Barcode Decoding Software Market Insights: 2032

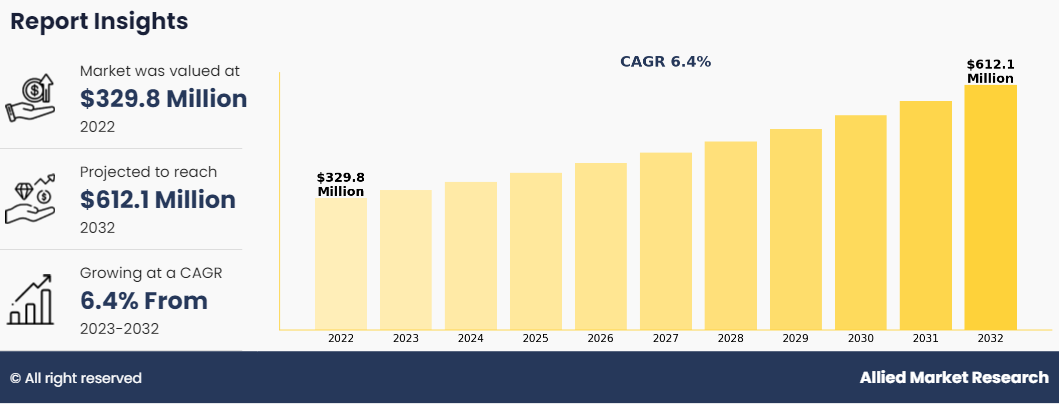

The global barcode decoding software market size was valued at $329.8 million in 2022, and is projected to reach $612.1 million by 2032, growing at a CAGR of 6.4% from 2023 to 2032. Barcode decoding software plays a major role across diverse industries, facilitating swift and precise extraction of encoded information from barcodes. Deploying sophisticated algorithms, these applications decode the complex patterns of bars and spaces within barcodes, transforming them into meaningful data for business applications.

The operational mechanism of such software entails capturing barcode images through compatible devices such as scanners or smartphone cameras. Following image capture, the software undertakes a comprehensive analysis of the barcode's composition, identifying crucial elements such as start-stop patterns, data modules, and error correction codes. The decoding process unfolds through several systematic steps.

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the market trends along with market forecast.

- The report elucidates the opportunity along with key drivers and restraints of the barcode decoding software market. It is a compilation of detailed information, inputs from industry participants & industry experts across the value chain, and quantitative & qualitative assessment by industry analysts.

- The Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the barcode decoding software market growth.

Initially, the software engages in image preprocessing to optimize the quality of the captured barcode image. This preprocessing stage encompasses tasks such as noise reduction, image rotation, and contrast adjustment, aimed at enhancing readability & accuracy. Once the preprocessing phase concludes, the software proceeds to decode the barcode, employing specialized algorithms tailored to the specific symbology utilized, such as UPC, Code 128, or QR codes.

The e-commerce industry has experienced remarkable growth in recent years. According to International Trade Administration, the global B2B e-commerce market is anticipated to be valued at USD 36 trillion by 2026. This is majorly fueled by the widespread adoption of online shopping platforms and digital marketplaces. This surge in online consumer activity has underscored the need for efficient and reliable barcode decoding software. Such software serves as a requirement in enabling smooth transactions, optimizing inventory management, and enhancing supply chain operations within the e-commerce ecosystem. The convenience of shopping from computers and smartphones has upsurged among consumers, driving the demand for barcode decoding solutions.

These tools play a pivotal role in enabling retailers and logistics providers to accurately identify and track products across the entire distribution process. As online shopping activities continue to increase, businesses face challenges in managing extensive inventories and fulfilling orders promptly & accurately. Barcode decoding software addresses these challenges by providing essential tools to streamline operations, thus allowing companies to enhance their operational efficiency and cater to the rising demands of online consumers effectively.

Barcode data plays a pivotal role across various industries, streamlining inventory management, product tracking, and transaction processing. However, alongside its efficiency, barcode technology brings forth significant concerns regarding security and data privacy. In healthcare, barcodes serve to track medical supplies, patient records, and pharmaceuticals, housing highly confidential information such as patient identities and medical histories. In addition, finance relies heavily on barcodes for payment processing, invoice management, and inventory tracking; thus holding confidential financial data and transaction records. Any breach or unauthorized access to this information leads to severe repercussions; including regulatory penalties, financial setbacks, and reputational harm.

For providers of barcode decoding software, the important factor is prioritizing the implementation of robust security measures to effectively mitigate these risks. This entails the deployment of encryption techniques to safeguard data both at rest & in transit, imposition of access controls to curtail unauthorized users from accessing or altering sensitive information, and conducting regular security audits to identify & rectify potential vulnerabilities. Moreover, adherence to industry-specific regulations such as health insurance portability and accountability act (HIPAA) in healthcare and payment card industry data security standard (PCI-DSS) in finance remains imperative to ensure compliance with legal requirements and standards for data protection.

Barcode decoding software industry has emerged as an innovative tool within logistics & transportation, presenting a significant opportunity for streamlining operations and enhancing efficiency. This software provides advanced algorithms to interpret barcode data swiftly & accurately, facilitating tracking and management of goods throughout the supply chain. In the dynamic landscape of logistics, where time is of the essence and precision is paramount, barcode decoding software serves as a driving factor for expediting processes as well as minimizing errors. By instantly decoding barcode information, such software enables logistics professionals to swiftly identify, locate, and manage inventory with unprecedented speed & accuracy.

Moreover, in the context of transportation, where the timely movement of goods is crucial, barcode decoding software plays a pivotal role in optimizing routing and scheduling. By providing real-time insights into the contents and destinations of shipments, this technology empowers transportation providers to devise the most efficient routes, allocate resources judiciously, and ensure timely deliveries. The adoption of barcode decoding software represents a paradigm shift in the logistics and transportation industry, leading to an era of high visibility, control, and operational efficiency. With its ability to decode vast amounts of barcode data rapidly & reliably, this software not only enhances the productivity of logistics and transportation professionals but also enhances the overall customer experience by ensuring prompt and accurate delivery of goods and thus would escalate barcode decoding software market forecast.

Competitive Landscape

The key players profiled in barcode decoding software industry report include TEKLYNX, Capterra, Banner, Zebra, Loftware, Honeywell, Datalogic, Cognex vision, Archon Systems Inc., and Britecheck. Market expansion and acquisition & mergers are common strategies followed by major market players. For instance, on 26 October 2023, Cognex Corporation introduced the DataMan 380 series of fixed-mount barcode readers, featuring advanced complementary metal oxide semiconductor (CMOS) sensor technology with a resolution of up to 5320 x 3032, 16.13 Mega Pixels.

These readers offer a versatile range of shutter speeds, from 15 μs for minimal exposure to 200 ms for maximum exposure, ensuring optimal performance across various environments. Equipped with C-mount Cognex high-speed liquid lenses, they deliver superior image clarity and precision. With one opto-isolated acquisition trigger input and up to three general-purpose inputs via the Breakout cable, alongside two ethernet ports, they offer uninterrupted integration & connectivity options.

Enhanced with artificial intelligence (AI) accelerated decoding, they efficiently handle 1D and 2D codes simultaneously, optimizing throughput in logistics and manufacturing operations. Tailored for machine vision applications, such as robotic pick-and-place tasks, pallet scanning, and tire barcode reading; the DataMan 380 series is expected to deliver high efficiency and accuracy.

Segments Overview

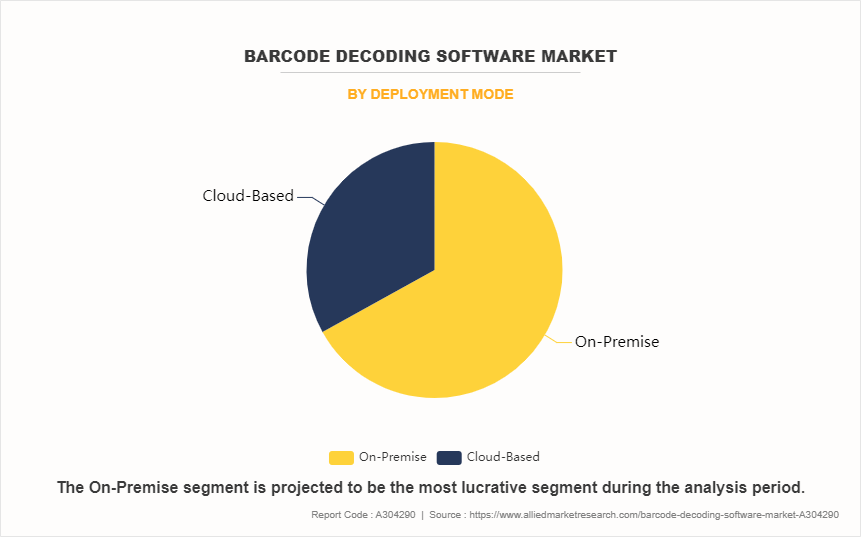

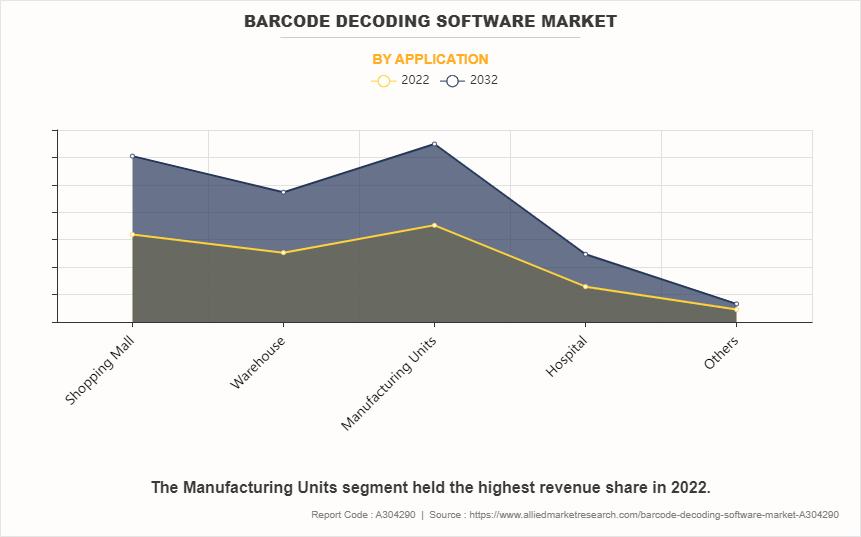

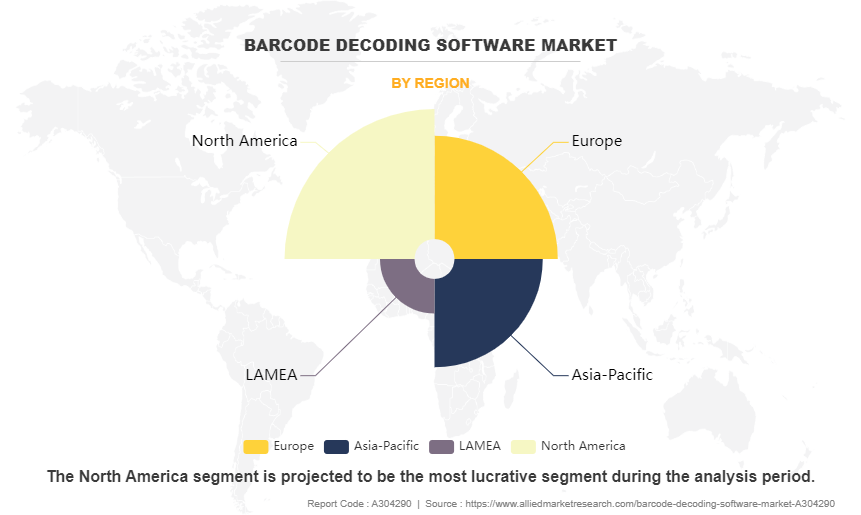

The barcode decoding software market size is segmented by deployment mode, application, and region. As per deployment mode, the market is bifurcated into on-premise and cloud. Depending on application, the market is classified into shopping mall, warehouse, manufacturing units, hospital, and others. According to region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The market is segmented into Deployment Mode and Application.

By deployment mode, the on-premise segment dominated the global barcode decoding software market share in 2022. The significance of on-premise solutions in the barcode decoding software market is increasing. These solutions offer businesses the autonomy to deploy and host their software locally within their infrastructure, rather than relying on external servers or cloud services. This segment has asserted its dominance, attracting companies seeking stringent security measures or compliance with regulatory standards. The preference for on-premise solutions highlights the importance placed on data security and privacy across various industries.

By opting for on-premise solutions, organizations exercise precise control over their data, ensuring adherence to industry regulations and safeguarding sensitive information. This strategic choice not only mitigates security risks but also boosts confidence in clients regarding data protection measures. Consequently, the on-premise segment emerged as a significant driving force behind the growth and evolution of the global barcode decoding software market in 2022. Its ability to address rising concerns regarding data security and regulatory compliance has positioned it as a preferred choice for businesses striving to maintain the integrity and confidentiality of their information assets.

By application, the manufacturing units segment dominated the global barcode decoding software market share in 2022. The manufacturing units segment demonstrates a pronounced embrace of barcode decoding software solutions, highlighting its pivotal importance within manufacturing operations globally. This prevalence underscores the indispensable role played by barcode decoding software in refining processes, boosting efficiency, and optimizing inventory management within manufacturing settings. With industries substantially prioritizing automation and digitalization endeavors, the demand for barcode decoding software solutions is poised to surge.

Moreover, boost in industrialization trend is projected to augment the growth of the manufacturing units segment in the global market. This symbiotic relationship between technology adoption & industrial advancement highlights the transformative impact of barcode decoding software in facilitating streamlined operations and fostering competitiveness within the manufacturing sector. As businesses strive for operational excellence and supply chains, the reliance on barcode decoding software is expected to intensify, strengthening its position as an indispensable tool in the modern manufacturing landscape.

By region, North America dominated the barcode decoding software market in 2022. North America has emerged as the preeminent market for barcode decoding software, leveraging its advanced technological infrastructure and widespread adoption of barcode technology across diverse industries. With an emphasis on efficiency and accuracy, companies in the region have integrated barcode technology to streamline operations, bolster inventory management, and elevate overall productivity levels. This strategic utilization of barcode solutions has propelled North America to the forefront of the market. The region's dominance is attributed to several factors.

The presence of key players within North America has facilitated the development of innovative barcode decoding software solutions. These companies have consistently invested in R&D, driving continuous technological advancements to meet evolving market demands. In addition, North American businesses have displayed a strong commitment to innovation, continuously exploring new applications and functionalities for barcode technology.

Furthermore, the widespread recognition of barcode technology's pivotal role in optimizing workflows and ensuring seamless supply chain management has propelled its growth in the region. Businesses across various sectors have significantly adopted barcode solutions to enhance operational efficiency and gain a competitive edge in the market. As a result, North America has acquired a significant share of the barcode decoding software market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the barcode decoding software market analysis from 2022 to 2032 to identify the prevailing barcode decoding software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the barcode decoding software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global barcode decoding software market trends, key players, market segments, application areas, and market growth strategies.

Barcode Decoding Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 612.1 million |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 305 |

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | Britecheck, Banner, Loftware, Zebra, Cognex vision, archon systems inc., TEKLYNX, Honeywell, Capterra, Datalogic |

The barcode decoding software market is expected to grow due to increase in online transactions globally. In addition, the market growth is driven by advancements in on-premise barcode deployment.

The major growth strategies adopted by the barcode decoding software market players are regional market expansion and acquisition & mergers.

Asia-Pacific is expected to provide more business opportunities for the barcode decoding software market in the future.

TEKLYNX, Capterra, Banner, Zebra, Loftware, Honeywell, Datalogic, Cognex vision, Archon Systems Inc., and Britecheck are the major players in the barcode decoding software market.

The manufacturing unit segment of application acquired the maximum share of the global barcode decoding software market in 2022.

Manufacturing units are the major customers of the global barcode decoding software market.

The report provides an extensive qualitative & quantitative analysis of the current trends and future estimations of the global barcode decoding software market from 2022 to 2032 to determine the prevailing opportunities.

Barcode decoding software finds extensive use in manufacturing units, serving as a critical tool for inventory management, quality control, and supply chain optimization.

Emerging trends such as the Internet of Things (IoT), edge computing, and the adoption of artificial intelligence (AI) are poised to shape the barcode decoding software market. These technologies enable faster processing, enhanced accuracy, and seamless integration; thus, fueling the demand for more efficient and intelligent barcode solutions.

Loading Table Of Content...

Loading Research Methodology...