Biometric Banking Market Research, 2032

The global biometric banking market was valued at $5 billion in 2022, and is projected to reach $23.6 billion by 2032, growing at a CAGR of 17.2% from 2023 to 2032.

Biometrics is an automated method of identifying customers with the help of biological characteristics and traits like iris, voice recognition, and fingerprints. This characteristic is unique for every individual and not easy to forge into. This technology is rising as an advanced layer to many personal and enterprise security systems.

The increase in security and reduced identity fraud are key drivers for the growth of biometric device for banking. The banking sector is quickly adopting biometric authentication as it offers more secure identity verification procedures. For user authentication, this technology makes use of physical traits like facial recognition, fingerprint scanning, voice recognition, and retinal scanning.

Moreover, biometric use in banking methods offer a great advantage to customers when compared to traditional banking processes in terms of time saved. In addition, the increase in mobile banking and contactless payments and biometric authentication addresses consumers’ key requirements of convenience are the major driving factors for biometric banking market. However, the security concerns and high implementation cost are major factors that hamper the growth of biometric banking market. Integrating biometric solutions into existing banking infrastructure is complex and requires significant investment. Compatibility issues and interoperability challenges may arise during the implementation process.

Furthermore, high implementation costs make biometric authentication solutions less accessible to smaller banks or institutions with limited financial resources. On the contrary, the significant adoption of artificial intelligence (AI) and machine learning (ML) presents a significant opportunity for the biometric banking industry. Machine learning algorithms help to adopt user behavior, increasing accuracy and efficiency. Moreover, advancements in biometric sensors and algorithms lead to greater accuracy and reliability in biometric authentication.

The report focuses on growth prospects, restraints, and trends of the biometric banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the biometric banking market.

Segment Review

The biometric banking market is segmented on the basis of component, type, end user, and region. On the basis of component, it is divided into hardware, software, and service. By type it is categorized into fingerprint, facial recognition, hand geometry, iris recognition, and others. On the basis of end user, it is classified into retail, government, transportation, healthcare hospitality, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

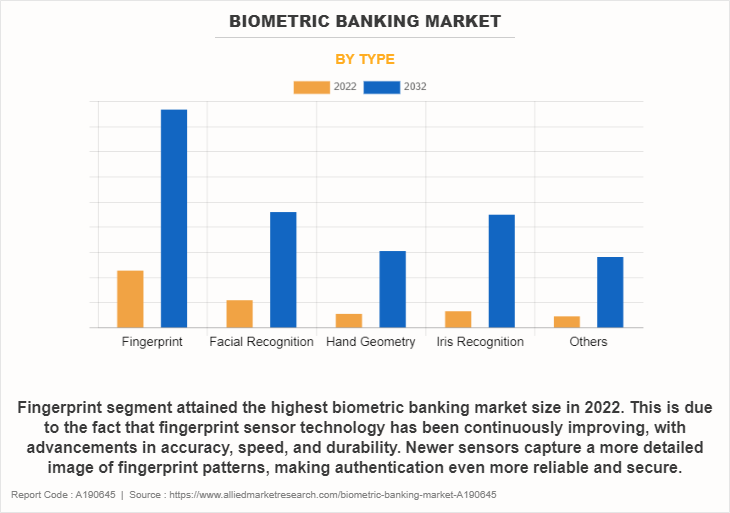

On the basis of type, the fingerprint segment attained the highest biometric banking market size in 2022. This is due to the fact that fingerprint sensor technology has been continuously improving, with advancements in accuracy, speed, and durability. Newer sensors capture a more detailed image of fingerprint patterns, making authentication even more reliable and secure.

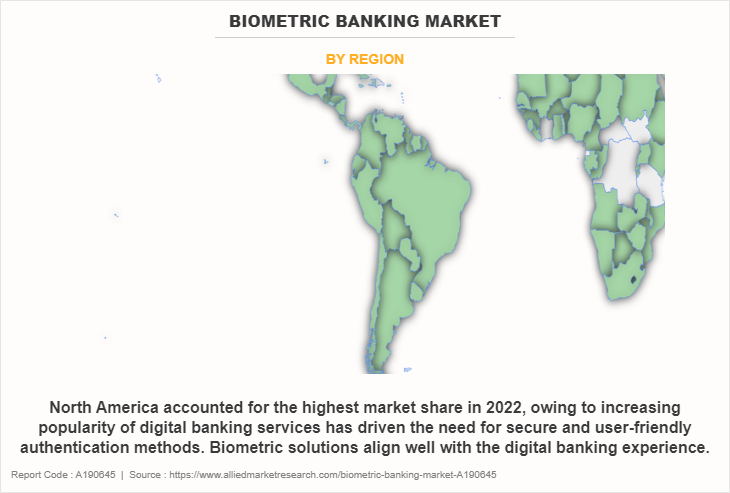

On the basis of region, North America held the highest biometric banking market share in 2022. Owing to increasing popularity of digital banking services has driven the need for secure and user-friendly authentication methods. Biometric solutions align well with the digital banking experience.

The report analyzes the profiles of key players operating in the biometric banking market such as Charles Schwab and Co., Visa, Inc, JPMorgan Chase & Co, Diebold Nixdorf, Incorporated., NEC CORPORATION, IDEMIA, Infineon Technologies AG, IDEX Biometrics ASA, Synaptics Incorporated, and Axon. These players have adopted various strategies to increase their market penetration and strengthen their position in the biometric banking market.

Market Landscape and Trends

Biometric authentication methods such as fingerprint scanning, facial recognition, iris scanning, and voice recognition have gained traction in the banking sector boosting the growth of biometric banking market. They offer enhanced security and convenience for customers during login, transactions, and account access.

Moreover, the widespread use of smartphones equipped with biometric sensors such as fingerprint scanners/facial recognition cameras has enabled biometric banking. As users get used to using biometrics to unlock devices and receive biometric authentication tom for financial services. In addition, banks and financial institutions are adopting innovative security technologies that are compliant with regulatory guidelines, secure, cost-effective, and help in improving customer satisfaction. Biometric technology integrated with an existing security system is helping in empowering banks in deploying a high level of security. this factor notably contributes towards the growth of biometric banking market.

Furthermore, facial biometrics offer an easy, secure way for customers to open a bank account. To successfully complete KYC and anti-money laundering (AML) compliance requirements, banks have to take certain risk assessment and security measures to verify customer identities at account opening. Thus, facial recognition helps in doing that without visiting the branch or in-person meetings for users and officials. Therefore, the biometric banking industry is constantly evolving, with new trends emerging as technology advances.

Top Impacting Factors

Increase in Mobile Banking and Contactless Payments

The rise in mobile banking and contactless payments has positively impacted the financial industry, driving changes in consumer behavior, and technological advancements of banking and payments. Furthermore, growth in mobile banking and contactless payments has increased the need for secure authentication methods benefiting the growth of biometric banking market. As more financial transactions are conducted remotely via mobile phones, biometric technologies such as fingerprint, face and voice recognition provide a higher level of security than traditional PINs or passwords and help secure biometric identities. This verification allows only authorized users to access the account and make transactions. In addition, biometric authentication adds an extra layer of security by tracking a person’s physical and behavioral uniqueness, making it harder for unauthorized users to access accounts or engage in fraudulent transactions. Therefore, these factors are driving the growth of the biometric banking market.

Increases Security and Reduces Identity Fraud

The banking sector has adopted biometric authentication as it offers more secure identity verification procedures. For user authentication, this technology makes use of physical traits like facial recognition, fingerprint scanning, voice recognition, and retinal scanning. Moreover, biometric use in banking methods offer a great advantage to customers when compared to traditional banking processes in terms of time saved. In addition, banks that employ these forms of identification reduce the need for manual reviews and investigations, subsequently increasing their operational efficiency. Furthermore, biometric system provides real-time authentication, allowing banks to identify suspicious activities and potential fraud attempts as they occur, helping to prevent financial losses. Therefore, these factors are projected to further foster the growth of biometric banking market.

Rise in Demand for Convenience

Biometric authentication addresses consumers’ key requirements of convenience, speed, and security. It removes the need to memorize passwords or PINs, thereby ensuring high levels of convenience. A swift fingerprint tap is all that is required to prove an individual’s identity, which is much more secure than just tapping a card. Moreover, the uniqueness of human biometric features renders them resistant to imitation, bolstering the security and integrity of biometric-based authentication. In addition, biometric authentication resonates with tech-savvy consumers who appreciate innovative and cutting-edge solutions. The adoption of biometrics attracts a tech-savvy demographic and position banks as forward-thinking institutions. For instance, in April 2023, City Union Bank Limited (CUB) launched a facility through which customers now use Voice biometric authentication for logging into the mobile banking app, aimed at improving security. Therefore, these strategies are projected to further foster the growth of biometric banking market.

Security Concerns and High Implementation Cost

Biometric systems are vulnerable to spoofing attacks where attackers use fake biometric samples to gain unauthorized access. Implementing anti-spoofing measures such as liveness detection and multi-modal authentication mitigate this risk. Moreover, biometric information is considered highly personal and sensitive. Ensuring compliance with data protection regulations and obtaining user consent for data collection and usage are vital to maintaining user trust. In addition, integrating biometric solutions into existing banking infrastructure is complex and require significant investment. Compatibility issues and interoperability challenges may arise during the implementation process. Furthermore, high implementation costs make biometric authentication solutions less accessible to smaller banks or institutions with limited financial resources. This could create a divide between larger and smaller players. Therefore, these factors are anticipated to restrict the growth of the biometric banking market.

Technological Advancements

The rapid adoption of artificial intelligence (AI) and machine learning (ML) is transforming the biometric banking market. Machine learning algorithms automatically adapt to user behavior, improving accuracy and efficiency. Furthermore, advances in biometric sensors and algorithms are leading to greater accuracy and reliability in biometric authentication. In addition, improvements in biometric sensors and algorithms are enhancing the precision and dependability of biometric authentication. For instance, in December 2020, Nuance Communications, Inc. partnered with Industrial Bank of Korea (IBK), in which they deployed its market-leading voice biometrics technology to create the banking industry's first biometrics solution for video calls. Leveraging Nuance AI, IBK protected more than 100,000 customers from falling victim to fraud by automatically authenticating their identities during both video and phone conversations. Therefore, these strategies are expected to further foster the growth of biometric banking market.

Growth in Emerging Economies

The rapid growth of banking services in emerging economies presents a significant opportunity for biometric technology. These regions have a large unbanked population, and biometrics enable secure and accessible financial services for these individuals. Moreover, biometric authentication plays a crucial role in expanding financial inclusion in emerging economies. Many individuals in these regions lack traditional identification documents, however, there are unique biometric characteristics that be used to verify identity. Furthermore, governments and regulators in emerging markets are focusing on financial inclusion as part of their policy objectives. Biometric authentication achieves these goals by providing a secure and convenient way for individuals to access financial services. Moreover, as the technology becomes more widespread in emerging economies, awareness and education regarding biometric authentication facilitates its adoption among the society and hence this development is expected to further boost the biometric banking market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biometric banking market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of biometric banking market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biometric banking market segmentation assists in determining the prevailing biometric banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global biometric banking market trends, key players, market segments, application areas, and market growth strategies.

Biometric Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23.6 billion |

| Growth Rate | CAGR of 17.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 442 |

| By Component |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Synaptics Incorporated, Axon, IDEX Biometrics ASA, NEC CORPORATION, Visa, Inc, Diebold Nixdorf, Incorporated., Charles Schwab and Co., JPMorgan Chase & Co, Infineon Technologies AG, IDEMIA |

Analyst Review

As per the insights of the top-level CXOs, IoT testing includes functional and integration testing relevant to the specifics of distributed architectures, performance testing to check how the app handles large volumes of streaming data, security testing at the application, gateway, and IoT device levels. The availability of highly reliable internet access and the quick adoption of interconnected devices in manufacturing industries also contribute to the market's growth. Significant R&D expenditures are being made to enhance the necessary network connectivity infrastructure and IoT testing technologies & services, which support the market shares. In addition, smart devices and IoT in the retail sector help companies enhance the customer experience to drive more conversions, altering the day-to-day store operations and increasing the managed services in this sector. Furthermore, Managed IoT testing service providers see emerging technology as a significant business opportunity for the next few years. Among managed IoT testing services, security testing will have a more substantial market share than other testing services.

The CXOs further added that market players are adopting strategies such as acquisition for enhancing their services in the market and improving customer satisfaction. For instance, in March 2023, Rapid7 Inc. acquired Minerva Labs, a leading provider of anti-evasion and ransomware prevention technology. Customers accessed enhanced detection and response capabilities across their cloud, on-premises, and extended attack surfaces with Rapid7 Managed Detection and Response (MDR) services. With this acquisition, Rapid7 aims to organize enhanced ransomware prevention, further enhancing its industry-leading managed threat detection capabilities. Customers will be able to further consolidate their security investments. This strategy was implemented to strengthen Rapid7 Inc. position in the IoT testing market. Therefore, such strategies are expected to boost the growth of the IoT testing market in the upcoming years.

Moreover, some of the key players profiled in the report are AFour Technologies, Apica, Novacoast, Inc., Capgemini SE, Happiest Minds, HCL Technologies Limited, Infosys, Keysight Technologies, Praetorian, and Rapid7. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The biometric banking market is estimated to grow at a CAGR of 17.2% from 2023 to 2032.

The biometric banking market is projected to reach $23.57 billion by 2032.

Increase in mobile banking and contactless payments, increases security and reduces identity fraud, and rise in demand for convenience contribute towards the growth of the market.

The key players profiled in the report include biometric banking market analysis includes top companies operating in the market such as Charles Schwab and Co., Visa, Inc, JPMorgan Chase & Co, Diebold Nixdorf, Incorporated., NEC CORPORATION, IDEMIA, Infineon Technologies AG, IDEX Biometrics ASA, Synaptics Incorporated, and Axon.

The key growth strategies of biometric banking players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...