The global bike rental market was valued at $2.1 billion in 2021, and is projected to reach $11.3 billion by 2031, growing at a CAGR of 18.5% from 2022 to 2031.

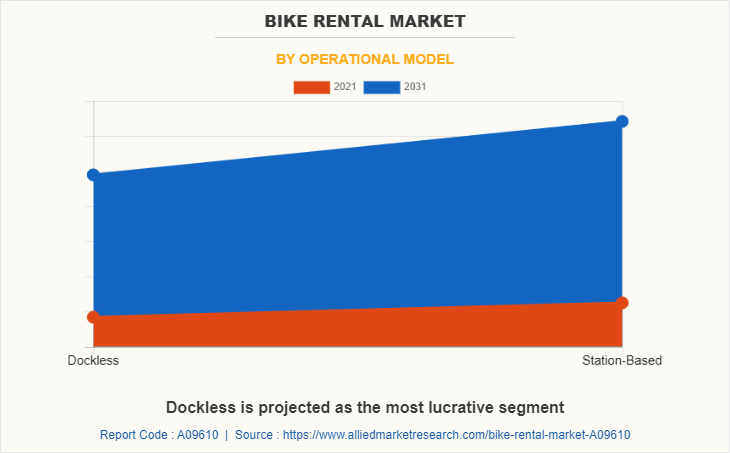

A bike rental or bike hire service is a transport service that offers convectional bikes or electric bikes for rent for an individual on a short-term basis for a price or free. Using rented bikes is an easy and convenient way to own a bike without paying maintenance costs. Users can pick up bikes around the city from multiple docked or dock-less stations and return them at another same system. Docks are special bike racks that lock the bike and only release it by computer control; while dock-less bike share does not require a docking station, bikes can be parked within a defined bike rack or along the sidewalk.

Currently, most of the players in this industry are using mobile applications that provide seamless service. For instance, in urban areas, the new app-based startups are strengthening their presence by giving app-based dockless bike rental/sharing services to working professionals and students for commuting needs. In 2020, Bolt Technology OÜ launched an electric bike-sharing service in Paris for daily commuters. The bike-sharing service platform “Bolt app” can access these electric bikes and be used like other free-floating vehicles. It can be unlocked by scanning a specific QR code. Hence, renting a bike has become easy and convenient after digitalization.

The factors such as rise in venture capital and strategic investments, increasing inclusion e-bikes in the rental fleet, and rise in demand for short-term rental services supplement the growth of the bike rental market. However, high initial investment cost and rise in bike vandalism & theft are the factors expected to hamper the growth of the market. In addition, technological advancement in bike rental system and increasing government initiatives for the development of rental-bike infrastructure creates market opportunities for the key players operating in the bike rental market.

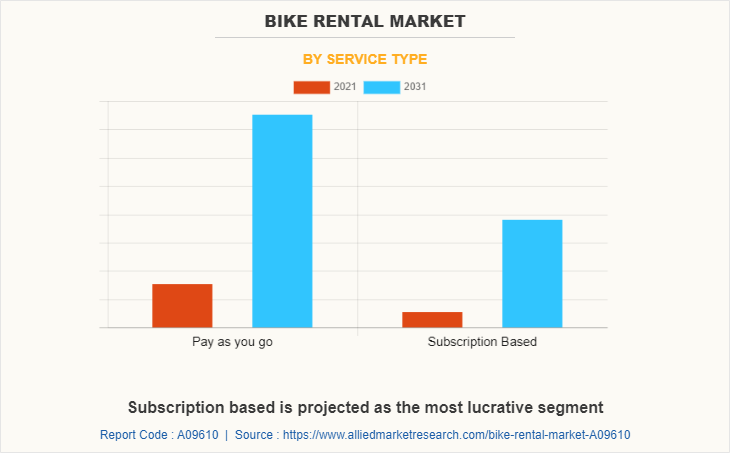

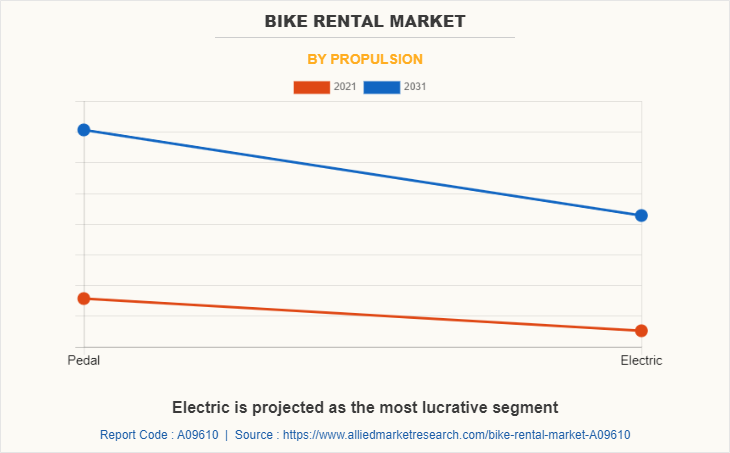

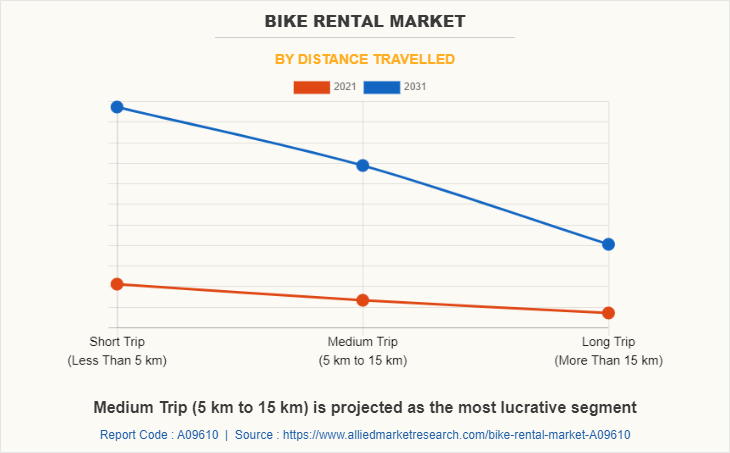

The bike rental market is segmented into service type, propulsion, operational model, distance travelled and region. By service type, the market is divided into pay as you go and subscription based. By propulsion, it is fragmented into pedal and electric. By operational model, it is categorized into dockless and station based. By distance travelled, it is further classified into short trip (less than 5 km), medium trip (5 km to 15 km), and long trip (more than 15 km). By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the bike rental market are Bird Rides, Inc., Bolt Technology OÜ, Bounce, Cityscoot, Cooltra, Drivezy, Inc., Lime, Lyft, Inc., Nextbike GmbH, ONN Bikes, SG Bike Pte Ltd, Spin, Tembici, Uber Technologies Inc., Vogo Automotive Pvt. Ltd., VOI Technology, and Yulu Bikes Pvt Ltd.

Rise in venture capital and strategic investments

The significant rise in the preference for carpool and bike pool services among regular office commuters is the primary factor contributing to the growth of bike rental services. In addition, the increase in the services offered by the leading market players, including Uber and Ola, and the option to choose convenient pick-up and drop locations encourage consumers to opt for ride-hailing and ride-sharing services. Moreover, the significant rise in the number of multiple ride-hailing and ride-sharing services such as bike sharing and auto sharing services, even for short-distance travel, fuels the growth of the bike rental market. Also, several service providers offer various facilities, offers, and discounts such as monthly passes on rental bikes to reduce the expenses of daily commuters. For instance, in February 2022, Lime partnered with Revolut, a British financial services company, to offer up to 70% cashback on rides of Lime electric vehicles when users pay with Revolut. This encouraged the residents in the Australian region to make the shift towards sustainable mobility solutions offered by Lime. This will propel the demand for bike rental services during the forecast period.

Increasing inclusion e-bikes in the rental fleet

The demand for e-bikes is increasing globally owing to their fast & flexible operations and zero carbon emissions. In addition, the rising consumer inclination toward using e-bikes as cost-effective & eco-friendly transport solutions is adding advantage to bike rental business expansion. Moreover, an e-bike is a preferred option, as it better fulfils the requirement for higher speed in short-distance commuting compared to a pedal-operated bike. Features such as higher speed, more convenience, effortless driving, and variable motor power per road conditions make e-bikes more preferred for sharing purposes. Furthermore, governments worldwide are taking various initiatives to promote the usage of e-bikes. For instance, most governments worldwide look forward to converting fuel vehicles into electric vehicles to tackle environmental issues. Also, several bike-sharing providers have started focusing on expanding their fleet of e-bikes to sustain the growing competition in the bike rental market. For instance, in June 2021, SG Bike Pte Ltd announced the launch of the S-100T 1st edition as its new flagship electric scooter. It featured a 500w motor and was a custom-designed built developed by Spin’s in-house team, allowing it to perform in adverse environmental conditions. Thus, the increasing adoption of e-bikes in bike rental services propels the market growth.

High initial investment cost

In order to grab more bike rental market share in the initial stage of market entry, each brand tends to put large numbers of rental bikes into cities. In addition, significant amounts of subsidies, such as free rides, cashback, and lottery entries, are given to customers as incentives to gain competitive edge. Moreover, the large amount of capital investment is required to setup the related infrastructure such as parking zones for free-floating bikes, docked bike stations network, recharging docks for e-bikes and others. For instance, electric bikes require battery charging or swapping facilities at bicycle docks. Therefore, the high initial investment cost to setup the bike rental services anticipated to hamper the market growth.

Technological advancement in bike rental system

Service providers are making large investments in technological innovations such as artificial intelligence (AI) and internet of thing (IoT) to offer reliable performance to commuters. In addition, integration of GPS technology, consumer-ready mobile payments and reducing the investment cost of locking & tracking systems for bikes have led to the introduction of dock-less bike rental system. Moreover, the integration of advanced technologies such as IoT and GPS trackers on bikes aid service providers to locate them in any region, eliminating the chances of theft incidents. For instance, in December 2020, Spin partnered with Drover AI, provider of AI-Powered IoT Solutions for Micro mobility fleets to Incorporate its pathpilot technology into the next generation of its e-scooter monitoring platform. Further, the platform is expected to be deployed in cities of the U.S., UK, and in other regions around the world in 2021. Furthermore, development of user-friendly smartphone applications also increases usability to the operator and customers. Thus, the technological advancement in bike rental system offering the future growth opportunities for the bike rental market.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global bike rental market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall bike rental market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global bike rental market with a detailed impact analysis.

- The current bike rental market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Bike Rental Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Propulsion |

|

| By Operational Model |

|

| By Distance Travelled |

|

| By Region |

|

| Key Market Players | Bounce, SG Bike Pte Ltd, ONN Bikes, Cityscoot, Bird Global Inc, Cooltra, Vogo Automotive Pvt. Ltd., Bolt, VOI Technology, Yulu Bikes Pvt Ltd, Tembici, Nextbike GmbH, Uber Technologies Inc., Drivezy, Inc., Lyft, Inc., Lime, Spin |

Analyst Review

This section provides the opinions of various top-level CXOs in the global bike rental market. According to Quan Jing, executive president of Cheetah Lab, a mobile big data analysis platform, several countries worldwide are beginning to emerge as high potential markets for bike rental consumption. Hence, based on the interviews of various top-level CXOs of leading companies, rapid digitalization and high cost associated with owning & maintenance of two-wheelers have been some of the factors that are expected to fuel the demand for bike rental market during the forecast period.

Furthermore, various governments worldwide are offering subsidies to service providers for developing stations and expanding their reach to several commuters. The government is also setting up the bike charging infrastructure, dedicated bike lanes, and parking zone. For instance, in June 2020, Pittsburgh unveiled a 10-year plan to significantly expand bike infrastructure in the city by more than 120 miles of new trails, bicycle lanes, and other street improvements. Therefore, increasing government initiatives for developing reliable rental-bike infrastructure and the proliferation of smart cities across the globe are anticipated to offer lucrative growth opportunities for the bike rental market.

The market growth is supplemented by factors such as rise in venture capital and strategic investments, increasing inclusion e-bikes in the rental fleet, and rise in demand for short-term rental services supplement the growth of the bike rental market. However, high initial investment cost and rise in bike vandalism & theft are the factors expected to hamper the growth of the bike rental market. In addition, technological advancement in bike rental system and increasing government initiatives for the development of rental-bike infrastructure creates market opportunities for the key players operating in the bike rental market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to growing awareness among peoples for environmental concerns and the emergence of new players entering the market with innovative propositions like dock-less bikes.

Introduction of subscription based bike rental services are the upcoming trends of Bike Rental Market in the world

Introduction of bike rentals in Long Trip (More Than 15 Km) is the leading application of Bike Rental Market

Asia-Pacific is the largest regional market for Bike Rental

The global bike rental market was valued at $2.07 billion in 2021, and is projected to reach $11.32 billion by 2031, registering a CAGR of 18.5% from 2022 to 2031

The leading players operating in the bike rental market are Bird Rides, Inc., Bolt Technology OÜ, Bounce, Cityscoot, Cooltra, Drivezy, Inc., Lime, Lyft, Inc., Nextbike GmbH, ONN Bikes, SG Bike Pte Ltd, Spin, Tembici, Uber Technologies Inc., Vogo Automotive Pvt. Ltd., VOI Technology, and Yulu Bikes Pvt Ltd.

Loading Table Of Content...