Battery Additives Market Research, 2033

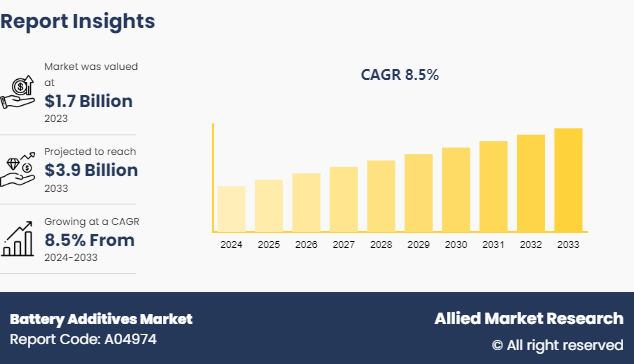

The global battery additives market was valued at $1.7 billion in 2023, and is projected to reach $3.9 billion by 2033, growing at a CAGR of 8.5% from 2024 to 2033.

Market Introduction and Definition

Battery additives are substances introduced into battery electrolytes or components to enhance performance, longevity, and efficiency. These additives can improve various aspects of battery operation, such as increasing capacity, extending cycle life, enhancing safety, and boosting charge and discharge rates. Common types of battery additives include conductive agents, which improve electron transport; stabilizers, which prevent electrolyte decomposition; and protective coatings, which reduce wear and degradation of battery materials. For example, lithium battery additives like fluoroethylene carbonate (FEC) improve the stability of the solid electrolyte interphase (SEI) layer, reducing capacity loss. Other additives can mitigate issues like dendrite formation in lithium-ion batteries, enhancing safety by preventing short circuits. In summary, battery additives play a crucial role in advancing battery technology by addressing specific performance and durability challenges, thereby making batteries more reliable and efficient for various applications.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The battery additives market is fragmented in nature among prominent companies such as BASF SE, Ascend Performance Materials, ALTANA, Harsha Industries, Arkema, Cabot, 3M, Imerys S.A., Hammond Group, Inc., and SGL Carbon.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global battery additives market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,400 battery additives -related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global battery additives market.

Key Market Dynamics

One of the most significant drivers of the battery additive market is the rapid growth of the electric vehicle industry. Lithium-ion batteries, which rely on additives such as fluoroethylene carbonate (FEC) , vinylene carbonate (VC) , lithium bis (oxalato) borate (LiBOB) , and others are the preferred choice for powering electric cars due to their high energy density and high voltage properties. As governments and consumers worldwide prioritize sustainable transportation, the demand for EVs is increasing, subsequently boosting the demand for battery additives market. According to a report published by Society of Manufacturers of Electric Vehicles in 2024, the total sales of electric vehicles in India increased by 41.6% in 2023 as compared to 2022.

Additionally, technological advancements and innovations in portable consumer electronic devices has surged the demand for highly-efficient batteries which in turn has led the battery manufacturers to use battery additives for enhancing their battery efficiencies. According to a report published by The State Council of The People’s Republic of China in 2022, China ranks first globally in the production and sales of consumer electronics with 6.1% year-on-year growth in consumer electronics sector. This factor may surge the demand for a wide range of battery additives used for enhancing efficiencies of batteries of various portable consumer electronic devices; thus, augmenting the market growth.

However, regulatory policies and frameworks significantly impact the battery additives market. In many countries such as the U.S., Canada, Germany, UK, and others the registration, sale, and use of battery additives are strictly regulated to ensure environmental and human safety. For instance, Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) Registration, Evaluation, Authorisation, and Restriction of Chemicals governs the production and use of battery additives and ensure they do not pose undue risks to human health or the environment. These regulations may hinder the growth of the battery additives market during the forecast period.

On the contrary, the development of novel electrolytes using battery additives such as vinylene carbonate (VC) , lithium bis (oxalato) borate (LiBOB) , and others for enhancing operational efficiency of both graphene and lithium-ion batteries have led the manufacturers to become linear towards using battery additives in battery manufacturing. Moreover, several research institutes such as American Chemical Society, Tianjin University of China, and others are constantly engaged in developing high-quality electrolytes using battery additives to enhance battery’s voltage and efficiency. This event may create remunerative opportunities for the battery additives market in the coming future.

Parent Market Overview

Parent Market Name | Battery Technology Market |

Market Value in 2022 | $102.9 billion |

CAGR (2023-2032) | 5.9% |

Drivers | Renewable energy integration and rise in demand for electric vehicles |

Restraint | Raw material procurement and cots challenges |

Market Segmentation

The battery additive market is segmented on the basis by type, application, and region. By type, the market is classified into electrolyte additive, conductive additive, cathode additives, anode additives, and others. By application, the market is categorized into lead-acid batteries, graphene batteries, lithium-ion batteries, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for battery additives owing to rapid advancements in electric vehicles (EVs) , renewable energy projects, and consumer electronics. Countries such as China, Japan, and South Korea are leading the global EV market, requiring high-performance, durable batteries, which in turn boosts the need for specialized additives to enhance battery efficiency and longevity. Additionally, the region's significant investments in renewable energy storage solutions and the proliferation of smartphones, laptops, and other portable devices further drive the demand. Government policies promoting green energy and technological innovations in battery materials also contribute to the growing market for battery additives, as manufacturers seek to improve battery performance and safety while adhering to stringent environmental standards.

- In China, according to a report published by The State Council of The People’s Republic of China in 2022, China ranks first globally in the production and sales of consumer electronics with 6.1% year-on-year growth in consumer electronics sector. This may surge the demand for battery additives in the growing consumer electronics sector in China.

- In Inda, according to a report published by Society of Manufacturers of Electric Vehicles in 2024, the total sales of electric vehicles in India increased by 41.6% in 2023 as compared to 2022.

- In Japan, the government has launched several programs such as National EV Vision, Electrified Vehicle Strategy 2050, Green Growth Strategy, Japan’s 2030 Fuel Efficiency Targets, and others which in turn aids the growth of electric vehicle.

Competitive Landscape

The major players operating in the battery additives market include BASF SE, Ascend Performance Materials, ALTANA, Harsha Industries, Arkema, Cabot, 3M, Imerys S.A., Hammond Group, Inc., and SGL Carbon. Other players in the battery additive market include Borregaard AS, HOPAX, Penox Group, US Research Nanomaterials, Inc., and others.

Industry Trends

- According to a report published by the Science Direct in 2022, researchers from China have produced more efficient, safer, and longer-lasting graphene batteries as compared to lithium-ion batteries using battery additives. The newly developed graphene batteries offer faster charging, longer lifespans and greater safety than lithium-ion batteries

- According to an article published by the American Chemical Society in 2024, researchers have developed novel electrolyte that can be used in next generation energy storage devices such as lithium-ion batteries. The use of novel electrolyte has enhanced the efficiency of batteries, mainly lithium-ion batteries operating at high temperatures (between 40 to 60 degree Celsius) .

- In 2023, researchers from Tianjin University, China have developed novel electrolyte made from solvents and battery additives to enhance higher energy density and high-voltage (>4.3 Volt) of lithium-ion batteries. This event has led the manufacturers of lithium-ion battery to use novel electrolyte for enhancing battery voltages for various applications.

Public Policies

Several acts and regulations have been imposed in order to avoid safeguard the manufacturing and utilization of battery additives for various batteries. For instance:

- In U.S, Toxic Substances Control Act (TSCA) regulates the use of chemicals used in manufacturing battery additives that may be hazardous for both humans as well as the environment.

- In Europe, Registration, Evaluation, Authorisation, and Restriction of Chemicals Regulation (EC) No 1907/2006 governs the production and use of battery additives and ensure they do not pose undue risks to human health or the environment.

- Moreover, Battery Directive Act (2006/66/EC) regulates the manufacture, disposal, and recycling of batteries within the EU, including those containing specific additives. It sets requirements for the labeling and collection of batteries to minimize environmental impact.

- In China, China's Regulations on the Safety Management of Hazardous Chemicals require the registration and assessment of hazardous chemicals, including those used in battery additives. They aim to control risks associated with the production, storage, transport, and use of hazardous chemicals.

- In Japan, Japan's Chemical Substances Control Law (CSCL) regulates the import, manufacture, and use of chemical substances in battery additive manufacturing that may pose risks to human health and the environment.

Key Sources Referred

- National Promotion and Facilitation Agency

- BioMed Central

- U.S. Development Authority

- United States Department of Agriculture

- Science Direct

- Invest In India

- Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery additives market analysis from 2024 to 2033 to identify the prevailing battery additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery additives market trends, key players, market segments, application areas, and market growth strategies.

Battery Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.9 Billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Harsha Industries, SGL Carbon, 3M, Hammond Group, Inc., ALTANA, Arkema, Cabot, Imerys S.A., Ascend Performance Materials, BASF SE |

Surge in demand from automotive sector, rise in demand from portable electronics sectors, and rapid shift towards renewable energy storage applications are the upcoming trends of battery additives market in the globe.

Asia-Pacific is the largest regional market for battery additives

The battery additives market was valued at $1.7 billion in 2023, and is projected to reach $3.9 Billion by 2033, growing at a CAGR of 8.5% from 2024 to 2033.

The major players operating in the battery additives market include BASF SE, Ascend Performance Materials, ALTANA, Harsha Industries, Arkema, Cabot, 3M, Imerys S.A., Hammond Group, Inc., and SGL Carbon.

Loading Table Of Content...