Autopilot Systems Market Research, 2033

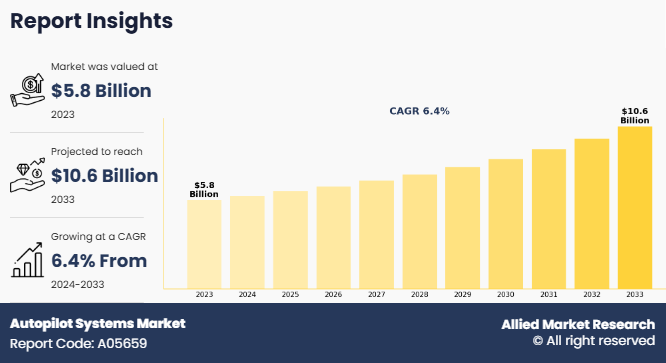

The global autopilot systems market size was valued at $5.8 billion in 2023, and is projected to reach $10.6 billion by 2033, growing at a CAGR of 6.4% from 2024 to 2033.

Report Key Highlighters:

- The autopilot systems market share market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the autopilot systems market trends.

- The autopilot systems industry market share is highly fragmented, into several players including Honeywell International Inc., Garmin Ltd, Collins Aerospace, Thales, Boeing, Airbus, Safran, BAE Systems, L3Harris Technologies, Inc., and Northrop Grumman. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An autopilot system in an aircraft is an advanced avionics system that automates the control of an aircraft by managing its trajectory, altitude, speed, and navigation without continuous direct input from a human pilot. It integrates multiple sensors, gyroscopes, accelerometers, and GPS data to maintain stable flight, follow pre-programmed routes, and assist in landing or take-off under certain conditions. Modern autopilot systems are equipped with Flight Management Systems (FMS) and work in coordination with Automatic Flight Control Systems (AFCS) to ensure smooth and efficient aircraft operations, reducing pilot workload and enhancing flight safety.

In recent years, the aviation industry witnessed rapid technological advancements, and autopilot systems are becoming an integral part of modern aircraft. Initially developed to assist pilots in maintaining stable flight, autopilot systems have evolved into sophisticated automation tools which enhance safety, efficiency, and precision in modern aeroplanes. With the rise in air traffic, longer flight times, and increase in safety demands, autopilot systems are becoming more important across the world.

Moreover, modern autopilot systems are equipped with collision avoidance system, weather monitoring, and emergency response protocols which enhances overall flight safety. These systems significantly reduce the likelihood of accidents caused by pilot error, which is one of the leading causes in the aviation industry.

The autopilot systems market growth is driven by growth in air travel, rise in orders of new aircraft from developing countries and increase in advancement in the electric and hybrid aircrafts. Moreover, modernization of military aircrafts and increase in sales of personal aircrafts are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high development cost and stringent regulatory compliance limit the growth of the autopilot systems market analysis.

The aviation industry has grown rapidly in recent years globally. The major factor for increase in air travel is rise in globalization, and growing disposable income among consumer. Flying has also become more affordable, however, a shortage of skilled pilots has boosted the need for autopilot systems.

According to the International Air Transport Association (IATA), global air traffic increased by 55.5% as of February 2023. Air travel is expanding quickly in developing countries, especially in Asia-Pacific, due to higher incomes and more demand for leisure travel.

In India, government data shows that the number of airports doubled from 74 in 2014 to 157 in 2024, with plans to reach 350-400 by 2047. In 2024, India became the third-largest domestic aviation market, with a 13% rise in domestic passengers and a 22% rise in international travelers. As air travel continues to grow, the demand for autopilot systems in new airplanes will also increase.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On February, 2024 Garmin Ltd. developed GFC 600H helicopter flight control system (HFCS) for helicopter. The IFR GFC 600H includes GFS 83 smart servos in four axes and one GLA 85 smart linear actuator each for pitch, yaw, and roll. Autopilot modes include altitude acquire and hold, approach auto-level, radar height hold, vertical speed, indicated airspeed, heading select, attitude hold, and level mode for return to straight-and-level flight.

- On September 2024, Boeing signed an agreement with MicroPilot, one of the leaders in professional UAV autopilots, to support the further advancement of MicroPilot's autopilot and ground control software. Through this strategy Aurora Flight Sciences (Aurora), a Boeing company delivered two SKIRON-X small, unmanned aircraft systems (sUAS) to MicroPilot. SKIRON-X that combines vertical take-off and landing capabilities with long-endurance fixed-wing flight serves as a platform for accelerating MicroPilot's customer-centric software development plans.

- On November 2023, Thales collaborated with StandardAero to developed 4-axis StableLight autopilot system. This true 4-axis autopilot system is available for retrofit on Airbus Helicopters AS350 and H125 platforms. This autopilot system transforms the flight control experience of the helicopter with transparent stability augmentation that works precisely and without feedback to the control sticks.

- On November 2024, Airbus collaborated with Garmin for 3-axis autopilot system for H130 helicopter. The newly developed technology support across all flight phases whether cruising, taking off, landing. Furthermore, the 3-axis stabilization provides steady flight control.

Segmental Analysis

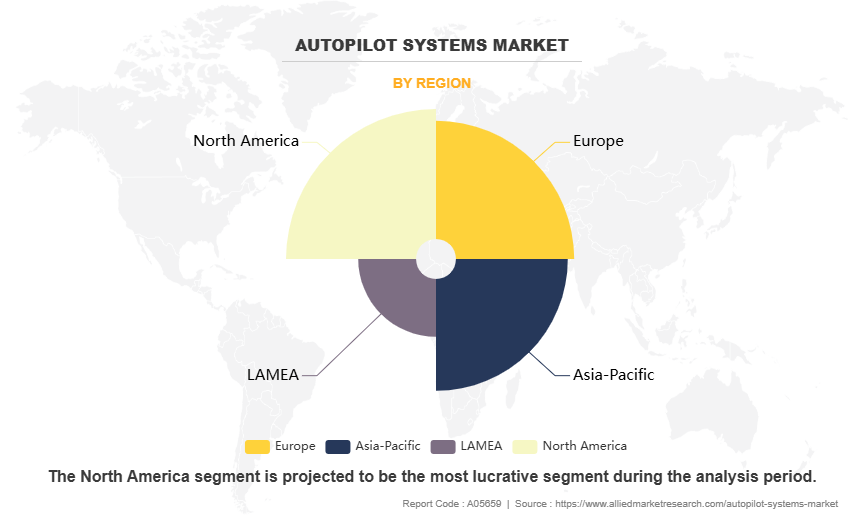

The global autopilot systems market forecast is segmented into aircraft type, application, end user and region. On the basis of aircraft type, the global market is analyzed into rotary wing aircraft, and fixed wing aircraft. Based on application, the market is segmented into navigation & flight control, automatic takeoff & landing, altitude & heading control, collision avoidance systems, and others. On the basis of end user, the global market is segregated into commercial, military and civil. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

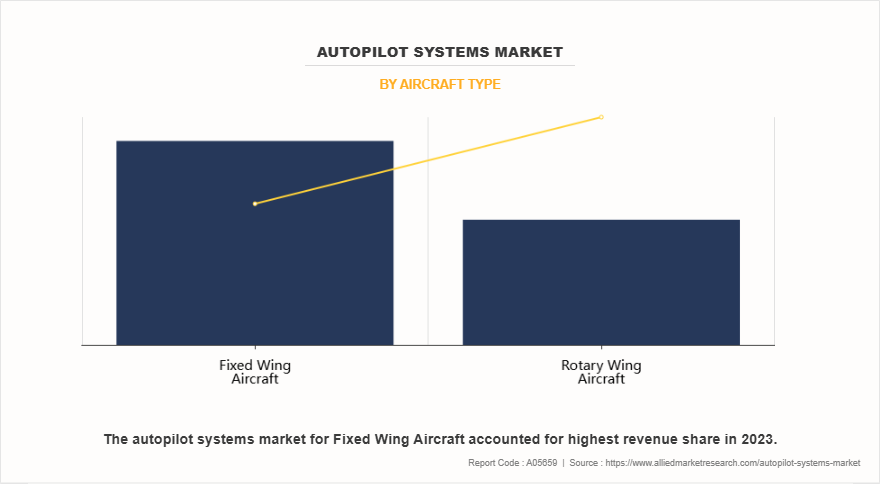

By Aircraft Type

By aircraft type, the global autopilot systems market report is analyzed into rotary wing aircraft and fixed wing aircraft. The fixed wing aircraft segment dominated the global market share in 2023, owning to airlines are increasingly adopting autonomous and AI-driven autopilot systems to improve flight efficiency, reduce human error, and optimize fuel consumption, in order to make air travel safer and more cost-effective. Moreover, modern fixed wing aircraft such as the Boeing 787 and Airbus A350, require years of skills to fly as they have lots of feature; hence, companies are mandating AI-driven autopilot systems that assist with takeoff, cruise, and landing in these larger aircrafts.

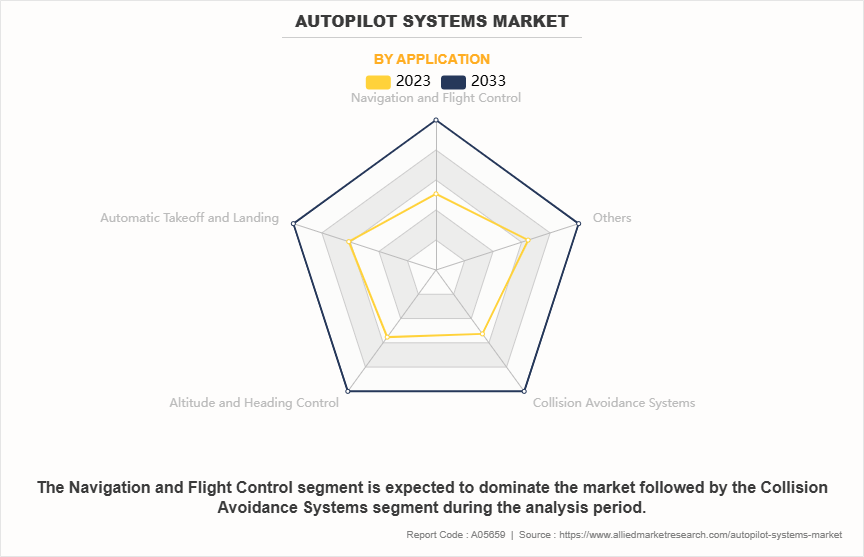

By Application

By application, the global market is segregated into navigation & flight control system, automatic take off & landing, altitude & heading control, collision avoidance system , and others. The navigation and flight control system dominated the global market share in 2023, owing to growing focus on accident prevention in aircrafts. Advanced navigation and flight control systems improve situational awareness and prevent collisions by integrating Terrain Awareness and Warning Systems (TAWS) and Traffic Collision Avoidance Systems (TCAS).

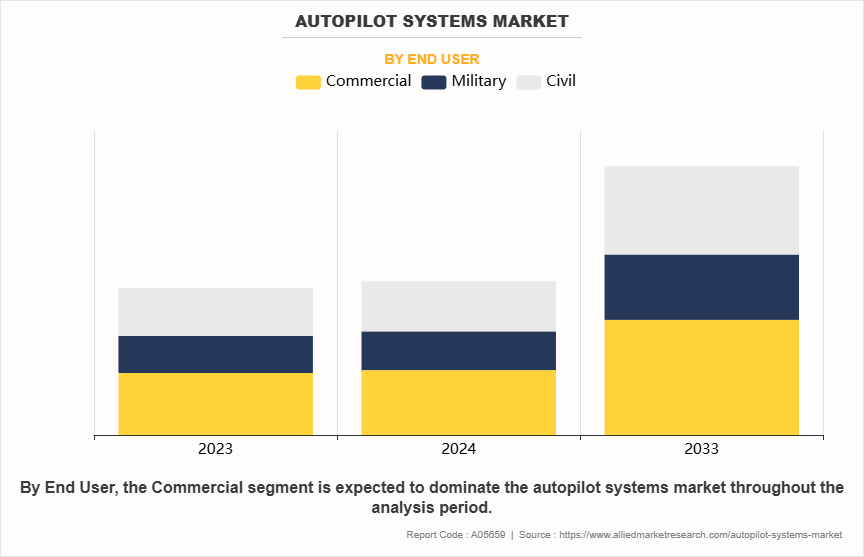

By End User

Based on end user the global market is segregated into commercial, military and civil. The commercial segment the global market in 2023, owing to rising demand from airline operators for improved flight efficiency & fuel optimization: Airlines prioritize fuel-efficient flight paths to reduce operational costs and carbon emissions. Moreover, due to increased air traffic pilots need to handle complex navigation and airspace regulations autopilot system help in managing workload, especially on long-haul flights.

By Region

Region wise, the global market is analyzed into North America, Europe, Asia-Pacific, and LAMEA, the North America region dominated the global market share in 2023, owing to the increase in military spending particularly in countries such as U.S. and Canada. The rising geopolitical tension resulted in increase investment in modernizing military aircrafts. Moreover, the U.S. and Canada have pledged their allegiance to NATO, and also looks after United Nations peace keeping mission and arctic security missions, which has resulted in increased need for modern fighter jets. Moreover, U.S. and Canada also collaboratively are increasingly investing in modernization of military aircrafts and also increasing their investment in autopilot technologies, which will drive the market demand during the forecast period.

Increase in Order for New Aircraft From Developing Countries

The growth in air travel and fleet modernization program in the major countries around the world has resulted in increased demand for new aircrafts. The demand for new aircrafts is particularly driven by economic growth, expanding middle-class populations, and a growing focus on improving regional and international connectivity among countries. Similarly, the government in the countries are also focusing on developing new airports, which can handle more number of flights. The rising demand for new aircrafts, coupled with growing pressure on airline operators reduce operational costs which are influencing the growth of autopilots system market across the world.

As of December 9, 2024, Air India announced its agreement with Airbus SE for the orders of 10 A350 widebody, and 90 A320 narrowbody aircraft to be added to its fleet. Also, in 2023, Air India announced the order of 470 new aircraft, out of which 250 were with Airbus SE. The latest order will increase the total number of aircraft that Air India ordered from Airbus SE in 2023 from 250 aircraft to 350. Air India has also announced that it has done an agreement with Airbus SE for services and component to support the maintenance requirements of its growing A350 fleet. The surge in air travel and increase in order for new aircrafts are anticipated to drive the market for autopilot system during the forecast period.

Modernization of Military Aircraft

In recent years due to escalating war situations across different regions around the world has resulted in increasing investing in modernization of military aircraft. Additionally, modern military aircraft are increasingly equipped with advanced avionics systems such as active electronically scanned array, radars, infrared sensors, advanced cameras and so on.

On July 3, 2024, the U.S. government Department of Defense, in partnership with the Government of Japan, announced its plan to upgrade U.S. tactical aircraft across multiple military installations in Japan. According to the agreement, modernization plan will be implemented over the next several years, and the total investment will reach around US$10 billion to enhance the U.S.-Japan Alliance, and further bolster both the country regional strength, and peace and stability in the Indo-Pacific region. The U.S. Air Force will upgrade its presence at Kadena Air Base by deploying 36 F-15EX aircraft as part of the modernization program. The growing investment in next gen military aircraft are anticipated to positively drive the market for autopilot system in coming years.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autopilot system market analysis from 2023 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft propulsion system market trends, key players, market segments, application areas, and market growth strategies.

Autopilot Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.6 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Aircraft Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | L3Harris Technologies, Inc., Northrop Grumman, Safran, Boeing, BAE Systems, Collins Aerospace, Garmin Ltd., Airbus, Thales, Honeywell International Inc. |

Integration of AI and Machine Learning are the upcoming market trends in the industry.

Commercial aviation is the leading market application.

North America is the largest regional market for autopilot system.

The global autopilot systems market was valued at $5,780.0 million in 2023 and is estimated to reach $10,573.5 million by 2033, exhibiting a CAGR of 6.4% from 2024 to 2033.

Honeywell International Inc., Garmin Ltd, Collins Aerospace, Thales, Boeing, Airbus, Safran, BAE Systems, L3Harris Technologies, Inc., and Northrop Grumman are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...