Banking BYOD Security Market Research, 2032

The global banking byod security market was valued at $8.4 billion in 2022, and is projected to reach $63.3 billion by 2032, growing at a CAGR of 22.7% from 2023 to 2032.

BYOD stands for "Bring Your Own Device," and it refers to a policy or practice in which employees use their personal devices, such as smartphones, tablets, or laptops, for work-related tasks, including accessing corporate resources and conducting business transactions. In the context of banking, BYOD security refers to the measures and protocols put in place to ensure the security of banking operations when employees use their personal devices. Furthermore, implementing BYOD in the banking industry brings several security considerations due to the sensitive nature of financial data and the potential risks associated with unauthorized access or data breaches.

With the increasing demand for remote work and the adoption of mobile technologies, employees in the banking sector are seeking the freedom to use their personal devices for work-related tasks. Thus, this trend has offered numerous advantages, such as enhanced productivity and convenience, as employees can seamlessly switch between personal and professional tasks on a single device.

Furthermore, employee satisfaction and retention play a crucial role in driving the growth of the banking BYOD security market, because when employees are satisfied and engaged, they tend to be more invested in their work and take necessary precautions to protect sensitive information and data. In addition, now-a-days more individuals rely on their smartphones and tablets for financial transactions therefore, banks are compelled to offer user-friendly and convenient mobile banking services to meet customer demands. However, banks deal with sensitive customer information, financial transactions, and proprietary data, making them attractive targets for cybercriminals and raise the issue of security concern.

Moreover, lack of employee education and awareness among employees leads to significant threats to the security of sensitive banking data, which hampers the growth of the market in the upcoming years. On the contrary, the continuous advancements in technology provide the banking BYOD security market with opportunities to develop and implement more sophisticated and comprehensive solutions. Therefore, by leveraging these advancements, the banking industry has enhanced its security measures, protected sensitive data, and ensured a secure and seamless BYOD experience for employees, ultimately enabling greater productivity and efficiency in the banking sector.

The report focuses on growth prospects, restraints, and trends of the banking BYOD security market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the banking BYOD security market.

Segment Review

The banking BYOD security market size is segmented on the basis of component, device type, security type, and region. Based on component, it is segmented into solution and service. By device type, it is segmented into laptop and smartphone & tablet. By security type, it is segmented into device security, email security, application security, mobile content security, network security, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

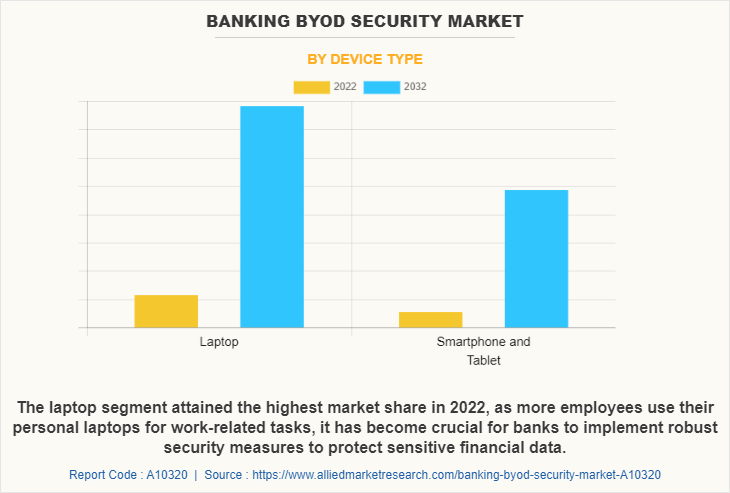

By device type, the laptop segment attained the highest growth in 2022. This is because BYOD security solutions for laptops in the banking industry have become increasingly important in recent years. As more employees use their personal laptops for work-related tasks, it has become crucial for banks to implement robust security measures to protect sensitive financial data. However, the smartphone & tablet segment is considered to be the fastest growing segment during the forecast period. This is because these solutions aim to protect sensitive financial data and ensure secure access to banking services on personal devices. Mobile device management, mobile application management, and secure containerization are the key components of a banking BYOD security solution, as these software enables IT administrators to manage and secure mobile devices used in the banking environment.

Region wise, North America attained the highest growth in 2022. This is because consumers in this region prefer mobile banking and banks are also developing user-friendly mobile applications that allow customers to perform a wide range of transactions conveniently. Furthermore, mobile banking offers features like fund transfers, bill payments, mobile check deposits, and real-time account monitoring. This in turn is driving the banking BYOD security market growth in this region. However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is because banks in this region are investing in digital platforms and mobile applications to provide convenient and accessible banking services to customers. Furthermore, digital banking includes features such as online account opening, mobile payments, fund transfers, and personalized financial management tools. These are some of the major drivers of banking BYOD security industry in the Asia-pacific region.

The report analyzes the profiles of key players operating in banking BYOD security market outlook such as Broadcom (Symantec), BlackBerry Limited., Cisco Systems, Inc., Check Point Software Technologies Ltd, Fortinet, Inc., IBM corporation, Palo Alto Networks, Inc, Sophos Ltd., Trend Micro Incorporated., and VMware, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking BYOD security industry.

Market Landscape and Trends

With the increasing adoption of mobile devices and the rising trend of employees using their personal devices for work purposes, the need for robust security solutions in the banking sector has become paramount. Banks are actively embracing BYOD policies to enhance employee productivity and flexibility, but they also face the challenge of ensuring the security of sensitive financial data. Furthermore, one of the notable trend in the banking BYOD security market is the adoption of containerization technology. Containers create isolated environments on mobile devices, separating personal and corporate data, applications, and settings. This approach allows banks to maintain control over sensitive information without compromising user privacy or interfering with personal device usage.

Moreover, another emerging trend is the implementation of advanced authentication methods. As traditional username and password-based authentication methods are increasingly being replaced or supplemented with biometric authentication, such as fingerprint or facial recognition. These biometric measures provide enhanced security and convenience, as they rely on unique physiological characteristics of individuals, reducing the risk of unauthorized access to banking systems. In addition, the integration of artificial intelligence (AI) and machine learning (ML) technologies is revolutionizing BYOD security in the banking sector. Because this AI-powered solutions analyze vast amounts of data, detect patterns, and identify anomalies in real-time, enabling banks to proactively respond to potential security threats.

Hence, the banking BYOD security market is witnessing a shift towards comprehensive and intelligent security solutions. As the adoption of BYOD policies continues to grow in the banking sector, the demand for advanced security measures will remain strong. Therefore, these are some of the major market trends of banking BYOD security market.

Top Impacting Factors

Employee productivity and flexibility

Employee productivity and flexibility have emerged as significant drivers for the growth of the banking BYOD security market share. With the increasing demand for remote work and the adoption of mobile technologies, employees in the banking sector are seeking the freedom to use their personal devices for work-related tasks. Thus, this trend has offered numerous advantages, such as enhanced productivity and convenience, as employees can seamlessly switch between personal and professional tasks on a single device.

However, it also introduces security challenges for banks, as personal devices may lack the necessary security measures to protect sensitive financial data. Hence, to address this, banks are investing in BYOD security solutions that enable employees to access corporate resources securely from their personal devices. For instance, a bank might implement a mobile device management (MDM) system that enforces strict security policies, such as encryption, secure access controls, and remote wiping capabilities, to safeguard sensitive data. This ensures that employees can enjoy the flexibility and productivity gains of using their own devices while maintaining the necessary security standards required by the banking industry.

Employee Satisfaction and Retention

Employee satisfaction and retention play a crucial role in driving the growth of the banking BYOD security market, because when employees are satisfied and engaged, they tend to be more invested in their work and take necessary precautions to protect sensitive information and data. This heightened sense of responsibility extends to the use of personal devices for work-related tasks, as employees are more likely to adhere to security protocols and guidelines.

For instance, in any leading bank, after implementing a BYOD policy along with employee satisfaction initiatives, such as flexible work hours and recognition programs, the overall job satisfaction and retention rates increased significantly. This positive shift resulted in a higher level of employee compliance with BYOD security measures, leading to a reduced risk of data breaches and cyber-attacks. Therefore, the demand for BYOD security solutions in the banking sector has witnessed a notable surge, as financial institutions recognize the importance of fostering a secure and satisfying work environment for their employees.

Increase in Mobile Banking and Customer Expectations

The increase in mobile banking and the rising customer expectations have emerged as significant drivers for the banking BYOD security market. As more individuals rely on their smartphones and tablets for financial transactions, banks are compelled to offer user-friendly and convenient mobile banking services to meet customer demands. However, this shift also poses security challenges for financial institutions, as sensitive customer data is accessed and transmitted through personal devices. Hence, to ensure the protection of customer information, banks are investing in BYOD security solutions that enable secure access to banking applications, data encryption, and multi-factor authentication.

For instance, many banks have implemented a robust BYOD security framework, incorporating secure containerization technology and advanced authentication protocols, allowing customers to conduct secure transactions through their personal devices while maintaining the confidentiality and integrity of their financial information. This proactive approach not only addresses customer expectations but also reinforces the trust in mobile banking services, fostering a positive banking experience.

Security Concerns

While BYOD policies offer flexibility and convenience for employees, allowing them to use their personal devices for work-related tasks, they also introduce various security risks. The use of personal smartphones, tablets, and laptops within the banking sector raises concerns about data breaches, unauthorized access, and potential malware infections. Moreover, banks deal with sensitive customer information, financial transactions, and proprietary data, making them attractive targets for cybercriminals. The diverse range of devices used in BYOD environments further complicates security measures, as each device may have different security vulnerabilities. Thus, ensuring the security of data across multiple platforms and operating systems becomes a daunting task for banks, requiring robust security protocols, continuous monitoring, and frequent updates. As a result, the banking BYOD security market faces challenges in striking a balance between providing employees with the flexibility they desire and safeguarding critical data against potential threats.

Lack of Employee Education and Awareness

As the banking industry increasingly adopts BYOD policies, allowing employees to use their personal devices for work-related tasks, the need for robust security measures becomes important. However, without adequate education and awareness among employees, the potential risks associated with BYOD can pose significant threats to the security of sensitive banking data.

Hence, by providing comprehensive training programs and promoting awareness campaigns, banks can ensure that their employees understand the importance of adhering to strict security protocols while using personal devices for work. Educating employees about the potential vulnerabilities and the best practice for securing their devices helps instill a sense of responsibility and vigilance. This, in turn, reduces the likelihood of negligent behavior or accidental data breaches that could compromise the security of the banking network. In addition, by investing in training programs and promoting a security-conscious culture, banks empower their employees to be proactive in mitigating potential risks associated with BYOD. Therefore, educated employees become a valuable asset in ensuring the security and integrity of banking systems and data, significantly reducing the likelihood of security breaches and their associated consequences.

High Prevalence of Advanced and Innovative Technologies

With the widespread adoption of smartphones, tablets, and other personal devices, employees in the banking sector are increasingly using their own devices for work-related tasks. This trend allows for greater flexibility, productivity, and convenience, but it also raises security concerns. As technology advances, innovative solutions are emerging to address these challenges. Furthermore, technological advancements such as biometric authentication, machine learning algorithms, and advanced encryption techniques have paved the way for enhanced security measures in the banking BYOD space.

This is because biometric authentication, which includes fingerprint and facial recognition, provides a more secure and convenient way to verify the identity of users, reducing the risk of unauthorized access. Moreover, the development of advanced encryption technologies in banking ensures that sensitive banking data remains protected even in the event of a security breach. Thus, encryption techniques such as end-to-end encryption and tokenization add an extra layer of security to data transmission and storage, mitigating the risk of data leaks or unauthorized interception. In addition, technological advancements have enabled the creation of secure containers and virtualization solutions that segregate personal and corporate data on BYOD devices.

This separation is helping to ensure that sensitive banking information is isolated and can be remotely wiped in case of loss or theft of the device, without affecting personal data. Hence, the continuous advancements in technology provide the banking BYOD security market with opportunities to develop and implement more sophisticated and comprehensive solutions. Therefore, by leveraging these advancements, the banking industry has enhanced its security measures, protected sensitive data, and ensured a secure and seamless BYOD experience for employees, ultimately enabling greater productivity and efficiency in the banking sector.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the banking BYOD security market forecast from 2023 to 2032 to identify the prevailing banking BYOD security market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the banking BYOD security market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global banking BYOD security market trends, key players, market segments, application areas, and market growth strategies.

Banking BYOD Security Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 63.3 billion |

| Growth Rate | CAGR of 22.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 256 |

| By Component |

|

| By Device Type |

|

| By Security Type |

|

| By Region |

|

| Key Market Players | IBM Corporation, Check Point Software Technologies Ltd., Fortinet, Inc., Broadcom (Symantec), Cisco Systems, Inc., Palo Alto Networks, Inc., BlackBerry Limited, VMware, Inc., Sophos Ltd., Trend Micro Incorporated. |

Analyst Review

In the banking BYOD security market, as technology continues to advance and mobile devices become increasingly integrated into the daily lives, the banking industry recognizes the need to enhance security measures to protect sensitive financial information. One of the significant trends that shape the market is the adoption of biometric authentication methods, such as facial recognition and fingerprint scanning, which provide more robust and convenient security solutions for customers. In addition, with the rise of 5G networks, there will be increased bandwidth and faster connectivity, enabling real-time monitoring and response to potential security threats.

Another emerging trend is the implementation of artificial intelligence (AI) and machine learning algorithms to detect and prevent fraud in real-time, enhancing the overall security posture of BYOD environments in the banking sector. Furthermore, the market witnesses the development of innovative encryption technologies and secure communication protocols, ensuring the confidentiality and integrity of data transmitted through mobile devices. These trends present a various opportunities for the banking BYOD security market, with companies specializing in mobile device management, endpoint security, and threat intelligence poised to thrive.

Moreover, as banks strive to strike a balance between convenience and security, there will be a growing demand for comprehensive BYOD security solutions, creating opportunities for innovation and growth in the banking industry. Furthermore, market players are adopting strategies like product launch for enhancing their services in the market and improving customer satisfaction. For instance, in March 2021, IBM Security announced new and enhanced services designed to help financial organizations to manage their cloud security strategy, policies and controls across hybrid cloud environments.

The services bring together cloud-native, IBM and third-party technologies along with IBM expertise to help organizations create a unified security approach across their cloud ecosystems. Therefore, such strategies are expected to boost the growth of the banking BYOD security market in the upcoming years.

Moreover, some of the key players profiled in the report are Broadcom (Symantec), BlackBerry Limited., Cisco Systems, Inc., Check Point Software Technologies Ltd, Fortinet, Inc., IBM corporation, Palo Alto Networks, Inc, Sophos Ltd., Trend Micro Incorporated., and VMware, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Banking BYOD Security Market will expand from 2023 - 2032 at a CAGR of 22.7%

The market value of Banking BYOD Security Market by the end of 2032 will be $63,305.28 million

The factors that drives Banking BYOD Security Market Growth are:- Employee productivity and flexibility Employee satisfaction and retention Increase in mobile banking and customer expectations

The leading players in Banking BYOD Security Market are Broadcom (Symantec), BlackBerry Limited., Cisco Systems, Inc., Check Point Software Technologies Ltd, Fortinet, Inc., IBM corporation, Palo Alto Networks, Inc, Sophos Ltd., Trend Micro Incorporated., and VMware, Inc.

The banking BYOD security market is segmented on the basis of component, device type, security type, and region. Based on component, it is segmented into solution and service. By device type, it is segmented into laptop and smartphone & tablet. By security type, it is segmented into device security, email security, application security, mobile content security, network security, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...