Biopharma Plastics Market Research, 2032

The global biopharma plastics market was valued at $5 billion in 2022 and is projected to reach $14.9 billion by 2032, growing at a CAGR of 11.6% from 2023 to 2032.

Report Key Highlighters:

- The biopharma plastics market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The biopharma plastics market is highly fragmented, with several players including BASF SE, SABIC, DOW Inc, Covestro AG, Formosa Plastics Corporation, Solvay, TORAY INDUSTRIES, INC., LyondellBasell Industries Holdings B.V., Mitsui & Co. Plastics Ltd, and INEOS Group.

Biopharma plastics refer to a specialized category of substances used in the biopharmaceutical and clinical industries due to their unique properties and suitability for functions involving drugs, scientific devices, and biotechnology processes. These plastics are designed to meet stringent requirements such as biocompatibility, chemical resistance, and sterility, ensuring they do not interact with or contaminate sensitive biopharmaceutical products.

Some frequently used biopharma plastics include polyethylene, polypropylene, polyvinyl chloride (PVC), polyethylene terephthalate (PET), and polycarbonate. These materials offer excellent durability, transparency, and ease of molding, making them perfect for the manufacturing of vials, syringes, IV bags, and quite a number of scientific devices. Additionally, biopharma plastics play an imperative role in safeguarding drug efficacy, decreasing the risk of contamination, and ensuring the average safety and efficacy of biopharmaceutical products, making them necessary in modern-day healthcare practices.

The expansion of the biopharmaceutical manufacturing sector is a significant driving factor for the increase of the biopharma plastics market.

As the demand for biopharmaceutical products, such as vaccines, therapeutic proteins, and monoclonal antibodies, continues to rise, the want for advanced and specialized plastic materials in the manufacturing process also increases. Biopharma plastics play a crucial role in a number of degrees of biopharmaceutical production, consisting of single-use systems, bioreactors, filtration systems, and packaging materials. These plastics offer vital houses such as biocompatibility, chemical resistance, and sterilization capabilities, making sure the integrity and security of the tablets in the course of manufacturing and storage.

Moreover, the expansion of the biopharmaceutical manufacturing sector is driven by factors such as technological advancements, increasing investments in R&D, and growing demand for personalized medicine. Additionally, the COVID-19 pandemic has similarly highlighted the significance of the biopharmaceutical industry, ensuing in large investments in vaccine improvement and production. This has led to an increased demand for biopharma plastics, as they are fundamental elements in the manufacturing of vaccines and other biopharmaceutical products.

The growing demand for sustainable packaging will drive the biopharma plastics market.

As environmental concerns become increasingly prominent, the need for eco-friendly and recyclable materials has intensified across various sectors, including healthcare. Biopharma plastics, with their unique properties and capabilities, have emerged as a viable and sustainable alternative for packaging pharmaceutical products. Traditional packaging materials, such as single-use plastics and non-recyclable materials, have raised environmental issues and regulatory scrutiny. In response, pharmaceutical companies are actively seeking sustainable packaging solutions that minimize their carbon footprint and reduce waste generation. Biopharma plastics, being biodegradable and recyclable, offer a compelling choice for pharmaceutical packaging applications.

Moreover, sustainable packaging aligns with the broader sustainability goals of pharmaceutical companies, enabling them to showcase their commitment to environmentally responsible practices. The adoption of biopharma plastics can help pharmaceutical manufacturers enhance their brand image and appeal to eco-conscious consumers and investors. The increased focus on sustainability and the integration of circular economy principles in the pharmaceutical supply chain are driving the demand for biopharma plastics. As a result, manufacturers are investing in R&D to innovate and optimize the properties of biopharma plastics, making them even more suitable for pharmaceutical packaging needs.

The healthcare and pharmaceutical industries are challenged by rigorous rules and great standards, biopharma plastics need to meet strict standards for safety, biocompatibility, and chemical resistance. Manufacturers may additionally face elevated compliance costs and longer approval timelines, affecting product development and market entry. Moreover, regulatory adjustments can result in normal updates to manufacturing strategies and materials, main to uncertainty and extra expenses. Small and medium-sized companies may additionally locate it specifically challenging to cope with these worrying requirements, probably limiting their participation in the market. Consequently, the biopharma plastics market may trip slower boom quotes as agencies navigate the complexities of regulatory compliance and adapt their operations to ensure adherence to evolving standards. Thus, stringent regulatory necessities will avoid the biopharma plastics market.

As economies in these areas proceed to develop and healthcare infrastructure improves, there is a growing demand for advanced medical devices and pharmaceutical products. Biopharma plastics play an imperative role in the manufacturing of a number of clinical devices and packaging solutions due to their special properties such as biocompatibility and chemical resistance. The upward jab in research activities, drug development, and medical trials in rising markets in addition drives the need for specialized plastic components. Moreover, as governments in these regions' focal point on improving healthcare get admission to and affordability, the demand for biopharma plastics in affordable and environment-friendly healthcare solutions is predicted to soar. Companies investing in these markets stand to attain an aggressive area and an extensive share in the increasing biopharma plastics market. Thus, the biopharma plastics market is anticipated to gain substantially from the expansion of the pharmaceutical industry in rising markets, presenting lucrative opportunities for increase and development.

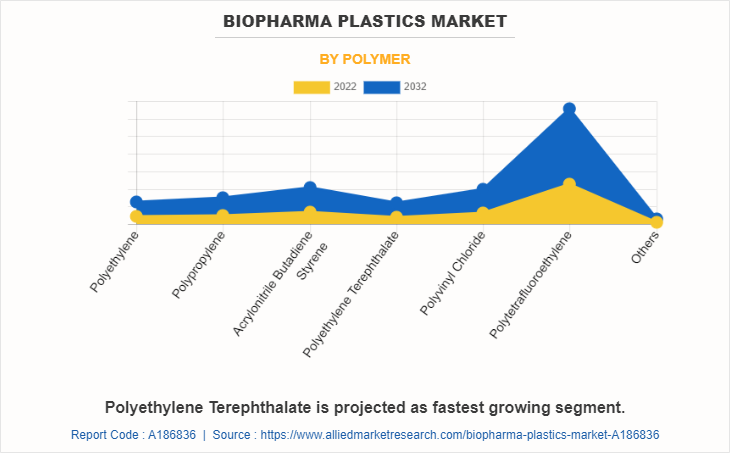

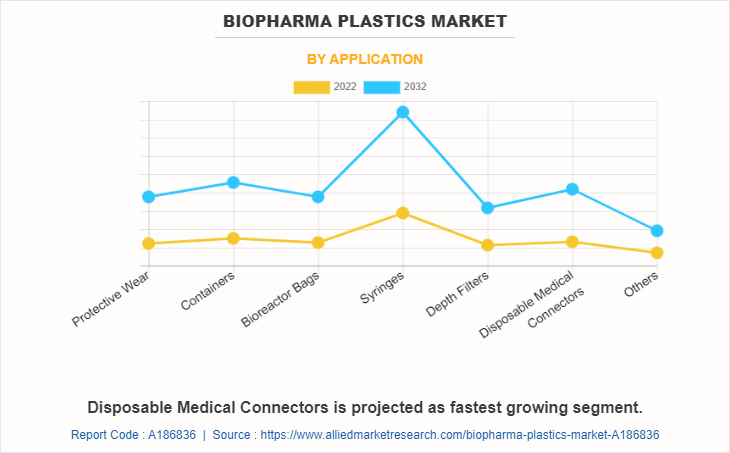

The biopharma plastics market is segmented on the basis of polymer, application, and region. By polymer, the market is divided into polyethylene, polypropylene, acrylonitrile butadiene styrene, polyethylene terephthalate, polyvinyl chloride, polytetrafluoroethylene, and others. On the basis of the application, it is categorized into protective wear, containers, bioreactor bags, syringes, depth filters, disposable medical connectors, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global biopharma plastics market are BASF SE, SABIC, DOW Inc, Covestro AG, Formosa Plastics Corporation, Solvay, TORAY INDUSTRIES, INC., LyondellBasell Industries Holdings B.V., Mitsui & Co. Plastics Ltd, and INEOS Group.

Other Players include Thermo Fisher Scientific, GE Healthcare, Lonza Group, Corning Incorporated, Saint-Gobain Life Sciences, Eppendorf AG, Merck KGaA, Pall Corporation, Entegris, Inc., Meissner Filtration Products, Inc., Repligen Corporation, West Pharmaceutical Services, Inc., Agilent Technologies and IDEX Health & Science LLC.

The polytetrafluoroethylene segment held the highest market share in 2022, accounting for more than two-fifths of the global biopharma plastics market revenue. Polytetrafluoroethylene (PTFE) is a preferred biopharma plastic due to its remarkable chemical inertness, thermal stability, and low friction properties. These qualities enable PTFE to face up to corrosive chemicals, maintain the purity of pharmaceutical products, and facilitate smooth fluid transfer in scientific applications. Its non-reactive nature ensures minimal interaction with sensitive biomolecules, making PTFE a reliable choice for critical biopharmaceutical processes, ensuring product integrity and patient safety.

The polyethylene terephthalate segment is projected to manifest the highest CAGR of 12.5% from 2023 to 2032. Polyethylene terephthalate (PET) has gained traction in biopharma purposes due to its great properties. Its excessive chemical resistance ensures compatibility with numerous drug formulations, while its transparency lets in for convenient monitoring of processes. PET's cost-effectiveness and suitability for single-use systems similarly promote its adoption. Additionally, PET's recyclability aligns with sustainability goals, attractive to environmentally-conscious practices in the biopharmaceutical industry.

The syringes segment held the highest market share in 2022, accounting for more than one-fourth of the global biopharma plastics market revenue. Syringe demand is driven by healthcare needs, immunization programs, and pharmaceutical applications. Medical procedures, vaccine distribution, and drug administration remember on syringes. Technological advancements, disease outbreaks, and population increase have an impact on the market. Safety features, precision, and fabric improvements also have an effect on syringe development. As healthcare evolves, syringes remain integral for the unique and invulnerable administration of medicines in a range of medical environments.

Disposable medical connectors are projected to manifest the highest CAGR of 12.5% from 2023 to 2032. Disposable medical connectors are particularly driven with the aid of the need for infection control and affected person safety in healthcare settings. These connectors stop cross-contamination, ensuring hygienic connections between medical gadgets and tubing. The comfort of single-use connectors reduces the risk of infections, streamlines workflows, and complies with stringent regulatory standards, making them an essential thing of current disposable scientific equipment.

Asia-Pacific held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global Biopharma plastics market revenue. The Asia-Pacific biopharma plastics market is pushed through the region's increasing biopharmaceutical sector, growing demand for superior packaging solutions, and rising adoption of single-use systems in drug manufacturing processes. Stringent regulations, cost-effectiveness, and developing investments in healthcare infrastructure further bolster the market, as biopharma agencies seek innovative plastic substances for drug storage, transportation, and production, propelling the market's increase in the region.

Public Policies:

Public policies play a crucial role in shaping the biopharma plastics market, ensuring its safety, sustainability, and competitiveness. Several key policies and regulations are implemented to govern the production, use, and disposal of biopharma plastics within the region.

European Medicines Agency (EMA) Guidelines sets guidelines for the use of plastics in pharmaceutical packaging and medical devices to ensure the safety and efficacy of drugs and medical products. These guidelines focus on issues such as leachable and extractable, ensuring that plastic materials do not contaminate pharmaceutical products.

Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) is a comprehensive regulation aimed at managing the risks associated with chemical substances, including those used in plastics. It requires manufacturers to provide information on the properties and safe use of chemical substances, promoting the responsible use of plastics in biopharmaceutical applications.

The European Union (EU) is actively promoting circular economy initiatives to reduce plastic waste and improve recycling rates. Policies such as the Single-Use Plastics Directive and the Plastic Packaging Tax encourage the use of recyclable and biodegradable plastics in the biopharma industry, fostering a more sustainable approach to packaging and disposal.

Good Manufacturing Practice (GMP) Regulations ensure the quality and consistency of pharmaceutical products, including those packaged in biopharma plastics. These regulations establish standards for the manufacturing, storage, and distribution of medicinal products, ensuring that the plastics used meet the necessary quality standards.

The EU's Horizon Europe program fosters research and innovation in various sectors, including healthcare and materials science. Funding opportunities are available to support R&D efforts in biopharma plastics, driving innovation and advancements in the field.

The European Pharmacopoeia sets standards for the quality of medicinal substances and products, including materials used in pharmaceutical packaging. Compliance with these standards is essential for manufacturers and suppliers of biopharma plastics in the European market.

Food and Drug Administration (FDA) Regulations oversee the approval and regulation of medical devices, including biopharma plastics used in drug delivery systems and medical packaging. Strict guidelines are in place to ensure the safety, efficacy, and quality of these products before they can be introduced into the market.

The U.S. government has implemented environmental regulations aimed at promoting sustainable practices and reducing the environmental impact of plastic waste. Companies in the biopharma plastics market must adhere to guidelines concerning the use of recyclable and biodegradable materials to support environmentally friendly initiatives.

These public policies and regulations create a supportive environment for the biopharma plastics market. By prioritizing safety, sustainability, and innovation, these policies ensure that the biopharma plastics industry continues to contribute to the development of safe and effective pharmaceutical products while minimizing their environmental impact.

Russia-Ukraine War Impact Analysis:

The Russia-Ukraine war had several potential impacts on the biopharma plastics market, both in the region and globally. The conflict affected the supply chain, pricing, and availability of biopharma plastics, leading to disruptions in the industry.

Both Russia and Ukraine were significant players in the global petrochemical industry, providing critical raw materials for plastics production. The war and geopolitical tensions in the region disrupted the production and transportation of these raw materials, leading to supply chain disruptions for biopharma plastics manufacturers worldwide.

Uncertainty and geopolitical risks caused fluctuations in the prices of raw materials and finished products. Market volatility led to price increases for biopharma plastics, impacting manufacturing costs for pharmaceutical companies and potentially affecting drug prices.

The Russia-Ukraine war created economic instability in the region, affecting local demand for pharmaceutical products and consequently impacting the sales and consumption of biopharma plastics within Russia, Ukraine, and neighboring countries.

The ongoing conflict resulted in the imposition of trade restrictions and sanctions on Russia, limiting its ability to export biopharma plastics and other related products. This created opportunities for other global players to fill the gap in the market but also led to increased competition and uncertainties in international trade dynamics.

The conflict diverted resources and attention away from R&D in the biopharma plastics sector within the region. Economic uncertainty and geopolitical risks discourage investment in innovative technologies and sustainable solutions, impacting the long-term growth and progress of the industry.

To mitigate risks associated with the conflict, some pharmaceutical companies sought to diversify their supply chains and reduce reliance on the region for biopharma plastics. This led to the exploration of alternative suppliers and manufacturers in other parts of the world.

Overall, the Russia-Ukraine war introduced a level of uncertainty and volatility into the biopharma plastics market, affecting supply chain dynamics, pricing, and regional market dynamics. Companies in the pharmaceutical and biopharma plastics industries had to closely monitor the situation and develop contingency plans to navigate potential challenges and capitalize on emerging opportunities in this dynamic geopolitical environment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biopharma plastics market analysis from 2022 to 2032 to identify the prevailing biopharma plastics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biopharma plastics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biopharma plastics market trends, key players, market segments, application areas, and market growth strategies.

Biopharma Plastics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.9 billion |

| Growth Rate | CAGR of 11.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 349 |

| By Application |

|

| By Polymer |

|

| By Region |

|

| Key Market Players | Dow Inc., BASF SE, TORAY INDUSTRIES, INC., Mitsui & Co.Plastics Ltd, Formosa Plastics Corporation, INEOS Group, Solvay, LyondellBasell Industries Holdings B.V., Covestro AG., SABIC |

Analyst Review

According to the insights of the CXOs of leading companies, the increasing demand for advanced drug delivery systems, medical devices, and pharmaceutical packaging solutions in the healthcare industry is driving the demand for the biopharma plastics market. In addition, the rise in the prevalence of chronic diseases and the focus on personalized medicine are propelling the demand for biopharma plastics. Moreover, the emphasis on sustainable and eco-friendly materials in the pharmaceutical sector is creating opportunities for biodegradable and recyclable biopharma plastics. Stringent regulatory requirements for medical devices and pharmaceutical packaging, along with concerns about the environmental impact of plastics, could pose challenges to market growth. Economic uncertainties and fluctuations in raw material prices may also act as restraining factors for the biopharma plastics market.

The CXOs further added that the advancements in R&D can lead to the development of innovative and high-performance plastic materials while increasing investments in healthcare infrastructure in emerging economies offer new growth prospects. Furthermore, the growing trend of 3D printing technology in the pharmaceutical industry presents opportunities for customized and precise biopharma plastic applications.

The biopharma plastics market attained $5.0 billion in 2022 and is projected to reach $14.9 billion by 2032, growing at a CAGR of 11.6% from 2023 to 2032.

Asia-Pacific is the largest regional market for Biopharma Plastics.

Biopharma Plastics Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Advancements in biopharma plastic technologies is the upcoming trend of Biopharma Plastics Market in the world.

Rising adoption of biologics and personalized medicines and growing demand for sustainable packaging are the driving factor of Biopharma Plastics Market.

BASF SE, SABIC, DOW Inc, Covestro AG, Formosa Plastics Corporation, Solvay, TORAY INDUSTRIES, INC., are the top companies to hold the market share in Biopharma Plastics.

Disposable medical connectors is the leading application of Biopharma Plastics Market.

Loading Table Of Content...

Loading Research Methodology...