BFSI BPO Services Market Outlook

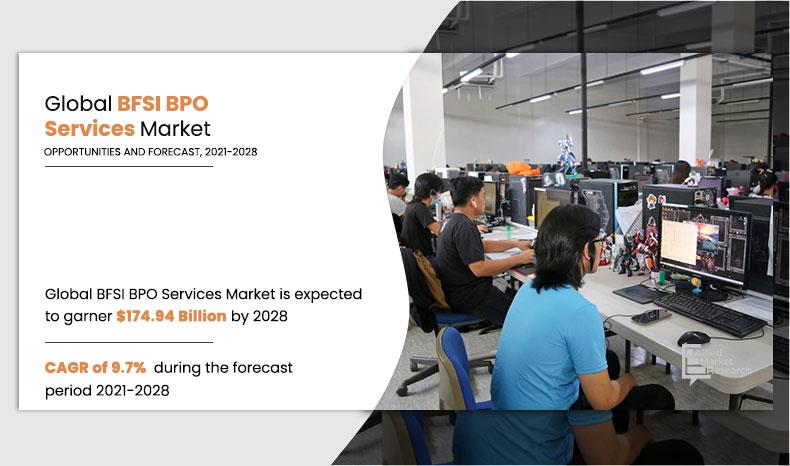

The global BFSI BPO services market size was valued at $85.12 billion in 2020, and is projected to reach $174.94 billion by 2028, growing at a CAGR of 9.7% from 2021 to 2028. Banking and financial services outsourcing refers to the use of third party vendors to deliver services or perform tasks, which is normally undertaken by financial institutions. The objective behind its adoption among banks and financial institutions is to make it easier for them to dedicate their time and resources to core business and operations. Banking business process outsourcing (BPO) is a strategic tool that supports banks for its business growth and account servicing functions. The third party financial services provider may be offshore on onshore.

The global BFSI BPO services market growth is expected to exhibit robust during the forecast period. The key factors impacting the growth of the BFSI BPO services market include rise in need for operational efficiency & transparency in business processes, surge in adoption of cloud communication based BPO services, and increase in demand for cost saving on infrastructure & technology. In addition, surge in demand for faster and better services in banks during the COVID-19 pandemic is anticipated to witness growth in the BFSI BPO services market. Furthermore, higher investment & maintenance costs and overdependence on the BPO companies are expected to affect the BFSI BPO market growth during the forecasted period. Moreover, increase in demand for BPO services among banks, and financial institutions and technological advancements in BPO services are likely to have a notable effect on the global market. However, each of these factors is anticipated to have a definite impact on the overall market growth during the forecast period.

On the basis of service type, the customer services segment dominated the BFSI BPO services market share in 2020, and is expected to maintain its dominance in the upcoming years. This is attributed to the increase in number of leads and enquiries at various stages of the customer lending lifecycle. Customer services based BFSI BPO companies are focused on handling customer requirements that are generated through emails, phone calls, and social media platforms. In addition, the human resource segment is expected to witness highest growth rate in the upcoming years, owing to surge in demand for experienced middle managers in financing and accounting to perform billing services, accounts payable, receivables, and other financial services.

North America dominated the overall BFSI BPO services market share in 2020, attributed to number of factors such as penetration of BPO vendors and improvement in economy. Advancements in information technology and increase in development of interactive & consumer-friendly user interface of websites & applications are the major factors that boost growth of the BFSI BPO services market in the region.

However, Asia-Pacific is expected to grow at the highest rate during the BFSI BPO services market forecast period, due to the rapid growth in establishment of customer service centers & call centers, and government initiatives & support for the development of business process outsourcing industry, which are turning toward the hosted BPO services to efficiently manage their business processes, particularly in the developing countries such as China, India, and Singapore.

The report focuses on the growth prospects, restraints, and BFSI BPO services market analysis. The study provides Porter’s five forces analysis of the BFSI BPO services industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the BFSI BPO services market trends.

Segment review

The BFSI BPO services market is segmented into service type, enterprise size, end user, and region. On the basis of service type, it is classified into customer services, finance & accounting, human resource, KPO, procurement & supply chain and others. As enterprise size, it is segregated into large enterprises, small & medium-sized enterprises. In terms of end user, the market is bifurcated into banks, capital market, insurance companies, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service Type

Human Resource service is projected as one of the most lucrative segments.

The market players operating in the BFSI BPO services market include Accenture PLC, Cognizant, Concentrix Corporation, Genpact, IBM Corporation, Infosys Limited, Mphasis, NTT Data Corporation, Tata Consultancy Services Limited and Wipro Limited.

COVID-19 impact analysis

The COVID-19 pandemic has led to decline in revenue of BFSI BPO services market, owing to disruptions caused by the global pandemic, stringent lockdowns and business shutdowns. In addition, the companies faced various challenges for moving their operations from office premises to work–from-home environment. However, the pandemic has enabled various organizations to adopt digital platform for increasing their work efficiency and to regain their customers trust. Further, digitization in BPO companies have helped BPO companies with more affordable, accessible and accurate business operations, which is providing opportunity to the market.

By Enterprise Size

Large Enterprises accounted for the highest market share in 2020

Top impacting factors

Surge in adoption of cloud communication based business process outsourcing Services in the banking sector

During the COVID-19 pandemic, upsurge in demand for cloud-based BPO services supported banks to sustain during disruptions. In addition, the BPO services solution played a vital role in keeping the entire banks, businesses, and financial institution processes efficiently operating by allowing banks to use their internal resources for core competencies and essential business function. Cloud communication helps financial institutions improve performance through various features such as remote access, digital data exchange, automated reporting, and real-time work floor control. According to Forbes, around 77% of banks use cloud computing to outsource a part of their work to other companies. In addition, the pandemic has forced the banking sector around the globe to in invest in solutions which balance overworked and under-resourced bankers, streamline their products & services, cut costs and bring added value for investors and customers through outsourcing. This factor has led to surge in demand for cloud communication based BPO services, thereby fueling the growth of the market

Technological advancement in BPO Services

Traditional BPO services have been deployed since several decades; however, increased adoption of advanced technologies such as IoT, AI, and robotics process automation have led to the growth of the industry. Increase in technological innovations in Asia-Pacific countries, which include India, China, Australia, and Singapore is expected to create several opportunities for the BFSI BPO services market. The integration of “Swiss Post Solutions” BPO services with IoT-based devices allows organizations, banks, and financial institutions to identify and eliminate issues such as unnecessary assets and lead to operational efficiencies, cost reductions, and optimal human resource deployment. In addition, automation of processes by robotic process automation technology keeps the bank operations running on time without any human intervention. Similarly, multiple benefits of integrating advance technologies includes Ucaas Solutions, AI, and others with BPO services in banking institution, such as real-time information transmission, minimized errors, real-time access to data, and faster decision-making are creating several opportunities for the market.

By Region

Asia-Pacific would exhibit the highest CAGR of 11.3% during 2021-2028

Key Benefits For Stakeholders

- This study includes the BFSI BPO services market forecast, BFSI BPO services market trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and BFSI BPO services opportunity.

- The BFSI BPO services market size is quantitatively analyzed from 2020 to 2028 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the BFSI BPO services market.

Key Market Segments

By Service Type

- Customer Services

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End User

- Banks

- Commercial Banking

- Retail Banking

- Cards

- Lending

- Capital Markets

- Investment Banking

- Brokerage

- Asset Management

- Others

- Insurance Companies

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Market Players

- Accenture PLC

- Cognizant

- Concentrix Corporation

- Genpact

- IBM Corporation

- Infosys Limited

- Mphasis

- NTT Data Corporation

- Tata Consultancy Services Limited

- Wipro Limited

BFSI BPO Services Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Cognizant, Infosys Limited, Mphasis, Concentrix Corporation, Accenture PLC, Tata Consultancy Services Limited, Wipro Limited, NTT Data CORPORATION, Genpact, INTERNATIONAL BUSINESS MACHINES CORPORATION |

Analyst Review

In accordance with several interviews conducted by the top level CXOs, the Asia-Pacific region is witnessing an increased adoption of BFSI BPO service from developing economies such as China and India. Several banks and financial institutions have a low capital to invest in expensive infrastructure, labor, and other related expenses due to liquidity crunch in economy. As a result, these institutions increasingly consider the adoption of digital technologies such as cloud-based BPO services, which manage their business operations at a less capital investment. As the business operations of such banks are simple, they do not require complicated and expensive labor, and infrastructure. Increased adoption of BPO services by financial institutions is one of the key trends expected to gain prominence in the market. In addition, these institutions are also adopting BPO for lowering their financial costs and risks. Integration of AI in BPO further enables new ways of managing financial assets, resulting in increased adoption of the BFSI BPO services during the forecast period.

In the current scenario, there has been a substantial rise in the usage of the BPO services across various banks, and financial institutions. By integrating their business functions in critical business processes of banks, they can increase the productivity and efficiency of their business. Hence, to lower the IT expenses and streamline processes, banks are implementing BPO services. Adoption of BPO services allows banks to integrate business operations with their suppliers, channel partners, and customers. However, the selection of BPO services differs in accordance to business outfits and their respective process.

Loading Table Of Content...