Autonomous Last Mile Delivery Market Research, 2033

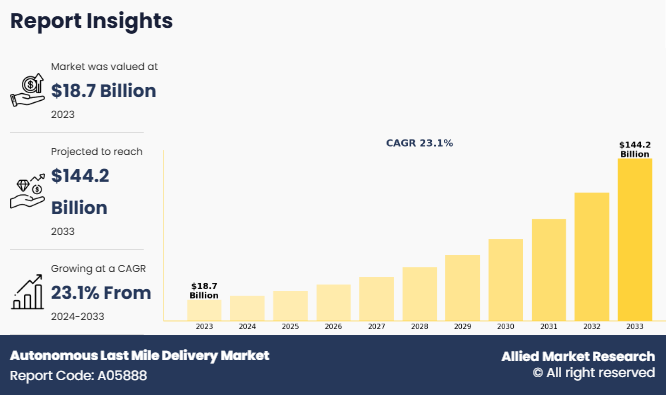

The global autonomous last mile delivery market size was valued at $18.7 billion in 2023, and is projected to reach $144.2 billion by 2033, growing at a CAGR of 23.1% from 2024 to 2033.

Report Key Highlighters:

- The autonomous last mile delivery industry study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the autonomous last mile delivery market are Airbus S.A.S., Flirtey, Drone Delivery Canada, Flytrex, Amazon.com, JD.com, Inc., Marble Robot, Savioke, DHL International GmbH, and United Parcel Service of America, Inc. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Autonomous last mile delivery (ALMD) refers to the use of self-operating vehicles, drones, or robots to transport goods from a local distribution center to the end customer's location, completing the most complex and costly phase of the logistics chain. This process leverages cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and advanced sensor systems to enable navigation and obstacle avoidance without human oversight. By automating the delivery process, companies aim to reduce operational inefficiencies and streamline the supply chain. The autonomous last mile delivery market forecast suggests robust growth over the next decade due to increasing investments in smart logistics.

A typical autonomous last mile delivery sequence begins when a customer places an order. The item is prepared and packaged at a nearby fulfillment center or local warehouse. Once ready, the order is loaded onto an autonomous delivery unit be it a ground robot, a self-driving van, or a drone. This unit navigates its way to the customer’s location, overcoming traffic and environmental challenges by dynamically recalculating its route. Upon arrival, the delivery vehicle can either deposit the package at the doorstep or use secure verification methods like PIN codes or facial recognition to complete the final handoff. Thus, autonomous last mile delivery market demand is fueled by the need for quick and reliable delivery in urban areas.

A significant trend shaping the autonomous last mile delivery industry is the focus on sustainability and reducing carbon emissions. Many autonomous delivery vehicles are electric, contributing to lower greenhouse gas emissions and supporting global efforts to combat climate change. Companies are also prioritizing the use of small, lightweight delivery robots that consume less energy and operate efficiently in urban environments. The development of drone delivery systems is another emerging trend, allowing for faster deliveries to remote or hard-to-reach areas, bypassing traditional road networks. This is particularly useful for the delivery of medical supplies, groceries, and essential goods in rural regions.

Moreover, urbanization and traffic congestion are driving the need for alternative delivery methods. Autonomous ground robots and drones can navigate sidewalks, bike lanes, and air routes, avoiding congested roads and reducing delivery delays.

The autonomous last mile delivery market is segmented on the basis of application, solution, range, vehicle type, and region. By application, the market is categorized into logistics, healthcare and pharmaceutical, food and beverage, retail, and others. Depending on the solution, it is fragmented into hardware, software, and service. By range, it is bifurcated into short range and long range. By vehicle type, the market is divided into aerial delivery drones, ground delivery vehicles, and self-driving trucks and vans. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The rise in e-commerce demand and the need for contactless delivery, along with technological advancements in AI, robotics, and sensors, and the increased need for cost reduction and operational efficiency, are expected to drive the global autonomous last mile delivery market growth during the forecast period. However, high initial investment and operational costs, as well as limited infrastructure for autonomous vehicle operation, are expected to hamper market growth. Moreover, the integration with smart city infrastructure and collaboration between technology firms and logistics companies are expected to offer lucrative opportunities for the market in the future.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In October 2024, Serve Robotics Inc., a major company in autonomous sidewalk delivery, announced a pilot partnership with Wing Aviation LLC, an on-demand drone delivery provider, to expand eco-friendly and autonomous food delivery services. This collaboration introduces a hybrid delivery model aimed at redefining last-mile logistics. Serve’s AI-powered, low-emissions sidewalk delivery robots handle pick-ups in dense urban areas, while Wing drones extend the delivery range.

- In October 2024, Bolt, a major ride-hailing company, expanded into autonomous food delivery by partnering with Starship Technologies, an Estonian tech start-up specializing in last-mile delivery robots. The collaboration aims to combine Starship’s autonomous delivery robots with Bolt’s growing delivery services, contributing to the future of urban mobility across Europe. Both companies highlighted their shared goal of advancing sustainable, efficient delivery solutions to enhance convenience and reduce congestion in urban areas.

- In February 2024, Starship Technologies raised $90 million in funding this year, with the investment co-led by Plural and Iconical, the company announced on Tuesday. Having completed over 6 million deliveries using its autonomous robots, Starship plans to utilize the new funding to expand its operations and scale its autonomous delivery services further.

- In March 2021, Flirtey, the first company in the U.S. to receive Federal Aviation Administration (FAA) approval for drone delivery in 2015, announced plans to increase production of its drone delivery system and is now accepting preorders. The company's delivery solution, known as the Flirtey Eagle, is part of a broader technology package that includes the Flirtey Portal and an autonomous software platform. Flirtey is actively pursuing FAA certification for its last-mile drone delivery system, positioning itself to expand operations and meet growing demand for automated delivery services.

Segmental analysis

The autonomous last mile delivery market is segmented on the basis of application, solution, range, vehicle type, and region. By application, the market is categorized into aerial delivery drones, ground delivery vehicles, self-driving trucks and vans, retail, and others. Depending on the solution, it is fragmented into hardware, software, and service. By range, it is bifurcated into short range and long range. By vehicle type, the market is divided into aerial delivery drones, ground delivery vehicles, and self-driving trucks and vans. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

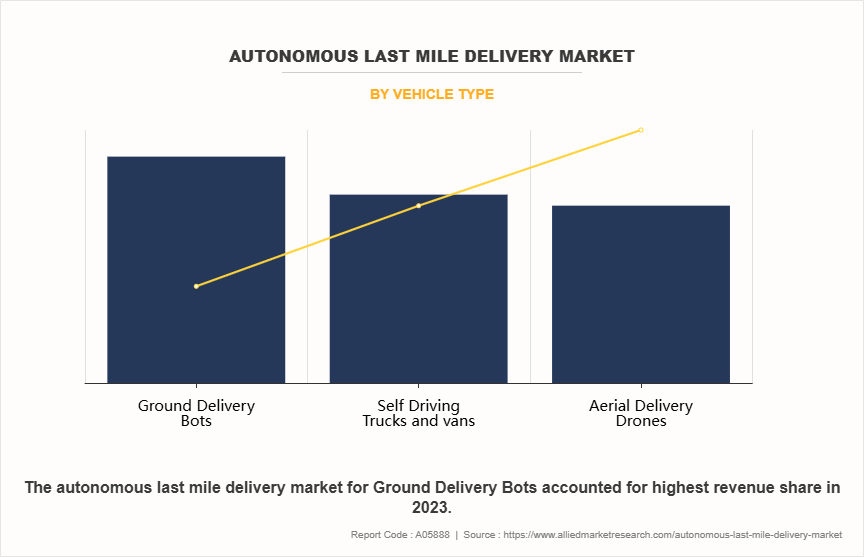

By Vehicle Type

By vehicle type, the global autonomous last mile delivery market is segmented into aerial delivery drones, ground delivery vehicles, and self-driving trucks and vans. The ground delivery vehicles segment accounted for the largest autonomous last mile delivery market share in 2023, due to advancements in AI and robotics, enabling efficient last-mile delivery. Increased adoption by e-commerce and logistics sectors, driven by rising demand for contactless delivery and operational cost reduction, fosters growth. Increase in adoption of autonomous delivery robots is contributing to the rapid growth of the autonomous last mile delivery market size.

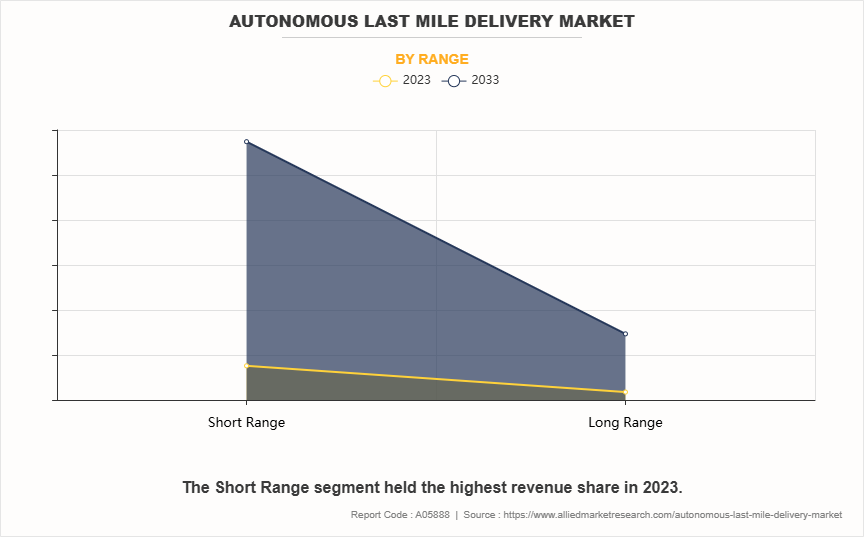

By Range

By range, the global autonomous last mile delivery market is segregated into short range and long range. The short range segment accounted for a dominant market share in 2023. This is primarily driven by most last-mile deliveries taking place within urban and suburban areas, thus covering short distances between local distribution hubs and customer locations. Autonomous ground robots and drones are particularly well-suited for short-range operations, efficiently managing deliveries of food, medical supplies, and e-commerce orders within city environments.

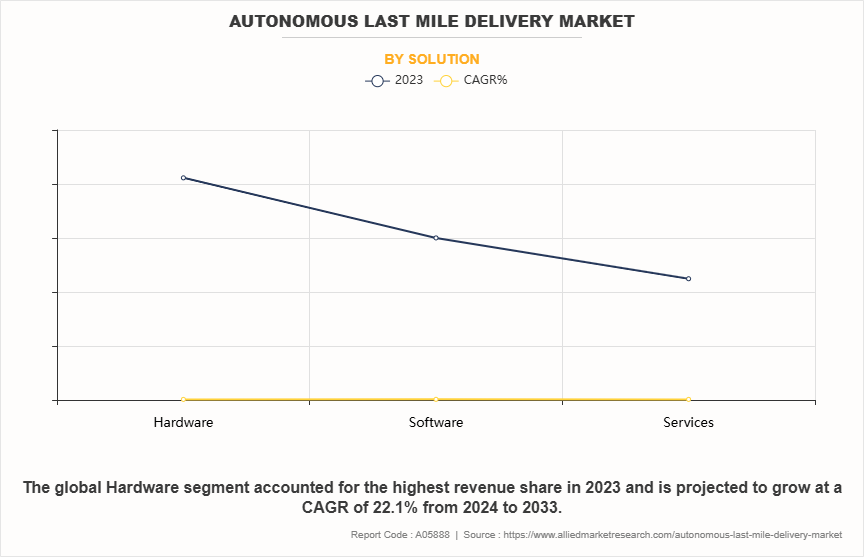

By Solution

By solution, the global autonomous last mile delivery market is segregated into hardware, software, and service. The hardware segment accounted for a dominant market share in 2023, driven by the critical role of physical delivery vehicles such as drones, robots, and autonomous trucks in autonomous last-mile delivery systems. The substantial initial investment required for the development, testing, and deployment of these vehicles reinforces hardware's dominance in the market.

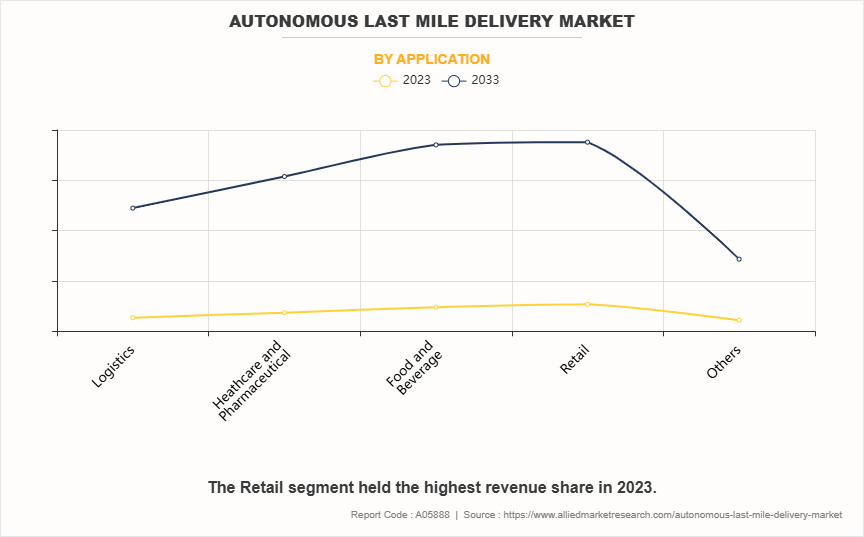

By Application

By application, the global autonomous last mile delivery market is segmented into aerial delivery drones, ground delivery vehicles, self-driving trucks and vans, retail, and others. The retail segment accounted for the largest market share in 2023. The growing demand for e-commerce and retail deliveries is driving the adoption of autonomous vehicles, including self-driving trucks, vans, and drones. These technologies are transforming supply chains by reducing delivery times and lowering operational costs.

By Region

Region wise, North America held the largest market share in 2023. This growth is driven by high demand for automated solutions, a well-established e-commerce infrastructure, and significant investment in logistics innovation. The region is home to major industry leaders such as Amazon, UPS, FedEx, and innovative startups such as Starship Technologies and Nuro, which are at the forefront of developing and deploying autonomous delivery systems.

Rise in e-commerce demand and need for contactless delivery

The rapid growth of e-commerce is a key factor driving the adoption of autonomous last mile delivery solutions. As consumers increasingly turn to online shopping for convenience and variety, the demand for faster, more efficient delivery services has surged. Retailers and logistics providers face the challenge of managing large volumes of orders while maintaining quick delivery times. Autonomous delivery systems, such as self-driving vehicles, robots, and drones, help address this by streamlining the final stage of delivery, reducing operational costs, and enhancing overall efficiency.

For instance, in July 2023, Vayu Robotics introduced an on-road delivery robot designed to enhance e-commerce logistics efficiency by reducing delivery costs. This new solution leverages advanced AI foundation models and low-cost, lidar-less passive sensors to navigate and operate autonomously. By eliminating the need for expensive lidar technology, Vayu Robotics aims to make autonomous delivery systems more affordable and scalable for the growing e-commerce industry.

The increasing demand during peak seasons, such as holidays and major sales events, further amplifies the need for automation. Autonomous delivery vehicles can operate continuously, ensuring that products are delivered on time even when order volumes are high. This allows companies to manage seasonal spikes more effectively and meet customer expectations for faster delivery.

The need for contactless delivery has become a significant driver, especially following the COVID-19 pandemic. Consumers are more conscious about safety and prefer delivery methods that minimize human interaction. Autonomous delivery vehicles and drones provide a solution by enabling products to be delivered directly to the customer’s doorstep without requiring physical contact. This not only reduces health risks but also enhances delivery speed and reliability.

Technological advancements in AI, robotics, and sensors

The rapid advancement of artificial intelligence (AI), robotics, and sensor technologies is a key driver in the growth of the autonomous last mile delivery market. Improvements in AI algorithms, machine learning, and computer vision have enabled autonomous delivery vehicles and robots to navigate complex environments, detect obstacles, and make real-time decisions without human intervention. These technologies enhance the accuracy and reliability of deliveries, reducing errors and operational costs.

One notable example is Cartken, an AI-powered autonomous delivery robot developer. For instance, in July 2024, Cartken, an AI-powered autonomous delivery robot developer, secured an additional $10 million in funding, raising its total to $22.5 million. This latest round was led by 468 Capital, with contributions from Magna International, Shell Ventures, Mitsubishi Electric, and Volex. Cartken’s robots are designed to automate goods transportation in industrial settings and for last-mile delivery, addressing the inefficiencies of manual processes. Their ability to navigate both indoor and outdoor environments broadens their application across various industries, enhancing operational efficiency and scalability.

The development of low-cost sensors and lidar alternatives is also making autonomous delivery more accessible. As sensor technology becomes more affordable, companies can integrate advanced navigation systems into smaller delivery robots, drones, and vehicles, expanding the market. These advancements not only reduce the cost of deploying autonomous delivery systems but also improve performance, allowing for faster, safer, and more reliable deliveries.

Therefore, the continuous progress in AI, robotics, and sensor technology is transforming the logistics and delivery landscape. As these technologies evolve, they will play a crucial role in making autonomous last mile delivery more efficient, cost-effective, and scalable, benefiting businesses across various sectors.

High initial investment and operational costs

High initial investment and operational costs pose a significant challenge to the growth of the autonomous last mile delivery market. Developing and deploying autonomous delivery vehicles, whether drones, ground robots, or self-driving trucks, requires substantial capital. Companies need to invest in advanced technologies such as LiDAR, GPS systems, AI-powered software, and sensor integration, all of which add to the upfront costs. Moreover, extensive testing, research, and regulatory compliance contribute to higher expenses before these systems can be fully operational.

Operational costs also remain high due to the need for regular maintenance, software updates, and continuous monitoring of autonomous vehicles. Ensuring reliability and safety in real-world environments requires robust infrastructure, such as dedicated charging stations, communication networks, and secure storage facilities for delivery units. For smaller companies, these financial requirements can create barriers to entry, limiting their ability to compete with larger players that have greater financial resources.

Moreover, the transition from traditional delivery methods to autonomous solutions often involves reconfiguring logistics networks and retraining staff, further increasing overall costs. While autonomous delivery systems promise long-term savings, the initial investment and operational expenditures can delay profitability, slowing down market adoption in the short term.

Integration with smart city infrastructure

The integration of autonomous last mile delivery solutions with smart city infrastructure presents a significant opportunity for market growth. As cities continue to develop smarter, technology-driven environments, there is a growing demand for efficient and sustainable delivery methods. Autonomous delivery vehicles, including drones and ground robots, can seamlessly operate within these connected urban ecosystems, enhancing traffic flow, reducing congestion, and improving delivery efficiency.

Smart cities are equipped with advanced technologies like IoT (Internet of Things), real-time traffic management systems, and connected roadways, which create an ideal environment for autonomous delivery operations. These technologies enable delivery vehicles to communicate with traffic signals, avoid congested areas, and select the most efficient routes, reducing delivery times and operational costs. By aligning with smart city initiatives, companies can deploy their autonomous systems more effectively, contributing to the overall sustainability and efficiency of urban logistics.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autonomous last mile delivery market analysis from 2023 to 2033 to identify the prevailing autonomous last mile delivery market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the autonomous last mile delivery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global autonomous last mile delivery market trends, key players, market segments, application areas, and market growth strategies.

Autonomous Last Mile Delivery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 144.2 billion |

| Growth Rate | CAGR of 23.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 340 |

| By Vehicle Type |

|

| By Range |

|

| By Solution |

|

| By Application |

|

| By Region |

|

| Key Market Players | Airbus S.A.S., DHL International GmbH, Savioke, JD.com, Inc., MATTERNET, Starship Technologies, Flirtey, Drone Delivery Canada, DPD Group, Flytrex, United Parcel Service of America, Inc., Amazon.com, Marble Robot |

The upcoming trends of Autonomous Last Mile Delivery Market are innovation, improve competitiveness, and cater to the growing demand for advanced software defined automotive solutions.

The key players in the autonomous last mile delivery market include Airbus S.A.S., Flirtey, Drone Delivery Canada, Flytrex, Amazon.com, JD.com, Inc., Marble Robot, Savioke, DHL International GmbH, and United Parcel Service of America, Inc.

The leading application of Autonomous Last Mile Delivery Market is reatil.

The largest regional market for Autonomous Last Mile Delivery is North America.

The autonomous last mile delivery market was valued at $18.7 billion in 2023, and is estimated to reach $144.2 billion by 2033, growing at a CAGR of 23.1% from 2024 to 2033.

Loading Table Of Content...

Loading Research Methodology...