Biomass Briquette Fuel Market Research, 2033

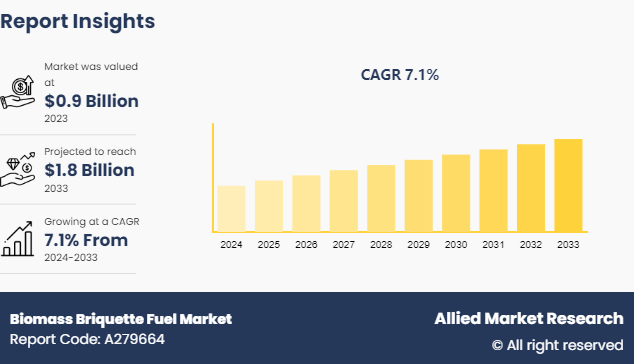

The global biomass briquette fuel market was valued at $0.9 billion in 2023, and is projected to reach $1.8 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033.

Market Introduction and Definition

Biomass briquette fuel refers to a renewable energy source produced by compressing organic materials such as agricultural residues, forestry waste, and other biomass feedstocks into dense, uniform briquettes. These briquettes are typically formed under high pressure without the use of additional binders or adhesives. Biomass briquette fuel is known for its high energy density and can serve as an efficient and cost-effective alternative to traditional fossil fuels. It is characterized by its sustainability, as it is derived from renewable biomass sources, and its environmentally friendly nature, as it emits lower greenhouse gas emissions as compared to fossil fuels when burned. Biomass briquette fuel finds applications in residential heating, industrial processes, and power generation due to its versatility, consistent quality, and reliable performance.

Key Takeaways

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

The biomass briquette fuel market is fragmented in nature with prominent companies such as KKR Bio Fuels, Yashhraj Group of Companies, Ecostan, Gattuwala., Energy Plus India, Sree Amman Briquettes, NIRMALA & SIDDAGANGA BIOFUEL INDUSTRIES, Neerpati Biofuels Private Limited, NARSIHMA AGRO INDUSTRIES, Buyo India Pvt. Ltd., and Vidhyut Power & Systems.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

Latest trends in global biomass briquette fuel market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 2, 800 biomass briquette fuel-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global biomass briquette fuel market.

Key Market Dynamics

Rise in demand for renewable energy sources has become a primary driver propelling the expansion of the biomass briquette fuel market. As the global focus on sustainability intensifies, there is a growing r transition from fossil fuels towards cleaner alternatives. Biomass briquettes, derived from organic materials such as agricultural residues, forest waste, and energy crops, offer a renewable and eco-friendly fuel option. Increase in demand for renewable energy sources is fueled by the need to diversify energy portfolios and reduce reliance on finite fossil fuel reserves. Biomass briquettes provide a reliable and readily available source of energy that can be produced locally, thereby enhancing energy security, and reducing dependence on imported fuels. According to the International Energy Agency (IEA) , global renewable electricity capacity is expected to rise more than 60% from 2020 levels to over 4, 800 GW by 2026. Renewables are set to account for almost 95% of the increase in global power capacity by 2026, with solar PV alone providing more than half. The amount of renewable capacity added over the period of 2021 to 2026 is expected to be 50% higher than from 2015 to 2020.

Government initiatives and subsidies aimed at promoting biomass energy have emerged as significant drivers propelling the growth of the biomass briquette fuel market. Governments across the globe are increasingly recognizing the importance of transitioning towards renewable and sustainable energy sources to mitigate the adverse effects of climate change and reduce dependence on fossil fuels. With these objectives, various policies, incentives, and subsidies have been introduced to encourage the adoption and production of biomass-based fuels like biomass briquette. These government initiatives often include financial incentives such as grants, subsidies, tax credits, and preferential tariffs for biomass energy producers and consumers. By providing financial support and creating a favorable regulatory environment, governments aim to stimulate investment in biomass energy infrastructure, promote research and development activities, and facilitate market expansion. All these factors drive the growth of the biomass briquettes fuel market.

However, the limited availability of biomass resources hinders the growth of the biomass briquettes fuel market. Biomass, which forms the primary raw material for producing briquettes, includes a diverse range of organic materials such as agricultural residues, forestry residues, animal waste, and municipal solid waste. The availability of these biomass resources is subject to various factors, including seasonal fluctuations, geographical constraints, and competing uses. Furthermore, the quality and suitability of biomass resources for briquette production can vary significantly depending on factors such as moisture content, density, and chemical composition. Inconsistent biomass feedstock characteristics can pose challenges in achieving uniform briquette quality and performance, thereby impacting market acceptance and customer satisfaction.

On the contrary, the development of advanced briquetting technologies represents a significant opportunity for the biomass briquette fuel market. Briquetting technology plays a crucial role in transforming biomass residues into compact and energy-dense briquettes, facilitating easier handling, storage, and transportation. With advancements in briquetting techniques, several key benefits emerge, driving the market growth. Moreover, the development of advanced briquetting technologies enables the utilization of a wider range of biomass feedstocks. By accommodating diverse biomass materials, including agricultural residues, forestry wastes, and energy crops, these technologies enhance feedstock flexibility, reducing dependency on specific biomass sources.

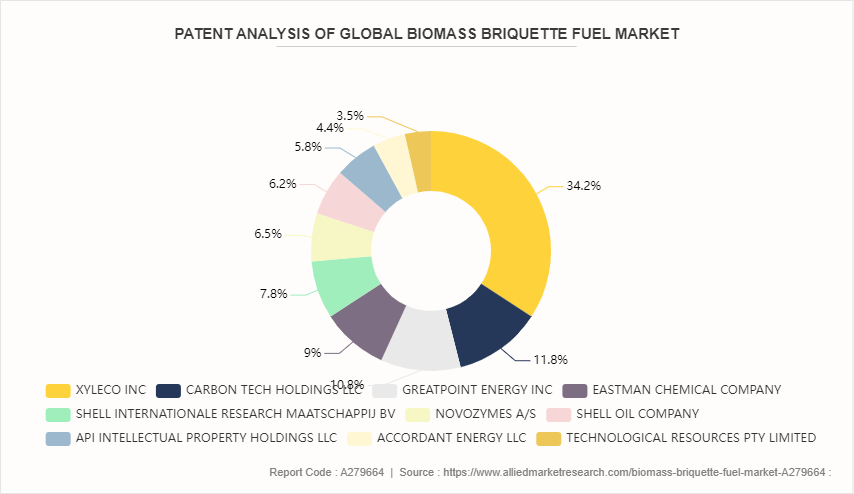

The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and outlook within the biomass briquettes fuel market.

Year-wise, 2022 was a significant year for patent fillings related to biomass briquette fuel registering 279 patents followed by the year 2021, registering 255 patents, while 2023 has been on third position with 251 patent grants in the year. Patent filings related to biomass briquettes fuel have shown a steady increase over the past decade, indicating growing interest and investment in biomass briquettes fuel research and development.

In addition, patent analysis provides competitive intelligence, R&D strategy and planning, identify and mitigate risk management efforts, product portfolio management, investment and financial analysis, and policy formulation for biomass briquette manufacturers worldwide. Key patent holders in the biomass briquette market include energy companies, research institutions, universities, and biomass manufacturers.

Market Segmentation

The biomass briquette fuel market is segmented on the basis by raw material, application, end-use industry, and region. By raw material, the market is classified into saw dust, wood, rice husk, groundnut shells, bagasse, and others. By application, the market is segmented into brick kilns, dyeing plants, oil extraction units, cooking and baking, and others. By end-use industry, the market is classified into FMCG and beverage, pharmaceuticals, cement manufacturing, power generation, leather, rubber, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for biomass briquette fuel owing to various factors such as cost-effectiveness, environmental benefits, and energy security. Biomass briquettes, made from abundant agricultural and forestry residues, offer a cheaper and cleaner alternative to fossil fuels, helping to reduce air pollution and carbon emissions. Technological advancements have improved production efficiency and briquette quality, making them more attractive. In addition, supportive government policies and incentives are promoting renewable energy sources, aligning with national and international climate commitments. For instance, according to a report published by the Indian Ministry of New and Renewable Energy in 2022, the Indian government has given administrative approval for implementation of Biomass Programme under the Umbrella scheme of National Bioenergy Programme for duration of 2021-2022 to 2025-2026.

Also, the local production of briquettes in countries such as China, India, Bangladesh, and other ASIAN countries have also stimulated rural economies and provided reliable energy access in areas with limited conventional fuel supplies, further driving the growth of the biomass briquette fuel market in Asia-Pacific region.

Competitive Landscape

The major players operating in the biomass briquette fuel market include KKR Bio Fuels, Yashhraj Group of Companies, Ecostan, Gattuwala., Energy Plus India, Sree Amman Briquettes, NIRMALA & SIDDAGANGA BIOFUEL INDUSTRIES, Neerpati Biofuels Private Limited, NARSIHMA AGRO INDUSTRIES, Buyo India Pvt. Ltd., and Vidhyut Power & Systems.

Industry Trends

In January 2021, a group of researchers from China developed microbial fuel cell (MFC) that have the ability to directly convert the chemical energy from organic compounds into electric energy. By using this technology, biomass energy can be directly harvested in the form of electricity which is the most convenient, wide-spread, and clean energy. Therefore, MFC is considered as another promising way to harness the sustainable energies in biomass and added new dimension to the biomass energy industry.

According to an article published by International Journal of Hydrogen Energy in February 2024, researchers have produced hydrogen from biomass pyrolysis and gasification. This technique can be used on a commercial scale to produce hydrogen in bulk quantities and cater to serve end-use industries.

Key Sources Referred

National Promotion and Facilitation Agency

BioMed Central

International Energy Agency (IEA)

Science Direct

Invest In India

Press Information Bureau

International Renewable Energy Agency (IRENA)

Ministry of New and Renewable Energy

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomass briquette fuel market analysis from 2024 to 2033 to identify the prevailing biomass briquette fuel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomass briquette fuel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomass briquette fuel market trends, key players, market segments, application areas, and market growth strategies.

Biomass Briquette Fuel Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.8 Billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 550 |

| By Raw Material |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Sree Amman Briquettes, Neerpati Biofuels Private Limited, Gattuwala, NARSIHMA AGRO INDUSTRIES, KKR Bio Fuels, NIRMALA & SIDDAGANGA BIOFUEL INDUSTRIES, Vidhyut Power & Systems, Ecostan, Energy Plus India, Yashhraj Group of Companies |

Loading Table Of Content...