Bariatric Surgery Devices Market Research, 2033

The global bariatric surgery devices market size was valued at $1.7 billion in 2023, and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.A significant driver of the bariatric surgery devices market is the alarming rise in global obesity rates.

Market Introduction and Definition

Bariatric surgery devices are specialized tools and equipment used in weight-loss surgeries to help individuals with severe obesity. These devices, including gastric bands, bypass devices, staplers, and sutures, facilitate procedures such as gastric bypass, sleeve gastrectomy, and adjustable gastric banding. The need for bariatric surgery devices has surged due to the global obesity epidemic, which is linked to numerous health complications like diabetes, hypertension, and cardiovascular diseases. These devices are essential for providing effective, minimally invasive surgical options, helping to improve patients' quality of life, reduce obesity-related health risks, and lower long-term healthcare costs.

Key Takeaways

- The bariatric surgery devices market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected bariatric surgery devices market forecast period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Bariatric surgery devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Obesity has become a major public health concern, contributing to numerous chronic diseases such as type 2 diabetes, hypertension, cardiovascular diseases, and certain cancers. As traditional weight loss methods like diet and exercise often fail to provide sustainable results for severely obese individuals, the demand for effective surgical interventions has increased. Bariatric surgeries, including gastric bypass, sleeve gastrectomy, and adjustable gastric banding, have proven to be successful in helping patients achieve significant weight loss and improve obesity-related health conditions. This growing need for effective obesity treatment is driving the demand for advanced bariatric surgery devices, which facilitate these procedures with greater safety and efficiency.

Despite the increasing need for bariatric surgeries, the high cost of these procedures and the associated devices can be a significant barrier for many patients. The expenses related to bariatric surgeries include not only the surgical procedure itself but also pre-operative evaluations, post-operative care, and potential complications. These costs can be prohibitive, especially in regions with limited healthcare coverage and reimbursement options. Additionally, access to specialized bariatric surgery centers and trained surgeons can be limited in certain areas, particularly in low- and middle-income countries. These factors collectively restrain the market growth, as many patients are unable to afford or access the necessary surgical interventions.

Technological advancements and innovations present a substantial opportunity for the bariatric surgery devices market growth. The development of minimally invasive surgical techniques and advanced devices, such as laparoscopic instruments, robotic-assisted systems, and improved stapling devices, has revolutionized bariatric surgery. These innovations enhance surgical precision, reduce recovery times, and minimize complications, making bariatric procedures more appealing to patients and surgeons alike. Additionally, ongoing research and development efforts are focused on creating more efficient and cost-effective devices, potentially lowering the overall costs of bariatric surgeries. As these technological advancements continue to evolve, they are expected to drive market growth by improving the accessibility, safety, and effectiveness of bariatric surgeries, ultimately benefiting a larger patient population.

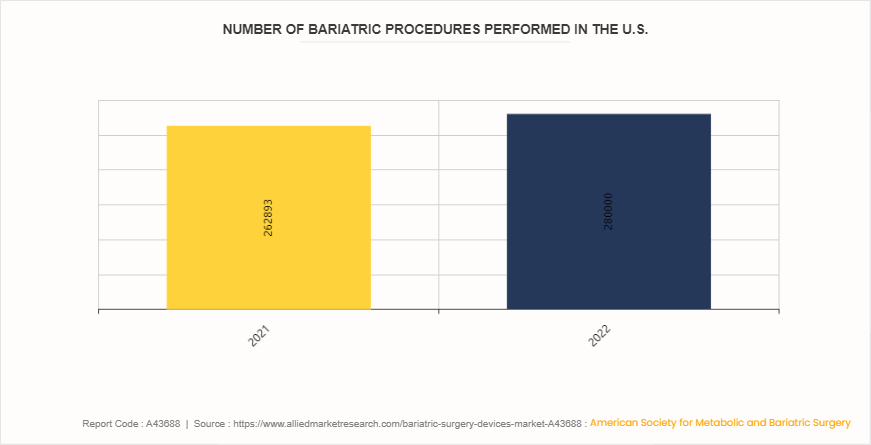

Number of Bariatric Procedures Performed in the U.S. for Bariatric surgery devices Market

The bariatric surgery devices market is experiencing significant growth, driven by the increasing prevalence of obesity and the rising number of bariatric procedures. According to an article by the American Society for Metabolic and Bariatric surgery devices, the total number of bariatric procedures in the U.S. increased by almost 6.5% from 262, 893 in 2021 to 280, 000 in 2022. This surge reflects greater awareness and acceptance of surgical weight-loss solutions. Consequently, the demand for advanced bariatric surgery devices, such as gastric bands, staplers, and laparoscopic instruments, is expanding, underscoring the market's vital role in addressing obesity and improving patient outcomes.

Market Segmentation

The bariatric surgery devices market size is segmented into device type, procedure, end user and region. On the basis of device type, the market is categorized into assisting devices, implantable devices, and others. The assisting devices segment is further categorized stapling devices, suturing devices, and others. The implantable devices segment is further categorized gastric balloon, suturing devices, and others. On the basis of procedure, the market is segmented into sleeve gastrectomy, gastric bypass, and others. On the basis of End user, the market is categorized into hospitals, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The bariatric surgery devices market share shows varying dynamics across regions. North America dominates due to high obesity rates and advanced healthcare infrastructure. Europe follows, driven by increasing surgical volumes and favorable reimbursement policies. In Asia Pacific, rising obesity levels and improving healthcare access are boosting market growth. Latin America and the Middle East & Africa are experiencing gradual market expansion, driven by increasing awareness and healthcare investments. Overall, technological advancements, regulatory reforms, and demographic shifts continue to shape regional market outlooks, with North America and Europe leading in adoption and innovation.

- According to the World Health Organization, in 2022, 2.5 billion adults (18 years and older) were overweight. Of these, 890 million were living with obesity. In addition, 43% of adults aged 18 years and over were overweight and 16% were living with obesity.

- In June 2022, Apollo Hospital in Hyderabad, achieved a significant milestone by conducting the inaugural Complete Robotic Bariatric surgery in the Telugu states. The operation, a pioneering endeavor, was carried out on Hibibo Abdulle Mohamed, a 40-year-old patient from Somalia weighing 180 kg and facing multiple health challenges.

Industry Trends

The National Program for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) , launched in 2010 by the Government of India, still being operational. The NPCDCS aims to provide early diagnosis, management, and referral of chronic non-communicable diseases, including obesity. It focuses on strengthening infrastructure, promoting healthy lifestyles, and improving healthcare services at various levels, these programs aim to reduce obesity-related complications, potentially increasing the demand for bariatric surgeries as an effective intervention in managing severe obesity and related health conditions.

Competitive Landscape

The major players operating in the Bariatric surgery devices market share include Asenus Surgical US, Inc., B Braun Melsungen AG, Cousin Surgery, Johnson & Johnson, Olympus Corporation, Richard Wolf GmbH, SPATZ FIGA, Inc., Teleflex Incorporated, and USGI Medical, Inc. Other players in the bariatric surgery devices market include Intuitive Surgical Inc., and Apollo endosurgery, Inc and so on.

Recent Key Strategies and Developments?

- In September 2022, Teleflex Incorporated, announced that it has completed the previously announced acquisition of Standard Bariatrics, Inc., which has commercialized an innovative powered stapling technology for bariatric surgery.

- In December 2021, Spatz FGIA, Inc., announced that the U.S. Food and Drug Administration (FDA) has approved the Spatz3 Gastric Balloon, the first adjustable gastric balloon system, to aid in weight loss for adult patients struggling with obesity.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- American Society for Metabolic and Bariatric surgery devices

- National Health Service (NHS)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- Australian Institute of Health and Welfare (AIHW)

- Public Health England (PHE)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bariatric surgery devices market analysis from 2024 to 2033 to identify the prevailing bariatric surgery devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bariatric surgery devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bariatric surgery devices market trends, key players, market segments, application areas, and market growth strategies.

Bariatric Surgery Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.2 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Device Type |

|

| By Procedure |

|

| By End User |

|

| By Region |

|

| Key Market Players | Johnson And Johnson, Cousin Surgery, SPATZ FIGA, Inc., Olympus Corporation, Teleflex Incorporated, Richard Wolf GmbH, Asensus Surgical US, Inc., USGI Medical, Inc, B.Braun Melsungen AG, Medtronic plc |

The total market value of bariatric surgery devices market is $1.7 billion in 2023.

The forecast period for bariatric surgery devices market is 2024 to 2035

The market value of bariatric surgery devices market in 2035 is $3.2 billion

The base year is 2023 in bariatric surgery devices market .

Top companies such as Asenus Surgical US, Inc., B Braun Melsungen AG, Cousin Surgery, Johnson & Johnson Ltd held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The major factor that fuels the growth of the bariatric surgery devices market are Rising obesity rates, growing health complications, and supportive government policies.

Bariatric surgery devices are specialized tools and equipment used in weight-loss surgeries to help individuals with severe obesity.

Loading Table Of Content...