B2B Payments Market Overview

The global b2b payments market was valued at $125432 billion in 2021, and is projected to reach $313947.8 billion by 2031, growing at a CAGR of 9.9% from 2022 to 2031. Rapid digitalization, automation, expanding global trade, increased cross-border transactions, and rising demand from businesses, suppliers, and retailers for efficient, scalable payment solutions are contributing to the growth of the market.

Market Dynamics & Insights

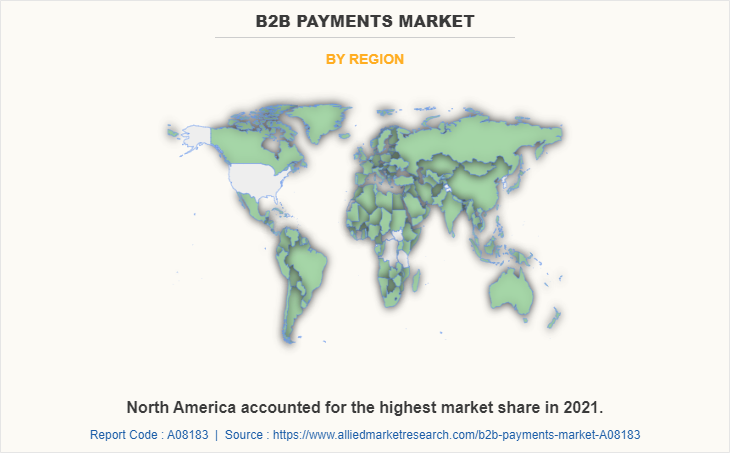

- The db2b payments industry in North America held the largest market share in 2021.

- By industry vertical, the manufacturing segment held the largest market share in 2021.

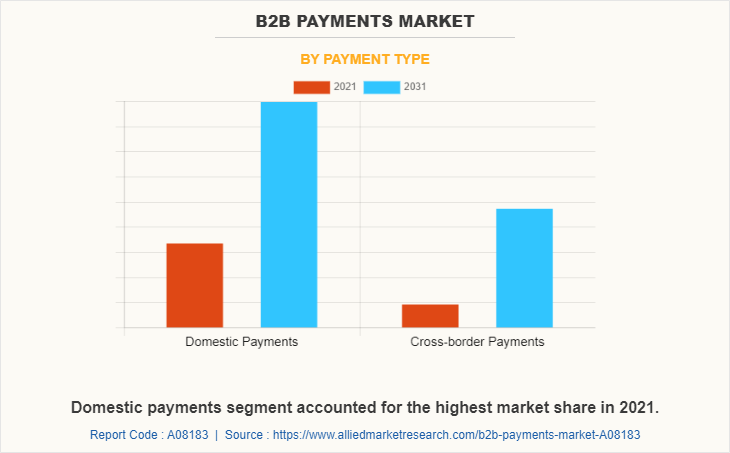

- By payment type, the domestic payment segment held the largest market share in 2021.

Market Size & Future Outlook

- 2021 Market Size: $125432.00 Billion

- 2031 Projected Market Size: $313947.8 Billion

- CAGR (2022-2031): 9.9%

- North America: dominated the market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by B2B Payments

B2B payments, or business-to-business payments, are progressing at a rapid pace as technology and commercial authenticities place perpetually a greater emphasis on productivity, speed and effectiveness. B2B processing is a way to deal with the exchange of currency between two business entities for goods and services that are delivered through the supply chain process. It allows safer transactions for merchants that involve routine, periodic transactions and provides several functions to end-users such as receivable accounts, accounts payable, payroll, and acquisition departments. In addition, end-users are increasingly implementing emerging technologies such as AI, ML, and others to allow faster and safer payment processes alongside reducing workload for account payable.

Market Drivers

The B2B payments market is expected to witness substantial growth during the forecast period. Rapid digitalization & automation in the B2B payment solutions has accelerated its demand among business owners driving the growth of the B2B payments market size. Moreover, the growth of global trade, strategies to expand the business sector, and surge in cross-border transactions involving the number of suppliers, wholesalers, retailers, and businesses further drive the growth of the B2B payments market.

However, the increase in fraud in business payment and discontinuations of numerous businesses due to the outbreak of the global COVID-19 pandemic restrict the growth of the B2B payments market. In addition, integrating new B2B payment solutions with existing enterprise systems can be complex and costly, posing a barrier for SMEs with limited resources, limiting the growth of the B2B payments market. Furthermore, limited internet connectivity, low financial literacy, and underdeveloped financial infrastructures could hinder the global expansion of market. Moreover, high transaction fees for cross-border payments and certain digital platforms can reduce the cost-effectiveness of B2B payment solutions, thus hindering the growth of the B2B payments market.

On the contrary, the B2B payments market is expected to offer several opportunities for new players in the market. The advancements in way of digitalization and automation to bring transparency across B2B payments and increase in partnership among B2B payments players & FinTech giants are expected to offer remunerative opportunities for expansion of the B2B payments market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the global B2B payments market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, in the B2B payments market.

The b2b payments market is segmented into Payment Type, Enterprise Size, Payment Method and Industry Vertical.

B2B Payments Market Segment Review

The B2B payments market is segmented into payment type, enterprise size, payment method, industry vertical, and region. By payment type, the market is bifurcated into domestic payments and cross-border payments. By payment method, the market is fragmented into bank transfer, cards, and others. By enterprise size, it is segregated into large enterprises, medium-sized enterprises, and small-sized enterprises. By industry vertical, the B2B payments market is classified into manufacturing, IT & telecom, metals & mining, energy & utilities, BFSI, government sector and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of payment type, the domestic payment segment holds the largest B2B payments market size owing to the rise in the adoption of cash for purchasing products from domestic businesses coupled with the rise in demand for virtual cards and online payment among corporate owners. However, the cross-border payment segment is expected to grow at the highest rate during the forecast period owing to the rise in manufacturers’ efforts to expand supply chains across borders, cross-border asset management and global investment flows. In addition, the emergence of innovative new business models and participants will contribute to the B2B payments market growth.

Regional Insights:

Region wise, the B2B payments market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to increasing adoption and growth of advanced and latest technology, such as cloud computing, artificial intelligence (AI), and machine learning (ML) is positively impacting the growth of B2B payments market. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the increasing digital transformation initiative across the IT and telecommunication sector coupled with growing investments in IT and advanced payment systems is anticipated to drive the b2b payments market growth.

Key Players in the B2B Payments Market:

The key players that operate in the B2B payments market are American Express, JPMorgan & Chase Co., Mastercard, Payoneer Inc., PayPal Holdings, Inc., Paystand, Inc., Square, Inc., Stripe, TransferWise Ltd., and Visa Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the B2B payments market.

COVID-19 Impact Analysis

The B2B payments market outlook has witnessed significant growth in the past few years; however, due to the outburst of the COVID-19 pandemic, the market is anticipated to observe a slight downfall in the short run, especially in 2020. This is attributed to the imposition of lockdown by government authorities in a range of countries and the shutdown of business and travel across the world to prevent the transmission of the virus. However, the B2B payments market is likely to gain huge traction in the upcoming years after the recovery from the COVID-19 pandemic scenario. Moreover, many companies have incorporated new strategies such as business expansion and new product launches to support companies in their work culture of manufacturing and innovation on B2B payments in these crucial times. For instance, in August 2020, PayMate, a B2B payments platform, introduced the first full-stack of supply chain payment automation platform for large enterprises and their suppliers. This platform is anticipated to improve additional value to supply chains by enabling large enterprises to extend payables through commercial cards. These new strategic initiatives notably prosper the b2b payments market growth in the forecasting years.

Market Trends Insights

The B2B payments market is expected to witness several noteworthy trends. Businesses are gradually shifting away from paper-based payment methods such as cheques and manual invoicing and opting for digital payment alternatives. This shift is driven by the demand for faster, more accurate payments, simplified operations, and cost reductions. As businesses embrace digital transformation, there is increase in the need for more efficient commercial payments and corporate transactions. Companies are seeking to streamline processes, eliminate errors, and reduce operational costs, leading to a rise in the adoption of digital payment solutions. Furthermore, the rise in financial technology firms, or FinTechs, emerging as key players in the B2B payments market, enables specialized, faster, more secure, and cost-effective solutions, driving the shift toward payment processing solutions for B2B payment processing, that are optimized for B2B transactions.

Moreover, the proliferation of smartphones and mobile devices has led to the expansion of mobile payment solutions for business-to-business transactions. Payment gateways integrated into mobile apps and platforms allow businesses to process B2B payments conveniently and flexibly. In addition, businesses seek integrated payment solutions that seamlessly connect with their existing accounting, ERP, and CRM systems. This integration solutions streamline the payment processing lifecycle, decreases errors and enhances efficiency by eliminating the need for manual data entry. Embedded payments which integrate payment systems directly into business tools and software, offer a streamlined experience for businesses handling payments within their daily operations.

Moreover, blockchain technology and cryptocurrencies are rapidly being investigated as potential B2B payment alternatives. Blockchain's decentralized nature provides increased security, transparency, and traceability, while cryptocurrencies can allow cross-border transactions and lessen reliance on traditional financial institutions. Furthermore, the use of data analytics and artificial intelligence (AI) is becoming more common in B2B payment procedures. These technologies assist firms in automating payment reconciliation, detecting fraudulent activity, and gaining insights into payment patterns, thus boosting decision-making and risk management. Therefore, digital transformation, rise of finTech, and mobile payments are the major trends for the growth of the B2B payments market.

Another significant B2B payment trend the market is expected to witness is the shift in preference toward digital solutions, with B2B payments FinTech innovations driving the development of B2B payment software that offers faster, more secure, and automated solutions. Businesses are increasingly looking to streamline their payment workflows with technologies that enable real-time payments, reduce friction, and ensure compliance with evolving financial regulations.

Government Initiatives

Many countries have initiated initiatives to increase the speed of business-to-business payments. These projects seek to shorten payment processing delays, allowing businesses to receive payments more quickly and enhance cash flow. For example, in the U.S., the Federal Reserve established the Faster Payments Task Force to improve the speed and efficiency of B2B payments. Furthermore, several countries have mandated e-invoicing to simplify B2B payment processes. These laws require enterprises to send and receive invoices electronically in a standardized manner, allowing for more automation and lowering administrative overhead. The European Union's e-invoicing legislation and India's Goods and Services Tax Network (GSTN) e-invoicing system are two notable instances. In addition, open banking regulations have been implemented in various countries to promote competition and innovation in the financial sector. These initiatives enable businesses to securely share their financial data with authorized third-party providers, thus facilitating seamless B2B payment transactions and creating opportunities for new payment solutions and services within the B2B payments market.

Moreover, governments are actively working on modernizing their payment systems to support faster, more secure, and efficient B2B transactions. This involves upgrading legacy systems, adopting new technologies like blockchain and distributed ledger technology (DLT), and implementing real-time payment infrastructures. Examples of companies adopting latest technologies include the European Central Bank's TARGET Instant Payment Settlement (TIPS) and Australia's New Payments Platform (NPP). These ongoing efforts will further strengthen the growth and efficiency of the B2B payments market, ensuring smoother transactions and enhancing overall business operations.

What are the Top Impacting Factors in B2B Payments Market

Growth and Expansion of Business

The growth of the business is widely relying on the quality of goods & services provided by the firm. Therefore, businesses need to have a robust relationship with the suppliers of goods and services that the firm sells, to grow and compete in the b2b payments market. Maintaining a strong relationship with the supplier means having better cash flow management among the business parties, including wholesalers, retailers, and supply chain managers, among others. Furthermore, small and medium-sized businesses are focusing on capitalizing on the B2B payments market trends by assessing the cost-benefits and maintaining operational efficiency with different payment methods. For instance, in January 2022, Rupifi, a finance company operating in the B2B payments sector, raised $25 million to expand its product portfolio of B2B Buy Now Pay Later (BNPL) and SME-focused Commercial Card, as well as product reachability to several marketplaces, to serve their merchants. Therefore, such strategic initiative and investment pooling in payment system plays a prominent role in accelerating the B2B payments market.

Technology Insights

In recent years, the B2B payments market, more than any other sector, has undergone significant advancements with the emergence of radical technology, due to keeping pace with market change and customer experiences for transparency, secure and reliable business transactions. Business owners are shifting their consideration toward the latest technology-based B2B payments solutions irrespective of using the conventional mode of payment methods and receiving payments. For instance, the shift from physical cards to digital payment solutions, including transfers, eChecks, BNPL solutions, and more, focused on utilizing working capital benefits such as virtual accounts and payment platforms. This proves a suitable development for a broader range of addressable spending. Moreover, mobile payments and cross-border payment solutions as well as the utilization of new technologies, including artificial intelligence (AI) and the Internet of Things are playing a considerable role in business success and enabling improved shopping experience for consumers. Thus, multiple benefits related to proliferation of emerging technology are expected to open new avenues for the global B2B payments market opportunity.

Which are Insights on Choosing the Right B2B Payment Solution

Selecting the best payment solution for your business can be tough in the b2b payment market. With numerous platforms offering a wide range of services, it’s essential to evaluate your needs and find a system that aligns with your operational goals. Factors to consider include security, fees, integration capabilities, and customer support. For example, Authorize.net and NMI provide excellent options for businesses looking to streamline payment processing while offering robust security features. However, platforms like Tipalti focus on automating accounts payable processes, making them ideal for businesses with complex vendor ecosystems.

Furthermore, companies need to consider global payment capabilities. With the increase in international business, a platform that can handle multiple currencies and offer seamless cross-border transactions is essential. MPGS, for instance, offers global payment solutions alongside subscription, tax, and compliance management tools.

What are the Strategic Collaborations and Technological Breakthroughs

- On November 2024, Mastercard’s Multi-Token Network (MTN) partnered with J.P. Morgan’s Kinexys Digital Payments to streamline cross-border transactions using blockchain. This partnership enabled real-time value transfers, reducing time zone friction and settlement delays. The integration allowed clients to settle transactions more efficiently through a single API.

- On December 2024, Nuvei Corporation launched a blockchain-based payment solution for Latin American merchants, partnering with Rain, BitGo, and Visa. This solution enabled the use of stablecoins like USD Coin (USDC) for faster global settlements, reducing reliance on traditional payment rails. It provided a seamless payment experience, simplified treasury management, and improved cross-border transactions and liquidity.

- in November 2024, Mastercard partnered with UAE-based fintech Fundbot to accelerate B2B payment flows through a new platform linking buyers and suppliers in the UAE and Saudi Arabia. The platform included Fundbot's dynamic discount product, which incentivized quicker payments and reduced days sales outstanding (DSO). Fully integrated with leading ERP systems, the AI-powered tool recommended optimal discount rates for transactions based on various factors, enhancing user experience and adoption.

- In February 2025, Two partnered with Avarda to introduce a fully integrated white label payment solution for the Nordic e-commerce market. This collaboration aimed to streamline payment processes by combining B2B and B2C options into a single checkout experience. The solution leveraged Two's BNPL expertise and Avarda's B2C capabilities, improving conversion rates and reducing transaction friction for Nordic merchants. The Nordic e-commerce market is rapidly growing, but the B2B sector still faced challenges with outdated invoicing systems.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the B2B payments market from 2021 to 2031 to identify the prevailing B2B payments market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the B2B payments market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global B2B payments market trends, key players, market segments, application areas, and market growth strategies.

B2B Payments Market Report Highlights

| Aspects | Details |

| By Payment Type |

|

| By Enterprise Size |

|

| By Payment Method |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Payoneer Inc., TransferWise Ltd, American Express, Mastercard, Square, Inc., Stripe, JPMorgan & Chase, PayPal Holdings, Inc., Visa Inc., Paystand Inc. |

Analyst Review

B2B, or business-to-business payments, involves the transaction of value denominated in currency from buyer to supplier between businesses for goods or services supplied in the market, irrespective of whether a payment is made in one country or international and contains corporate expenses such as business-related per-diem or travel. Furthermore, several end-use industries are deploying B2B payments with an exceptional focus is to provide seamless payments channeled along an inclusive network of payment corridor. As a result, end-users are nowadays prefer robust B2B payment solutions to streamline business operations and consistently provide fast, reliable payments to a wide range of global destinations.

The global B2B payments market is expected to register high growth due to the rising instances of business spending to build up the robust payment infrastructure and a surge in government regulations & policies regarding payment systems. Moreover, the recent trend of incorporation of cryptocurrency and other emerging technologies in the B2B payment process aids in removing barriers to global transactions and can reduce payment costs by 75% as compared to wired transfers. Therefore, the B2B payment industry helps to increase business efficiency in compliance with new tech trends. With the growth in requirements for B2B payments, various companies often have established product launch strategies to increase their capabilities. For instance, in July 2022, the global B2B payments and invoicing network, TreviPay unveiled a new B2B payment method for the specific needs of large, mid-size, and small businesses, facilitating the trade connection of 90,000 buyers and 80,000 seller locations globally. Hence, owing to such expansion strategies associated with product portfolios are expected to increase their B2B payment in the upcoming years.

In addition, with further growth in investment in B2B payment infrastructure across the world, and the rise in demand for B2B payment solutions, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in August 2022, Jarvis Invest, India’s first AI investment advisory firm, onboarded a strategic investment of $600,000 to expand its global presence and launch new B2B products in a key market that begins in UAE. The investment will create new abilities for the company for the generation of additional profits by expanding the business portfolio of B2B payment systems. This investment pooling is set to accelerate the market demand for B2B payments in the forecasting years.

Moreover, with the increase in competition, major market players have started new partnerships and collaborations as a part of a key strategy to expand their market penetration and reach. For instance, in June 2022, Payoneer, a commerce technology company, completed a collaboration with Fiserv to streamline the cross-border payouts to sellers, vendors, contractors, and consumers across borders. This strategic collaboration further reinforces the cross-border payment transactions, which eventually prosper the growth of the B2B payments market.

The B2B Payments market is estimated to grow at a CAGR of 9.9% from 2022 to 2031.

The B2B Payments market is projected to reach $313,947.75 billion by 2031.

Rapid digitalization & automation in the B2B payment solutions, growth of global trade, strategies to expand the business sector, and surge in cross-border transactions involving the number of suppliers, wholesalers, retailers, and businesses contribute toward the growth of the market.

The key players profiled in the report include American Express, JPMorgan & Chase Co., Mastercard, Payoneer Inc., PayPal Holdings, Inc., Paystand, Inc., Square, Inc., Stripe, TransferWise Ltd., and Visa Inc.

The key growth strategies of B2B Payments market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...