Biocomposites Market Research, 2033

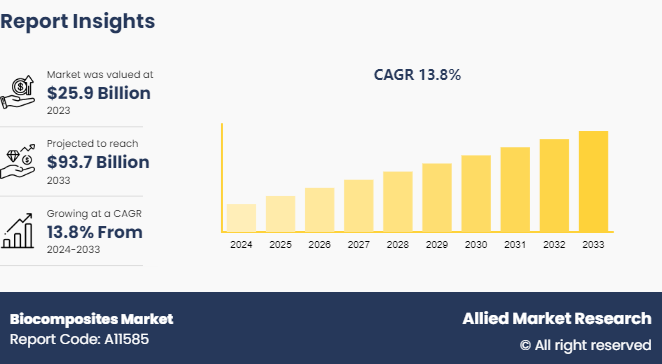

The global biocomposites market was valued at $25.9 billion in 2023, and is projected to reach $93.7 billion by 2033, growing at a CAGR of 13.8% from 2024 to 2033.

Market Introduction and Definition

Biocomposites are materials formed by combining natural fibers, such as flax, hemp, or wood, with a biopolymer matrix, often derived from renewable resources like starch or polylactic acid (PLA) . They offer a sustainable alternative to traditional composites, reducing reliance on fossil fuels and minimizing environmental impact. Biocomposites exhibit several key properties, including high strength-to-weight ratio, biodegradability, low density, and good thermal and acoustic insulation. These materials find applications in various industries, including automotive, construction, packaging, and aerospace, due to their versatility and eco-friendly nature.

In addition, biocomposites can be tailored to specific requirements by adjusting fiber content, orientation, and matrix composition, offering designers flexibility in achieving desired performance characteristics while meeting sustainability goals. With ongoing research and development, biocomposites continue to gain traction as a promising solution for addressing environmental concerns and advancing toward a more sustainable future.

Key Takeaways

- The biocomposites market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major biocomposites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in demand for bio-based polymers is expected to significantly drive the growth of the biocomposites market. Bio-based polymers, derived from renewable resources such as plants, sugars, or starches, are gaining popularity due to their reduced environmental footprint compared to conventional petroleum-based polymers. There is a growing emphasis on utilizing renewable materials in manufacturing processes as industries strive to meet sustainability goals and reduce carbon emissions. The U.S. Department of Energy (DOE) declared in January 2022 that it will invest $13.4 million in next-generation plastic materials technology to reduce the energy consumption and carbon emissions associated with single-use plastics. Moreover, by 2030, the Japanese government wants to replace 25% of plastic with renewable resources. The European automobile industry uses 80, 000 tons of fiber per year to reinforce composite items instead of using substitute synthetic fibers, according to the European Commission. Using recyclable and biodegradable materials for interior automotive components is another priority for the European Union. These laws are expected to drive the demand for biopolymers and other end-use manufacturers.

Biocomposites, which combine these bio-based polymers with natural fibers, offer an eco-friendly alternative to traditional composite materials. They not only reduce dependency on finite fossil resources but also contribute to lowering greenhouse gas emissions throughout their lifecycle. The demand for biocomposites is expected to increase with industries across sectors such as automotive, construction, and consumer goods increasingly adopting sustainable practices. Moreover, advancements in biopolymer technology and manufacturing processes are likely to further enhance the performance and cost-effectiveness of biocomposites, driving their market growth in the coming years.

High production costs are a significant barrier to the growth of the biocomposites market. The manufacturing process for biocomposites involves the use of natural fibers and biopolymers, which are often expensive when compared to conventional materials. The extraction, processing, and treatment of natural fibers require specialized equipment and technology, driving the production costs. In addition, biopolymers, especially those derived from renewable resources, tend to be costlier than traditional petroleum-based polymers. This price disparity makes biocomposites less competitive, particularly in cost-sensitive markets. Furthermore, the lack of large-scale production facilities and economies of scale contribute to the higher costs. As a result, industries may hesitate to adopt biocomposites, despite their environmental benefits, due to financial implications. To overcome this restraint, advancements in production technologies, increased investment, and government incentives are necessary to reduce costs and make biocomposites economically viable, promoting their widespread adoption.

The surge in demand for sustainable packaging solutions presents a lucrative opportunity for the biocomposites market. Biocomposites stand out due to their biodegradable nature and reduced environmental footprint as consumers and industries increasingly prioritize eco-friendly products. These materials, which combine natural fibers with biopolymer matrices, are ideal for packaging applications, offering high strength, lightweight properties, and the ability to decompose naturally. This aligns with global efforts to reduce plastic waste and enhance recyclability. Innovations in biocomposites are expanding their applicability in packaging, providing alternatives to conventional plastics used in food containers, bottles, and wrapping materials. Companies adopting biocomposites packaging can also enhance their brand image and appeal to environmentally conscious consumers. Consequently, the focus towards sustainability is driving significant investment and research in biocomposites, positioning them as a key player in the future of the packaging industry and contributing to the broader goal of environmental conservation.

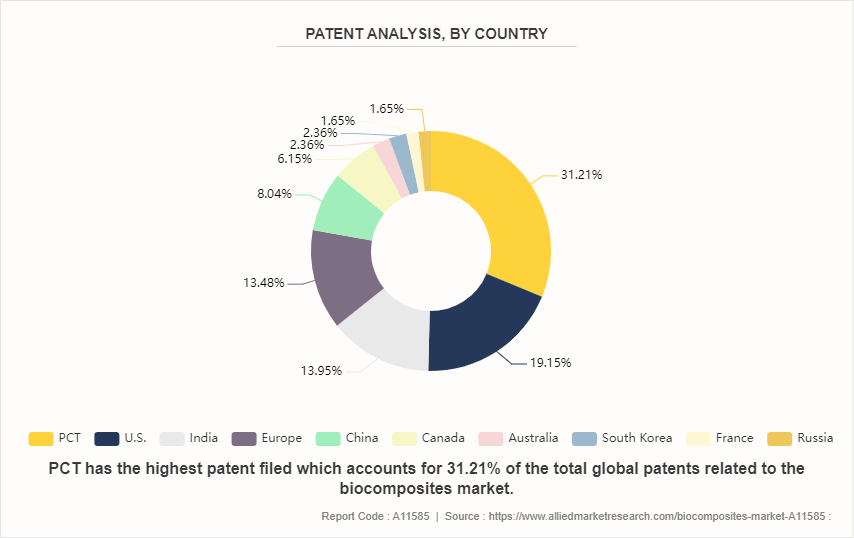

Patent Analysis of Biocomposites Market

The patent landscape for the biocomposites market is led by the PCT with a substantial 31.21% share, indicating a strong global interest in biocomposites innovations. The U.S. follows with 19.15%, highlighting its active role in biocomposites research and development. India and the Europe hold significant shares at 13.95% and 13.48%, respectively, showcasing their growing focus on sustainable materials. China (8.04%) , Canada (6.15%) , and Australia (2.36%) also contribute notably. In addition, the Republic of Korea, France, and the Russia each hold around 1.65%, reflecting a broad international engagement in biocomposite technologies.

Market Segmentation

The biocomposites market is segmented into fiber type, polymer matrix, processing method, end-use industry, and region. By fiber type, the market is classified into wood fibers and non-wood fibers. By polymer matrix, the market is classified into synthetic polymer and bio-based polymer. By processing method, the market is divided into filament winding, extrusion, injection molding, compression molding, machine press, and others. By end-use industry, the market is divided into transportation, electrical and electronics, building and construction, packaging, medical, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the biocomposites market include A B Composites Pvt Ltd., Bast Fibers LLC, BioComposites Group, COLAN AUSTRALIA, Green Dot Corporation, LANXESS AG, Stora Enso, Procotex Corporation, Meshlin Composites Zrt, and FlexForm Technologies LLC.

Recent Key Strategies and Developments

- In December 2023, Lingrove, an innovative company utilizing patented technology to convert rapidly maturing plants into composite surfaces and panels for diverse applications such as construction and other sectors, proudly declares the triumphant closure of its Series B funding round. The investment round exceeded expectations, spearheaded by Lewis & Clark Agrifood and Diamond Edge Ventures, accompanied by significant investments from Bunge Ventures and SOSV. This influx of capital is projected to boost the research and production of ekoa natural fiber composite panels and surfaces, leading to aesthetically appealing, high-performing, and eco-conscious interior designs.

- In September 2023, Rock West Composites acquired the assets of Performance Plastics Inc. This strategic move enables RWC to broaden its market reach by entering supplementary markets that share similarities with its current business operations but differ in terms of materials and processes.

- In December 2021, Deckorators, Inc., a subsidiary under Universal Forest Products, Inc., completed the acquisition of Ultra Aluminum Manufacturing Inc., a notable manufacturer specializing in aluminum railing, fencing, and gates.

- In November 2021, Celanese Corporation and Mitsubishi Chemical Advanced Materials joined forces to create recycling solutions while ensuring product quality, performance, and consistency are upheld.

- In October 2021, Retrac Group, a prominent manufacturer specializing in metallics, unveiled intentions to introduce a new line of eco-friendly biocomposites. These innovative products combine the characteristics of carbon fiber with those of natural fibers, offering versatile applications in lightweight constructions.

- In October 2021, Trex Company, Inc. unveiled intentions for establishing its third manufacturing facility within the U.S. This strategic expansion aims to enhance accessibility to Trex Residential offerings for customers, facilitating the company's prospective expansion.

- In March 2021, Fiberon LLC introduced its new Wildwood composite cladding, boasting outstanding features including superior durability, minimal maintenance requirements, and optimized performance.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The expanding construction, automotive, and electronics industries in the Asia-Pacific region are set to drive the biocomposites market. Rapid urbanization and infrastructure development are boosting the demand for sustainable construction materials. In the automotive sector, the focus on lightweight, eco-friendly components is increasing the adoption of biocomposites. In addition, the electronics industry is incorporating biocomposites to enhance sustainability and reduce environmental impact. This growth across key industries, coupled with rise in environmental awareness and regulatory support, is propelling the growth of the biocomposites market in the Asia-Pacific region.

- According to the World Paint & Coating Association, the Asia-Pacific paints and coatings market is predicted to be worth & 63 billion by 2022. China now dominates the region's market, which is expanding at a CAGR of 5.8%. In 2022, the Chinese market is expected to increase by 5.7%. Based on current trends, China's total paint and coatings sales will exceed $ 45 billion in 2022. In East Asia, the country has the biggest market share (78%) . Increasing paints and coatings will eventually expand the construction industry.

- According to the Japan Electronics and Information Technology Industries Association (JEITA) , the Japanese electronics industry's total production value is expected to exceed $88.18 billion (JPY 9.8 trillion) in November 2023, representing approximately 97.2% of the previous year.

- According to Invest India, the construction Industry in India is expected to reach $1.4 Tn by 2025.

- Following the Chinese Association of Automotive Manufacturers, China's automotive output increased by approximately 3.4% in 2022 over the previous year. In 2022, roughly 27 million automobiles were manufactured, compared to 26.08 million units in 2021.

- Thus, expanding construction, electronics and automotive industry in Asia-Pacific region will drive the growth of biocomposites market in this region.

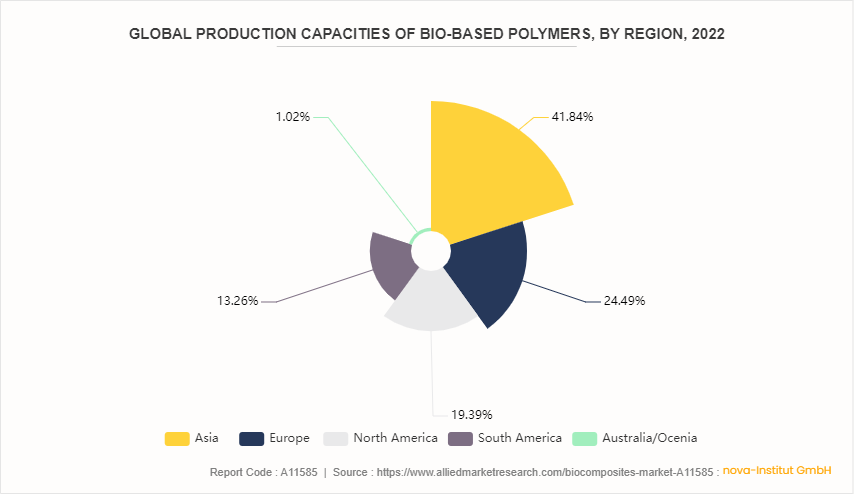

The Biocomposites Market is being Significantly driven by the Rising Global Production Capacities of Bio-Based Polymers

The increasing global production capacities of bio-based polymers are significantly driving the biocomposites market. As manufacturers expand their capabilities to produce eco-friendly, bio-based polymers, the demand for biocomposites, which incorporate these sustainable materials, is surging. This growth is fueled by rising environmental awareness and stringent regulations aimed at reducing carbon footprints. Consequently, industries such as automotive, construction, and packaging are increasingly adopting biocomposites for their durability, lightweight properties, and lower environmental impact. The synergy between enhanced production capacities and the growing preference for sustainable materials is propelling the biocomposites market toward substantial growth.

Industry Trends

- The surge in demand for biobased polymers in the packaging industry is driving the growth of the biocomposites market. Biocomposites offer an eco-friendly alternative to conventional materials as consumers and companies increasingly prioritize sustainability. These composites, made from natural fibers and biopolymers, provide desirable properties like biodegradability and reduced environmental impact. The packaging industry's shift towards greener solutions is expected to significantly boost the adoption of biocomposites, promoting innovation and growth in the market.

- Bio-based polymers are predominantly utilized in packaging for fruits and vegetables in supermarkets, bread bags, bakery boxes, bottles, envelopes, display carton windows, and shopping or carrier bags. According to the Department of Commerce (India) , the export value of fresh vegetables from India reached approximately $802 million in the fiscal year 2022, while processed vegetables amounted to nearly $425 million. This represents a 10.87% increase in fresh vegetable exports and a 0.21% increase in processed vegetables compared to 2020. Consequently, the rise in fresh and processed vegetable exports is expected to drive demand for bio-based polymers in India.

- The bio-based polymer for packaging is rapidly expanding in Europe and North America. The FDA and similar organizations are increasingly advocating for biodegradable and food-grade plastics to ensure food safety. Restaurant chains and food processing industries are adopting biodegradable materials for packaging, surged by rising consumer awareness about food safety and the carcinogenic risks associated with some plastics, particularly in emerging economies.

- Growth in regions like Asia-Pacific, South America, and the Middle East is anticipated to increase due to improving food packaging standards set by various food safety organizations. In addition, the ease of disposing of biodegradable polymers has further fueled their demand in the packaging industry.

Key Sources Referred

- OurWorldInData.org

- National Bureau of Statistics of China

- According to the Department of Commerce

- Organisation for Economic Co-operation and Development (OECD)

- Invest India

- International Organization of Motor Vehicle Manufacturers (OICA)

- Federation of Automobile Dealers' Association (FADA) .

- Chinese Association of Automotive Manufacturers

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biocomposites market analysis from 2024 to 2033 to identify the prevailing biocomposites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biocomposites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biocomposites market trends, key players, market segments, application areas, and market growth strategies.

Biocomposites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 93.7 Billion |

| Growth Rate | CAGR of 13.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Fiber Type |

|

| By Polymer Matrix |

|

| By Processing Method |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | FlexForm Technologies LLC, Bast Fibers LLC, A B Composites Pvt Ltd., BioComposites Group, Green Dot Corporation, Stora Enso, Meshlin Composites Zrt, Lanxess AG, COLAN AUSTRALIA, Procotex Corporation |

Building and construction is the leading end-use industry of Biocomposites Market.

The biocomposites market was valued at $25.9 billion in 2023 and is estimated to reach $93.7 billion by 2033, exhibiting a CAGR of 13.8% from 2024 to 2033.

Green building materials and eco-friendly packaging are the upcoming trends of Biocomposites Market in the globe.

A B Composites Pvt Ltd., Bast Fibers LLC, BioComposites Group, COLAN AUSTRALIA, Green Dot Corporation, LANXESS AG, Stora Enso, Procotex Corporation, Meshlin Composites Zrt, and FlexForm Technologies LLC. are the top companies to hold the market share in Biocomposites.

Asia-Pacific is the largest regional market for Biocomposites.

Loading Table Of Content...