Bio-coatings Market Research, 2033

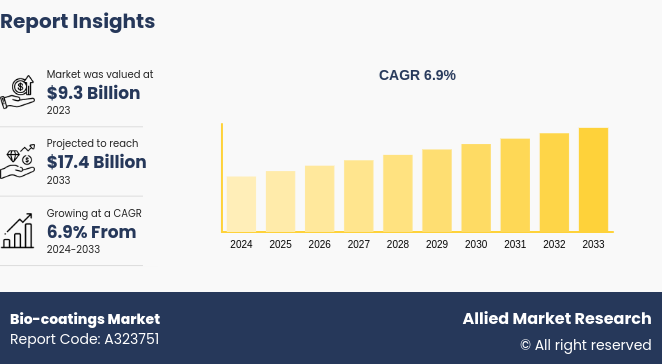

The global bio-coatings market was valued at $9.3 billion in 2023, and is projected to reach $17.4 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Market Introduction and Definition

The bio-coatings market refers to the industry segment focused on the development, production, and distribution of coatings derived from renewable and sustainable sources, such as plant oils, natural resins, and other bio-based materials. Bio-coatings serve as environmentally friendly alternatives to traditional chemical-based coatings, offering comparable performance while minimizing environmental impact.

Key Takeaways

- The bio-coatings market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- Analyzing the competitive landscape, including major players, market share, and strategies, which may help businesses to understand the position relative to competitors and identify areas for differentiation or improvement.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The global bio-coatings market is experiencing growth driven by various factors, including the increasing emphasis on sustainable and eco-friendly products worldwide. As industries strive to reduce their environmental footprint and meet regulatory standards, bio-coatings have emerged as crucial solutions in diverse sectors such as construction, automotive, and packaging.

The increase in demand for sustainable packaging solutions is a significant driver of growth in the bio-coatings market. As consumers and businesses become more environmentally conscious, there is a growing emphasis on reducing the environmental impact of packaging materials. This shift towards sustainability has led to a surge in demand for bio-coatings, which offer eco-friendly alternatives to conventional chemical-based coatings. In addition, bio-coatings offer excellent barrier properties, moisture resistance, and printability, making them suitable for a wide range of packaging applications. For instance, according to a report by the Confederation of Indian Industry (CII) , the market for biodegradable plastics packaging in India is expected to grow at a CAGR of over 15% between 2020 and 2025. Whether used in food packaging, consumer goods packaging, or industrial packaging, bio-coatings provide durable and functional finishes while meeting stringent regulatory standards for food safety and environmental sustainability. All these factors drive the demand for the bio-coatings market during the forecast period.

However, the higher initial costs compared to conventional coatings represent a significant obstacle to the widespread adoption and growth of the bio-coatings market. While bio-coatings offer numerous environmental benefits and long-term savings, their upfront expenses deter potential customers, especially those operating within budget constraints or facing tight profit margins. In addition, the limited availability of raw materials for bio-coatings can contribute to higher prices. While synthetic chemicals used in conventional coatings are mass-produced and readily accessible, bio-based materials are subject to fluctuations in supply and demand, leading to price volatility. All these factors hamper the growth of the bio-coatings market.

Innovation in renewable raw materials presents significant opportunities for the bio-coatings market. As industries increasingly prioritize sustainability and seek alternatives to traditional petroleum-based coatings, the development of bio-coatings from renewable resources is gaining traction. In addition, the advancement of renewable raw materials offers opportunities for enhancing the performance and properties of bio-coatings. By leveraging the unique characteristics of renewable resources, such as their biodegradability, low toxicity, and abundance, manufacturers develop bio-coatings with improved durability, adhesion, and weather resistance. All these factors are anticipated to offer new growth opportunities for the bio-coatings market during the forecast period.

Market Segmentation

The bio-coatings market is segmented on the basis by resin, application, and region. By resin, the market is classified into alkyd, polyurethane, acrylic, and others. Based on application, the market is segmented into transportation, construction, woodworking, packaging, and other. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

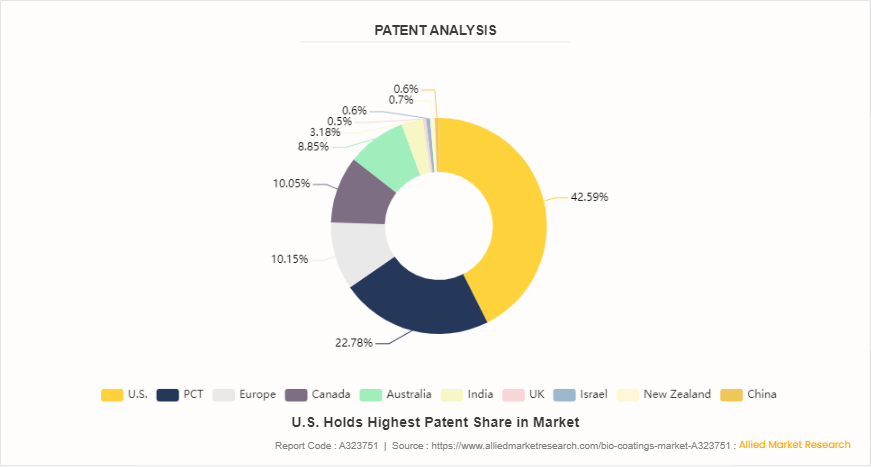

Patent Analysis of Global Bio-coatings Market

The U.S. leads with 42.8% of the total patents, indicating a significant focus on innovation and development within the country. This dominance is attributed to the presence of established research institutions, robust funding mechanisms, and a thriving ecosystem for biotechnology companies. Europe and Canada hold relatively similar shares at 10.2% and 10.1%, respectively, reflecting a moderate level of activity in patent filings within these regions. The presence of renowned research institutions, government support for research and development, and a focus on sustainability initiatives may contribute to the development of bio-coatings in these areas. The recently filed patent is related to the bio-based coating, bio-based coating composition and its coated article, photosetting type bio-based coating composition and its coated article, and biobased fertilizer coatings with nanoparticles.

Regional Market Outlook

In 2023, the collective production volume of bio-based polymers is projected to reach approximately 4.4 million tons, constituting roughly 1% of the production volume of fossil-based polymers. With a compound annual growth rate (CAGR) of 17%, significantly surpassing the overall growth rate of the polymer market (estimated at 2 to 3%) , this trend is anticipated to persist until 2028.

In 2023, Asia emerges as the leading continent in terms of installed production capacities for bio-based polymers, commanding a significant 55% share globally. It boasts the largest capacities for various polymers, including PLA and PA. North America follows with a 19% share, characterized by substantial installed capacities for PLA and PTT. South America holds a 13% share, primarily driven by PE production. However, Europe's share of global capacity for bio-based polymers has declined to just 13% compared to 2022. This decrease is primarily attributed to updated data reflecting the production of PE and PP in Europe, where only 10% of the total volume is bio-based.

The demand for bio-based coatings in the Asia-Pacific region was experiencing significant growth driven by several factors such as rapid industrialization and urbanization in the Asia-Pacific region are driving demand for coatings across various sectors, including construction, automotive, electronics, and packaging. Furthermore, government policies and regulations aimed at reducing emissions, promoting renewable resources, and improving environmental sustainability are creating a favorable environment for bio-based coatings. In countries such as China, Japan, South Korea, and India, are initiatives to incentivize the use of environmentally friendly products, which is boosts the demand for bio-based coatings in the region.

Competitive Landscape

The major players operating in the bio-coatings market include Akzo Nobel N.V., BASF SE, PPG Industries, Inc., RPM International Inc., Arkema SA, DuPont, Asian Paints Limited. Other players in the bio-coatings market include The Sherwin-Williams Company, Axalta Coating Systems Ltd., and Hempel A/S.

Recent Key Strategies and Developments

- In April 2024, Engineered Polymer Solutions (EPS) company introduces PC-Mull 815, designed for wood coatings applications. This bio-based acrylic copolymer is tailored for premium furniture and wood finishes, catering to high-performance requirements. Product is currently accessible in the EMEIA markets.

- In February 2024, PPG industries launched several new products for different applications. This development helped the company to increase the product portfolio and revenue.

- In September 2023, BASF will broaden its expanding collection of 14C bio-based monomers through an in-house process for manufacturing 2-Octyl Acrylate (2-OA) . This latest addition underscores BASF's steadfast dedication to innovation for a sustainable tomorrow, boasting a 73% bio-based content traceable to 14C according to ISO 16620.

Industry Trends

- In February, 2024, bio-based interior coating for KIA Motors created with rapeseed and pine rosin. KIA Motors is using bio-based paint supplied by AkzoNobel for the inside of its new EV9 electric SUV.

- In 2023, Regulations and policies aimed at reducing emissions and promoting eco-friendly practices are driving the adoption of bio coatings across various industries.

- In December 2022, BASF reached an agreement to divest its manufacturing site in Quincy, Florida and the associated attapulgite business related to coatings

- Growing consumer awareness of environmental issues and health concerns related to traditional coatings is influencing purchasing decisions. German consumers are increasingly seeking products with eco-friendly credentials, including bio-based coatings.

Key Sources Referred

- Coatings World

- American Coating Association

- European Coatings

- Advance polymer coatings

- ICA Group

- PCI magazine

- Biobased Coatings Europe

- Automotive Refinish Paint

- Marine Coatings

- Protective Coatings

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bio-coatings market analysis from 2024 to 2033 to identify the prevailing bio-coatings market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bio-coatings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bio-coatings market trends, key players, market segments, application areas, and market growth strategies.

Bio-coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 17.4 Billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 288 |

| By Resin Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Arkema SA, Axalta Coating Systems Ltd., The Sherwin-Williams Company, DuPont, Hempel A/S, PPG Industries, Inc., RPM International Inc., BASF SE, Akzo Nobel N.V., Asian Paints Limited. |

Loading Table Of Content...