Biomass Market Research, 2033

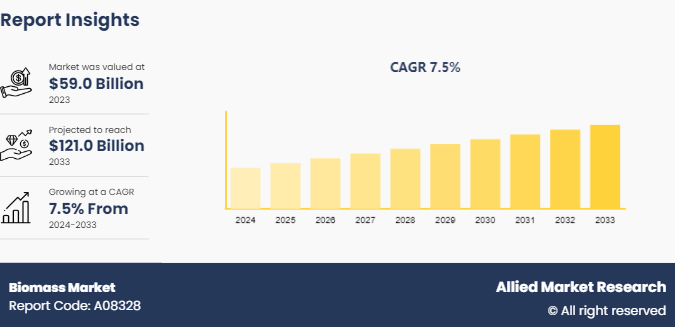

The global biomass market was valued at $59.0 billion in 2023, and is projected to reach $121.0 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

Market Introduction and Definition

Biomass refers to organic material derived from plants and animals that can be used to generate energy. This renewable resource can be utilized directly or through various conversion processes to produce biofuels, heat, and electricity. Biomass includes a wide range of materials such as wood, agricultural residues, animal waste, and dedicated energy crops such as switchgrass and miscanthus. It is considered a sustainable energy source because it can be replenished within a human lifetime and can potentially offset greenhouse gas emissions associate with fossil fuels.

One of the primary applications of biomass is in energy production. Biomass can be burned directly to produce heat or converted into biofuels such as ethanol and biodiesel. Thermal conversion processes like combustion, gasification, and pyrolysis transform biomass into energy-rich gases or liquids. These fuels can then be used to generate electricity or heat homes and businesses. Biomass power plants are increasingly being integrated into energy grids worldwide to diversify energy sources and reduce dependence on fossil fuels.

Biofuels derived from biomass, such as ethanol and biodiesel, play a crucial role in the transportation sector. Ethanol, typically made from corn or sugarcane, is blended with gasoline to reduce emissions and enhance octane ratings. Biodiesel, produced from vegetable oils or animal fats, can be used as a renewable substitute for diesel fuel. These biofuels offer a cleaner alternative to conventional fossil fuels and help mitigate environmental impacts associated with vehicle emissions.

Key Takeaways

- The biomass industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period in the biomass market report.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global biomass market statistics and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the biomass market size.

- The biomass market share is highly fragmented, with several players including Enviva, Drax Global, RWE, ANDRITZ, ENERGEX PELLET FUEL, INC., German Pellets GmbH, Viridis Energy Inc, Fram Fuels, Bioenergy International, and Verdo. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the biomass market growth.

Market Segmentation

The biomass market is segmented into type technology, application, end-use, and region. On the basis of type, the market is divided into solid, liquid, and gaseous. On the basis of technology, the market is classified into combustion, gasification, anaerobic digestion, and others. Based on application, the market is divided into, power generation, heat production, biofuels, and combined heat and power. By end-use, the market is categorized into residential, commercial, and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Increase in demand for renewable energy sources is expected to drive the growth of biomass market during the forecast period. Biomass offers a versatile solution to manage organic waste streams from agriculture, forestry, and municipal sources. This dual benefit of waste management and energy generation aligns with circular economy principles, further enhancing its appeal in sustainable development strategies worldwide. Innovations in biomass conversion technologies, such as advanced combustion, gasification, and biochemical processes, continue to improve efficiency and expand the range of biomass applications beyond traditional uses.

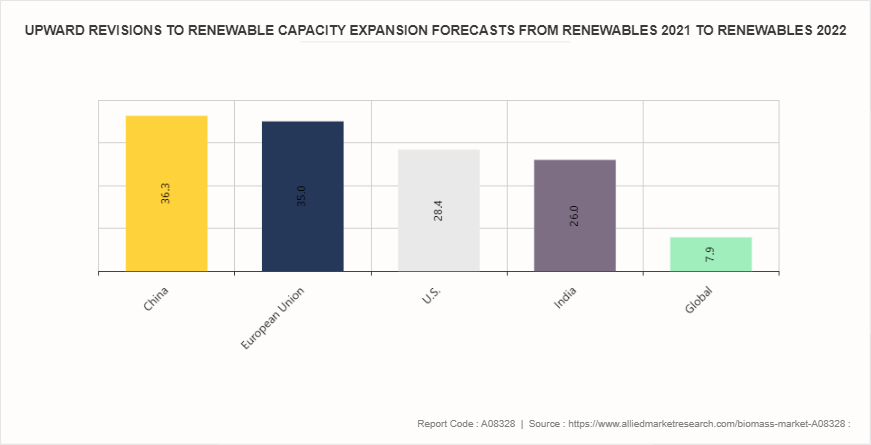

Government policies and regulatory frameworks also play a crucial role in fostering the expansion of the biomass market. Many countries have implemented supportive measures such as renewable energy targets, subsidies, tax incentives, and feed-in tariffs to encourage investment in biomass projects. These policies not only stimulate market demand but also create a favorable environment for innovation and technological advancements in biomass conversion technologies. As per the International Energy Administration, in 2023, global renewable energy capacity surged by nearly 50%, reaching around 510 gigawatts (GW) . This marked the fastest growth in two decades and continued a 22-year streak of record-setting expansions. Europe, the U.S., and Brazil saw unprecedented highs in renewable capacity additions. China's performance was exceptional, with solar photovoltaic (PV) installations matching the entire world's 2022 output and wind power growing by 66% compared to the previous year. Solar PV dominated globally, comprising three-quarters of all new renewable capacity.

However, seasonality and dependence on climate is expected to restraint the growth of biomass market during the forecast period. Seasonality and dependence on climate present significant restraints for biomass-based operations, impacting their reliability and economic viability across various sectors. Biomass feedstocks, including agricultural residues, forestry residues, and energy crops, are crucial sources for biomass conversion processes such as power generation, biofuels production, and bioproduct manufacturing. One of the primary issues stemming from seasonality is the irregularity in biomass availability throughout the year. Agricultural residues, such as crop stalks and husks, and forestry residues, such as branches and sawdust, are typically generated after harvesting seasons. Energy crops, like switchgrass and miscanthus, also follow growth cycles that depend heavily on climatic conditions like temperature and precipitation. As a result, biomass supply can experience fluctuations, leading to periods of abundance followed by scarcity. This variability complicates planning and operational scheduling for biomass facilities, affecting their ability to maintain consistent output levels and meet contractual obligations.

Furthermore, expansion into bioproducts and biochemicals is expected to offer lucrative opportunities in the biomass market forecast. Bioproducts and biochemicals derived from biomass present innovative solutions across various sectors, including agriculture, pharmaceuticals, materials science, and consumer goods. This diversification not only enhances the economic viability of biomass-based operations but also contributes to sustainable development goals by reducing dependency on fossil fuels and promoting circular economy principles. One of the primary opportunities presented by bioproducts and biochemicals is their potential to meet the growing global demand for sustainable alternatives to conventional products. Biomass-derived chemicals, such as organic acids, solvents, and bio-based polymers, offer environmentally friendly alternatives to petrochemical-based counterparts. These bio-based chemicals are often biodegradable, reducing environmental impacts and aligning with regulatory trends favoring sustainable practices. In February 2021, Hangzhou SciwindBiosciences Co. Ltd (Sciwind) secured $37 million in Series B funding from LYFE Capital. This investment is aimed at advancing research and development efforts focused on novel biologics targeting chronic metabolic and immunological diseases.

Competitive Analysis

Key market players in the biomass market overview includes Enviva, Drax Global, RWE, ANDRITZ, ENERGEX PELLET FUEL, INC., German Pellets GmbH, Viridis Energy Inc, Fram Fuels, Bioenergy International, and Verdo.

Industry Trends

- According to the International Renewable Association, in 2022, global installed bioenergy capacity reached approximately 148.9 GW, marking a 5% growth from the previous year. The adoption of modern bioenergy has shown consistent annual increases averaging around 7% from 2010 to 2021, highlighting a continuing upward trajectory in its adoption.

- In June 2023, Spain's Energy Ministry unveiled updated goals for 2030, significantly increasing ambitions in biogas and green hydrogen production. The revised plan now aims for 11 gigawatts (GW) of electrolyzers by 2030, up from the initial target of 4 GW. Additionally, biogas production targets have been raised to 20 terawatt hours (TWh) , reflecting a substantial expansion compared to previous projections.

- In June 2023, the Victorian government of Australia unveiled a substantial initiative with an USD 8 million bioenergy fund, marking the region's most extensive investment in bioenergy to date. This funding aims to enhance Victoria's bioenergy capabilities significantly. It supports 24 projects focused on converting agricultural and food production waste such ascooking oil, surplus dairy products, and vegetable trimmings into electricity, heat, gas, or liquid fuels, thereby promoting sustainable energy solutions.

- In May 2024, BASF introduced a pioneering line of biomass balanced products within its ammonia and urea portfolio. This innovative range includes ammonia anhydrous BMBcert, ammonia solution 24.5% BMBcert, urea prills BMBcert, urea solution 40% BMBcert, and urea solution 45% BMBcert. This initiative substantially reduces the carbon footprint of these products by at least 80% compared to conventional fossil ammonia derivatives.

Regional Market Outlook

Region-wise, biomass market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, biomass is extensively used for both energy production and industrial applications. The U.S. and Canada lead in biomass utilization, leveraging abundant agricultural residues, forest biomass, and dedicated energy crops like switchgrass. Biomass power plants and biofuel refineries are prominent, supported by government incentives and a strong research base focused on improving efficiency and sustainability.

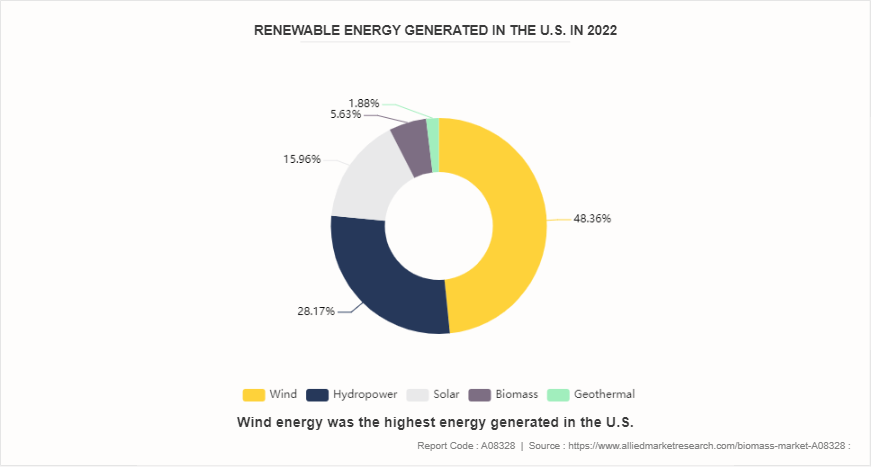

In Fiscal Year (FY) 2022, federal agencies utilized over 5.8 million megawatt-hours (MWh) of renewable electricity, accounting for 11% of their total electricity consumption. During the same period, federal agencies generated 784, 695 MWh of renewable electricity through on-site solar projects. The leading states for federal on-site solar energy generation were California (173, 927 MWh) , Hawaii (100, 517 MWh) , Georgia (65, 995 MWh) , Arizona (62, 916 MWh) , and Texas (50, 250 MWh) . According to Section 203 of the Energy Policy Act of 2005 (42 U.S.C. § 15852) , federal agencies are required to source at least 7.5% of their electricity from renewable sources annually, encompassing solar, wind, biomass, landfill gas, ocean, geothermal, municipal solid waste, and new hydroelectric generation capacity improvements.

Key Regulations Analysis of Biomass Market

The Energy Independence and Security Act of 2007 mandates replacing 36 billion gallons/year of transportation fuels with biofuels by 2022, with at least 16 bg/yr coming from cellulosic feedstock. The Energy Independence and Security Act of 2007 mandates that the U.S. replace 36 billion gallons per year of transportation fuels with biofuels by 2022, with at least 16 billion gallons coming from cellulosic feedstocks. This has driven increased demand for biomass as a renewable energy source.

The Biomass Research and Development Act of 2000 promotes the production and utilization of woody biomass through grants and other funding mechanisms. This legislation aims to support the development of biomass technologies and supply chains. The UK has a robust multi-tiered governance structure to ensure compliance with biomass sustainability criteria across various support schemes like the Renewables Obligation, Renewable Heat Incentive, and Green Gas Support Scheme.

Renewable Fuel Standard - EISA establishes a Renewable Fuel Standard (RFS) that requires fuel producers to use at least 36 billion gallons of biofuel by 2022, with at least 21 billion gallons coming from non-corn starch sources such as cellulosic biomass. This has driven increased demand for biomass feedstocks to produce biofuels.

Biomass Research and Development

Expert Imaging and Sound Association (EISA) amends the Biomass Research and Development Act of 2000 to include lifecycle greenhouse gas emissions and environmental impacts in the evaluation of biomass projects. This aims to promote the sustainable development of biomass energy.

Key Sources Referred

- The International Trade Administration

- Department of Energy

- U.S. Department of Commerce

- International Energy Agency

- National Renewable Energy Laboratory

- Biomass Power Association

- California Biomass Energy Alliance

- Algae Biomass Organization

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomass market analysis from 2024 to 2033 to identify the prevailing biomass market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomass market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomass market trends, key players, market segments, application areas, and market growth strategies.

Biomass Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 121.0 Billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | ENERGEX PELLET FUEL, INC., Viridis Energy Inc, Verdo, RWE, German Pellets GmbH, Enviva, Drax Global, Bioenergy International, Fram Fuels, ANDRITZ |

The global biomass market was valued at $59.0 billion in 2023, and is projected to reach $121.0 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

Asia-Pacific is the largest region of biomass market.

Expansion into bioproducts and biochemicals are the upcoming trends of biomass market in the globe.

Key market players in the biomass market include Enviva, Drax Global, RWE, ANDRITZ, ENERGEX PELLET FUEL, INC., German Pellets GmbH, Viridis Energy Inc, Fram Fuels, Bioenergy International, and Verdo.

Combined heat and power is the leading application of biomass market.

Loading Table Of Content...