Battery Binders Market Research, 2032

The global battery binders market was valued at $3.5 billion in 2022, and is projected to reach $7.5 billion by 2032, growing at a CAGR of 7.9% from 2023 to 2032. Rapid adoption of electric vehicles (EVs) is driving significant growth in the battery industry, particularly for lithium-ion batteries, which is dominant technology in EVs. Battery binders play a crucial role in ensuring the performance and stability of these batteries by holding together the active materials within the electrodes (anode and cathode) and maintaining structural integrity during charge-discharge cycles.

Introduction

Battery binders are essential components used in the construction of modern energy storage devices, particularly in lithium-ion batteries (Li-ion), sodium-ion batteries, and other advanced battery chemistries. They are responsible for holding the active material particles together within the electrode matrix and ensuring adhesion between the electrode particles and the current collector. Without binders, the electrode materials would lack structural integrity, leading to poor electrochemical performance and battery failure. Battery binders do not participate directly in the electrochemical reactions but play a crucial role in maintaining the mechanical stability and performance of the battery throughout its charge and discharge cycles.

Battery binders are crucial for the longevity and efficiency of a battery. The main function of a binder is to provide mechanical stability to the electrode, which is subjected to expansion and contraction during battery cycling. The particles within the electrode experience volumetric changes as lithium or sodium ions intercalate and deintercalate from the electrode materials. A suitable binder ensures that the electrode maintains its structural cohesion and adhesion to the current collector during this process, preventing the disintegration of the electrode and, consequently, the failure of the battery binder market.

In addition to mechanical stability, battery binders contribute to maintaining good electrical conductivity within the electrode. They form a matrix that helps create a continuous conductive pathway, enabling efficient electron flow between the electrode material and the current collector. This ensures that the battery can deliver optimal energy and power performance.

Polyvinylidene Fluoride (PVDF) binder is one of the most commonly used polymer binders in lithium-ion batteries, especially for cathodes. It is highly valued for its chemical stability, mechanical strength, and ability to form stable films. PVDF binders offer excellent resistance to various solvents and electrochemical environments, making them ideal for high-performance batteries. However, PVDF binders are processed in organic solvents like N-methyl-2-pyrrolidone (NMP), which poses environmental and safety challenges due to its toxicity.

Report Key Highlighters:

- The battery binders market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the battery binder market.

- The battery binders market is highly fragmented, with several players including Arkema, The Lubrizol Corporation, BASF SE, Solvay S.A., Daikin Industries, Ltd., Zeon Corporation, Targray, I.S.T Corporation, Synthomer PLC, and Trinseo. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the battery binders market.

Market Dynamics

Expansion of energy storage system (ESS) is expected to drive the growth of the battery binders market during the forecast period. The expansion of ESS is becoming increasingly vital as renewable energy sources such as solar and wind power gain prominence in the global energy storage. These renewable sources are inherently intermittent, meaning they do not produce energy consistently. Solar power, for example, only generates electricity during daylight hours, and wind energy is dependent on weather conditions. To ensure a stable and reliable energy supply, ESS is essential for storing excess energy produced during peak generation times and delivering it when demand is high or when renewable generation is low. In May 2024, ESS Tech, Inc., a prominent provider of long-duration energy storage systems (LDES) for commercial and utility-scale applications, announced a partnership with Sapele Power Plc, a leading Nigerian energy company focused on power generation. As part of this agreement, ESS Tech will deliver an initial 1 MW / 8 MWh long-duration energy storage system. This project marks the largest battery storage system export to Africa, financed by the Export-Import Bank of the U.S., and is set to enhance the efficiency of Sapele’s existing power assets by offering critical ancillary services.

Modern ESS solutions majorly depend on advanced battery technologies, particularly lithium-ion batteries. These systems are being widely deployed in both utility-scale projects and smaller commercial or residential setups. There is an increase in the need for high-quality binders that play a critical role in the functionality and longevity of these batteries, with the increase in the demand for efficient and high-performing batteries. Battery binders are responsible for holding together active materials within the electrodes, ensuring that the batteries maintain structural integrity over thousands of charge-discharge cycles.

However, the affinity of binders to liquid electrolytes is expected to hinder the growth of the battery binders market during the forecast period. The interaction between binders and liquid electrolytes is crucial for the performance of energy storage devices, especially lithium-ion batteries. Binders are responsible for holding active materials and conductive additives together in the electrode structure of the battery. They play a vital role in maintaining the mechanical integrity of the electrode during charge and discharge cycles.

One of the main concerns in lithium-ion batteries is the reactions that occur at the interface between the lithium metal and the liquid electrolyte. Battery binders with high affinity to electrolyte have been found to improve performance. For instance, polyvinylidene fluoride (PVDF) is a commonly used binder for graphite anodes in Li-ion batteries due to its favorable affinity to the liquid electrolyte.

Moreover, Advancements in next-generation batteries are expected to provide sufficient development prospects for the expansion battery binders market in the future years. Advancements in battery technology have led to the development of new and improved multifunctional battery binders. These binders possess enhanced properties, including better adhesion, mechanical strength, and thermal stability. They are designed to meet the requirements of advanced battery chemistries as battery technology continues to evolve. The demand for battery binders is further driven by global trends in energy storage. For instance, China has announced plans to significantly increase its non-pumped hydro energy storage capacity by 2025. In addition, the adoption of power tariffs, which create variations in power prices, contributes to the growth in demand for battery binders. .

Segments Overview

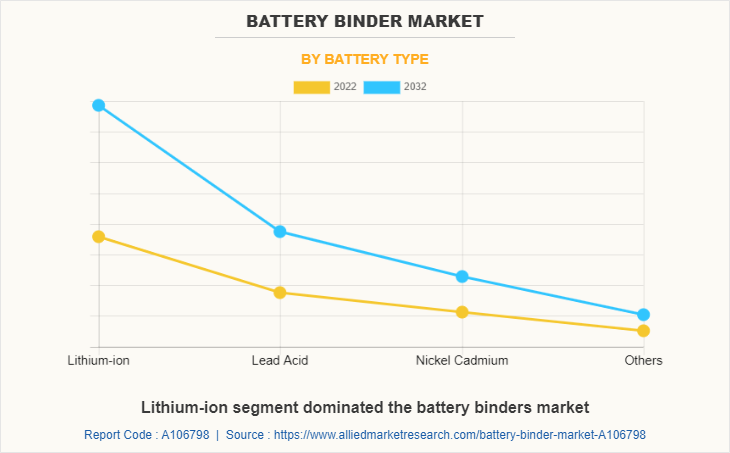

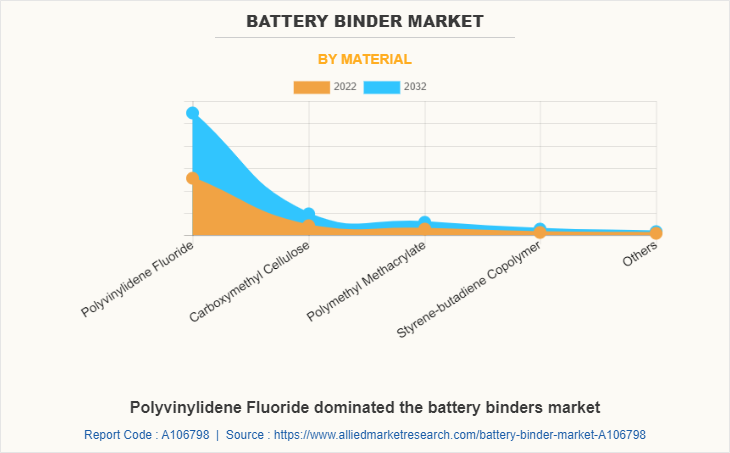

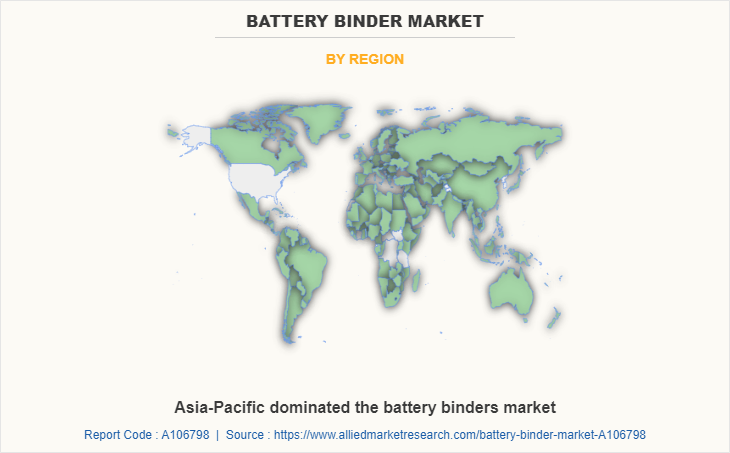

The battery binders market is segmented into battery type, material, and region. On the basis of battery type, the market is segmented into lithium-ion, nickel cadmium, lead acid, and others. On the basis of materials, the market is divided into polyvinylidene fluoride (PVDF), carboxymethyl cellulose (CMC), polymethyl methacrylate (PMMA), styrene-butadiene copolymer (SBR), and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Battery Binders Market, By Segment

Based on battery type, lithium-ion segment dominated the battery binders market accounting for half of the market revenue in 2022, and is expected to witness a CAGR od 8.2% during the forecast period. Lithium-ion batteries are widely used in various applications, including electric vehicles, portable electronics, and renewable energy storage systems. The performance and safety of lithium-ion batteries depend not only on the active materials, such as the cathode and anode, but also on the components that hold these materials together.

Battery Binders Market, By Material

On the basis of material type, the polyvinylidene fluoride segment dominated the battery binders market accounting for more than half of the market share in 2022. The polyvinylidene fluoride segment dominated the metal abrasives market in 2022. Polyvinylidene fluoride (PVDF) is indeed used as a binder material in batteries, particularly in lithium-ion batteries (Li-ion). PVDF is a high-performance polymer known for its excellent chemical resistance, mechanical strength, and thermal stability, which make it suitable for demanding applications such as battery binders.

PVDF is often preferred as a binder material due to its unique properties. It has good adhesion to various electrode materials, including metal foils and active particles. PVDF can form a strong bond with the active materials, which enhances the overall electrode performance and stability. Additionally, PVDF has excellent chemical compatibility with the electrolyte used in Li-ion batteries, which minimizes unwanted side reactions and improves the long-term stability of the battery.

Battery Binders Market, By Region

Region-wise, Asia-Pacific was the highest revenue contributor and fastest growing region representing in the battery binders market the CAGR o8.3% during the forecast period.. China is the leading global producer of lithium-ion batteries, primarily driven by the growing demand for electric vehicles and renewable energy storage systems. The most commonly used battery binders in China are polyvinylidene fluoride (PVDF), carboxymethyl cellulose (CMC), and styrene-butadiene rubber (SBR).

Japan and South Korea, home to industry giants such as Panasonic, LG Chem, and Samsung SDI, also have a substantial demand for high-performance binders. These countries focus on developing batteries for both automotive and consumer electronics, and they rely on high-quality binders to enhance energy density and the mechanical strength of electrodes. These manufacturers often work with advanced binder technologies to ensure that the batteries can withstand the rigorous charging cycles required by modern applications.

Competitive Analysis

Competitive intelligence on prominent manufacturers of aerogel provides key insights on the strategies implemented to gain a significant share in the global aerogel market. Top market players in global battery binders are adopting product launch, partnership, and expansion as their key business strategies to sustain in the competitive market. Some of the leading manufacturers profiled in this report include Arkema, The Lubrizol Corporation, BASF SE, Solvay S.A., Daikin Industries, Ltd., Zeon Corporation, Targray, I.S.T Corporation, Synthomer PLC, and Trinseo.

Historical Trends of Battery Binders:

- In 1859, Gaston Plante developed the lead-acid battery, a significant advancement in battery technology. These batteries used lead electrodes and a sulfuric acid electrolyte. Initially, Plante used asphalt as a binder to hold the active material on the lead grids.

- In the 1990s, polyvinylidene fluoride (PVDF) emerged as a commonly used battery binder material for lithium-ion batteries. PVDF is a high-performance polymer known for its exceptional chemical stability, mechanical strength, and adhesion properties. These characteristics make it well-suited for use as a binder in lithium-ion battery electrodes.

- In the early 2000s, researchers began exploring the use of alternative binder materials to address limitations and improve battery performance. These included carboxymethyl cellulose (CMC), styrene-butadiene rubber (SBR), and polyacrylic acid (PAA).

- In 2003, solid polymer electrolytes, such as polyethylene oxide (PEO) and polyacrylonitrile (PAN)-based polymers, were investigated as combined binder-electrolyte materials to simplify the cell assembly process and improve interfacial stability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery binder market analysis from 2023 to 2032 to identify the prevailing battery binder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery binder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery binder market trends, key players, market segments, application areas, and market growth strategies.

Battery Binder Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.5 billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Battery Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | Arkema, Daikin Industries, Ltd., The Lubrizol Corporation, Trinseo S.A., Industrial Summit Technology Corp., Targray, Solvay S.A., BASF SE, Zeon Corporation, SYNTHOMER PLC |

Analyst Review

According to the opinions of various CXOs of leading companies, the metal abrasives market is driven by rise in demand for lithium-ion batteries. Lithium-ion battery binders have a vital function in the fabrication of lithium-ion batteries. Their primary purpose is to securely bind the active materials, including the cathode and anode, while also providing structural support to the battery electrodes. Acting as an adhesive substance, the binder effectively holds the active materials together and ensures continuous contact with the current collectors, enabling efficient electron and ion transfer within the battery.

Mechanical binding of battery binders drives the growth of the battery binders market. Mechanical binding of battery binders is a technique that aims to securely hold the binders in position without relying solely on adhesives or chemical bonding. Instead, various methods are employed to achieve physical attachment. One common method is the use of snap-fits, which involve designing interlocking features on the binder and battery housing. These features, such as tabs, hooks, or grooves, allow the binder and housing to snap or click together, ensuring a secure connection. This approach is frequently employed in consumer electronics, where batteries often need to be easily replaceable.

However, the affinity of binders to liquid electrolytes is expected to restrain industry expansion. The performance of energy storage devices, especially lithium-ion batteries, can be significantly influenced by the affinity of binders to liquid electrolytes. Binders are responsible for holding the active materials and conductive additives together in the electrode structure. They play a vital role in maintaining the electrode's mechanical integrity during charge and discharge cycles. A crucial concern in lithium-ion batteries is the reactions occurring at the interface between the lithium metal and the liquid electrolyte. Researchers have discovered that battery binders exhibit a high affinity, which leads to improved performance.

The Asia-Pacific region is projected to register robust growth during the forecast period. China, the world's leading producer of lithium-ion batteries, has witnessed a significant surge in demand for battery binders primarily driven by the increasing adoption of electric vehicles (EVs) and renewable energy storage systems. The most commonly used battery binders in China include polyvinylidene fluoride (PVDF), carboxymethyl cellulose (CMC), and styrene-butadiene rubber (SBR). These binders play a crucial role in enhancing the performance and stability of lithium-ion batteries, making them vital components in the rapidly expanding market of EVs and renewable energy.

The battery binders market is segmented into battery type, material, and region. On the basis of battery type, the market is segmented into lithium-ion, nickel metal hydride, lead acid, and others. On the basis of materials, the market is divided into polyvinylidene fluoride (PVDF), carboxymethyl cellulose (CMC), polymethyl methacrylate (PMMA), styrene-butadiene copolymer (SBR), and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Lithium ion is the leading battery type of Battery Binder Market.

Asia-Pacific is the largest regional market for Battery Binder Market

Mechanical binding of battery binders, Rise in demand for multifunctional battery binders, and Increase in demand for battery binders in electric vehicles are the driving factor of Battery Binders Market.

Advancements in next-generation batteries are the upcoming trends of Battery Binder Market in the world.

Arkema, The Lubrizol Corporation, BASF SE, Solvay S.A., Daikin Industries, Ltd., Zeon Corporation, Targray, I.S.T Corporation, Synthomer PLC, and Trinseo are the top companies to hold the market share in Battery Binder Market.

The global battery binder market was valued at $3.5 billion in 2022, and is projected to reach $7.5 billion by 2032, growing at a CAGR of 7.9% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...