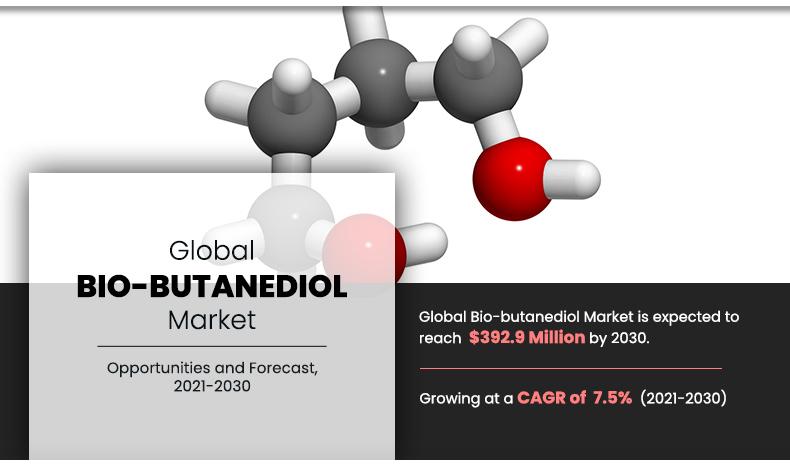

Bio-Butanediol Market Statistics - 2030

The global bio-butanediol market was valued at $190.6 million in 2020, and is projected to reach $392.9 million by 2030, growing at a CAGR of 7.5% from 2021 to 2030.

The bio-butanediol (bio-BDO) is an organic compound that is commonly used as a solvent in industrial cleaners in the production of various useful polymers. Bio-butanediol, also known to be a drop-in of butanediol, is used as a key chemical building block for the manufacturing of several products, including elastic fibers, polybutylene terephthalate (PBT), and polyurethanes. It serves as an alternative to its fossil-based counterpart.

The production of bio-butanediol has gained momentum in recent years. It is majorly produced by the fermentation of sugars through experimental and metabolically engineered E.coli bacteria. This is an evolving technology that is expected to have great yield, with a lower risk of market disintegration and competition. Moreover, the availability of abundant feedstock is an added advantage in the production of bio-butanediol. The cost of producing bio-butanediol is lower than the production of fossil-based butanediol. The lower the crude oil prices, the less competitive bio-butanediol becomes. Continuous improvements in production capacities and processes will further reduce the costs of bio-butanediol. Furthermore, rise in content of bio-based plastics in shopping bags and other packaging products is expected to drive the demand for bio-butanediol in the next couple of years. Various companies across the world are currently developing and up-scaling bio-butanediol production through single-step fermentation of vegetal biomass, owing to the fact that it requires less energy and results in low carbon emissions as compared to its petroleum-based counterparts. These factors collectively are propelling the demand for bio-butanediol, thereby propelling the market growth.

However, bio-butanediol is expected to face tough competition from its fossil-based butanediol until a commercial production process for the production of bio-butanediol will be streamlined. Moreover, various end-user applications still prefer fossil-based butanediol, owing to the lack of reliability concerns associated with the properties of bio BDO. These factors are expected to hamper the demand for bio BDO during the forecast period.

During the last few decades, global policies have been oriented toward a sustainable future aiming toward reduced dependency on fossil fuels and associated environmental impacts and to generate renewable and sustainable products. The bio-based industry has been recognized by the European Union (EU) as a priority area that focused on sustainability. In addition, manufacturers are presently addressing the issue and inclining toward the production of bio-based production. These factors are expected to offer remunerative opportunities for the global bio-butanediol market. Manufacturers such as Novamont, BASF, and Genomatica have developed bio-butanediol. Commercial production is increasing, and is expected to grow further during the next couple of years.

The global bio-butanediol market analysis is done based on source, application, end use, and region. Depending on source, the market is divided into sugar and biomass. On the basis of application, it is fragmented into polytetramethylene ether glycol, thermoplastic polyurethane, polybutylene terephthalate, tetrahydrofuran, n-methyl-2-pyrrolidone, others. By end use, the market is divided into automotive, packaging, textile, aviation, consumer goods, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include Novamount S.p.A, BASF SE, Genomatica Inc., Qira, Yuanli Chemical Group Co. Ltd., Biokemik. It also includes raw materials suppliers such as Shandong Landian Biological Technology Co. Ltd., Roquette Frères, J. Rettenmaier & Söhne GmbH + Co KG., and Cargill Incorporated.

Bio-butanediol market, by region

The Asia-Pacific bio-butanediol market size is projected to grow at the highest CAGR of 8.2% during the forecast period and accounted for 45.4% of bio-butanediol market share in 2020. Bio-butanediol is majorly used in the production of polybutylene terephthalate (PBT), a major bioplastic, which is witnessing increased demand in the industries such as automotive, plastics, and consumer goods. Moreover, rise in automotive production in countries, including India, China, Malaysia, and Thailand is driving the demand for bio-butanediol. In automotive and other industries, PBT is highly used for energy absorption, shock absorption for bumpers, weight reduction, and reduced explosion risk in fuel tanks.

By Region

Asia Pacific is the most lucrative region

Bio-butanediol market, by source

In 2020, the sugar-based bio-butanediol segment was the largest revenue generator, and is anticipated to grow at a CAGR of 7.6% during the forecast period. It is attributed to the fact that a sustainable and environment-friendly bioprocess has been developed for the production of bio-butanediol from carbohydrate feedstocks.

By Source

Sugar segment is the most lucrative in the market

Bio-butanediol market, by application

By application, the polytetramethylene ether glycol (PTMEG) held the largest share in the global market in 2020, and is anticipated to grow at a CAGR of 7.7% during forecast period. This is attributed to the fact that PTMEG is highly used in the production of spandex and other textiles. It is majorly used in wide variety of bioplastics, but is expected to be used more in automotive and textile industries in the future. One of the major factors of rising demand for bio-butanediol is that it reduces greenhouse emissions by nearly 60% compared to that of fossil-based butanediol.

By Application

Polytetramethylene Ether Glycol application is the most lucrative segment

Bio-butanediol market, by end-use

In 2020, the automotive segment garnered the largest market share, and is anticipated to grow at a CAGR of 7.7% during the forecast period. This is attributed to the fact that bio-butanediol is used in the production of PBT, which offers enhanced thermal stability, high strength, and high durability. These properties make it a suitable choice in the automotive industry for the production of fenders, bumpers, front & rear end fascia, and spoilers. The major factor why the demand for PBT is rising in the automotive sector is its high performance, competitive pricing, enhanced strength, and superior reliability.

By End-use

Textile end-use is the fastest growing segment

Key benefits for stakeholders

- The report outlines the current trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- The major countries have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Bio Butanediol

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe.

- The bio-butanediol market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on the automotive, textile, and other industrial sectors.

- The Organization for Economic Co-operation and Development (OECD) reported that due to this epidemic, the global GDP growth would dwindle to 2.4% from 2.9% in 2020 and it has impacted the global supply chain. In addition, more than 100 countries have locked their international borders for transportation and nonessential trade activities, which, in turn, have led to demand–supply disruptions for bio-butanediol market.

- Furthermore, the temporary shutdown of textiles and automotive industries amid the COVID-19 period has reduced the consumption of bio-butanediols. Several companies have either shut down or shrank their operations due to the risk of infection among the workforce. This has temporarily hampered the demand and supply gap of the bio-butanediol. In addition, the declining income of customers has led to the contraction of the demand for consumer products amid the COVID-19 period.

- In addition, factors such as financial stress, reduction of demand, and disruptions of the power supply chain have negatively impacted the chemical sector, which, in turn, has decreased the demand for bio-butanediol amid the COVID-19 scenario.

- However, several key players such as Novamont, BASF, DuPont, and Mitsubishi Chemical Corporation are constantly engaged in increasing their production and seeking for new investment opportunities amid the COVID-19 situation. For instance, BASF has been producing commercial production of bio-butanediol and has secured rights to produce bio-butanediol up to 75,000 tons per annum. Moreover, in June 2021, Cargill and HELM established a joint venture, Qore, for the production of bio-based products. As a part of the agreement, both companies have invested approximately $300 million to build the commercial-scale production facility of bio-butanediol in the U.S. to provide automotive, packaging, apparel, and electronics industries the ability to improve their environmental footprint and to produce robust product without sacrificing the quality.

Key market segments

By Source

- Sugar

- Biomass

By Application

- Polytetramethylene Ether Glycol

- Thermoplastic Polyurethane

- Polybutylene Terephthalate

- Tetrahydrofuran

- N-Methyl-2-pyrrolidone

- Others

By End Use

- Automotive

- Packaging

- Textile

- Aviation

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Key players in the global bio-butanediol market are:

- Manufacturers:

- Novamont spA

- BASF SE

- Genomatica, Inc.

- Qira

- Yuanli Chemical Group Co. Ltd.

- Biokemik

Key players in the global bio-butanediol market are:

- Raw Material Suppliers:

- Roquette Frères

- Shandong Landian Biological Technology Co. Ltd.

- J. Rettenmaier & Söhne GmbH + Co KG

- Cargill Incorporated

Bio-butanediol Market, by Source Report Highlights

| Aspects | Details |

| By Source |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | J. Rettenmaier & Söhne GmbH + Co KG., Qira, Yuanli Chemical Group Co., Ltd, Novamont s.p.A, BASF SE, Cargill Incorporated, Biokemik, Genomatica, Inc., Shandong Landian Biological Technology Co. Ltd., Roquette Frères |

Analyst Review

The global bio-butanediol market is expected to exhibit high growth potential, owing to its use in the production of polytetramethylene ether glycol, thermoplastic polyurethane, and polybutylene terephthalate. Bio-butanediol is expected to face tough competition from its fossil-based butanediol. However, lower cost and optimum properties of bio-butanediol compared to fossil-based butanediol helped the market to gain high traction during the forecast period. Moreover, the availability of abundant feedstock and biomass is an added benefit for the production of bio-butanediol. It is further expected that in few years bio-butanediol can completely replace fossil-based butanediol, owing to rise in concerns over sustainability and surge in adoption of eco-friendly products.

In addition, bio-butanediol is used in the production of polybutylene terephthalate (PBT). Owing to the development of lightweight vehicles across the world, the adoption of PBT has increased drastically in the production of fenders, bumpers, front & rear end fascia, and spoilers. Moreover, in the automotive and transportation sectors, PBT offers weight reduction, energy absorption, shock absorption, and it reduces the risk of explosion in fuel tanks. The presence of big players in the bio-butanediol market creates immense opportunity for the development in the production process of products. Healthy competition in the market further leads to the quality product to end users. These factors are expected to drive the global bio-butanediol market during the forecast period.

Increasing adoption of lightweight materials in automotive sector and Rapid shift towards eco-friendly products are the key factors boosting the Bio-BDO (Butanediol) market growth.

The global bio-butanediol market was valued at $190.6 million in 2020, and is projected to reach $392.9 million by 2030, growing at a CAGR of 7.5% from 2021 to 2030.

The major companies profiled in this report include Novamont S.p.A, BASF SE, Genomatica Inc., Qira, Yuanli Chemical Group Co. Ltd., Biokemik. It also includes raw materials suppliers such as Shandong Landian Biological Technology Co. Ltd., Roquette Frères, J. Rettenmaier & Söhne GmbH + Co KG., and Cargill Incorporated.

Automotive industry is projected to increase the demand for Bio-BDO (Butanediol) Market.

The global bio-butanediol market analysis is done based on source, application, end use, and region. Depending on source, the market is divided into sugar and biomass. On the basis of application, it is fragmented into polytetramethylene ether glycol, thermoplastic polyurethane, polybutylene terephthalate, tetrahydrofuran, n-methyl-2-pyrrolidone, others. By end use, the market is divided into automotive, packaging, textile, aviation, consumer goods, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The production of bio-butanediol has gained momentum in recent years. The availability of abundant feedstock is an added advantage in the production of bio-butanediol. Moreover, the cost of producing bio-butanediol is lower than the production of fossil-based butanediol. This factors are expected to drive the market.

Textile and packaging end-use industry are expected to drive the adoption of Bio-BDO (Butanediol).

The bio-butanediol market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on the automotive, textile, and other industrial sectors.

Loading Table Of Content...