Banking Consulting Services Market Research, 2033

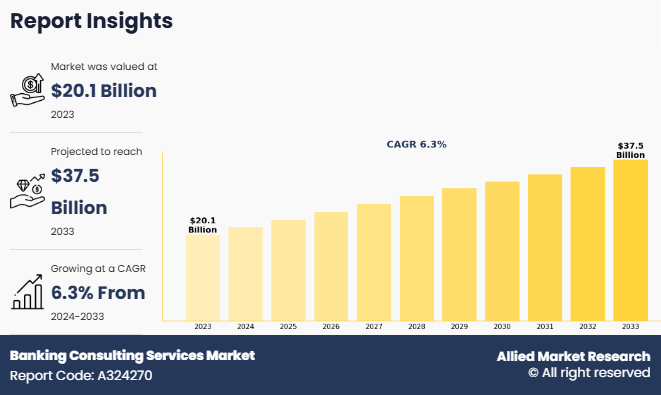

The global banking consulting services market was valued at $20.1 billion in 2023 and is projected to reach $37.5 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. The banking consulting services market is driven by the need for improved efficiency, digital transformation, and compliance with regulations. Moreover, technological advancements and risk management requirements are also fueling demand for banking consulting services industry.

Key Findings:

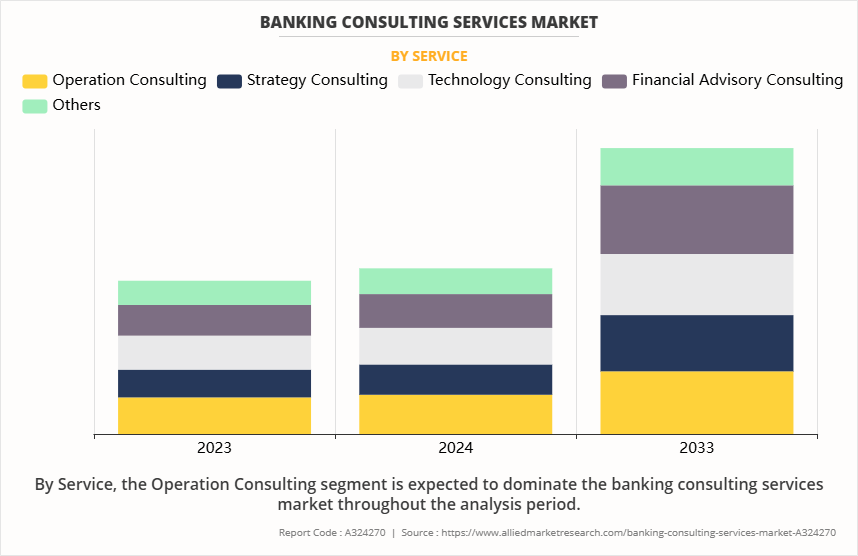

- By service, the operation consulting segment accounted for the largest market share in 2023.

- By enterprise size, the large enterprise segment accounted for the largest market share in 2023.

- By end user, the retail banking segment accounted for the largest market share in 2023.

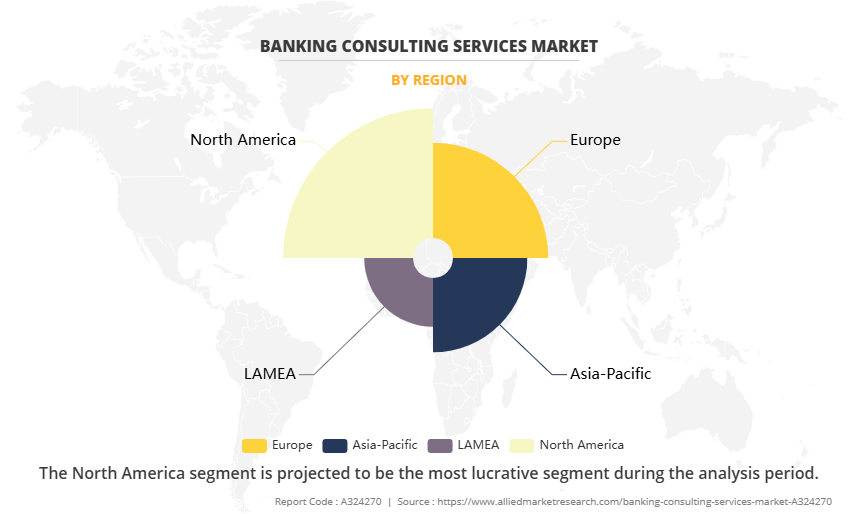

- Region-wise, North America generated the highest revenue in 2023.

The banking consulting services industry is driven by the rise in demand for strategic advisory, process automation, and financial restructuring in response to evolving market dynamics. Moreover, the expansion of digital payment ecosystems, the rise in mergers & acquisitions, and the growing need for ESG (Environmental, Social, and Governance) compliance further fuel demand for banking consulting services. The market is expected to grow as banks prioritize cost optimization, sustainable finance, and innovative business models. Financial institutions seek expert guidance on capital efficiency, customer-centric banking models, and technology-driven financial solutions to maintain resilience and growth in an increasingly complex financial environment

Segment Review

The banking consulting services market is segmented into service, enterprise size, end user, and region. By service, it is classified into operation consulting, strategy consulting, technology consulting, financial advisory consulting, and others. By enterprise size, it is segmented into large enterprises and SMEs. By end-user, it is analysed into corporate and commercial banking, investment banking, retail banking, and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of service, the global banking consulting services market share was dominated by the operation consulting segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to the growing emphasis on efficiency, automation, and risk management amid digital transformation. Banks seek expert consulting to optimize processes and ensure compliance amid AI-driven operations and infrastructure demands, which is driving the segment growth.

By region, North America dominated the banking consulting services market share in 2023. This is due to the rise in the demand for strategic advisory, banking regulatory compliance, and technology integration in banking operations. In addition, increase in fintech collaborations, digital banking expansion, and a strong focus on risk management have further fueled fintech advisory growth in the region. However, Asia-Pacific is expected to exhibit the highest CAGR during the forecast period. This is attributed to rapid digital transformation, increasing regulatory reforms, and the rising adoption of fintech solutions. In addition, government efforts to modernize financial systems, coupled with a surge in cross-border transactions and e-commerce growth are expected to drive the banking consulting services market's growth in the Asia-Pacific region.

Competition Analysis:

The market players operating in the banking consulting services market are Accenture, KPMG, McKinsey & Company, Boston Consulting Group, Bain & Company, Inc, Oliver Wyman Inc., Booz Allen Hamilton, Roland Berger., IBM Corporation, Capgemini, FIS Global., Ernst & Young, CGI Inc., PwC, Kearney., Tata Consultancy Services Ltd., Deloitte Touche Tohmatsu Limited, Wipro Ltd, Infosys Limited. and Alvarez & Marsal Holdings, LLC. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, among others which help to drive the growth of the banking consulting services market size globally.

Recent Developments in Banking Consulting Services Market Outlook

- In October 2024, Infosys partnered with Old National Bank to drive its operational and technological transformation. It focuses on modernizing the bank’s systems and streamlining processes. Infosys aimed to enhance efficiency by integrating advanced digital solutions. This partnership supports the bank’s long-term digital growth strategy.

- In September 2024, Capgemini partnered with AutoRek, a financial controls and regulatory reporting firm, to become AutoRek's first strategic professional services and technology partner. This collaboration is aimed to position AutoRek at the forefront of regulatory changes and reporting requirements, with Capgemini providing expert support for solution implementation.

Top Impacting Factors

Driver

Demand for Enhanced Digital Banking Experiences and Personalized Financial Services

The growing demand for enhanced digital banking experiences and personalized financial services is significantly driving the banking consulting services market growth. As customer expectations evolve, banks and financial institutions are increasingly focusing on user-friendly, technology-driven solutions to improve engagement and satisfaction. Consulting firms play a crucial role in helping banks integrate AI-powered chatbots, real-time data analytics, and omnichannel banking platforms to offer seamless, customized experiences. Personalized financial services, such as tailored investment plans, AI-driven credit scoring, and predictive banking insights, are becoming essential for customer retention and market differentiation. In addition, the shift towards digital-first banking and open banking frameworks has accelerated the adoption of customer-centric financial solutions. Consulting firms assist banks in leveraging cloud computing, automation, and blockchain technology to enhance security, efficiency, and transparency in financial transactions. As financial institutions strive to provide customized product offerings, data-driven recommendations, and hyper-personalized banking solutions, consulting services are in high demand to ensure seamless technology implementation and compliance with evolving financial regulations. Furthermore, as digital banking continues to expand, cybersecurity and data privacy concerns remain a top priority. Banking consultants help institutions develop robust security frameworks, ensure regulatory compliance, and implement fraud detection measures to build customer trust. The increasing emphasis on seamless digital interactions and personalized banking services will continue to drive the growth of banking consulting services, ensuring long-term success for financial institutions in a rapidly evolving landscape.

Restraint

High Costs of Integration

The high costs of digital transformation initiatives and consulting services create a barrier to adoption in the banking consulting services market. Smaller banks and financial institutions often face budget constraints, making it difficult to invest in advanced technologies like AI, cloud computing, and automation. In addition, consulting services require continuous investment for strategy implementation, compliance, and system upgrades, further increasing financial pressure. For cost-conscious organizations, the expense of modernization may outweigh perceived benefits, leading to delays or scaled-down projects. This financial hurdle slows the widespread adoption of consulting services, despite the growing need for innovation and regulatory compliance in banking.

Opportunity

Increase in Complexity of Banking Operations & IT Systems

The rise in the complexity of banking operations and IT systems fuels the banking consulting services market. As financial institutions expand their digital offerings, integrate advanced technologies, and comply with evolving regulations, they require expert guidance to streamline operations. The increase in the use of AI, cloud computing, and blockchain further adds to system complexity, necessitating specialized consulting for seamless implementation. In addition, cybersecurity threats and the need for real-time data management make robust IT strategies essential. Banking consultants help institutions in process optimization, improve system efficiency, and ensure compliance, which leads to banking consulting services market opportunity for growth and development. In addition, consulting services play a crucial role in helping financial institutions improve efficiency, adopt new technologies, and navigate regulatory challenges, with the banking consulting services market forecast anticipating continued growth driven by digital transformation and innovation in the banking sector..

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the banking consulting services market analysis from 2023 to 2033 to identify the prevailing banking consulting services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the banking consulting services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global banking consulting services market trends, key players, market segments, application areas, and market growth strategies.

Banking Consulting Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 37.5 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 261 |

| By Service |

|

| By Enterprise Size |

|

| By End Users |

|

| By Region |

|

| Key Market Players | Bain & Company, Inc., Roland Berger, Capgemini, Infosys Limited, Wipro Ltd., Kearney, FIS Global, McKinsey & Company, Tata Consultancy Services Ltd., Deloitte Touche Tohmatsu Limited, Booz Allen Hamilton, IBM Corporation, Ernst & Young, Alvarez & Marsal Holdings, LLC, PwC, CGI Inc., Oliver Wyman Inc., Boston Consulting Group, KPMG, Accenture |

Analyst Review

As the banking consulting services are evaluating the opportunities and challenges regarding this emerging technology. The banking consulting services market is experiencing significant growth, driven by the increasing demand for strategic guidance, regulatory compliance, and digital transformation in financial services. Banks and financial institutions seek consulting expertise to navigate evolving market trends, regulatory complexities, and technological advancements, ensuring operational efficiency and long-term competitiveness.

Furthermore, the rise of digital banking, AI-driven analytics, and FinTech collaborations has accelerated the demand for consulting services that support core banking modernization, automation, and risk management frameworks. Financial institutions require tailored solutions to optimize their business models, improve customer experience, and enhance cybersecurity measures, making consulting services a key contributor to digital-first banking strategies. In addition, the rise of FinTech startups and technology-driven partnerships presents new opportunities for banking consulting firms. Traditional banks are engaging consultants to integrate open banking solutions, cloud-based platforms, and blockchain technologies, ensuring seamless financial operations and better market positioning.

Moreover, governments and financial regulators globally are encouraging financial institutions to adopt secure digital banking solutions by improving risk management policies, fraud detection, and consumer data protection. However, financial institutions face challenges such as cybersecurity threats, complex regulatory requirements, and changing customer expectations. These challenges create a need for ongoing strategic guidance from consulting firms. Despite these challenges, the banking consulting services market is expected to expand further, with growing investments in digital transformation, risk management, and personalized financial solutions, ensuring sustainable growth for banks in an increasingly competitive landscape.

The global banking consulting services market is evolving rapidly, driven by advancements in technology, changing customer expectations, and the growing demand for digital transformation in the financial sector.

Operation consulting is the leading service of the banking consulting services market.

North America is the largest regional market for banking consulting services market.

$37.5 billion will be the estimated industry size of the banking consulting services market in 2033.

Accenture, KPMG, McKinsey & Company, Boston Consulting Group, Bain & Company, Inc., Oliver Wyman Inc., Booz Allen Hamilton, Roland Berger., IBM Corporation, Capgemini, FIS Global., Ernst & Young, CGI Inc., PwC, Kearney., Tata Consultancy Services Ltd., Deloitte Touche Tohmatsu Limited, Wipro Ltd., Infosys Limited, and Alvarez & Marsal Holdings, LLC. are the top companies to hold the market share in the banking consulting services market.

Loading Table Of Content...

Loading Research Methodology...