Barrier Systems Market Research - 2031

The Global Barrier Systems Market Size was valued at $19.3 billion in 2021 and is projected to reach $28.1 billion by 2031, growing at a CAGR of 3.7% from 2022 to 2031.

Barrier Systems Market Introduction and Definition

This report includes an in-depth analysis of the present and future trends, impacting factors, and market opportunities. Barrier systems are a set of road safety products that are typically used for vehicular and pedestrian traffic management. Barrier systems ensure the smooth movement of vehicular traffic as well as the safety of pedestrians and cyclists.

Barrier Systems Market Dynamics

In addition to traffic management, barrier systems also play a vital role in property management as it is effective in preventing unwarranted access to private properties. Thus, barrier systems are extensively used on roads as well as in other facilities such as airports, railways, and commercial buildings. Furthermore, the availability of barrier systems in metals such as steel, tungsten, and aluminum whereas, and in non-metals such as plastic, wood, and concrete, further increase its usability.

The availability of barrier systems in various systems further increase the cost efficiency and safety of various facilities. For instance, the use of flexible crash barriers significantly reduces the crash impact thereby, providing a safer environment for vehicle occupants. And rigid barriers can be used for enhancing safety of railways. In addition, drop arms are extensively used for traffic management in facilities such as toll booths and parking lots. These factors positively influence the barrier systems market growth.

Emerging economies such as India and China are focusing on the development of infrastructure, thereby, creating a demand for barrier systems. In addition, the expansion of the real estate market is also contributing toward the growth of the fencing barrier market. Furthermore, technological advancements in barrier systems have significantly increased its usability. For instance, technologies such as biometric systems are equipped with drop arms that have a vast application in parking areas and automatic bollards that are operated via an automated control panel, which is used on pedestrian footpaths, entrance of commercial buildings, and high security applications.

The rising awareness regarding road safety has fueled the demand for barrier systems that that provide additional crash protection. For instance, in 2022, a rolling barrier guardrail system was installed as a pilot project on the Nahan to Kumarhatti section of NH 907A in Himachal Pradesh. In addition, major manufacturers of automated barriers and bollards components offer a wide range of products and services, to meet the customer needs. They constantly innovate their offerings to stay competitive in the market. For instance, in October 2021, CAME, a company involved in manufacturing security products, introduced SYGMA 4, a new centralized access control management system for retractable bollards. This system is expected to ease the management of retractable bollards.

The novel coronavirus had rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted the production of many components of barrier systems due to lockdown. The economic slowdown initially resulted in reduced spending on various building residential and non-residential building construction projects. However, owing to the introduction of various vaccines, the severity of COVID-19 pandemic has significantly reduced. As of mid-2022, the number of COVID-19 cases have diminished significantly. This has led to full-fledged reopening of barrier systems manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Barrier Systems Market Segmentation Overview

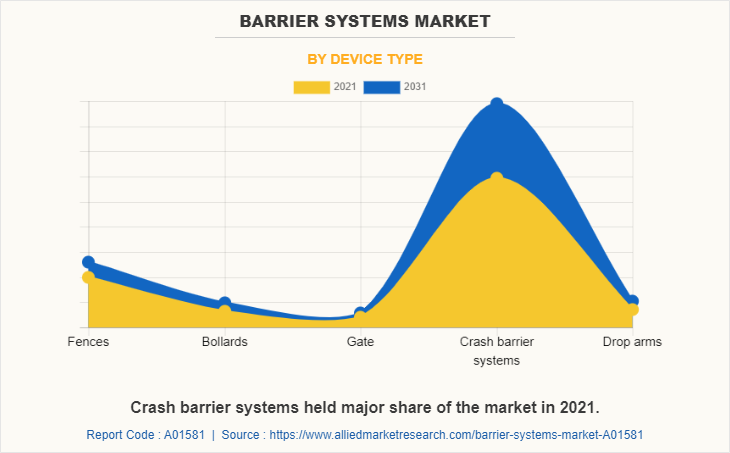

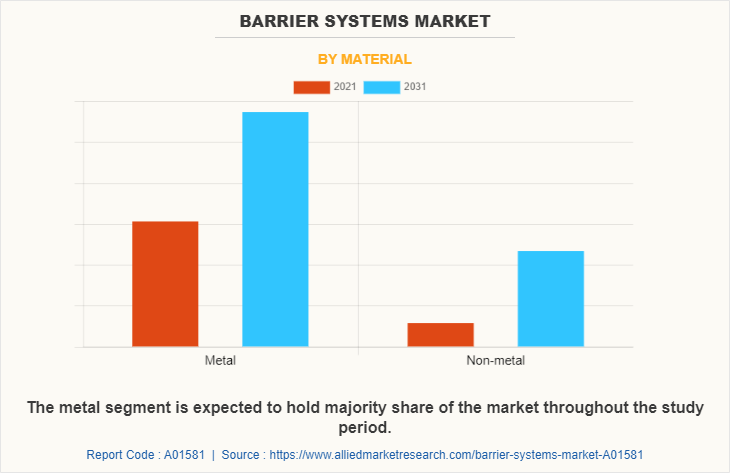

The barrier systems market is segmented into Material, Application, Device type and Technology. The market segmentation on the basis of device type includes fence, bollards, crash barriers gate and drop arms. The barrier systems market is also categorized on the basis of its material type, which includes metal and non-metal.

Based on technology, this market is classified into rigid, semi-rigid, and flexible.

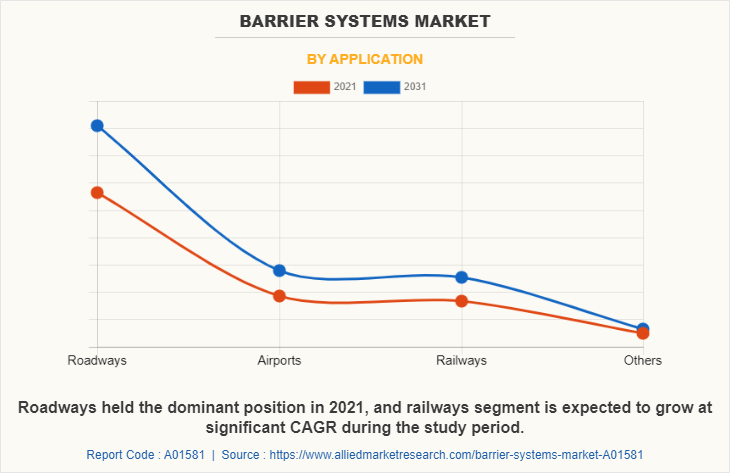

By application, the barrier systems market is segmentation into roadways, airports, railways and others.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Europe held the largest barrier systems market share in 2021, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to high spending on development and maintenance of infrastructure.

Key companies profiled in the barrier systems market forecast report include A-SAFE, Avon-barrier, Barrier1 Systems, Inc., DELTABLOC, Global GRAB Technologies, Inc, Gramm Barrier Systems Limited, Hill & Smith Barrier, Lindsay Corporation, Tata Steel Europe, and Valmont Structures Pvt. Ltd.

On The Basis of Material,

Metal segment generated the highest revenue, owing to the extensive use of metal crash barrier systems.

On The Basis of Application,

Roadways segment generated the highest revenue, and railways segment is anticipated to grow at a significant CAGR, owing to rise in number of rail and metro rail projects in emerging economies.

Furthermore, rapid growth of emerging economies in Asia and Latin America is anticipated to provide lucrative opportunities for the barrier systems industry.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the barrier systems market analysis from 2021 to 2031 to identify the prevailing barrier systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the barrier systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global barrier systems market trends, key players, market segments, application areas, and market growth strategies.

Barrier Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 28.1 billion |

| Growth Rate | CAGR of 3.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 260 |

| By Material |

|

| By Application |

|

| By Device type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Avon Barriers Corporation Limited, Tata Steel Group, Deltabloc International GmbH, Gramm Barriers Systems Limited, Lindsay Corporation, Global Grab Technologies Inc., Valmont Structures Pvt Ltd., Barrier 1 Systems, Inc, A-Safe, Hill & Smith Ltd |

Analyst Review

The barrier systems market has witnessed significant growth in the past few years, owing to the rapid increase in the number of infrastructure projects in emerging economies.

Furthermore, an increase in investments in transport infrastructure across all regions is estimated to drive the growth of the market. Asia-Pacific is projected to be the fastest-growing market for crash barrier systems, owing to various government initiatives to expand the transport infrastructure, especially for roadways and highways.

The global barrier systems market is set to increase in the future with the implementation of various sensing and control technologies, modification of transport infrastructure, and growth commercial real estate. Moreover, the advancements in technologies that enable easy operation and enhanced durability of products such as automated barriers and bollards, are anticipated to provide lucrative opportunities for market growth.

The global barrier systems market was valued at $19.3 billion in 2021 and is projected to reach $28.1 billion by 2031, growing at a CAGR of 3.7% from 2022 to 2031.

The barrier systems market encompasses road safety products designed for vehicular and pedestrian traffic management, ensuring smooth movement and safety.

Key players include Tata Steel Group, Hill & Smith Ltd, Global Grab Technologies Inc., Avon Barriers Corporation Limited, Lindsay Corporation, Deltabloc International GmbH, Gramm Barriers Systems Limited, A-Safe, Barrier 1 Systems, Inc., and Valmont Structures Pvt Ltd.

The report provides a regional analysis of the barrier systems market, including North America, Europe, Asia-Pacific, and LAMEA.

Factors include infrastructure development in emerging economies, expansion of the real estate market, and technological advancements in barrier systems.

The report discusses various market dynamics, including challenges, but specific challenges are not detailed in the provided excerpt.

Loading Table Of Content...