Bioimplants Market Research, 2035

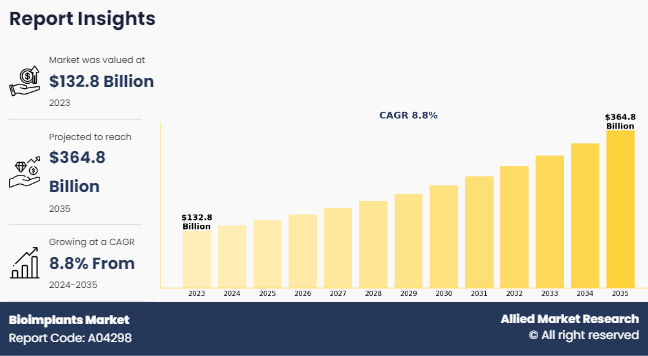

The global bioimplants market was valued at $132.8 billion in 2023, and is projected to reach $364.8 billion by 2035, growing at a CAGR of 8.8% from 2024 to 2035. The growth of the bioimplants market is driven by a surge in prevalence of cardiovascular diseases, high adoption of the dental and prosthetic implant. According to 2023 World Heart Report, it was reported that more than half a billion people around the world continues to be affected by cardiovascular diseases. The implants such as stent plays a major role in managing cardiovascular diseases such as coronary artery disease.

Bioimplants are sophisticated medical devices designed to be implanted into the human body to replace or support a biological structure or function. These implants can vary widely in complexity and purpose, ranging from simple devices like dental implants to more intricate systems such as pacemakers, artificial joints, and neural implants. One of the primary goals of bioimplants is to improve the quality of life for individuals suffering from various medical conditions or injuries by restoring lost or impaired functions. They are often made from biocompatible materials to minimize the risk of rejection by the body's immune system. Additionally, advancements in technology have led to the development of bioimplants with integrated sensors and wireless connectivity, allowing for real-time monitoring of physiological parameters and remote adjustments.

Key Takeaways

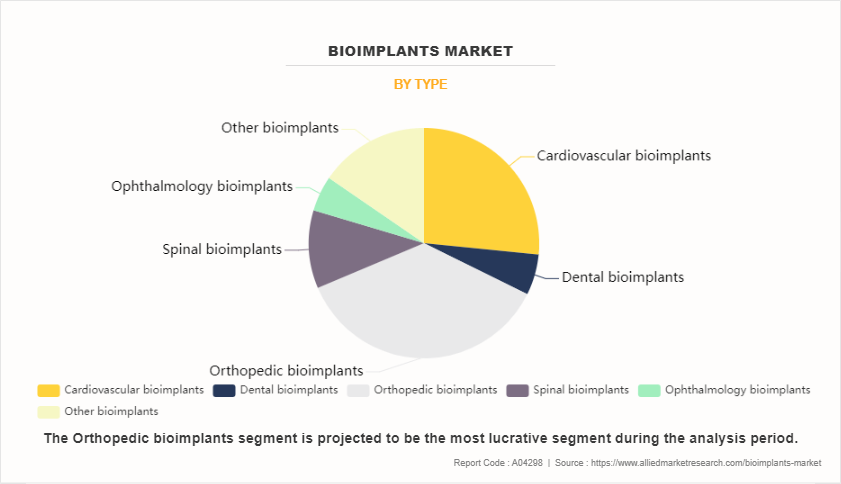

- On the basis of type, the orthopedic bioimplants segment dominated the market in terms of revenue in 2023.

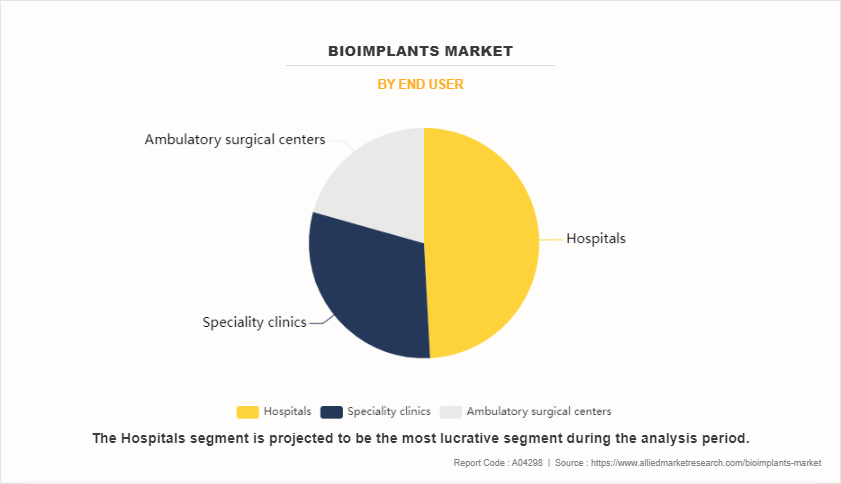

- On the basis of end user, the hospital segment dominated the market in terms of revenue in 2023. However, the specialty clinics segment is expected to register the highest CAGR during the forecast period.

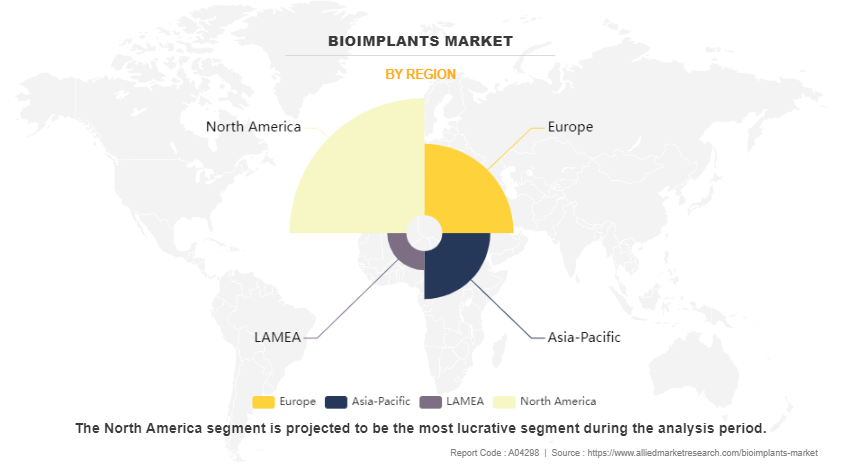

- On the basis of region, North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The bioimplants market size is expected to grow significantly owing to rise in prevalence of cardiovascular diseases, surge in geriatric population, and high adoption of the orthopedic implants to for the treatment of joints and other complications. The exponential rise in the prevalence of cardiovascular diseases (CVDs) has emerged as a significant driver propelling the growth of the bioimplants market. CVDs, including coronary artery disease, hypertension, and heart failure, remain leading causes of mortality globally, placing an immense burden on healthcare systems. According to 2023 article by Center of Disease Control and Prevention it was estimated that about 1 in 20 adults age 20 and older have coronary artery disease.

Factors such as sedentary lifestyles, unhealthy dietary habits, and an aging population have contributed to the escalating incidence of CVDs worldwide. Consequently, there is a pressing need for advanced treatment modalities to address these conditions effectively. Bioimplants, ranging from stents and pacemakers to heart valves and vascular grafts, play a crucial role in managing and treating cardiovascular ailments. These implants offer innovative solutions by restoring proper cardiovascular function, alleviating symptoms, and improving patients' quality of life. Moreover, advancements in biomaterials and manufacturing techniques have enhanced the efficacy, durability, and biocompatibility of these implants, further driving their adoption. Thus, the rise in the prevalence of the cardiovascular diseases is expected to drive the bioimplants market growth.

According to bioimplants market opportunity analysis, rise in adoption of dental implants is expected to contribute significantly in the bioimplant market growth. Dental implants have gained widespread acceptance and preference over traditional tooth replacement methods due to their superior functionality, durability, and aesthetics. One of the primary factors contributing to their rising popularity is the increasing prevalence of dental diseases and conditions such as periodontal disease, tooth decay, and dental trauma, which often result in tooth loss.

Additionally, the aging population, coupled with a growing awareness of the importance of oral health and aesthetic concerns, has fueled the demand for dental implant procedures. Furthermore, advancements in implant materials, design, and surgical techniques have significantly enhanced the success rates and outcomes of dental implant procedures, thereby instilling greater confidence among patients and clinicians alike. According to 2023 article by National Library of Medicine, it was reported that dental implants are increasingly used to replace single teeth, especially in the posterior regions of the mouth.

Rather than removing sound tooth structure and crowning multiple teeth, which can increase the risk of decay and other complications, the dental implant offers more safe and practical solution. Dental implants offer a more targeted solution compared to procedures like splinting teeth with pontics, potentially improving oral hygiene and reducing plaque retention. Moreover, the expanding scope of dental implant applications beyond conventional tooth replacement, such as in orthodontics and maxillofacial reconstruction, has further widened the applications of the implants. Thus, rise in adoption of dental implants is expected to drive the growth of bioimplants industry.

According to bioimplants market forecast analysis, the surge in orthopedic diseases is expected to drive the growth of the growth of the bioimplant market. Orthopedic conditions, encompassing a wide range of ailments such as osteoarthritis, rheumatoid arthritis, fractures, and spinal disorders, have been increasingly prevalent globally. Factors contributing to this surge include aging populations, sedentary lifestyles, rising obesity rates, and a higher incidence of sports-related injuries. As individuals live longer and engage in more physically demanding activities, the demand for orthopedic interventions continues to rise. Bioimplants, including prosthetic joints, spinal implants, and ortho biologics, offer innovative solutions for restoring mobility, alleviating pain, and enhancing quality of life for patients suffering from orthopedic ailments.

According to 2024 article by National Library of Medicine, it was reported that primary orthopedic surgeries using joint-replacement implants are one of the most successful types of treatments, providing pain relief, mobility, and improved quality of life for 10–20 years with implant survival rates of >80% even after 15 years of implantation. These implants, often made from biocompatible materials such as titanium alloys, ceramics, and polymers, mimic natural bone structure and function, promoting better integration and long-term durability within the body.

Moreover, advancements in medical technology and surgical techniques have made bioimplant procedures safer, more effective, and accessible to a broader patient population. Thus, the rise in the orthopedic diseases is expected to drive the bioimplants market growth. However, high cost of the bioimplants might restrain the growth of the market. Moreover the technological advancement such as 3d printed bioimplants and implants with sensor for more accurate patient monitoring is expected to drive the growth of bioimplants market size.

Segments Overview

The bioimplants market is segmented on the basis of type, end user, and region. By type the market is divided into cardiovascular bioimplants, dental bioimplants, orthopedic bioimplants, spinal bioimplants, ophthalmology bioimplants, other bioimplants. By end user, the market is classified into hospital, specialized clinics, and ambulatory surgical centers.

Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

By Type

The orthopedic bioimplants segment dominated the global bioimplants market share in 2023, owing rise in incidence of orthopedic injuries and high adoption of the bioimplants in knee replacement and hip replacement surgeries. Furthermore, the rise in the geriatric population has contributed significantly in the rise in demand for the orthopedic bioimplants. The development of new biocompatible materials with lower risk profile and high longitivity is expected to contribute significintly in the growing demand of orthopedic bioimplants in the forecast period.

By End User

The hospital segment dominated the global bioimplants market share in 2023, owing to high number of surgical bioimplant procedures being carried out in the hospitals. Furthermore, the avibility of financial resources at the hospitals facilitates hospitals to purchase advance medical equpiments and new advance bioimplants. However, the specialty clinics segment is expected to register the highest CAGR during the forecast period. This is attributed to the rise in adoption of minimally invasive procedures. This is attributed to the fact that minimally invasive procedures often result in faster recovery times, reduced pain, and fewer complications compared to traditional open surgeries. Patients are increasingly opting for these procedures because they offer similar efficacy with lower risks.

By Region

The bioimplants market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA. North America accounted for a major share of the bioimplants market in 2023 and is expected to maintain its dominance during the forecast period. This is attributed to well-developed healthcare infrastructure, strong presence of major key players and high adoption of the bioimplant technology for reconstructive joint replacements.However, Asia-Pacific is expected to register the highest CAGR during the forecast period owing to surge in geriatric population and rise in prevalence of cardiovascular diseases.

Competitive Analysis

Competitive analysis and profiles of the major players in bioimplants market, such as Medtronic plc, Stryker Corporation, Johnson & Johnson (Ethicon, Inc.), Abbott Laboratories (St. Jude Medical, Inc.), Dentsply Sirona Inc, Boston Scientific Corporation, Victrex Plc. (Invibio Ltd.), Smith & Nephew plc, Arthrex, Inc, Zimmer Biomet Holdings Inc are provided in this report. Major players have adopted product approval as a key developmental strategy to improve the product portfolio of the bioimplants market.

Recent Development in the Bioimplants Industry

- In June 2022, OssDsign AB (publ.) announced the launch of Oss sign Cranial PSI in Japan. The launch marks an important strategic milestone, following a period of postponed commercial activities due to the COVID-19 pandemic.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bioimplants market analysis from 2023 to 2035 to identify the prevailing bioimplants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bioimplants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bioimplants market trends, key players, market segments, application areas, and market growth strategies.

Bioimplants Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 280 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Medtronic plc, Zimmer Biomet Holdings Inc., Boston Scientific Corporation, Smith & Nephew plc, Johnson & Johnson, Victrex plc, Arthrex, Inc., Abbott Laboratories, Dentsply Sirona Inc., Stryker Corporation |

Analyst Review

This section provides various opinions of CXOs in the bioimplants market. Over the past few years, the bioimplant market has witnessed significant growth driven by advancements in medical technology, increasing prevalence of chronic diseases, and rising demand for minimally invasive surgical procedures. Bioimplants, ranging from orthopedic implants to cardiac implants and neurological implants, have revolutionized the treatment landscape by offering improved patient outcomes, reduced recovery times, and enhanced quality of life. Moreover, the growing aging population globally has further fueled the demand for bioimplants as older individuals seek solutions to age-related health issues such as joint degeneration and cardiovascular diseases. However, despite the market's promising growth trajectory, challenges such as regulatory hurdles, high costs associated with development and manufacturing, and concerns regarding implant compatibility and long-term efficacy remain pertinent.

The total market value of Bioimplants Market is $132.80 billion in 2023.

The bioimplants market growth is attributed to rise in geriatric population, surge in prevalence of cardiovascular diseases, and technological advancement in bioimplant technology.

North America is the largest regional market for Bioimplants.

The market value of Bioimplants Market in 2032 is expected to be $364.8 billion.

The forecast period for Bioimplants Market is 2023-2032.

The orthopedic bioimplants segment is the most influencing segment in the Bioimplants Market.

The base year is 2023 in Bioimplants Market report.

Medtronic plc, Stryker Corporation, Johnson & Johnson (Ethicon, Inc.), Abbott Laboratories, Dentsply Sirona Inc, and Boston Scientific Corporation are key players of the Bioimplants Market.

Loading Table Of Content...

Loading Research Methodology...