Aviation Crew Management System Market Research, 2032

The global aviation crew management system market size was valued at $2.6 billion in 2022, and is projected to reach $5.6 billion by 2032, growing at a CAGR of 8.2% from 2023 to 2032.

Report Key Highlighters

- The demand of aviation crew management system aviation studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The aviation crew management system market share is marginally fragmented, with players such as CAE Inc.; IBS Software Services; Jeppesen (Boeing Company); Lufthansa Systems; AIMS International Ltd; NAVBLUE Company; Mphasis Company; Intelisys System; Hitit Software Services, Leon Software. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Increase in Adoption of Integrated Platforms

Artificial intelligence (AI)-driven systems are replacing traditional rule-based scheduling by utilizing real-time data, like employee weariness, traffic, and weather. Consequently, there are reduced waiting times and more flexible, effective rosters that optimize employee utilization.

The aviation crew management system industry is witnessing an increase in the adoption of integrated platforms for crew management systems due to several compelling reasons. For instance, in December 2023, CAE signed a multi-year contract to provide its advanced Crew Management and Operations Control solutions to the Air India Group airlines. The complexity of crew management in aviation necessitates a comprehensive solution that can handle various aspects such as crew scheduling, roster management, qualifications tracking, and compliance with regulatory requirements. Integrated platforms simplify processes and lower the possibility of errors or inaccuracies by combining many features into a single system.

High Development Costs and Immobility

There are several factors for the high development costs of aviation crew management system market analysis in the aviation industry. Specialized software designed to fulfil the intricate requirements of crew scheduling, credentials tracking, and compliance management in the aviation industry is frequently needed for these systems.

Furthermore, there may be significant costs involved in connecting these systems with already-existing infrastructure, such as airline databases and communication networks. To ensure compliance with safety regulations and standards, extensive testing and validation procedures are also required, which increases the entire cost of development. The development of an overall aviation software solution can vary significantly in cost, ranging from $35,000 to $250,000. The crew management software is one such application in the overall aviation software.

In addition, the installation of crew management applications varies according to the aircraft. For instance, Leon crew management software basic plan costs $106 per month per aircraft and for > 110000 LBS aircraft it is $752.87.

The aviation crew management system market is segmented into Component, Deployment Mode, Application and End User.

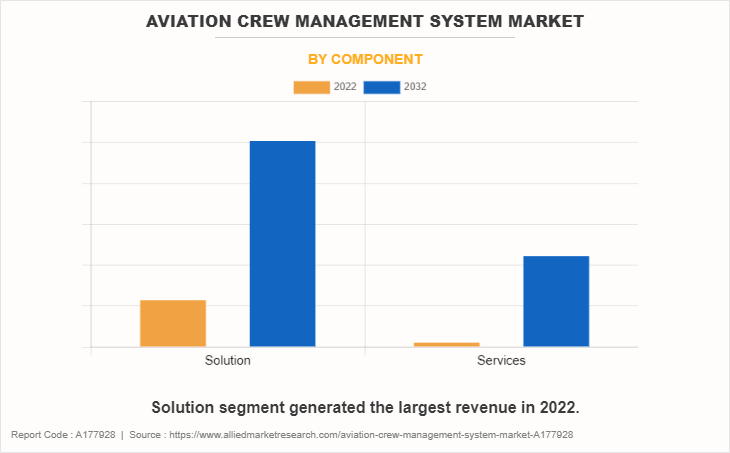

On the basis of component, the aviation crew management system industry is bifurcated into solution and services.Increasing expenditures in civil aviation is another trend that is being driven by improvements in infrastructure and safety regulations, as well as the growing demand for air travel and aviation technology.

According to an International Air Transport Association (IATA) report, global passenger demand is expected to reach 85.5% of 2019 levels over the course of 2023. These initiatives, which cover a range of topics, support the aviation industry’s growth, modernization, and sustainability. For instance, in November 2021, the Indian ministry declared that it invested around $10.8 billion to make up for the losses incurred during the epidemic.

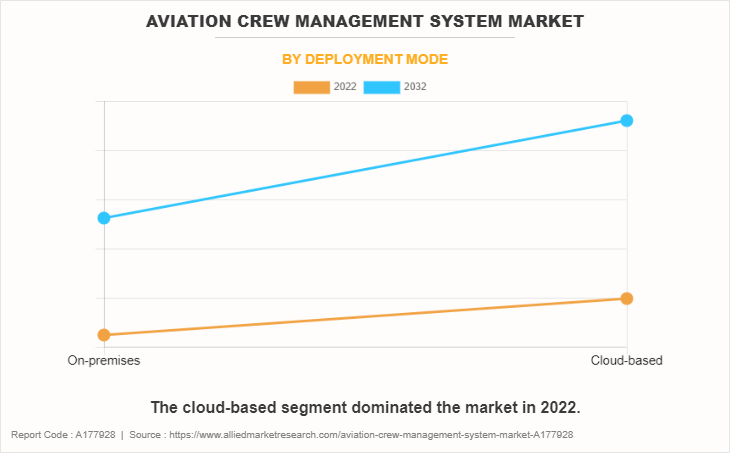

On the basis of deployment mode, the market is categorized into cloud based and on-premises.Governments provide regulatory control and support to ensure the safety and security of civil aviation operations.

This includes funding for regulatory agencies responsible for setting and enforcing safety standards, conducting inspections, and overseeing compliance with aviation regulations. Government investments in aviation safety contribute to maintaining high safety standards, reducing the risk of accidents, and enhancing public confidence in air travel.

Growing Investments in Civil Aviation

Governments are making significant investments in the aviation industry. This shift is the result of a constant increase in both passengers and shipments. Sales of the crew management system are anticipated to rise rapidly with a CAGR of 8.16% during the forecast period from 2023 to 2032.

Governments provide regulatory control and support to ensure the safety and security of civil aviation operations. This includes funding for regulatory agencies responsible for setting and enforcing safety standards, conducting inspections, and overseeing compliance with aviation regulations. Government investments in aviation safety contribute to maintaining high safety standards, reducing the risk of accidents, and enhancing public confidence in air travel.

In March 2022, the Indian aviation ministry approved the construction of 21 greenfield airports in the country. New airlines in the region have also helped to improve the market. Therefore, these factors will create lucrative growth opportunities during the forecast period of 2022-2032.

On the basis of application, the market is divided into planning, tracking, training and others. Advanced technologies such as machine learning (ML), artificial intelligence (AI), and big data analytics are being integrated into the sector. These technologies support precise crew decision-making, efficient personnel assignment, and improved crew performance as a whole.

In December 2023, NAVBLUE announced a strategic collaboration with C Teleport, a key player in crew travel solutions. This integration significantly streamlines the crew positioning flight booking process for aviation professionals by enabling automated, seamless crew travel arrangements through NAVBLUE’s platform.

Advancements in digital technologies and connectivity are also influencing crew management system trends. The integration of digital systems allows for real-time monitoring and data analysis, leading to more efficient engine performance. For instance, in October 2022, CrewApp, an Icelandic company, collaborated with NAVBLUE to provide a crew-centric mobile application. The application has been seamlessly integrated with NAVBLUE’s N-Ops & Crew (N-OC) and is easily accessible.

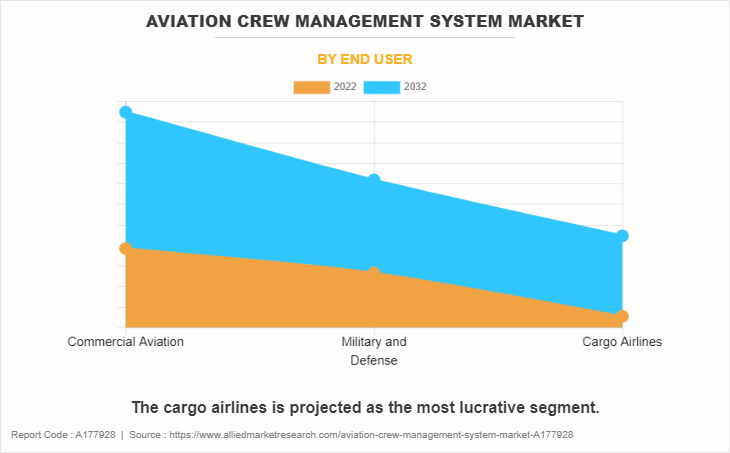

On the basis of end-user, the market is classified into commercial aviation, military and defense, and cargo airlines.Aircraft crews are constantly on the move, operating across various airports and routes globally. Traditional crew management systems tied to physical servers or fixed locations can be impractical and inefficient in this situation.

The inability to access real-time data and make instantaneous adjustments to crew schedules and assignments lead to disruptions, delays, and increased operational costs for airlines.The enhancement of this crew-centric mobile application and its seamless integration with NAVBLUE’s N-Ops & Crew (N-OC) platform have resulted in tangible improvements such as communication, operational efficiency, and decision-making within the aviation sector. Thus, crew members can access up-to-date flight information, operational updates, and crew schedules instantaneously, enhancing situational awareness and decision-making.

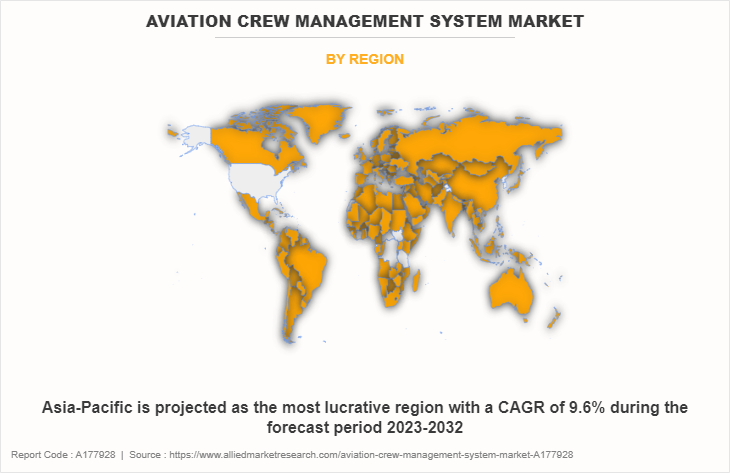

Region wise, the aviation crew management system market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of region, North America is expected to be the largest market shareholder with a CAGR of 7.37% from 2022 to 2032 owing to the constant increase in civil expenditure to integrate advanced technologies across aviation crew management systems.

Impact of Russia-Ukraine War on Aviation Crew Management System

Geopolitical tensions and conflict between Russia and Ukraine are expected to cause economic uncertainty in the impacted regions. Budgets and plans for implementing automation solutions may be impacted by economic instability, which may also have an impact on the choices made by airports, airlines, and technology suppliers about investments. Furthermore, projects pertaining to the expansion and upgrading of airports, among other infrastructure development initiatives, may be postponed or delayed in areas where there is a conflict between Russia and Ukraine.

This may affect how new aviation crew management system technologies are implemented. Moreover, the aviation crew management system market depends on an international supply chain for a range of parts and technology. Supply chains may be disrupted by the Russia-Ukraine war, delaying the production of aviation crew management system. In addition, the Russia and Ukraine together reduced business and tourist traffic to the impacted regions may be the outcome of conflict and geopolitical concerns.

In addition, the Association of Tour Operators of Russia (ATOR) report indicated that only 200,100 tourists visited Russia in 2022. It was a drop of 96.1% compared to before the war. The urgency and priority of crew management initiatives may be impacted by a decrease in passenger volume. According to Reuters report, overall passenger numbers for Russian carriers was down around 20% in September 2022, as compared to 2021. In addition, in 2021, international traffic between Russia and the rest of the world accounted for 5.2% of the global international traffic, but only 1.3% of the global total traffic.

Moreover, crew management may emphasize security measures in reaction to geopolitical concerns resulting from the Russia-Ukraine war, which could lead to greater investments in technologies linked to surveillance, access control, and threat detection. This may have an indirect effect on how other aviation automation projects are prioritized. In 2021, the U.S. Defense Department listed at least 685 ongoing AI projects, many of which involved major weapons systems. High-quality data was the foundation for all its pursuits.

Competitive Analysis

Competitive analysis and profiles of the major global aviation crew management system market players that have been provided in the report include CAE Inc.; IBS Software Services; Jeppesen (Boeing Company); Lufthansa Systems; AIMS International Ltd; NAVBLUE Company; Mphasis Company; Intelisys System; Hitit Software Services, Leon Software. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Top Impacting Factors

The global aviation crew management system market is expected to witness notable growth registering a CAGR of 8.16%, owing to an increase in adoption of integrated platforms, rise in demand for cloud-based crew aviation software and growing investments in civil aviation. On the other hand, high installation costs and immobility are projected to hinder the market growth.

Historical Data & Information

The global aviation crew management system market is highly competitive, owing to the strong presence of existing vendors such as CAE Inc., IBS Software Services, Jeppesen (Boeing Company), Lufthansa Systems, AIMS International Ltd, and NAVBLUE Company. Vendors of the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/ Strategies in Aviation Crew Management System Market

- In March 2022, DGCA has placed all Boeing 737 fleets under close observation following the same-make aircraft crash that claimed the lives of over a hundred passengers on board in China Eastern Airlines.

- In July 2022, Garmin introduced new features in its latest product, Garmin Pilot. Garmin Pilot has included a graphical layout for its aircraft that shows passenger seating, cargo, and fuel station information.

- In October 2022, Lufthansa Systems partnered with the peer-to-peer database business Ditto to develop a new crew App utilizing Apple’s Swift UI framework to transform analog operations into digital ones. This partnership by Lufthansa systems is demonstrating a proactive strategy to digitalization in order to improve overall operational performance, streamline communication, and increase crew productivity.

- In February 2022, Honeywell released an app for the pilots to increase crew connection and enhance fuel efficiency. Insights and suggestions regarding flight efficiency will be made possible with its proprietary “Honeywell Forge Pilot Connect app” & “Honeywell Forge Flight Efficiency”. Thus, the rising automation such as the adoption of AI and cloud-based technology as well as the development of mobile applications for aviation crew management system are driving the growth of the market. For instance, the aviation technology integration market is projected to reach $89.1 billion in 2031 growing at a CAGR of 15.9% from 2022 to 2032.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the global aviation crew management system market along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the aviation crew management system.

- The report includes the market share of key vendors and the global market.

Aviation Crew Management System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.6 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 314 |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | IBS Software Services (P), Boing (Jeppeson), CAE Inc., AIMS International Ltd, Leaon Software, NAVBLUE, Intelisys System, Lufthansa Systems, Mphasis Company, Hitit Software Services |

The planning segment is the leading application of Aviation Crew Management System Market.

The upcoming trends of Aviation Crew Management System Market include continuous increase in air traffic demands increased safety measures to accommodate the growing volume of passengers and aircraft.

North America is the largest regional market for Aviation Crew Management System Market.

The global aviation crew management system market was valued at $2.61 billion in 2022.

CAE Inc., Boing (Jeppeson), Airbus Company (NAVBLU), Mphasis Company, Lufthansa Systems are the top companies to hold the market share in Aviation Crew Management System.

Loading Table Of Content...

Loading Research Methodology...