS) as standard features in vehicles, thus supporting the government to improve safety measures. These safety systems need separate electronic control unit to handle and communicate between ABS sensors of vehicle to provide complete safety to passengers. Governments of different countries had made special regulations regarding the use of automotive emergency braking systems in the vehicles. For instance, the European Union and Japan have backed a draft of UN regulation for advanced emergency braking systems (AEBS) for new cars and light commercial vehicles. In addition, the regulation will impose strict and harmonized requirements for automatic braking at speeds of upto 60 kph (37 mph) in urban settings. Such system involves number of sensor including wheel speed sensors to monitor the proximity of the vehicle or pedestrian to avoid the collision. The adaption of ABS technology had played a vital role in the growth of the automotive wheel speed sensor market. Also, the Indian governments legislation regarding compulsion of ABS system in passenger cars from 2019 boost the growth of the market.

Increase in Automotive Sales across the Globe

The automotive environment is changing at a rapid pace due to globalization. The increase in automotive sales has been caused due to the improvement in manufacturing facilities in most of the emerging countries such as China, India, and Brazil. Global automotive sector promises better productivity and sales as this sector consists of different segment such as passenger car and commercial vehicles which in turn drives excellent profitability. This factor majorly influences prominent players of automotive sector to invest and expand the business through different segments to gain better profitability. Also, increase in disposable income of consumers and surge in car sale across the globe fuel the rise in sale of automotive vehicle. Developing countries such as India, China, and Brazil are the most promising countries for the automotive sector. China, being the worlds largest market for vehicles, is expected to grow further over the next few years as most OEMs are also making large investments in this sector. Along with China, the U.S. market is also anticipated to grow in near term. The increase in demand for ABS system for safety and the rise in demand for electric vehicles in automotive sector fuels the growth of the ABS sensors market and is anticipated to boost the automotive wheel speed sensor market opportunity in near future.

High Cost

High cost of vehicles embedded with ABS system is a major factor that restrains the growth of the automotive wheel speed sensor market. The cost of the electronic component and technology makes ABS costlier than traditional braking systems in vehicles. Moreover, ABS system consists of some wheel speed sensors, brake calipers, a hydraulic motor, and some pressure release valves. The manufacturing cost of such small components carries high initial cost. Also, the regular maintenance and replacements of electronic components such as electronic control units (ECU) costs around $1000. The fixed or displacement type of pump needed for fan drive system offers low noise operation. The sensing mechanism used of precise reading used for such efficient operation carries high initial cost; therefore, its use have become limited due to higher cost. Furthermore, the electronic stability control unit consists of cables to connect engine control unit and sensors output to pump solenoid increases the overall complexity and maintenance cost. Therefore, these factors are responsible to hinder the automotive wheel speed sensor market growth.

Increase in Penetration of Electric Vehicles across the Globe

The demand for automotive speed sensors is high for applications, especially in hybrid and electric cars. The ABS based in-wheel technology is emerging as the dominant drive system for electric vehicles. The existence of an electric motor at each wheel sensor unit provides opportunities for the development of efficient intelligent brakes for in-wheel cars. The market for automotive wheel sensor experiences growth and is projected to perform better because of the additional features such as vehicle dynamic control (VDC), anti-lock braking systems (ABS), and electronic stability programme (ESP) are introduced in upcoming vehicles. There is an increase in the sales of the electric vehicle because of rise in fuel cost. In addition, the governments subsidiaries support to the use of electric vehicle due to reduction in CO2 emission is directly creating an opportunity for the ABS sensors.

Rise in demand for Autonomous Vehicles

In recent years, consumers have shifted their interest to automotive vehicles, as these vehicles do not consume any kind of fuel such as petrol, diesel, or gasoline and are technologically advanced as against traditional vehicles and cost low amount of maintenance, and thereby reduce the customers expense. The autonomous vehicle uses steering-software wheel speed sensors to obtain information on current overall speed compared with speed from GPS device and movement sensors. Moreover, the information related with changing the direction of the front-wheels only slightly, if the road is slippery is done with the help of ABS sensors. Most cars currently use the speed wheel sensors for ABS and ASS, which controls the traction on each wheel during acceleration and braking to avoid losing the grip of the wheel on the road. Such rise in the sales of the autonomous vehicles due to their advanced features is expected to create numerous opportunities for the automotive wheel speed sensor market share expansion.

Key Benefits for Automotive Wheel Speed Sensor Market:

- This study presents analytical depiction of the automotive wheel speed sensor market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current automotive wheel speed sensor market size is quantitatively analyzed from 2018 to 2025 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the automotive wheel speed sensor industry.

Automotive Wheel Speed Sensor Market Report Highlights

| Aspects | Details |

| By SENSOR TYPE |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | NTN-SNR, WABCO, ZF Friedrichshafen AG, Melexis NV, Continental AG, Hella KGaA Hueck & Co., NXP Semiconductors N.V, Hitachi Metals, Ltd., DENSO Corporation, Robert Bosch GmbH |

Analyst Review

The anti-lock braking system uses wheel speed sensor as a main component. The ABS system is used in car for the purpose of maintaining tires contraction with road surface. The wheel speed sensor in automotive is used to determine accelerations and decelerations of the wheel. These sensors consist of an exciter (a ring with V-shaped teeth), inbuilt magnetic material/magnetic assembly, and coil of the wire to generate a signal. The continuous rotation of the wheel creates a magnetic field around the sensor. Furthermore, the fluctuation of such magnetic field generates a voltage signal into the sensor.

Increase in adoption of anti-locking breaking system for vehicles, rise in concern of consumer towards safety & security features, and government’s legislation to mandate the ABS system in cars boost the growth of the automotive wheel speed sensor market. In addition, rise in production and sales of vehicles in developing countries of Asia-Pacific is also influencing the growth of the automotive wheel speed sensor market. The growth of the automotive wheel speed sensor market directly depends on the advancement & expansion of ABS system.

Among the analyzed geographical regions, currently, Asia-Pacific is the highest revenue contributor, and is expected to remain dominant during the forecast period, followed by Europe, North America, and LAMEA. This growth is attributed to increase in demand for various types of vehicles.

Loading Table Of Content...