BFSI Crisis Management Market Research, 2033

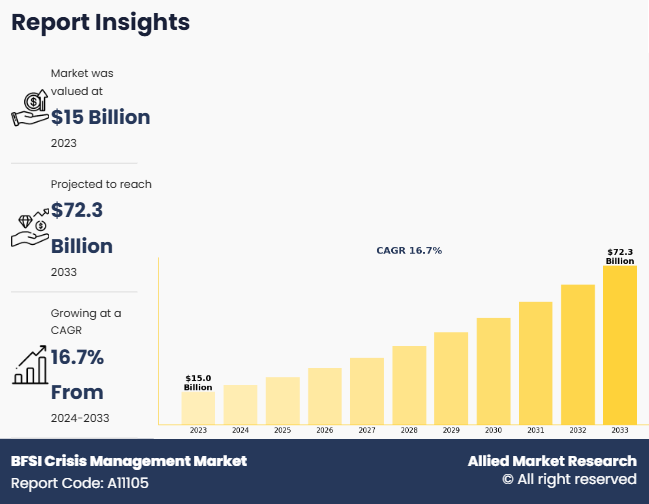

The BFSI crisis management market was valued at $15 billion in 2023 and is estimated to reach $72.3 billion by 2033, exhibiting a CAGR of 16.7% from 2024 to 2033. The BFSI crisis management solution is a financial technology that helps the BFSI industry deal with different incidents and emergencies. Technologies such as artificial intelligence, cloud computing, machine learning, and big data are all used in crisis management. In addition, BFSI crisis management is a cutting-edge program that adopts a new strategy through technology that concentrates on certain business risk areas and defends the dependability & credibility of financial institution networks. The need for these solutions in the BFSI crisis management market sector continues to expand, driving BFSI crisis management market growth as crisis management solution providers raise their focus on improving financial services, risk mitigation & fraud detection, and cyber security.

Key Takeaways

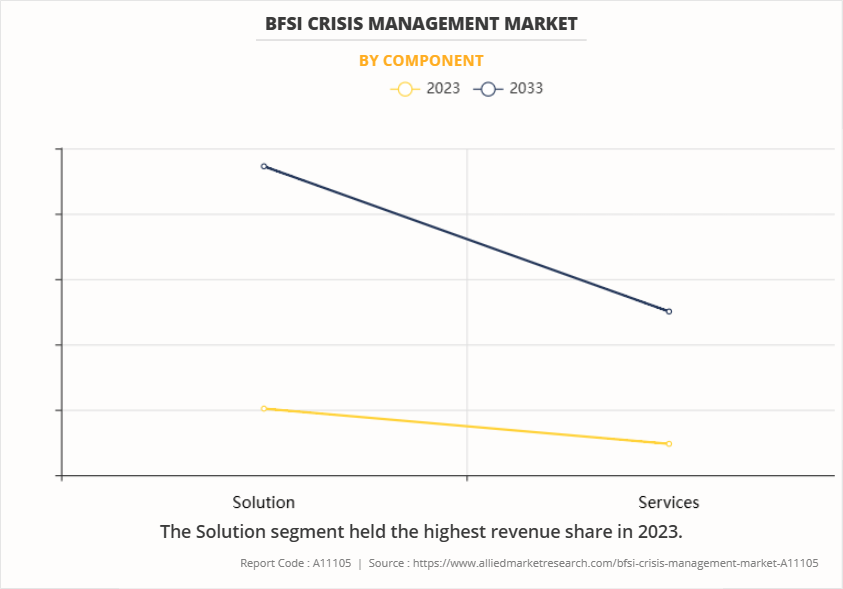

By component, the solution segment held the largest share in the BFSI crisis management market for 2023.

By application, the risk and compliance management segment held the largest share in the BFSI crisis management market for 2023.

By enterprise size, the large enterprises segment held the largest share in the BFSI crisis management market for 2023.

By end user, the banks and financial institution segment held the largest share in the BFSI crisis management market for 2023.

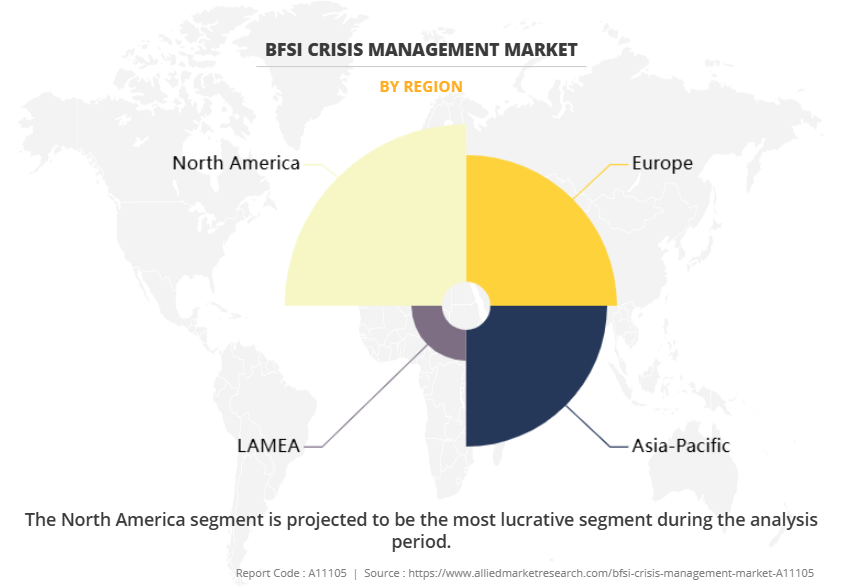

Region-wise, North America holds the largest share in the BFSI crisis management market in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Surge in number of cyber threats, such as data breaches, ransomware attacks, and phishing, increases the need for strong crisis management in the BFSI sector. As banks, insurance companies, and financial institutions move to digital platforms and store sensitive data online, they face higher risks of cyberattacks. These threats lead to financial losses, damage customer trust, and disrupt business operations. To protect themselves, BFSI firms are strengthening their security measures by using tools such as firewalls, encryption, and threat detection systems. In addition, with more employees working remotely and using cloud-based systems, the incidence of cyber threats has increased. This has created a high demand for crisis management solutions that offer real-time monitoring, rapid threat detection, and quick response plans to prevent major security incidents. As a result, the BFSI Crisis Management Market Forecast points to strong growth in the coming years, as financial institutions prioritize operational security. However, data theft & cyber security concerns and complex management of networks are some of the factors that limit market growth.

Segement Review

The BFSI crisis management market is segmented into component, application, enterprise size, end-user, and region. By component, the market is bifurcated into solution and service. By application, it is classified into disaster recovery & business continuity, risk & compliance management, crisis communication, incident management & response, and others. By enterprise size, it is segregated into large enterprises and small & medium enterprises (SMEs). By end user, the market is categorized into banks & financial institutions and insurance companies. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the global BFSI crisis management market was dominated by the solution segment in 2023 and is expected to maintain its dominance in the upcoming years owing to an increase in the adoption of advanced risk management solutions. A surge in the need for real-time monitoring, incident response, and regulatory compliance is further driving demand for the BFSI crisis management market size. In addition, financial institutions are investing in AI-driven and cloud-based crisis management platforms to enhance the resilience of their operations and risk management capabilities. However, the service segment is expected to register the highest CAGR during the forecast period. This is attributed to the rise in demand for consulting, training, and managed services to help financial institutions strengthen crisis preparedness and response strategies.

Region-wise, North America dominated the BFSI crisis management market share in 2023. This was attributed to the strong presence of major financial institutions, stringent regulatory frameworks, and high adoption of advanced risk management solutions. In addition, the region's focus on cybersecurity, AI-driven crisis response, and business continuity planning further contributed to its market leadership. However, Asia-Pacific is expected to exhibit the highest CAGR during the forecast period. This is attributed to the rapid digital transformation of the BFSI sector, increase in regulatory requirements, and surge in cybersecurity concerns. Factors such as rise in adoption of cloud-based crisis management solutions and AI-driven risk assessment tools further drive market growth. In addition, the expansion of financial services in emerging economies, such as India and China, boosts demand for crisis management solutions.

Competition Analysis

The report analyzes the profiles of key players operating in the cybersecurity market such as 4C Strategies, Everbridge, IBM Corporation, METRICSTREAM INC., NCC Group, SAS Institute Inc, Cura Software Solutions. Ltd, Konexus, Noggin, LogicGate Inc, Aon plc, Riskonnect., LogicManager, Inc., RockDove Solutions, Inc., INTELLICON, Resolver Inc, F24, Ascent, Guidehouse, and Vested LLC. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the BFSI crisis management market globally.

Recent Key Developments in BFSI Crisis Management Market

In November 2024, Guidehouse opened a new office in San Antonio, Texas, to expand its presence in key industries such as financial services, national security, and cybersecurity. This move strengthens its ability to serve clients in risk management, technology, and consulting while leveraging San Antonio’s growing industry hub.

In November 2024, Riskonnect partnered with Everbridge to enhance business continuity and critical event management. This collaboration enables organizations to respond more swiftly to crises by integrating business continuity program management with emergency communications within a single platform, benefiting financial institutions in managing critical events effectively.

Top Impacting Factors

Driver

Increasing Regulatory Compliance

The BFSI crisis management market growth is driven by an increase in the need for financial institutions to comply with regulatory requirements. Governments worldwide implement stricter regulations to protect consumers and ensure the stability of the financial system. This has led to a surge in demand for crisis management solutions that help financial institutions identify, assess, and respond to risks. The regulatory landscape for financial institutions is constantly evolving. In recent years, there have been a number of high-profile cases of financial institutions failing to comply with regulations, which has led to significant fines and reputational damage. This has made financial institutions more aware of the importance of compliance and has driven demand for crisis management solutions that help them meet their regulatory obligations. Increase in regulatory compliance requirements is driven by the surge in complexity of the financial system. Financial institutions are now operating in a more interconnected and globalized environment, which makes them more vulnerable to a wider range of risks. This has led to a need for crisis management solutions that help financial institutions identify and manage risks across a variety of jurisdictions. Overall, an increase in regulatory compliance requirements drives the growth of the BFSI crisis management market. The BFSI crisis management market outlook reflects a rising demand for real-time monitoring and rapid response solutions. Financial institutions are increasingly recognizing the importance of compliance and are investing in crisis management solutions to help them meet their regulatory obligations.

Restraints

Compliance with Different Regulations

Compliance with different regulations across regions hampers the growth of the BFSI crisis management industry. Financial institutions must follow strict rules set by governments and regulatory bodies to ensure security, transparency, and customer protection. However, these rules vary from country to country, making it difficult for banks, insurance companies, and other financial firms to create a single financial crisis management strategy. They need to invest time, money, and resources to meet different legal requirements, which increases costs and delays decision-making. Frequent changes in regulations make it hard for companies to keep up, forcing them to constantly update their crisis management plans. Failure to comply with these rules leads to heavy fines and reputational damage, adding more pressure on BFSI organizations. As a result, many companies hesitate to invest in advanced crisis management solutions, which hampers overall market growth.

Opportunity

Improved Customer Experience

Crisis management provides solutions that improve customer experience in terms of automated fraud detection, a fast payment system, and increased accessibility to financing solutions. In addition, BFSI risk management is a relatively new industry and is growing at a notable rate due to the innovative solutions it provides to financial institutions and banks. Moreover, the automated solution of crisis management offers faster service, which saves the time & effort of financial institutions and enhances user experience. Hence, improvement in the overall customer experience is expected to offer potential growth opportunities for the expansion of the global BFSI crisis management industry in the upcoming years. Furthermore, strategic partnerships between companies create new opportunities in BFSI crisis management by combining expertise, expanding service offerings, and enhancing crisis response capabilities. For instances, in March 2024, FIS partnered with Stratyfy to upgrade its SecurLOCK™ card fraud management solution. This collaboration aims to increase the accuracy of detecting and preventing fraudulent transactions while reducing false positives, thereby offering a more seamless payment experience for clients and their customers. This partnership directly aligns with the BFSI crisis management market opportunity by enhancing fraud detection capabilities, a crucial aspect of crisis prevention and response.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the BFSI crisis management market analysis from 2023 to 2033 to identify the prevailing BFSI crisis management market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the BFSI crisis management market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global BFSI crisis management market trends, key players, market segments, application areas, and market growth strategies.

BFSI Crisis Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 72.3 billion |

| Growth Rate | CAGR of 16.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 414 |

| By Component |

|

| By Application |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | LogicGate Inc, NCC Group, Resolver Inc., RockDove Solutions, Inc., IBM Corporation, Konexus, Everbridge, SAS Institute Inc, F24, METRICSTREAM INC., Cura Software Solutions, Ascent, Guidehouse, LogicManager, Inc., Noggin, Riskonnect, Vested LLC, INTELLICON, Aon Plc, 4C Strategies |

Analyst Review

As the BFSI industry continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. The BFSI crisis management market experienced significant growth driven by the need for disaster recovery and business continuity planning. Banks and financial firms must be prepared for unexpected events such as pandemics, power outages, and natural disasters, which disrupt operations and impact customers. Having strong crisis management strategies ensures that financial services continue without major interruptions. Institutions invest in backup systems, risk assessment tools, and emergency response plans to minimize losses and maintain stability. The surge in focus on preparedness fuels the demand for crisis management solutions in the BFSI sector.

Moreover, global financial instability, market fluctuations, and recession risks drive the growth of the BFSI crisis management market. Economic downturns lead to reduced investments, loan defaults, and financial losses, making it crucial for banks and financial institutions to protect their assets and operations. BFSI firms respond effectively to economic challenges, minimize risks, and ensure business continuity by implementing crisis management strategies. In addition, increase in investment in risk assessment tools, financial monitoring systems, and contingency plans to stay prepared further boosts the demand for crisis management solutions in the BFSI sector.

Furthermore, financial institutions rely more on third-party vendors for cloud services, payment processing, and cybersecurity, increasing the risk of external threats. Failures or security breaches in these services disrupt operations and cause financial losses. To prevent such risks, BFSI firms are strengthening crisis management strategies, driving the growth of the BFSI crisis management market. However, challenges remain in the BFSI crisis management market, particularly in ensuring data security, complying with evolving regulations and managing high implementation costs. Financial institutions face difficulties in integrating crisis management solutions with their existing legacy systems. Despite these challenges, the market is expected to grow as banks and financial firms increasingly adopt cloud-based solutions, AI-driven risk management, and managed security services to enhance crisis preparedness and operational efficiency.

The upcoming trends of the BFSI Crisis Management Market include the growing use of AI and machine learning for predictive threat detection and real-time response. In addition, cloud-based crisis management solutions are gaining traction for their scalability and faster recovery capabilities.

Risk and Compliance Management is the leading application of the BFSI Crisis Management Market.

North America is the largest regional market for the BFSI Crisis Management Market.

$72.3 billion is the estimated industry size of the BFSI Crisis Management Market in 2033.

4C Strategies, Everbridge, IBM Corporation, METRICSTREAM INC., NCC Group, SAS Institute Inc, Cura Software Solutions. Ltd, Konexus, Noggin, LogicGate Inc, Aon plc, Riskonnect., LogicManager, Inc., RockDove Solutions, Inc., INTELLICON, Resolver Inc, F24, Ascent, Guidehouse, and Vested LLC are the top companies to hold the market share in the BFSI Crisis Management Market.

Loading Table Of Content...

Loading Research Methodology...