Baby Food Packaging Market Research, 2033

The global baby food packaging market was valued at $6.5 billion in 2023, and is projected to reach $11.6 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Market Introduction and Definition

Baby food packaging includes the design and production of containers and materials used to store and deliver food specifically formulated for infants and toddlers. This packaging plays a critical role in ensuring the safety, freshness, and nutritional integrity of baby food products. It includes various types such as jars, pouches, cans, and cartons, made from materials like plastic, glass, metal, and paperboard. Key features include tamper-evidence, ease of use, and portability, reflecting the need for convenience and peace of mind for parents. The industry is increasingly focused on sustainable solutions, with a push towards recyclable and eco-friendly materials. Baby food packaging must comply with stringent safety regulations to prevent contamination and preserve product quality, catering to different stages of child development and dietary needs.

Key Takeaways

- The baby food packaging market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 2,500 product literatures, industry releases, annual reports, and other such documents of major baby food packaging industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The growth of the baby food packaging market is significantly driven by increase in birth rates and rapid urbanization, especially in emerging economies. As urban populations expand, there's a growing demand for convenient, ready-to-eat baby food solutions that cater to busy lifestyles. Urban parents often have less time for homemade baby food, leading to a preference for packaged options that are safe, nutritious, and easy to store. In addition, rising birth rates in these regions increase the overall consumer base for baby products. This trend fuels the need for innovative packaging that ensures the safety, freshness, and accessibility of baby food products.

However, high production costs significantly constrain the baby food packaging market, as the need for specialized materials and manufacturing processes, such as tamper-evident and chemical-safe features, drives up expenses. Sustainable packaging, increasingly demanded by eco-conscious consumers, further adds to these costs due to the premium price of eco-friendly materials like bioplastics and recycled paperboard. Environmental concerns also pose a restraint; the industry faces pressure to reduce waste and carbon footprints, requiring investment in green technologies and compliance with strict environmental regulations.

The rising awareness of environmental sustainability is creating significant opportunities in the baby food packaging market. Consumers increasingly prefer eco-friendly packaging options, driving demand for materials that are biodegradable, recyclable, or made from renewable resources. Brands that adopt sustainable practices can attract eco-conscious parents, enhancing their market appeal and competitive edge. This shift towards greener packaging not only meets regulatory pressures but also aligns with the growing consumer desire for products that minimize environmental impact, fostering long-term growth and innovation.

Market Segmentation

The baby food packaging market is segmented into material type, product type, and region. By material type, the market is categorized into plastic, glass, metal, paperboard. By product type, the market is bifurcated into dry baby food and wet baby food. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The key market players operating in the baby food packaging market include Ardagh Group S.A., Amcor plc, WINPAK LTD., Sonoco Products Company, Tetra Pak, Printpack, Logos Packaging, Trivium Packaging, Greiner Packaging, Guala Pack S.p.a., and others.

Regional Market Outlook

The Asia-Pacific and North America regions, encompassing countries such as India, China, and the U.S., are witnessing growth in the baby food packaging market due to surge in birth rates and accelerated urbanization. There is a growing preference for convenience foods, bolstered by advancements in packaging technology and the expanding reach of e-commerce platforms. These factors collectively drive innovation and demand in the sector, with manufacturers and suppliers increasingly focusing on meeting the evolving needs of consumers seeking safe, convenient, and hygienic packaging solutions for baby food products.

- According to report published by the United Nations, by the end of April 2023, India's population had reached 1, 425, 775, 850 people, thereby matching and subsequently surpassing the population of mainland China. China had reached its peak population size of 1.426 billion in 2022. Thus, the growing population and rising birth rates have propelled demand for baby food, thereby fostering growth in the baby food packaging market.

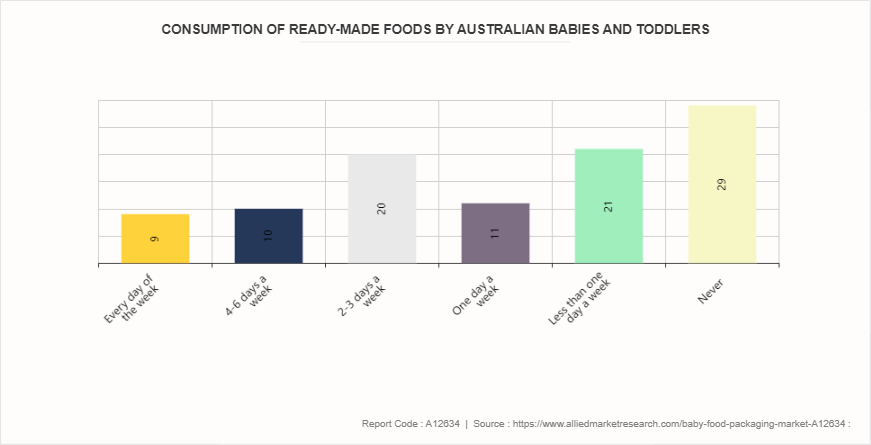

Consumption of Ready-Made Foods by Australian Babies and Toddlers

According to the report published by RCH National Child Health Poll on April 24, 2022, In Australia, many babies and toddlers regularly consume commercial ready-made foods. For children under five years, 19% eat these foods most days of the week, and 31% have them at least once a week. The highest consumption is among babies, with 54% eating ready-made foods at least weekly. Conversely, 29% of young children never consume these foods in a typical week, according to their parents. Moreover, frequent consumption of ready-made foods is more prevalent among children of sole parents, with 34% consuming them most days, compared to 16% among children with partnered parents. Similarly, children whose parents have lower educational levels (high school education or less) are more likely to consume these foods regularly (31%) than those with parents holding a certificate (17%) or higher education qualifications (19%) . Thus, the high consumption rates of ready-made foods among babies and specific demographics, such as children of sole parents and those with lower-educated parents, suggest significant market opportunities for tailored and convenient baby food packaging solutions.

Key Regulations

- Food and Drug Administration (U.S.) : The U.S. Food and Drug Administration enforces regulations under the Federal Food, Drug, and Cosmetic Act (FD&C Act) that stipulate materials used in packaging must be safe for food contact and not release harmful substances into the food.

- EFSA (European Food Safety Authority) : The European Food Safety Authority regulates materials in contact with food, including plastics, ensuring they do not pose a risk to health. Specific regulations include the Framework Regulation (EC) No 1935/2004 and Regulation (EU) No 10/2011 for plastic materials.

- ISO Standards: The International Organization for Standardization (ISO) develops standards for food packaging safety and quality, like ISO 22000 for food safety management systems. ISO 22000 is a globally recognized standard by ISO that specifies requirements for a food safety management system.

- Biodegradable and Compostable Standards: Standards such as ASTM D6400 in the U.S. and EN 13432 in Europe define the criteria for packaging to be considered biodegradable or compostable.

- BPA and Phthalates Restrictions: Many countries, including the U.S. and EU, have banned or restricted the use of Bisphenol A (BPA) and certain phthalates in baby food packaging due to their potential health risks.

- Waste Reduction and Recycling: Many regions have regulations promoting or mandating recyclable packaging materials and reducing packaging waste. The EU’s Packaging and Packaging Waste Directive (94/62/EC) and various state-level regulations in the U.S. address these concerns.

Industry Trends

- Innovative packaging technologies in the baby food market, such as aseptic processing, smart packaging, and Modified Atmosphere Packaging (MAP) , enhance product safety and shelf life. Aseptic processing maintains nutritional value without preservatives, smart packaging offers real-time safety and nutritional tracking, and MAP extends freshness by altering internal air composition.

- The developments in e-commerce have led to innovations in baby food packaging, emphasizing on durable, leak-proof designs for safe shipping. Packaging now often includes interactive elements, such as QR codes, enhancing consumer engagement by linking to digital platforms that provide additional product information and personalized content through apps and websites.

Key Sources Referred

- Perfect Packaging

- Flexible Packaging Association

- World Health Organization

- RCH National Child Health Poll

- Food Packaging Forum

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the baby food packaging market analysis from 2024 to 2033 to identify the prevailing baby food packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the baby food packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global baby food packaging market trends, key players, market segments, application areas, and market growth strategies.

Baby Food Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 11.6 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Material Type |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | WINPAK LTD., Sonoco Products Company, Tetra Pak, Printpack, Ardagh Group S.A., Logos Packaging, Amcor plc., Greiner Packaging, Guala Pack S.p.a, Trivium Packaging |

| | FPC Flexible Packaging Corp., Hood Packaging Corp, AptarGroup Inc., Bemis Company Inc. |

The baby food packaging market was valued at $6.5 billion in 2023 and is estimated to reach $11.6 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Asia-Pacific is the largest regional market for Baby Food Packaging

Growing awareness of sustainable packaging the upcoming trends of Baby Food Packaging Market in the globe

The leading application of the baby food packaging market is for ready-to-eat and convenience baby foods.

The key market players operating in the baby food packaging market include Ardagh Group S.A., Amcor plc, WINPAK LTD., Sonoco Products Company, Tetra Pak, Printpack, Logos Packaging, Trivium Packaging, Greiner Packaging, Guala Pack S.p.a., and others

Loading Table Of Content...