Biomass Briquette Market Research, 2033

The global biomass briquette market was valued at $0.9 billion in 2023, and is projected to reach $1.9 billion by 2033, growing at a CAGR of 7.9% from 2024 to 2033.

Market Introduction and Definition

Biomass briquettes are a type of renewable energy source made from organic materials, such as agricultural waste, forestry residues, and other biomass. These materials are compressed into small, dense blocks that can be used as fuel. Biomass briquettes are a sustainable alternative to traditional fossil fuels such as coal and petroleum, as they are produced from renewable resources and generate lower greenhouse gas emissions when burned. The process of making biomass briquettes involves collecting raw biomass, drying it to reduce moisture content, and then compressing it using a briquetting machine. The resulting briquettes are uniform in size and shape, making them easy to handle, store, and transport. They are typically cylindrical or square and can vary in size depending on the intended use and the machinery used for production. Biomass briquettes are commonly used for heating homes, particularly in rural areas where access to other forms of energy may be limited. They are burned in stoves, fireplaces, and heaters to provide warmth during cold seasons. The high energy content and low emissions of briquettes make them an efficient and eco-friendly option for residential heating.

In many developing countries, biomass briquettes are used as a cooking fuel. They serve as an alternative to traditional cooking fuels like firewood and charcoal, which can be expensive and contribute to deforestation. Briquettes produce a consistent and controllable heat, making them ideal for use in cookstoves and ovens. Biomass briquettes can be used in power plants to generate electricity. Co-firing biomass with coal is a common practice, where briquettes are mixed with coal to reduce carbon emissions and improve the sustainability of power generation. Some power plants are designed to run entirely on biomass, using briquettes as the primary fuel source.

Key Takeaways

- The biomass briquette industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period in the biomass briquette market report.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global biomass briquette market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the biomass briquette market growth.

- The biomass briquette market share is highly fragmented, with several players including Radhe Industrial Corporation, C.F. Nielsen A/S, Jaykhodiyar, ECOSTAN, RUF US, Inc, Gattuwala, MaxTon Industrial Co., Ltd., WEIM, VOTECS, and GROSS Apparatebau GmbH.

Segment Overview

The biomass briquette market is segmented into type, application, and region. On the basis of type, the market is divided into sawdust briquettes, agro waste briquettes, and wood briquettes. On the basis of application, the market is segmented into power generation, heating, cooking and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Rapid urbanization and industrialization are expected to drive the growth of biomass briquette market during the forecast period. As cities expand and industries grow, the need for reliable, affordable, and sustainable energy sources becomes more pronounced. This scenario creates a robust market for alternative energy sources, including biomass briquettes. Urbanization drives the expansion of residential areas, commercial establishments, and infrastructure development, all of which require substantial energy inputs. Traditional energy sources such as coal, oil, and natural gas often struggle to meet the soaring energy demands of rapidly growing urban populations. Additionally, these conventional fuels are associated with significant environmental and health issues, including air pollution and greenhouse gas emissions. In this context, biomass briquettes emerge as a viable and eco-friendly alternative. Made from agricultural residues, forestry waste, and other organic materials, biomass briquettes offer a renewable and sustainable energy solution that can help urban areas reduce their carbon footprint and enhance energy security.

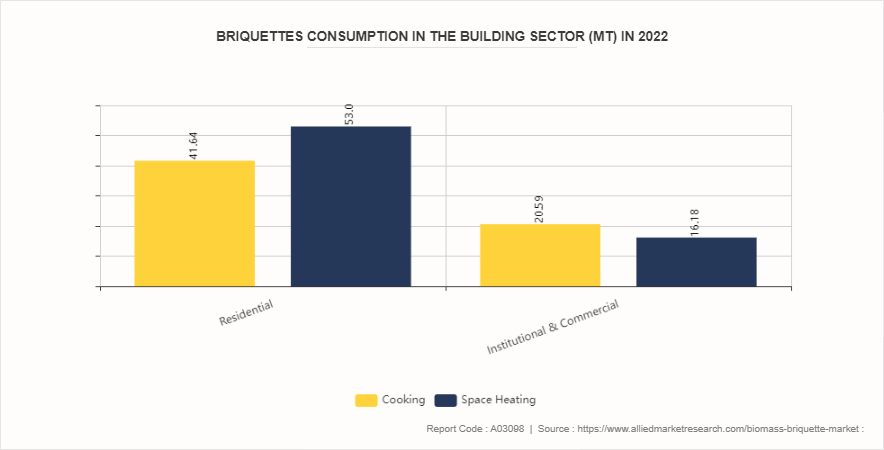

According to the Department of Energy, in 2022, the usage of briquettes in the Building Sector was divided between cooking and heating purposes, with 47.42% used for cooking and 52.58% for heating. Briquette consumption in this sector decreased from 316.15 MT in 2014 to 132.39 MT in 2022. Fuelwood consumption was mainly for cooking (36.2%) , followed by other purposes such as rituals, hot stone baths, and arts and crafts (41.3%) , and heating (22.5%) . Additionally, the institutional and commercial segment used 42, 768.02 MT of fuelwood.

However, competition from other renewable energy sources is expected to hamper the biomass briquette market during the forecast period. Competition from other renewable energy sources, such as solar and wind energy, can pose a significant challenge to the growth of the biomass briquette market forecast. As the global focus shifts towards sustainable and environmentally friendly energy solutions, various renewable energy technologies are emerging, each with their unique advantages and applications. Solar and wind energy, in particular, have gained substantial traction due to their abundant availability and decreasing costs. Solar energy harnesses the power of the sun through photovoltaic cells and solar thermal systems, providing a clean and renewable source of electricity and heat. The declining cost of solar panels and advancements in solar technology have made it increasingly accessible for residential, commercial, and industrial applications. Moreover, government incentives, subsidies, and supportive policies further accelerate the adoption of solar energy. This widespread acceptance and deployment of solar power can divert attention and investment away from biomass briquettes, particularly in regions with high solar insolation.

Surge in the use of co-firing biomass briquettes with coal in power plants is expected to offer lucrative opportunities in the market. Co-firing biomass briquettes with coal in power plants presents a substantial opportunity for the biomass briquette market, especially in the context of transitioning to more sustainable energy practices. As countries and industries grapple with the urgent need to reduce carbon emissions and meet climate goals, integrating biomass briquettes into existing coal-fired power plants offers a pragmatic and cost-effective solution. This hybrid approach allows for the incremental adoption of renewable energy sources without the need for substantial overhauls of current infrastructure, making it an attractive option for energy providers looking to balance environmental responsibility with economic viability. As per the Bhutan Energy Data Directory, in 2022, the coal sector exhibited distinct trends in production and imports. Sub-bituminous coal dominated production with a substantial volume of 133, 501.10 metric tons (MT) . On the import front, coke/semi-coke derived from coal led with 108, 998.06 MT, followed by sub-bituminous coal at 39, 389 MT, and other coal types at 14, 979.08 MT. Bituminous coal, uniquely, saw export activity amounting to 24.16 MT.

Regional Market Outlook

Region-wise, the biomass briquette market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, countries such as the U.S. and Canada have seen increasing adoption of biomass briquettes in response to growing environmental concerns and the need for renewable energy sources. These briquettes are used extensively in heating applications, particularly in residential and commercial sectors, as well as in some industrial processes. The supportive regulatory framework and emphasis on reducing carbon emissions have further boosted their usage in the region. Europe leads globally in the adoption of biomass briquettes, with countries such as Germany, Sweden, and Austria at the forefront. Biomass briquettes play a crucial role in achieving renewable energy targets set by the European Union. They are widely used in heating systems for homes, schools, and large-scale facilities. The region's focus on sustainable energy solutions and the availability of biomass resources contribute significantly to their widespread utilization. As per the European Commission, As regards heating and cooling, biomass fuels and bioliquids were used for the production of 17.3 million or mega tons of oil equivalent. (mtoe) of gross heat in the EU in 2021, notably using solid biomass (76.0%) , followed by renewable municipal waste (18.1%) and biogases (5.0%) . Solid biofuels (70.3%) represent the largest share of bioenergy, followed by liquid biofuels (12.9%) , biogas/ bio-methane (10.1%) and renewable share of municipal waste (6.6%) .

Asia-Pacific countries, including India, China, and Japan, have also embraced biomass briquette market trends as part of their renewable energy strategies. In rural areas, these briquettes are used for cooking and heating, offering an affordable and environmentally friendly alternative to conventional fuels like firewood and coal. Governments in the region are increasingly promoting biomass briquettes to address energy security and environmental challenges.

Competitive Analysis

Key market players in the biomass briquette market analysis across Radhe Industrial Corporation, C.F. Nielsen A/S, Jaykhodiyar, ECOSTAN, RUF US, Inc, Gattuwala, MaxTon Industrial Co., Ltd., WEIMA, VOTECS, and GROSS Apparatebau GmbH.

Industry Trends

- According to the International Energy Association, modern bioenergy stands as the leading renewable energy source worldwide, representing 55% of all renewable energy and over 6% of the global energy supply. Between 2010 and 2021, the adoption of modern bioenergy grew at an average annual rate of approximately 7%, and this trend continues to rise.

- In June 2023, Spain's Energy Ministry revealed an updated plan to significantly increase its biogas and green hydrogen production targets for 2030. The new objectives aim for 11 gigawatts (GW) of electrolyzer capacity, a substantial rise from the earlier target of 4 GW, and for biogas production to reach 20 terawatt hours (TWh) .

- In June 2023, the Victorian government in Australia announced an $8 million bioenergy fund, marking the state's largest investment in bioenergy to date. This fund, supporting 24 projects, aims to significantly enhance the region's bioenergy capacity. It will focus on converting farming and food production waste, such as cooking oil, dairy excess, and vegetable offcuts, into electricity, heat, gas, or liquid fuel.

- According to the U.S. Energy Information Administration, in March 2024, 76 manufacturers of densified biomass fuel were in operation, with a combined production capacity of 13.17 million tons per year and a total workforce equivalent to 2, 443 full-time employees. In March 2024, domestic sales of densified biomass fuel amounted to 0.05 million tons, with an average price of $218.92 per ton. Additionally, exports in the same month totaled 0.82 million tons, averaging $201.45 per ton.

Public Policies of Biomass Briquette

- Mandate for biomass co-firing in thermal power plants: The Indian government has mandated that all thermal power plants in the country use between 5-10% of biomass alongside coal to produce power. This policy, known as the 'national mission' on the use of biomass in coal-based power plants, was set up in May 2021 to reduce stubble burning and the carbon footprint of thermal power plants.

- Financial assistance for biomass briquette/pellet manufacturing: The Ministry of New and Renewable Energy (MNRE) provides central financial assistance (CFA) to support the setting up of biomass briquette/pellet manufacturing plants. The CFA is Rs. 9 lakh per MTPH (metric ton/hour) of manufacturing capacity, with a maximum of Rs. 45 lakhs per plant.

- Procurement provisions on government e-marketplace: A dedicated procurement provision for biomass category has been created on the Government e-Marketplace (GeM) portal to facilitate the purchase of biomass pellets by thermal power plants.

- State-level incentives: Some state governments such as Maharashtra provide up to 20% subsidy (max. Rs. 4 lakhs) on the cost of briquette/pellet machines to encourage entrepreneurs.

Key Sources Referred

- U.S. Department of Energy

- Ministry of New and Renewable Energy

- U.S. Energy Information Administration

- U.S. Energy Information Development

- United States Department of Agriculture

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomass briquette market analysis from 2024 to 2033 to identify the prevailing biomass briquette market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomass briquette market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomass briquette market trends, key players, market segments, application areas, and market growth strategies.

Biomass Briquette Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.9 Billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Jaykhodiyar, RUF US, Inc, WEIMA, MaxTon Industrial Co., Ltd., Radhe Industrial Corporation, VOTECS, Gattuwala, ECOSTAN, GROSS Apparatebau GmbH, C.F. Nielsen A/S |

| Other Key Market Players | Agropellets, West Oregon Wood Prod, Bayou Wood Pellets |

The global biomass briquette market was valued at $0.9 billion in 2023, and is projected to reach $1.9 billion by 2033, growing at a CAGR of 7.9% from 2024 to 2033.

Key market players in the biomass briquette market include Radhe Industrial Corporation, C.F. Nielsen A/S, Jaykhodiyar, ECOSTAN, RUF US, Inc, Gattuwala, MaxTon Industrial Co., Ltd., WEIMA, VOTECS, and GROSS Apparatebau GmbH.

Heating is the leading application of biomass briquette market.

Asia-Pacific is the largest region of biomass briquette market.

Surge in the use of co-firing biomass briquettes with coal in power plants is the upcoming trends of biomass briquette Market in the globe.

Loading Table Of Content...