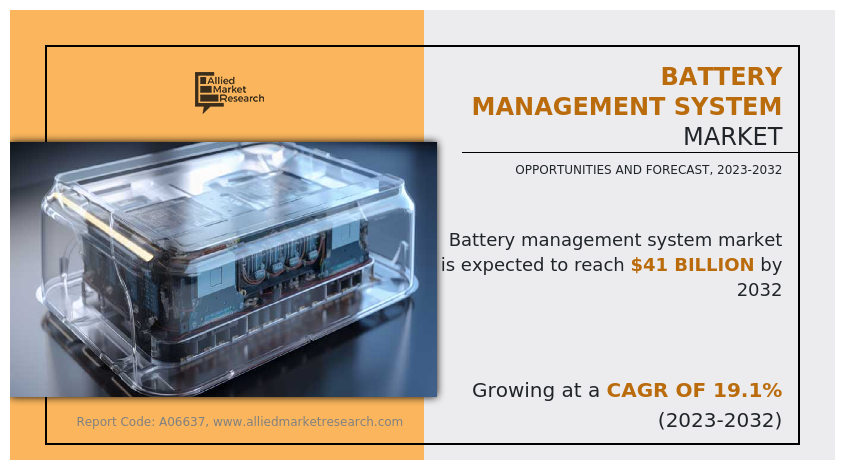

Battery Management System Market Overview

The Global Battery Management System Market size was valued at $7.5 billion in 2022, and is projected to reach $41 billion by 2032, growing at a CAGR of 19.1% from 2023 to 2032. This is growing rapidly due to rising demand for electric vehicles, renewable energy storage, and portable electronics. BMS ensures battery safety, efficiency, and longevity by monitoring and controlling charging cycles. Technological advancements and increasing energy storage needs are key drivers propelling the market forward.

Market Dynamics & Insights

- The battery management system industry in Asia-Pacific held a significant share of over 45.2% in 2022.

- The battery management system industry in U.S. is expected to grow significantly at a CAGR of 17.9% from 2023 to 2032.

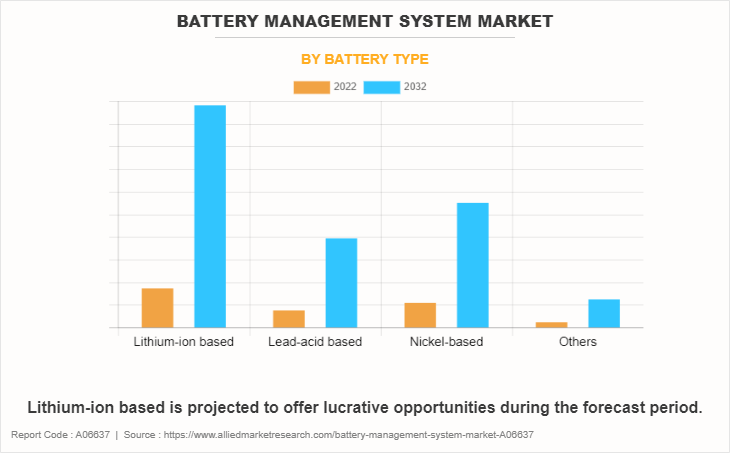

- By battery type, lithium-ion based segment is one of the dominating segments in the market and accounted for the revenue share of over 45.8% in 2022.

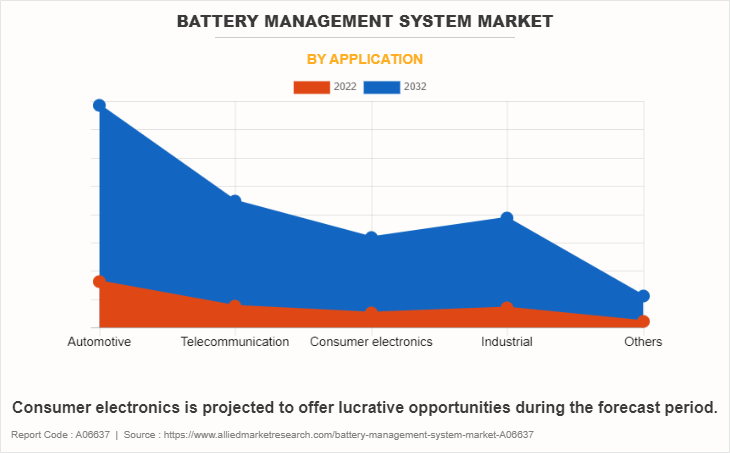

- By application, the consumer electronics segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2022 Market Size: $7.5 Billion

- 2032 Projected Market Size: $41 Billion

- CAGR (2023-2032): 19.1%

- Asia-Pacific: Largest market in 2022

- LAMEA: Fastest growing market

Factors such as accelerated adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) and A surge in industry preference toward the utilization of lithium-ion batteries drives growth of the battery management system market. In addition, growth in adoption of rechargeable batteries across multiple end-use industries propels the market growth. However, rise in overall price of products with addition of battery management system hinders growth of the market.

Segment Overview

The battery management system market is segmented into battery type, topology, application, and region.

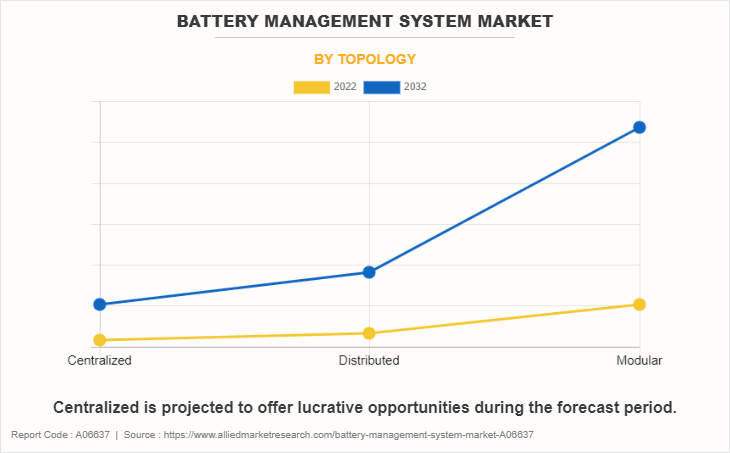

On the basis of battery type, the market is categorized into lithium-ion based, lead-acid based, nickel-based, and others. On the basis of topology, it is segregated into centralized, distributed, and modular.

On the basis of application, it is fragmented into automotive, telecommunication, consumer electronics, industrial, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Asia-Pacific region presents a diverse landscape for the battery management system (BMS) market. China, as the largest EV market in the world, drives significant demand for BMS technology, supported by government incentives and a robust domestic manufacturing industry. Japan, known for its technological advancements, has actively invested in EV and HV technology, creating a substantial market for advanced BMS solutions. India has experienced a rise in EV adoption, driven by government initiatives and private investments, leading to increased demand for BMS systems. South Korea, home to major battery manufacturers, relies on BMS solutions to ensure optimal performance and safety of lithium-ion batteries. In addition, Rest of Asia-Pacific countries, including Australia and Malaysia, has witnessed growth in EV adoption, contributing to the demand for BMS.

Overall, the Asia-Pacific region presents a promising market for battery management systems, fueled by the adoption of electric vehicles and supportive government policies.

Key players profiled in the BMS market report include Sensata Technologies, Inc., NXP Semiconductors, Renesas Electronics Corporation., Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics, Leclanché SA, Nuvation Energy, Elithion Inc., Eberspächer Gruppe GmbH & Co. KG, Infineon Technologies AG, and Exponential Power. The leading companies adopt strategies such as product launch and collaboration to strengthen their market position.

In February 2023, NXP Semiconductors collaborated with Qnovo, a major player in e-mobility battery management software for embedded applications. NXP is expected to include new electrified mobility, SpectralX, of Qnovo in its e-mobility enablement solutions for electric vehicles (EV) in 2023. SpectralX is a specially designed intelligent battery management system (BMS) software that uses predictive analytics technique to optimize battery performance, range, and safety in EVs equipped with lithium-ion battery.

Increase in adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs)

Countries across the world have introduced strict regulations and policies towards the usage of electric vehicles which has created a wider scope for the growth of the market across the globe. Rules alike Kyoto Protocol which is intended to to reduce green house gas (GHG) emissions has created an increased demand for green fuel vehicles to be available across countries. In addition, the increased awareness towards effects of petrol and diesel-fueled vehicles on the environment has led to innovations in the automotive industry through the introduction of electric vehicles. In addition, the vehicle manufacturers operating across the globe has announced plans to shift their focus toward electric and hybrid vehicles.

Increases in the costs of fuel, along with stringent government regulations pertaining to CO2 emissions suports the adoption of electric vehiclesacross the globe. The battery management system (BMS) is critical in maintaining and monitoring the operation of battery packs in EVs and HEVs, assuring optimal efficiency, safety, and lifetime. The demand for advanced systems develops in tandem with the demand for EVs and HEVs. These developments and the rapid adoption of electric vehicles (EVs) & hybrid electric vehicles (HEVs) are expected to drive the demand for BMS solutions thus leading to the growth of the BMS market share.

Surge in industry preference toward the utilization of lithium-ion batteries

BMS systems are an important component used for managing and optimizing lithium-ion battery performance, safety, and longevity in applications such as electric vehicles, consumer electronics, and renewable energy storage systems. BMS system monitors temperature and voltage of each battery cell, modify charging and discharging operations, balance charge levels, and provide safety functions such as overvoltage and overcurrent shielding to prevent problems such as thermal runaway. This movement in choice is being driven by higher energy density of lithium-ion batteries, longer lifespan, and lower environmental impact as compared to previous battery technologies. As a result, the need for a suitable battery management systems (BMS) to ensure the efficient and safe operation of these batteries has expanded drastically which supplements te growth of battery management system (BMS) market.

Increase in the overall cost of the product with the addition of a battery management system

The addition of BMS to a product raises the overall cost of the product, which is one of the key restraints of the battery management system (BMS) market. The BMS is an essential component of any battery-powered system as it assures the effective and safe operation of the battery. The cost of integrating a BMS, might drastically raise the entire cost of the system, making it less affordable to consumers.

Moreover, the semiconductor shortage across the globe has an impact on the adoption of battery management systems (BMS) as these systems rely heavily on semiconductor components such as microcontrollers, power management chips, and sensors. The availability and cost of these components are affected, with the shortage of semiconductors, which may lead to delays in the production and delivery of BMS systems. SUch factors creates a barrier affecting the growth of the market across the globe.

Evolution of an AI-based cloud-connected electric vehicle battery management system

Cloud-based BMS systems may further track batteries in real-time, allowing for remote access and control of battery performance. This is especially beneficial in large-scale applications such as electric vehicle fleets and renewable energy storage systems. AI-based BMS may significantly boost the efficiency and lifespan of EV batteries by real-time optimizing charging, discharging, and balancing processes.

The BMS may access real-time weather and traffic information due to cloud connectivity, allowing it to forecast driving conditions and adjust the performance of the battery accordingly. Furthermore, cloud connectivity provide remote battery monitoring and control, enabling early detection of any fault and lowering the chance of battery failure. AI-based BMS systems use machine learning algorithms to learn from performance data of battery and optimize its operation accordingly. This results in more accurate predictions of battery life and improved efficiency, which translates into longer battery life and reduced costs for EV owners.

Moreover, semiconductor providers developed a solution to connect BMS to cloud computing technology for monitoring in real-time. For instance, in November 2022, NXP Semiconductors developed a solution to link its high-voltage battery management system (HVBMS) to the cloud via its S32G GoldBox vehicle networking reference design to utilize a battery digital twin driven by artificial intelligence (AI). NXP may better predict and control the physical BMS in real time, utilizing the EVE-Ai 360 Adaptive Controls technology from Electra Vehicles, Inc., improve battery performance and battery state of health by up to 12%, and enable a variety of new applications, such as managing an EV fleet.

Key Developments in Battery Management System Industry

In January 2023, Texas Instruments Incorporated launched a pair of very precise EV battery monitoring ICs, which are expected to allow for greater EV ranges. It released the BQ79718-Q1 battery cell monitor IC and BQ79731-Q1 battery pack monitor IC as part of the battery management systems (BMS) portfolio of the company, a pair of ICs aimed at maximizing the driving range of electric vehicles (EVs).

- In May 2023, Sensata Technologies, Inc. launched c-BMS24X, a new compact Battery Management System (BMS) that addresses the market needs for industrial applications, low voltage electric vehicles, and energy storage systems. The c-BMS24X uses advanced software functionality that enables improvements in vehicle range, uptime, battery health and performance in applications up to 24 cells in series and 2000 amps like energy storage systems (ESS), scooters, 3-wheelers, forklifts and AGVs.

- In June 2022, Renesas Electronics Corporation, a leading provider of innovative semiconductor solutions, launched AUTOSAR-compliant complex device driver (CDD) software module for automotive battery management systems (BMS) in electric vehicles (EVs). The new software works in combination with ISL78714 Li-Ion battery management IC of Renesas to accelerate the design and performance of next-generation systems.

- In October 2023, Infineon Technologies AG partnered with Eatron Technologies for advance automotive battery management systems (BMS). Through this technology, both companies help electric vehicle (EV) manufacturers solve three technological challenges that have so far hindered increasing customer adoption of EVs: range anxiety, charging speed and battery health.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the battery management system market analysis from 2022 to 2032 to identify the prevailing battery management system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the battery management system industry segmentation assists to determine the prevailing BMS market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global battery management system market trends, key players, market segments, application areas, and market growth strategies.

Battery Management System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 41 billion |

| Growth Rate | CAGR of 19.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 339 |

| By Battery Type |

|

| By Topology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Exponential Power, Elithion Inc., NXP Semiconductors, Texas Instruments Incorporated, Leclanché SA, STMicroelectronics, Nuvation Energy, Eberspächer, Sensata Technologies, Inc., Infineon Technologies AG, Analog Devices, Inc., Renesas Electronics Corporation |

Lithium-Ion Based are the upcoming trends of Battery Management System Market in the world

Consumer Electronics is the leading application of Battery Management System Market

Asia-Pacific is the largest regional market for Battery Management System

The battery management system market was valued at $7.48 billion in 2022 and is estimated to reach $40.97 billion by 2032, exhibiting a CAGR of 19.1% from 2023 to 2032.

Key players profiled in the report include Sensata Technologies, Inc., NXP Semiconductors, Renesas Electronics Corporation., Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics, Leclanché SA, Nuvation Energy, Elithion Inc., Eberspächer Gruppe GmbH & Co. KG, Infineon Technologies AG, and Exponential Power.

Loading Table Of Content...

Loading Research Methodology...