Biomass Power Generation Market Research, 2033

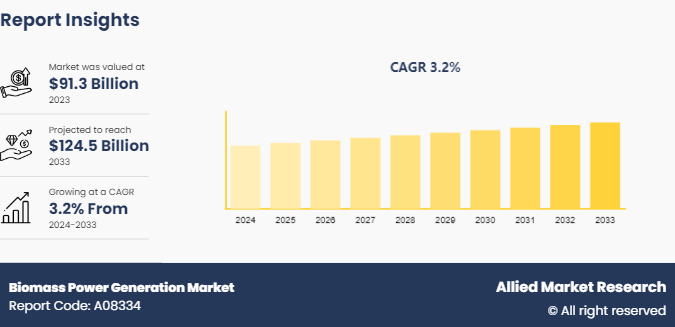

The global biomass power generation market size was valued at $91.3 billion in 2023, and is projected to reach $124.5 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Market Introduction and Definition

Biomass is a critical source for generating electricity. Biomass power plants function similarly to conventional coal-fired plants, where the biomass is burned to produce steam, which drives a turbine connected to an electricity generator. One significant advantage of biomass over fossil fuels is its potential for reducing greenhouse gas emissions, as the carbon dioxide released during biomass combustion is offset by the carbon dioxide absorbed by plants during their growth. This cycle can make biomass power generation nearly carbon-neutral, particularly when sustainable practices are employed.

Biomass is extensively used for producing heat, particularly in residential and commercial sectors. Wood pellets, chips, and logs are common forms of biomass used in heating systems, such as stoves and boilers. In industrial settings, biomass can replace conventional fuels in large-scale boilers and furnaces, providing an eco-friendly alternative for processing heat and steam. Biomass can be converted into liquid fuels, such as ethanol and biodiesel, which serve as alternatives to gasoline and diesel. These biofuels are primarily produced from crops such as corn, sugarcane, and soybeans, as well as from waste oils and fats. They play a crucial role in reducing dependence on fossil fuels in the transportation sector and contribute to lowering emissions from vehicles.

Anaerobic digestion of organic waste produces biogas, a mixture of methane and carbon dioxide. Biogas is used for heating, electricity generation, and as a vehicle fuel after purification. This process not only provides a renewable energy source but also helps manage waste effectively, reducing environmental pollution and producing nutrient-rich digestate as a by-product, which can be used as a fertilizer. In the agricultural sector, biomass power generation provides a way to manage waste while producing energy. Agricultural residues, such as crop stalks, husks, and animal manure, can be used to produce biogas through anaerobic digestion or can be directly combusted for heat and power. This reduces waste disposal issues and provides farmers with a sustainable energy source, enhancing rural energy security and economic development.

Key Takeaways

- The biomass power generation industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period in biomass power generation market statistics.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global biomass power generation market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the Biomass power generation market report.

- The biomass power generation market share is highly fragmented, with several players including Drax Global, ENGIE, Babcock & Wilcox Enterprises, Inc, Xcel Energy Inc., Ørsted A/S, Ameresco, Vattenfall AB, MITSUBISHI HEAVY INDUSTRIES, LTD., Sumitomo Corporation, and Hurst Boiler & Welding Co, Inc. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the biomass power generation market growth.

Market Segmentation

The biomass power generation market is segmented into feedstock, fuel, technology, and region. On the basis of feedstock, the market is divided into forest waste, agriculture waste, animal waste, and municipal waste. On the basis of fuel, the market is classified into solid, liquid, and gaseous. Based on technology, the market is divided into gasification, combustion, anaerobic digestion, and pyrolysis. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Advances in biomass conversion technologies are expected to drive the growth of biomass power generation market during the forecast period. Advances in biomass conversion technologies, including gasification, pyrolysis, and anaerobic digestion, represent pivotal innovations shaping the biomass power generation sector. These technologies are integral to improving efficiency, reducing costs, and broadening the scope of biomass feedstocks that can be effectively utilized. Gasification stands out as a transformative technology in biomass conversion. This process occurs in a controlled environment with limited oxygen, allowing to produce a cleaner fuel that can be used in various applications, including electricity generation, industrial heating, and biofuel production. The syngas produced through gasification can be further refined into higher-value fuels such as hydrogen or synthetic natural gas, offering versatility and flexibility in energy production. In June 2022, Shell PLC partnered with Tokyo Gas Co. and Osaka Gas Co. in a decarbonization initiative focused on natural gas. The collaboration includes plans for carbon capture, utilization, and sequestration (CCUS) projects. By 2030, Tokyo Gas and Osaka Gas aims to incorporate biomethane-based synthetic gas (syngas) to replace 1% of their current natural gas delivery.

In pyrolysis, biomass is heated in the absence of oxygen to break down organic matter into biochar, bio-oil, and syngas. This process enables the extraction of multiple products from biomass, each with distinct applications. Biochar, for instance, can be used as a soil amendment to enhance agricultural productivity and sequester carbon, contributing to both environmental sustainability and soil health improvement. Bio-oil derived from pyrolysis can be refined into transportation fuels or used as a precursor in the chemical industry, demonstrating the economic potential of pyrolysis technologies. In November 2023, BIOSORRA inaugurated a new biochar production facility in Thika, Kiambu County, Kenya. The biochar produced at this plant is slated for supply to Kenya Nut Company, a multinational agribusiness engaged in diverse agricultural production.

However, seasonal variability of biomass feedstocks is expected to restrain the growth of biomass power generation market during the forecast period. Seasonal variability in the availability of biomass feedstocks poses significant challenges to the reliability and stability of biomass power generation. This variability is primarily influenced by agricultural and forestry cycles, which dictate the availability of crop residues, forestry residues, and other organic materials used as biomass feedstocks. For example, crop residues such as corn stover and wheat straw are typically available after harvest seasons, resulting in periodic spikes in biomass availability. Similarly, forestry residues such as wood chips and sawdust can be influenced by logging activities and forest management practices, which vary seasonally. The impact of seasonal variability extends beyond mere availability to affect the planning and operational efficiency of biomass power plants. During peak biomass availability periods, power plants may experience surplus feedstock, potentially leading to storage challenges or lower utilization rates if plant capacities are not scalable or flexible.

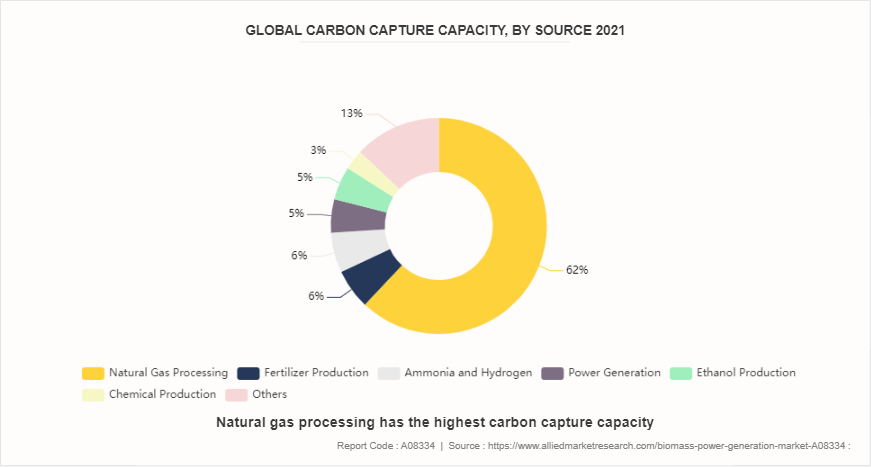

Moreover, increase in demand for bioenergy with carbon capture and storage (BECCS) is expected to offer lucrative opportunities in the biomass power generation market forecast. BECCS can play a pivotal role in decarbonizing hard-to-abate sectors such as heavy industry and transportation, where direct emissions reductions are particularly challenging. By utilizing biomass feedstocks such as agricultural residues, forestry wastes, and dedicated energy crops, BECCS can provide a reliable source of renewable energy while simultaneously sequestering CO2 emissions. According to IEA, in 2023, In 2023, the operational capacity of Carbon Capture and Storage (CCS) totaled 22 million metric tons of CO2 per year. Among the sectors utilizing CCS, natural gas processing and LNG led with the largest share, accounting for approximately 60% of the total capacity, equivalent to 13.1 million metric tons of CO2 per year. Following this, fuel transformation sectors held an 18% share, with a capacity of 3.9 million metric tons of CO2 per year. The scalability of BECCS also presents an opportunity for biomass power generation. As technological advancements continue to improve the efficiency and cost-effectiveness of carbon capture and storage systems, BECCS deployment can be scaled up to industrial levels. This scalability is crucial for integrating BECCS into existing energy infrastructure and ensuring its widespread adoption across different regions and sectors.

Competitive Analysis

Key market players in the biomass power generation market include Drax Global, ENGIE, Babcock & Wilcox Enterprises, Inc, Xcel Energy Inc., Ørsted A/S, Ameresco, Vattenfall AB, MITSUBISHI HEAVY INDUSTRIES, LTD., Sumitomo Corporation, and Hurst Boiler & Welding Co, Inc.

Regional Market Outlook

Region-wise, the biomass power generation market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The U.S., with its vast agricultural landscape, produces significant amounts of biomass from forest residues, agricultural waste, and dedicated energy crops. As per the Biomass Research and Development Initiative (BRDI) and incentives such as the Renewable Electricity Production Tax Credit (PTC) have fostered growth in this sector. In 2023, biomass power accounted for about 1.4% of total U.S. electricity generation. Key projects include the Gainesville Renewable Energy Center in Florida and the Domtar Biomass Plant in South Carolina. Canada follows a similar path, with substantial contributions from forest biomass, given its expansive forest cover. Biomass power is particularly significant in provinces like British Columbia and Ontario. Policies like the Renewable Energy Standard Offer Program (RESOP) have encouraged the development of biomass facilities.

Asia-Pacific presents a diverse landscape for biomass power generation, with significant developments in countries such as China, India, and Japan. China, facing severe air pollution and energy security issues, has invested heavily in biomass power as part of its renewable energy strategy. The country’s 13th Five-Year Plan emphasized biomass development, resulting in numerous biomass power plants using agricultural residues and municipal solid waste. By 2023, China had an installed biomass power capacity of over 20 GW. As per the Ministry of New and Renewable Energy, India's biomass power capacity stood at around 9 GW in 2023, with states like Punjab, Haryana, and Maharashtra leading the efforts.

Industry Trends

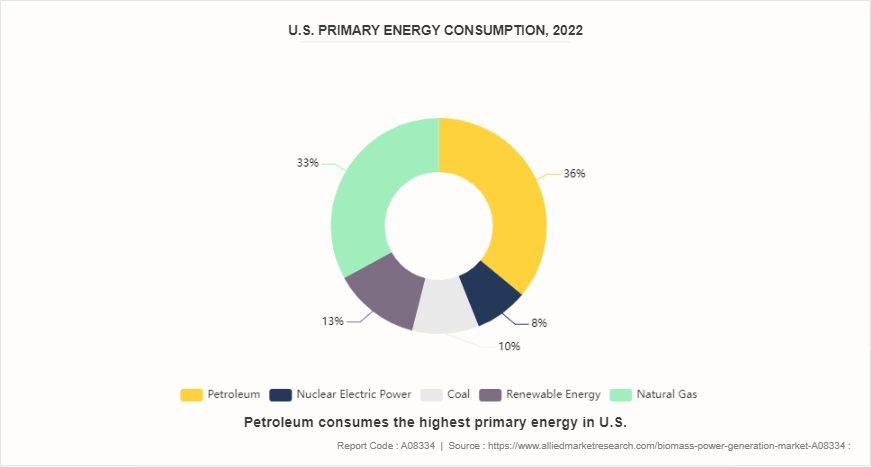

- As per the U.S. Energy Information Administration, in 2022, biomass accounted for 5% of total U.S. primary energy consumption, equal to about 4, 930 trillion British thermal units (TBtu) (or 4.9 quadrillion Btu) . In 2022, biomass provided nearly 5% of total primary energy use in the U.S.

- According to REN21, in 2022, electricity generation from various biomass feedstocks reached 672 terawatt-hours (TWh) , accounting for 2.4% of the total global electricity generation. The total installed bio-power capacity for that year was 149 gigawatts (GW) .

- In Europe, bio-power generation from solid biofuels (excluding charcoal) increased by 12% in 2021, reaching 93 TWh. Importantly, 87% of this power complied with EU sustainability criteria, and 96.5% of the solid biomass used was sourced from within Europe. Finland, Sweden, and Germany were the leading producers, contributing to 37% of the region's total production in 2021.

- According to the Energy Institute Statistical Review of World Energy 2023, coal-fired thermal power plants maintained their position as the leading source of global electricity generation in 2022. Coal's share of total power generation increased to 35.37% from 35.1% in 2020, with a total output of 10, 317.2 terawatt-hours (TWh) in 2022.

- In July 2022, Dubai Electricity and Water Authority (DEWA) revealed plans to advance 4 gigawatts (GW) of renewable energy projects through Independent Power Producers (IPP) , with a projected investment exceeding AED 40 billion. Central to these initiatives is the development of the Mohammed bin Rashid Al Maktoum Solar Park, aiming to achieve a capacity of 5, 000 megawatts (MW) by 2030.

Historic Trends of Biomass Power Generation Market

- Public Utility Regulatory Policies Act (PURPA) of 1978 played a significant role in promoting renewable energy development in the United States. PURPA required utilities to purchase power from small independent producers, which included renewable energy sources like biomass. This act aimed to diversify energy sources and encourage energy conservation and the development of renewable energy technologies.

- In the 1990s the adoption of biomass power in Europe during this period. Environmental regulations and incentives played a significant role in this growth. Countries like Sweden and Denmark were at the forefront, investing in biomass power to diversify their energy sources and reduce greenhouse gas emissions.

- The Kyoto Protocol was adopted in 1997 and it aimed to reduce greenhouse gas emissions, which in turn promoted the use of renewable energy sources, including biomass. This international treaty played a significant role in encouraging countries to invest in and develop renewable energy technologies.

- In 2015s, rapid expansion of biomass power in Asia, particularly in countries such as China and India. Development of advanced biomass conversion technologies such as gasification and anaerobic digestion.

Key Sources Referred

- Department of Energy

- The International Trade Administration

- National Renewable Energy Laboratory

- Algae Biomass Organization

- International Energy Agency

- U.S. Department of Commerce

- Biomass Power Association

- California Biomass Energy Alliance

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomass power generation market analysis from 2024 to 2033 to identify the prevailing biomass power generation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomass power generation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomass power generation market trends, key players, market segments, application areas, and market growth strategies.

Biomass Power Generation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 124.5 Billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Feedstock |

|

| By Fuel |

|

| By Technonolgy |

|

| By Region |

|

| Key Market Players | Hurst Boiler & Welding Co, Inc, Xcel Energy Inc., Ørsted A/S, Babcock & Wilcox Enterprises, Inc, Drax Global, Sumitomo Corporation, Ameresco, ENGIE, MITSUBISHI HEAVY INDUSTRIES, LTD., Vattenfall AB |

Key market players in the biomass power generation market include Drax Global, ENGIE, Babcock & Wilcox Enterprises, Inc, Xcel Energy Inc., Ørsted A/S, Ameresco, Vattenfall AB, MITSUBISHI HEAVY INDUSTRIES, LTD., Sumitomo Corporation, and Hurst Boiler & Welding Co, Inc.

The global biomass power generation market was valued at $91.3 billion in 2023, and is projected to reach $124.5 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Asia-Pacific is the largest region for biomass power generation

Agriculture waste is the leading of biomass power generation market.

Increase in demand for bioenergy with carbon capture and storage (BECCS) are the upcoming trends of biomass power generation market in the globe.

Loading Table Of Content...