Autonomous Finance Market Research, 2032

The global autonomous finance market was valued at $15.8 billion in 2022, and is projected to reach $82.6 billion by 2032, growing at a CAGR of 18.2% from 2023 to 2032.

Autonomous finance refers to the use of advanced technology such as artificial intelligence and machine learning to automate financial tasks and decisions. It aims to make it simpler for consumers and businesses to manage their money and improve their financial outcomes. It includes tasks such as budgeting, investing, risk management, and cash forecasting.

One of the key drivers of the autonomous finance market is the advancements in artificial intelligence (AI). Furthermore, consumer demand for convenient and personalized financial services is a key driver behind the rapid growth of the autonomous finance market. In addition, the cost efficiency and risk management of autonomous finance systems are significant drivers of the growth of the autonomous finance market. Financial institutions and businesses are increasingly turning to autonomous finance solutions to streamline their operations and reduce operational costs. Automation can handle repetitive and time-consuming tasks, such as data analysis and processing, with precision and speed, leading to substantial cost savings.

The data privacy and security concerns have emerged as significant barriers to the growth of the autonomous finance market. The autonomous finance ecosystem relies heavily on collecting and analyzing vast amounts of personal and financial data to provide tailored financial recommendations and services. This abundance of sensitive information makes it a prime target for cyberattacks and data breaches, hampering the autonomous finance market growth. On the contrary, the increase in the adoption of FinTech is expected to offer lucrative growth opportunities to the autonomous finance market in the upcoming years. FinTech innovations have transformed the way consumers manage and interact with their finances, from mobile banking apps to digital payment platforms. These technologies create a seamless and interconnected financial ecosystem, and autonomous finance can seamlessly integrate with these systems.

The report focuses on growth prospects, restraints, and trends of the autonomous finance market forecast. The study provides porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the autonomous finance market outlook.

Segment Review

The autonomous finance market is segmented into solution, end user, and region. On the basis of solution, the market is differentiated into asset management, auto payments, digital identity management system, liquidity management, loan application processing, and others. By end user, the autonomous finance market is divided into banks, financial institutions, insurance companies, and others. Region-wise, the autonomous finance market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

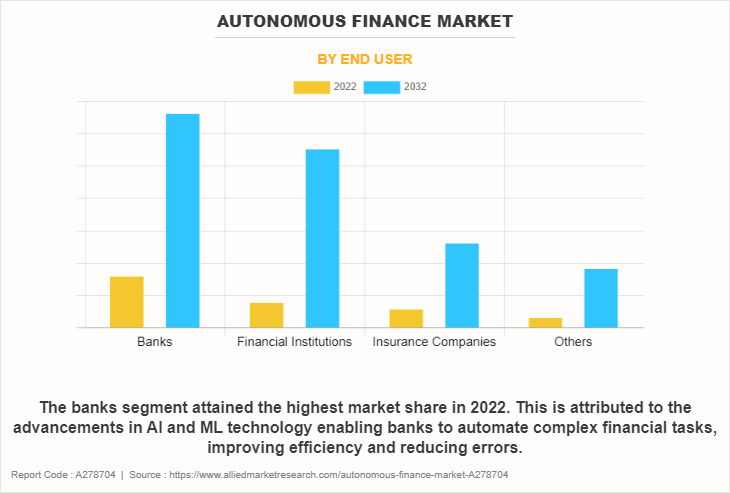

By end user, the banks segment acquired a major share in 2022. The growth of the banks segment is propelled by advancements in artificial intelligence and machine learning technology enabling banks to automate complex financial tasks, improving efficiency and reducing errors. Furthermore, customer demand for more convenient and personalized financial services has led banks to adopt autonomous systems that can deliver tailored recommendations and services in real-time. However, the financial institutions segment is expected to be the fastest-growing segment during the forecast period, owing to the fact that financial institutions are increasingly digitizing all services, including retail offers, payment platforms, and wealth and capital management processes. Furthermore, customers increasingly seek personalized and convenient financial services, driving institutions to adopt autonomous systems that can provide tailored solutions in real-time.

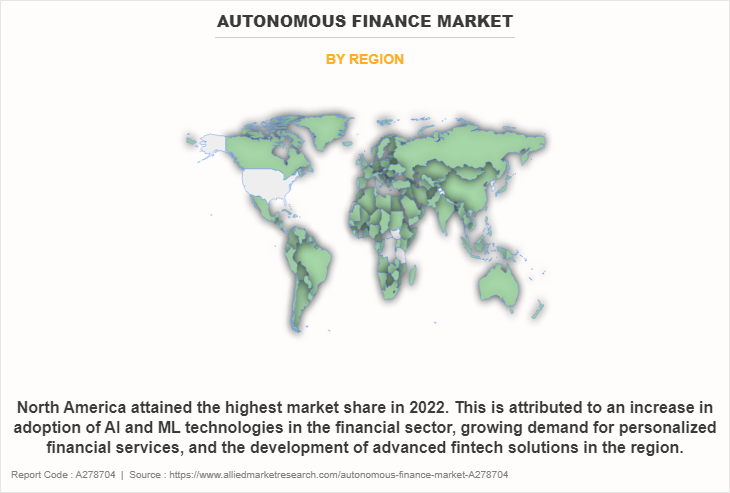

Region-wise, North America dominated the autonomous finance market share in 2022, owing to the increase in the adoption of artificial intelligence and machine learning technologies in the financial sector, the growing demand for personalized financial services, the need for more efficient and cost-effective financial management, and the development of advanced fintech solutions. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the rapid digitalization, the vast and diverse consumer base, and the increase in penetration of smartphones and internet connectivity in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major players in the autonomous finance market include Signzy Technologies Private Limited, Roots Automation, ReGov Technologies Sdn Bhd, Fennech Financial, HighRadius, Oracle, Auditoria.AI, Vic.ai, Emagia, and NICE Actimize. These players have adopted various strategies to increase their market penetration and strengthen their position in the autonomous finance industry.

Recent Partnerships in the Autonomous Finance Market

In September 2023, Oracle and Mastercard formed a partnership to help enterprise customers automate end-to-end business-to-business (B2B) payment transactions. The partnership allows Oracle to directly connect Oracle Fusion Cloud Enterprise Resource Planning (ERP) with banks to streamline and automate the entire B2B finance and payment process.

In December 2022, HighRadius, the autonomous finance platform for the office of the CFO, expanded its hosting partners with the new partnership with Google Cloud. The partnership accelerates the global deployment and expansion of HighRadius Autonomous Finance solutions for its clients on Google Cloud.

Recent Product Launch in the Autonomous Finance Market

In September 2023, Emagia, a leading innovator in autonomous finance solutions launched GiaGPT, their latest Generative AI solution tailored for finance operations executives. GiaGPT is designed to transform the way finance professionals interact with their enterprise finance reports, data, and documents. Instead of manual search and analysis methods, executives now simply chat with GiaGPT and gain rapid insights seamlessly.

In August 2023, Vic.ai, the leading AI autonomous finance platform, launched Vic.ai Payments to complete its vision of delivering an end-to-end solution for Accounts Payable (AP) teams. Vic.ai Payments saves time, reduces risk, and improves cash flow by integrating all components of AP processing, from invoice to payment, into a single, end-to-end system powered by the industry’s most advanced artificial intelligence (AI).

In February 2023, HighRadius launched LiveCube, a no-code platform for the office of the CFO at Radiance 2023, the annual conference of 1000+ finance professionals. LiveCube enables finance business users, including A/R, treasury and accounting teams, to build their own applications as extensions to standard functionality received from enterprise systems without depending on IT dept or admin users using a familiar excel-like spreadsheet interface.

Market Landscape and Trends

Autonomous finance has evolved alongside advancements in technology and rising customer demands for personalized financial services. Initially, financial institutions used basic algorithms to automate difficult tasks such as account balances and transaction reconciliation. However, with improved computing power and sophisticated machine learning algorithms, autonomous finance has transformed into a powerful tool for individuals and institutions alike. The current autonomous finance platforms offer features beyond simple automation. They provide users with actionable insights, investment suggestions, and customizable financial plans. Machine learning algorithms analyze data from various sources, enabling the system to identify trends, predict future outcomes, and offer personalized recommendations.

In addition, key players in the autonomous finance sector adopt various strategies such as partnerships and product launch to sustain their growth in the market and expand their product portfolio. For instance, in August 2022, Roots Automation expanded its relationship with an industry-leading health insurance and Medicare services provider to streamline efficiency during open enrollment. Together, their customer and digital coworker improved their service levels throughout the 2023 Open Enrollment Period (OEP) by removing the manual effort and manual errors around their premium payments and marketplace lookup processes.

Top Impacting Factors

Advancements in Artificial Intelligence

Advancements in artificial intelligence (AI) are driving the growth of the autonomous finance market size. AI is becoming increasingly sophisticated in its ability to analyze vast amounts of financial data, identify patterns, and make real-time decisions. This enables autonomous finance systems to provide more accurate and timely financial advice, investment strategies, and risk management. For individuals, this means personalized financial planning and investment recommendations based on their unique financial situations, helping them make better financial decisions. Moreover, AI's automation capabilities are streamlining various financial processes, reducing the need for manual intervention which saves time and resources as well as minimizes the margin for human error in financial operations. Furthermore, businesses are also benefiting from AI-driven autonomous finance solutions, which can optimize cash flow management, detect fraudulent activities, and even predict market trends. Therefore, such factors drive the growth of the autonomous finance market.

Consumer Demand for Convenient and Personalized Financial Services

Consumer demand for convenient and personalized financial services is a key driver behind the rapid growth of the autonomous finance market. People today are seeking financial solutions that fit seamlessly into their busy lives. Autonomous finance addresses this demand by offering user-friendly apps and platforms that simplify money management. These tools automate savings, provide instant financial insights, and offer personalized recommendations, making it much easier for individuals to achieve their financial goals without the hassle of manual calculations and decision-making. Furthermore, the financial situation of individuals is unique, and consumers want services that cater to their specific needs. Autonomous finance leverages technologies such as artificial intelligence and machine learning to analyze a person's financial data and create tailored strategies. This level of personalization ensures that financial advice and solutions are relevant and effective, driving the adoption of autonomous finance among consumers who value a customized approach to managing their money. Therefore, autonomous finance is meeting the growing demand for both, convenience and personalization in the financial sector, contributing to its substantial growth in autonomous finance market.

Data Privacy and Security Concerns

Data privacy and security concerns have emerged as significant barriers to the growth of the autonomous finance market. The autonomous finance ecosystem relies heavily on collecting and analyzing vast amounts of personal and financial data to provide tailored financial recommendations and services. However, the abundance of sensitive information makes it a prime target for cyberattacks and data breaches. Consumers are increasingly wary of sharing their financial data, fearing that it might be misused or exposed, which has led to reluctance to adopt autonomous finance solutions. To address this challenge, the industry needs to establish robust encryption and data protection mechanisms, as well as clear regulations to reassure consumers that their information is safe.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autonomous finance market analysis from 2022 to 2032 to identify the prevailing autonomous finance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the autonomous finance market segmentation assists to determine the prevailing autonomous finance market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as autonomous finance market trends, key players, market segments, application areas, and market growth strategies.

Autonomous Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 82.6 billion |

| Growth Rate | CAGR of 18.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Solution |

|

| By End User |

|

| By Region |

|

| Key Market Players | Oracle Corporation, Auditoria.AI, Signzy Technologies Private Limited, Roots Automation, ReGov Technologies Sdn Bhd, Emagia, NICE Actimize, HighRadius, Fennech Financial, Vic.ai |

Analyst Review

Artificial intelligence, particularly machine learning, plays a vital role in autonomous finance. Machine learning algorithms enable financial systems to learn from historical data, identify patterns, and make predictions based on these insights. It allows the system to adapt to user behavior, preferences, and market conditions. By leveraging AI and ML, autonomous finance platforms can analyze vast amounts of financial data, including personal transactions, income, and spending patterns. This analysis enables the system to generate tailored financial plans, identify potential investment opportunities, and optimize financial decisions.

Key players in the autonomous finance market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in September 2022, PwC India and HighRadius, the autonomous finance software platform for order to cash, treasury management, and record to report, formed a strategic alliance to bring the power of autonomous technology and digital transformation across finance and accounting business processes. The new alliance brings together HighRadius’s data-driven autonomous finance platform and PwC’s proven expertise in driving transformation for the office of the CFO. This gives financial institutions the confidence to embrace advanced technology and enable faster delivery of business outcomes. Therefore, such strategies adopted by key players propel the growth of the autonomous finance market.

The COVID-19 pandemic had a positive impact on the autonomous finance market. It accelerated the adoption of digital financial services and automation. With lockdowns and social distancing measures, people turned to online banking, robo-advisors, and automated budgeting tools to manage their finances remotely. Surge in demand for digital financial solutions boosted the growth of the autonomous finance sector, as more individuals and businesses sought automated ways to handle their money.

The key players in the autonomous finance market include Signzy Technologies Private Limited, Roots Automation, ReGov Technologies Sdn Bhd, Fennech Financial, HighRadius, Oracle, Auditoria.AI, Vic.ai, Emagia, and NICE Actimize. Major players operating in the market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness and rise in demand for autonomous finance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The autonomous finance market is segmented into solution, end user, and region. On the basis of solution, the market is differentiated into asset management, auto payments, digital identity management system, liquidity management, loan application processing, and others. By end user, the market is divided into banks, financial institutions, insurance companies, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Autonomous Finance.

The autonomous finance market size was valued at $15,769.41 million in 2022 and is projected to reach $82,578.76 million by 2032, growing at a CAGR of 18.2% from 2023 to 2032.

The major players in the autonomous finance market include Signzy Technologies Private Limited, Roots Automation, ReGov Technologies Sdn Bhd, Fennech Financial, HighRadius, Oracle, Auditoria.AI, Vic.ai, Emagia, and NICE Actimize.

Loading Table Of Content...

Loading Research Methodology...