Azelaic Acid Market Research, 2033

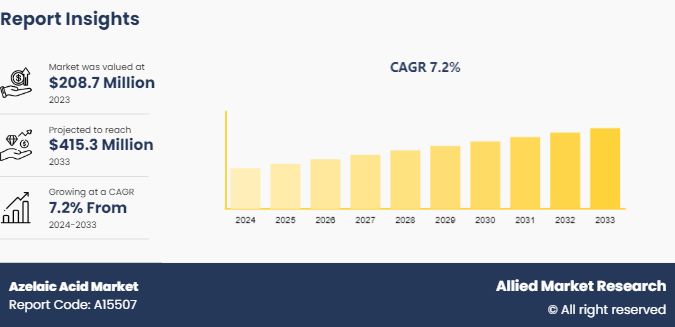

The global azelaic acid market was valued at $208.7 million in 2023, and is projected to reach $415.3 million by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Market Introduction and Definition

Azelaic acid is a naturally occurring dicarboxylic acid found in cereals such as wheat, rye, and barley. It has many uses in industry and health. Azelaic acid is highly valued in the cosmetics and pharmaceutical sectors due to its antibacterial, anti-inflammatory, and keratolytic characteristics, which make it a crucial component in acne, rosacea, and hyperpigmentation therapies. It works by reducing inflammation, lowering the growth of skin bacteria, and restoring the regular shedding of dead skin cells. As azelaic acid increases flexibility and stability, it is used in the manufacturing of biodegradable polymers, plasticizers, and lubricants in the industrial sector. Owing to its antibacterial qualities, it is also used as a food preservative. Its versatility and efficacy across various applications underscore its growing demand in both consumer and industrial markets.

Key Takeaways

- The azelaic acid market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major azelaic acid industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The growing adoption of azelaic acid in pharmaceuticals and dermatology significantly drives its market expansion. Renowned for its antibacterial, anti-inflammatory, and keratolytic properties, azelaic acid is increasingly used in medications for treating acne, rosacea, and hyperpigmentation. Rise in skin disorders, coupled with heightened consumer awareness about skincare, boosts demand for effective dermatological treatments. In addition, ongoing research and development in pharmaceutical formulations continue to explore new therapeutic uses for azelaic acid, reinforcing its role in skin health. This trend is propelling the market growth as both medical and over-the-counter skincare products capitalize on azelaic acid's benefits. According to a EY FICCI report, there has been a growing consensus over providing new innovative therapies to patients. The India pharmaceutical market is estimated to touch $130 billion in value by the end of 2030. Meanwhile, the global market size of pharmaceutical products was estimated to cross over the $1 trillion mark in 2023. Thus, continuous expansion in the pharmaceutical industry further drives the growth of azelaic acid market.

The growth in biodegradable polymer applications is a significant driver propelling the expansion of the azelaic acid market. Azelaic acid is a crucial component in biodegradable polymer production, contributing to their eco-friendly properties. These polymers are increasingly sought after in various industries due to their ability to degrade naturally, reducing environmental impact. With rise in demand for sustainable materials and regulatory emphasis on eco-friendly solutions, the use of azelaic acid in biodegradable polymers is expected to continue driving market growth, offering both environmental benefits and functional performance in diverse applications.

However, availability of alternatives and substitutes presents a significant restraint to the growth of the azelaic acid market. As various industries seek alternatives with comparable properties, such as other organic acids or synthetic compounds, the demand for azelaic acid is expected to be affected. In addition, the emergence of novel ingredients and technological advancements in formulation may further diminish the market share of azelaic acid, posing challenges to its sustained growth.

The emphasis on sustainable and eco-friendly solutions presents a significant opportunity for the azelaic acid market. As industries increasingly prioritize environmental responsibility, azelaic acid, derived from renewable sources, offers a sustainable alternative in various applications. Its biodegradability and low environmental impact make it attractive for companies seeking greener alternatives. Moreover, as consumer awareness grows, the demand for products formulated with eco-friendly ingredients like azelaic acid is expected to rise, driving further market expansion.

Market Segmentation

The azelaic acid market is segmented into grade, end-use industry, and region. By grade, the market is categorized into cosmetic grade, technical grade, and polymer grade. As per end-use industry, the market is categorized into pharmaceutical, cosmetic, polymers, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The key market players operating in the azelaic acid market include Anant Pharmaceuticals Pvt. Ltd., Krishana Enterprises, BASF SE, Emery Oleochemicals, Matrica S.p.A, Nantong Hengxing Electronic Materials Co., Ltd., Croda International Plc, Molekula Group, Spectrum Chemical, Cargill, Incorporated, and others.

Regional Market Outlook

In the Asia-Pacific and Europe regions, the azelaic acid market is significantly driven by the robust growth of the cosmetic, polymer, and pharmaceutical industries. In Asia-Pacific, rise in economies and a rapidly expanding middle class are boosting demand for skincare and cosmetic products that leverage azelaic acid for its anti-inflammatory and antimicrobial properties. Meanwhile, in Europe, the emphasis on advanced pharmaceutical formulations and innovative biodegradable polymers is creating substantial demand. Both regions are seeing increased use of azelaic acid in high-performance materials and sustainable solutions, aligning with consumer preferences and regulatory trends towards eco-friendly and health-conscious products, thereby driving market growth.

- According to India Brand Equity Foundation (IBEF) , the global cosmetics industry is on a rapid growth trajectory and is projected to reach $450 billion by 2025. India is set to account for 5% of this market and rank among the top five in revenue generation. This explosive growth in the cosmetics sector is significantly boosting the demand for azelaic acid, a key ingredient in many skincare products.

- According to IBEF, the Indian pharmaceutical industry is poised for substantial growth, with the market size expected to reach $65 billion by 2024, approximately $130 billion by 2030, and $450 billion by 2047. Government data corroborates this trend, indicating that the Indian pharmaceutical sector is currently valued at around US$ 50 billion, with over $25 billion attributed to exports. This robust growth trajectory underscores India's pivotal role in the global pharmaceutical landscape, driven by its competitive advantages in manufacturing capabilities, research and development, and a burgeoning export market.

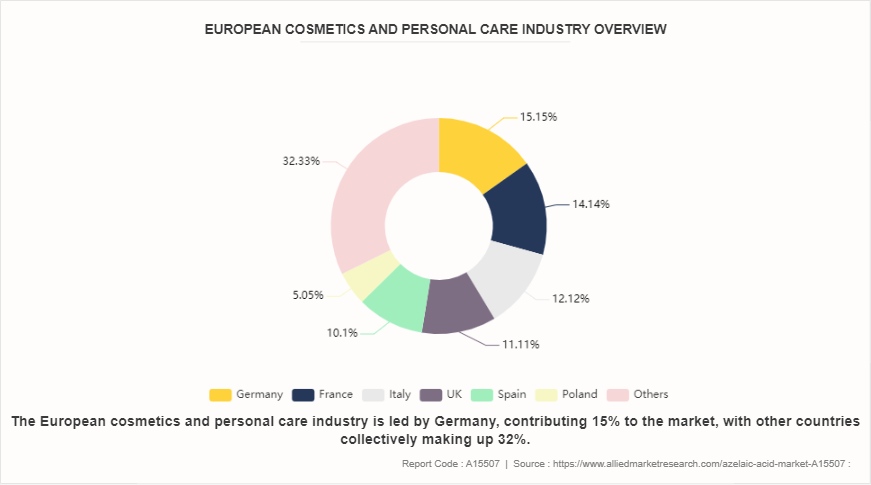

European Cosmetics and personal care industry overview

Rise in sales in the European cosmetic and personal care industry in 2022, with Germany leading at 15%, followed closely by France at 14%, Italy at 12%, and the UK at 11%, indicate a robust demand for skincare and beauty products across the region. The European cosmetic industry's focus on innovation and sustainability aligns with azelaic acid's natural origin and eco-friendly properties. As regulatory bodies and consumers push for cleaner, greener alternatives, azelaic acid emerges as a favored ingredient due to its biodegradability and minimal environmental impact. This trend drives cosmetic manufacturers to incorporate azelaic acid into their formulations, further boosting its market demand. Thus, the increasing cosmetic sales in Europe present a significant opportunity for the azelaic acid market. As consumers continue to prioritize skincare and sustainability, azelaic acid's efficacy and eco-friendly profile position it as a key ingredient driving innovation and growth in the cosmetic industry.

Industry Trends

- Azelaic acid, sourced from renewable raw materials, is a sustainable solution in biodegradable polymers, lubricants, and plasticizers. Its eco-friendly nature contributes to the development of environmentally conscious materials, aligning with growing demand for sustainability. This innovation reduces reliance on fossil fuels as well as promotes the adoption of greener alternatives in various industries.

- Continuous technological advancements in azelaic acid production, including refining chemical synthesis methods, optimizing fermentation processes, and implementing biotechnological approaches, improve production efficiency, sustainability, and cost-effectiveness. These innovations streamline manufacturing processes and reduce environmental impact, making azelaic acid a more attractive ingredient for various industries seeking sustainable and high-quality solutions.

Public Policies

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) : In the European Union, azelaic acid is subject to REACH regulations, which govern the registration, evaluation, and authorization of chemical substances. It must comply with REACH requirements for manufacturing, handling, and use.

- OSHA (Occupational Safety and Health Administration) : In the United States, azelaic acid is regulated under OSHA's Hazard Communication Standard (HCS) , which requires manufacturers to assess the hazards of chemical products and provide safety data sheets (SDS) and labeling to communicate these hazards to users.

- EU Cosmetics Regulation: In the European Union, azelaic acid is permitted for use in cosmetics with certain restrictions and maximum concentrations. It must adhere to Annex III of the Cosmetics Regulation (EC) No. 1223/2009, which outlines permitted substances and their conditions of use.

- Cosmetic Ingredient Approval: Azelaic acid is generally recognized as safe (GRAS) for use in cosmetics and skincare products by regulatory agencies such as the U.S. Food and Drug Administration (FDA) , the European Commission (EC) , and others. However, specific concentration limits and labeling requirements may apply depending on the jurisdiction.

- Over the Counter (OTC) Status: In many countries, certain formulations of azelaic acid are available over the counter for the treatment of acne and other skin conditions. These products typically contain azelaic acid at concentrations of 10% or lower. Higher concentrations may require a prescription.

- Pharmaceutical Regulation: In some regions, azelaic acid is regulated as a pharmaceutical drug for the treatment of acne, rosacea, and other dermatological conditions. Products containing higher concentrations of azelaic acid, such as prescription creams or gels, are subject to stricter regulatory oversight and may require clinical trials for approval.

Key Sources Referred

- Invest India

- India Brand Equity Foundation

- Cosmetics Info

- Cosmetics Europe

- Personal Care Product Council

- International Trade Administration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the azelaic acid market analysis from 2024 to 2033 to identify the prevailing azelaic acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the azelaic acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global azelaic acid market trends, key players, market segments, application areas, and market growth strategies.

Azelaic Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 415.3 Million |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Grade |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Molekula Group, BASF SE, Krishana Enterprises, Nantong Hengxing Electronic Materials Co., Ltd., Matrica S.p.A, Spectrum Chemical, Cargill, Incorporated, Anant Pharmaceuticals Pvt. Ltd., Croda International Plc, Emery Oleochemicals |

The azelaic acid market was valued at $208.7 million in 2023 and is estimated to reach $415.3 million by 2033, exhibiting a CAGR of 7.2% from 2024 to 2033.

Rising emphasis on sustainable and eco-friendly solutions is the upcoming trends of azelaic acid market across the globe

Cosmetic is the leading application of azelaic acid market

Asia-Pacific is the largest regional market azelaic acid

The key market players operating in the azelaic acid market include Anant Pharmaceuticals Pvt. Ltd., Krishana Enterprises, BASF SE, Emery Oleochemicals, Matrica S.p.A, Nantong Hengxing Electronic Materials Co., Ltd., Croda International Plc, Molekula Group, Spectrum Chemical, and Cargill, Incorporated.

Loading Table Of Content...