Biomedical Refrigerators And Freezers Market Research, 2033

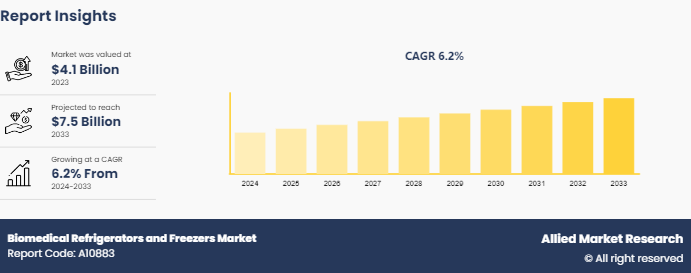

The global biomedical refrigerators and freezers market was valued at $4.1 billion in 2023, and is projected to reach $7.5 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033. The growth of the biomedical refrigerators and freezers market is driven by rising demand for biopharmaceuticals, vaccines, and blood products, coupled with advancements in biotechnology and life sciences research. Increasing government support for healthcare infrastructure, the growing need for secure storage of sensitive biological materials, and stringent regulations regarding temperature-sensitive pharmaceuticals further boost the market. Additionally, the expansion of clinical trials and the surge in organ transplant procedures contribute to the demand for reliable refrigeration and freezing solutions.

Market Introduction and Definition

Biomedical refrigerators and freezers are specialized equipment designed to store sensitive biological materials, such as vaccines, blood, tissues, and pharmaceuticals, at precise temperatures to ensure their safety and effectiveness. These units play a crucial role in hospitals, research laboratories, blood banks, and pharmacies by maintaining a controlled environment for temperature-sensitive substances. Available in various sizes and temperature ranges, biomedical refrigerators and freezers are equipped with advanced features like alarms, temperature monitoring systems, and energy-efficient technology to meet regulatory standards and ensure optimal storage conditions.

Key Takeaways

- The biomedical refrigerators and freezers market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major biomedical refrigerators and freezers industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to biomedical refrigerators and freezers market forecast analysis, the key factors driving the growth of the market are rising demand for the safe storage of biological products, increasing R&D activities in life sciences, and the increasing need for effective temperature-sensitive storage solutions in healthcare and life sciences sectors.

The expansion of biobanks and blood banks is a significant driver for the growth of the biomedical refrigerators and freezers market. According to the Biobank Resource Centre, as of 2023, there are 340 registered biobanks globally. Biobanks play a crucial role in storing biological samples, such as blood, tissues, and DNA, for research and clinical purposes. As the focus on personalized medicine, genomics, and population health studies increases, biobanks are expanding rapidly to support these growing fields. This expansion requires specialized storage solutions to maintain the integrity of samples, driving demand for advanced biomedical refrigeration systems. Similarly, blood banks need reliable refrigeration to preserve blood and blood components for transfusions. The rising demand for blood and plasma, particularly in emergencies and surgeries, along with the need to maintain strict temperature control to ensure product safety, further boosts the need for biomedical refrigerators and freezers.

The increasing research and development (R&D) activities in life sciences are a major driver for the growth of the biomedical refrigerators and freezers market. According to the FDA, as of 2023, 29 cell and gene therapies have been approved. Pharmaceutical and biotechnology companies, as well as academic and research institutions, are intensifying their R&D efforts in areas such as drug discovery, genetics, and molecular biology. These activities often involve the use of sensitive biological samples, reagents, vaccines, and cell cultures that require precise temperature-controlled storage to maintain their stability and effectiveness. Biomedical refrigerators and freezers are essential in these settings to ensure the safe preservation of these materials, especially as the complexity of experiments and the need for reproducibility in research outcomes increase. Furthermore, the surge in biopharmaceuticals and clinical trials for new therapies, including the development of personalized medicine and biologics, demands advanced cold storage solutions.

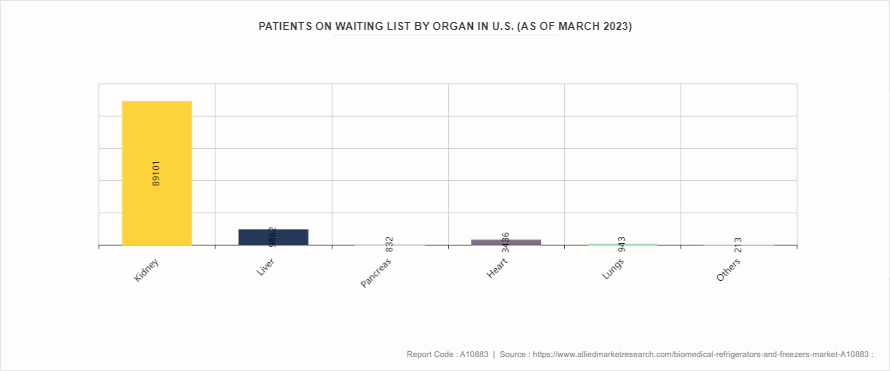

Organ Transplantation Statistics

The rise in organ transplantation is a significant driver for the biomedical refrigerators and freezers market due to the increasing demand for proper storage and preservation of organs, tissues, and other biological materials. As the number of organ transplants grows worldwide, driven by advancements in medical technology and rising awareness about organ donation, the need for reliable cold storage solutions becomes critical. Biomedical refrigerators and freezers play a vital role in maintaining the viability of organs before transplantation by ensuring precise temperature control and storage conditions. This surge in transplant procedures, alongside stringent regulations regarding organ preservation, has fueled the demand for advanced storage equipment in hospitals, laboratories, and transplant centers, boosting the biomedical refrigerators and freezers market growth.

Market Segmentation

The biomedical refrigerators and freezers market is segmented on the basis of product, end user, and region. By product, the market is classified into in plasma freezers, blood bank, refrigerators, lab refrigerators, lab freezers, ultra-low temperature freezers, and shock freezers. By end user, the market is divided into hospitals, research laboratories, pharmacies, diagnostic centers, blood banks and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the biomedical refrigerators and freezers market share in 2023. North America, particularly the U.S., has well-established healthcare system with advanced medical facilities, research institutions, and a high concentration of pharmaceutical and biotechnology companies. This infrastructure drives the demand for biomedical refrigeration solutions to store sensitive biological samples, vaccines, and pharmaceuticals. Significant investments in research and development activities in the life sciences, pharmaceuticals, and biotechnology sectors contribute to the high demand for biomedical refrigerators and freezers. These facilities require reliable storage solutions to ensure the integrity of sensitive samples during experimentation and testing.

However, Asia-Pacific region is expected to register highest CAGR. This is attributed to the fact that many countries in Asia-Pacific, particularly China and India, are experiencing rapid growth in their healthcare sectors. Increased investments in healthcare infrastructure, including hospitals and laboratories, are driving demand for biomedical storage solutions. The biopharmaceutical industry is expanding in Asia-Pacific, with several companies focusing on research and development of biologics and biosimilars. This growth necessitates efficient and reliable storage solutions for sensitive products, boosting the demand for biomedical refrigerators and freezers.

- According to National Library of Medicine, about 17, 000 to 18, 000 solid organ transplants are performed every year in India, the most in the world after the U.S. and China.

- According to American Kidney Fund, there were about 135, 000 Americans newly diagnosed with kidney failure in 2021.

- The University of Graz hosts one of the largest biosample repositories in Europe, holding around 20 million samples of many different tissue types.

Industry Trends

- According to The Society for Assisted Reproductive Technology, it was reported that the egg freezing cycle increased by 31% from 2020 to 2021 in the U.S.

- According to the Biobank Resource Center, as of 2023, there are 340 registered biobanks, including both Canadian and international biobanks.

- According to Health Resource and Service Administration, in 2023, it was reported that the donor registry contains more than 9 million potential donors in the U.S.

- According to Regulatory Affairs Professionals Society, in 2021, there were around 2, 754 clinics engaged in providing stem cell therapies

Competitive Landscape

Biomedical refrigerators and freezers market report summarizes top key players overview as Panasonic Healthcare Corporation, Haier Biomedical, Eppendorf AG, Power Scientific, Inc., Aegis Scientific, Inc., Follett LLC, Helmer Scientific, Thermo Fisher Scientific, NuAire, Inc and Azbil Corporation. Other players in the biomedical refrigerators and freezers market are Follett Products, LLC, and Helmer Scientific Inc.

Recent Key Strategies and Developments

- In February 2024, Helmer Scientific GX Solutions ultra-low temperature freezers were certified ENERGY STAR certification by the U.S. Environmental Protection Agency (EPA) for the category High-Performance Laboratory Grade Freezer) .

- In October 2023, Haier Biomedical announced the introduction of the efficient TwinCool Frequency Conversion ULT Freezers, which are designed for clinical research, pharmaceutical, and public health laboratories to help keep samples safe and secure with minimal environmental impact.

- In January 2022, B Medical Systems inaugurated its new Indian manufacturing facility in Mundra, Gujarat, to cater to the demands for biomedical refrigerators and freezers in the country.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biomedical refrigerators and freezers market analysis from 2024 to 2033 to identify the prevailing biomedical refrigerators and freezers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biomedical refrigerators and freezers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biomedical refrigerators and freezers market trends, key players, market segments, application areas, and market growth strategies.

Biomedical Refrigerators and Freezers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 7.5 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Power Scientific, Inc, Helmer Scientific, Azbil Corporation, Aegis Scientific, Inc, Eppendorf AG, Follett LLC, Thermo Fisher Scientific, Panasonic Healthcare Corporation, NuAire, Inc., Haier Biomedical |

The forecast period for biomedical refrigerators and freezers Market is 2024-2033.

The total market value of biomedical refrigerators and freezers Market is $4.1 billion in 2023

The market value of biomedical refrigerators and freezers Market is projected to reach $7.5 billion by 2033

The base year is 2023 in biomedical refrigerators and freezers Market

Major key players that operate in the biomedical refrigerators and freezers Market are Panasonic Healthcare Corporation, Haier Biomedical, Eppendorf AG, Power Scientific, Inc., Aegis Scientific, Inc., Follett LLC, Helmer Scientific, Thermo Fisher Scientific.

Loading Table Of Content...