Biodegradable Polymers Market Research, 2033

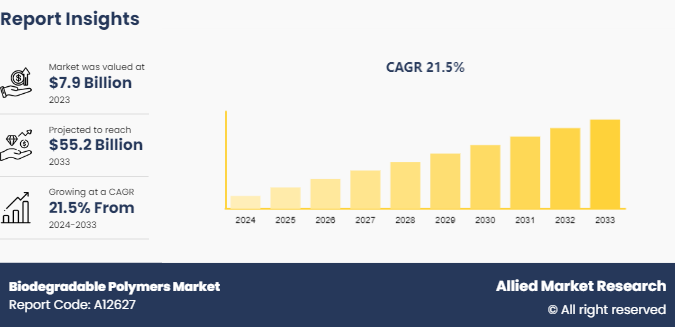

The global biodegradable polymers market was valued at $7.9 billion in 2023, and is projected to reach $55.2 Billion by 2033, growing at a CAGR of 21.5% from 2024 to 2033.

Introduction

Biodegradable polymers are a class of polymers that break down into natural byproducts, such as water, carbon dioxide, and biomass, through the action of living organisms, usually microorganisms. These polymers are designed to be environmentally friendly, offering a sustainable alternative to traditional plastics that persist in the environment for centuries. The degradation process can occur via various mechanisms, including hydrolysis, enzymatic action, or microbial activity, depending on the polymer's chemical structure and the environmental conditions.

One of the most significant domains for biodegradable polymers is the medical field. Their ability to degrade safely within the body makes them ideal for a variety of biomedical applications. For instance, polylactic acid (PLA) and polyglycolic acid (PGA) are widely used in the fabrication of sutures that dissolve over time, eliminating the need for a second surgery to remove them. These polymers are also used in the development of drug delivery systems, where the polymer matrix degrades and releases the encapsulated drug in a controlled manner.

The environmental benefits of biodegradable polymers are perhaps the most widely recognized. Traditional plastics contribute significantly to pollution and waste management challenges due to their long degradation times. Biodegradable polymers offer a solution to this problem by reducing the accumulation of persistent waste. These polymers are particularly valuable in applications such as agricultural films, which are used to cover soil and promote crop growth. After their functional life, these films degrade naturally, reducing plastic waste in agricultural industries.

Key Takeaways

- The biodegradable polymers market industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period (2024-2032) .

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global biodegradable polymers market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the biodegradable polymers market size.

- The biodegradable polymers market share is highly fragmented, with several players including BASF SE, NatureWorks LLC, Novamont S.p.A., TotalEnergies Corbion, Mitsubishi Chemical Group Corporation., Natur-Tec, Polysciences Inc, Danimer Scientific, FKuR, and Evonik Industries AG. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the biodegradable polymers market growth.

Segment Overview

The biodegradable polymers market is segmented into polymer type, application, and region. On the basis of polymer type, the market is divided into polylactic acid, polyhydroxyalkanoates, starch blends, polybutylene succinate, and polyhydroxyurethanes. On the basis of application, the market is segmented into packaging, agriculture, medical, consumer goods, textile, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Surge in demand for biodegradable packaging in the food and beverage industry is expected to boost the growth of biodegradable polymers market during the forecast period. The surge is driven by a confluence of environmental concerns, regulatory pressures, technological advancements, and shifting consumer preferences, all of which underscore the importance of sustainable packaging solutions. Governments and regulatory bodies worldwide are implementing stringent regulations to curb plastic pollution. Policies such as bans on single-use plastics, plastic taxes, and mandatory recycling targets are creating a favorable environment for the adoption of biodegradable packaging. For instance, the European Union’s directive on single-use plastics aims to reduce the environmental impact of certain plastic products by promoting the use of biodegradable alternatives. Such regulatory frameworks are expected to propel the demand for biodegradable polymers, particularly in industries with high plastic usage such as food and beverages.

In February 2024, Print & Pack launched, sustainable packaging solutions to small businesses and eco-conscious brands in North America. Their lineup includes innovative technologies such as BDP products for Biodegradable Packaging and GREENGUARD Gold Certified inks. INVISIBLEBAG, a compostable and water-soluble solution, is part of their offerings. The rise in sustainable packaging adoption is anticipated to drive demand in the biodegradable packaging market. Polylactic acid (PLA) and polyhydroxyalkanoates (PHAs) are gaining popularity due to their biodegradability and performance characteristics. PLA, derived from renewable resources such as corn starch or sugarcane, is widely used in food packaging due to its transparency and composability. PHAs, produced by microbial fermentation of sugars, offer excellent biodegradability and are suitable for a variety of packaging applications.

Furthermore, development of hybrid materials combining biodegradability with high performance is expected to provide lucrative opportunities in the biodegradable polymers market. Biodegradable polymers are often susceptible to thermal degradation at high temperatures, limiting their use in applications that require thermal stability. However, by blending biodegradable polymers with thermally stable additives or fillers, hybrid materials can be engineered to withstand elevated temperatures without compromising biodegradability. These thermal enhancement strategies expand the potential applications of biodegradable polymers in areas such as electronics, packaging, and consumer goods. As per the European Bioplastics e.V., Bioplastics are used for an increasing variety of applications, ranging from packaging and consumer products to electronics, automotive, and textiles. Packaging remains the largest market segment for bioplastics with 43 percent (934 000 tonnes) of the total bioplastics market in 2023.

However, higher production costs compared to traditional plastics is expected to restraint the growth of biodegradable polymers market. One of the primary reasons for the higher production costs of biodegradable polymers is the sourcing of raw materials. Unlike traditional plastics, which are derived from abundant and relatively inexpensive petrochemical feedstocks, biodegradable polymers often rely on renewable resources such as corn starch, sugarcane, or cellulose. These renewable feedstocks can be more costly to cultivate, harvest, and process, contributing to higher overall production costs for biodegradable polymers. Additionally, the manufacturing techniques used for biodegradable polymers may be more complex and require specialized equipment compared to the processes used for traditional plastics. For instance, the production of biodegradable polymers such as polylactic acid (PLA) involves fermentation, polymerization, and processing steps that may require precise control and optimization to achieve desired properties. These additional processing requirements can drive up production costs, particularly for smaller manufacturers or companies transitioning from conventional plastics to biodegradable alternatives.

Competitive Analysis

Key market players in the biodegradable polymers market include BASF SE, NatureWorks LLC, Novamont S.p.A., TotalEnergies Corbion, Mitsubishi Chemical Group Corporation., Natur-Tec, Polysciences Inc, Danimer Scientific, FKuR, and Evonik Industries AG.

Industry Trends

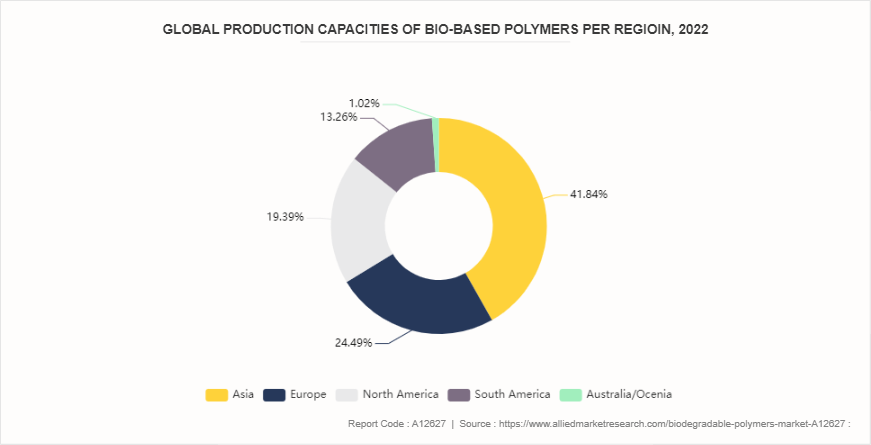

- According to European Bioplastics, the global production capacity of bioplastics is projected to grow from 2.2 million tons in 2022 to 6.3 million tons by 2027. Biodegradable polymers represent approximately 40% of this market. The packaging sector, which consumes around 50% of the total bioplastics volume, remains the largest market segment in the bioplastics industry.

- According to Interpak 2023, China commands a substantial portion of the global flexible packaging market. From an average annual growth rate of around 8% until 2022, China's packaging industry has significantly outpaced the global average growth rate of 4.3%. This robust growth is fueled by the country's dynamic economic development, rapid urbanization, and improvements in the quality of life. As a result, consumers are increasingly favoring packaging that is safer, more convenient, unique, and environmentally friendly.

- In December 2023, Sulzer introduced CAPSUL, a new end-to-end licensed technology for the continuous manufacturing of polycaprolactone (PCL) . PCL is a biodegradable polyester widely used in packaging, textiles, agriculture, and horticulture. The CAPSUL solution enhances process efficiency, allowing for the production of high-quality PCL at competitive prices. This technology complements Sulzer’s existing renewable and circular plastic offerings, including their polylactic acid (PLA) process technology.

- In May 2022, NatureWorks and CJ Bio signed an agreement to bring new biopolymer solutions to the market. They aim to develop high-performance biopolymers by combining NatureWorks' Ingeo biomaterials technology with CJ Bio's polyhydroxyalkanoate (PHA) . These biopolymers are intended for use in food packaging, personal care products, and various other applications.

Regional Market Outlook

Based on region the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In Europe, the adoption of biodegradable polymers is at the forefront of the sustainability agenda. The European Union has implemented ambitious targets to reduce plastic waste, prompting widespread adoption of bioplastics across industries. Stringent regulations and policies promoting circular economy principles have incentivized companies to incorporate biodegradable polymers into their product offerings. As a result, the region has witnessed a surge in demand for eco-friendly packaging materials, disposable cutlery, and agricultural films made from biodegradable polymers.

Biodegradable polymers are experiencing significant growth in the Asia-Pacific region, fueled by urbanization, population expansion, and heightened consumer consciousness about environmental concerns. Key players like China, India, and Japan are propelling the demand for bioplastics, notably in packaging and consumer goods. Government efforts to curb plastic waste and endorse sustainable alternatives are driving the uptake of biodegradable polymers. Moreover, partnerships between industry stakeholders and research bodies are spurring innovation and broadening the utility of bioplastics across diverse sectors.

Key Regulation Analysis

- ASTM D6400 is the standard specification for compostable plastics in the United States. It defines the requirements for plastics and products made from plastics that are designed to be composted in municipal and industrial aerobic composting facilities. ASTM D6400 requires that compostable plastics biodegrade at least 90% into carbon dioxide, water, inorganic compounds, and biomass within 180 days in a controlled composting environment. They must also disintegrate into small pieces and leave no visible, distinguishable, or toxic residues.

- The European Committee for Standardization (CEN) has developed standards for compostable packaging, EN 13432, which is harmonized with ASTM D6400 In India, the Bureau of Indian Standards (BIS) has notified IS/ISO: 17088:2008, which defines the criteria for biodegradable plastics under composting conditions, similar to ASTM D-6400.

- Oxo-degradable and photo-degradable plastics that break down into small fragments are not considered biodegradable under ASTM D6400 standards, as they do not meet the degradation rate or residue requirements. The U.S. Composting Council and Biodegradable Products Institute collaborate on a labeling program that certifies biodegradable plastics, ensuring they adhere to the ASTM D-6400 standard for composability.

Key Sources Referred

- The Oxo-biodegradable Plastics Association

- GOV.UK

- U.S. Department of Energy

- U.S. Environmental Protection Agency

- Department of Ecology State of Washington

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biodegradable polymers market analysis from 2024 to 2033 to identify the prevailing biodegradable polymers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biodegradable polymers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biodegradable polymers market trends, key players, market segments, application areas, and market growth strategies.

Biodegradable Polymers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 55.2 Billion |

| Growth Rate | CAGR of 21.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Novamont S.p.A., Natur-Tec, BASF SE, NatureWorks LLC, Polysciences Inc, FKuR, TotalEnergies Corbion, Evonik Industries AG, Danimer Scientific, "Mitsubishi Chemical Group Corporation. " |

| | Others |

Loading Table Of Content...