Bioplastics Market Overview:

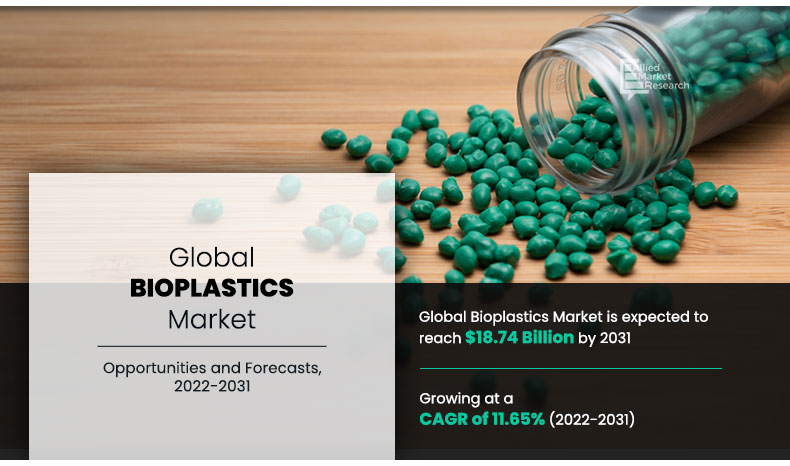

The global bioplastics market size was valued at USD 6.3 billion in 2021, and is projected to reach USD 18.7 billion by 2031, growing at a CAGR of 11.7% from 2022 to 2031. Factors such as eco-friendly properties, availability of renewable feedstocks, and favorable government policies related to manufacturing of sustainable products enable manufacturers to adopt bio-based plastics. Increase in adoption of biodegradable products and improvement in scope of bioplastic across end-user industries drive the growth of the bioplastics market.

Key Market Insights

- By Type, the biodegradable plastics segment was the largest revenue generator, and is anticipated to grow at a CAGR of 12.2% during the forecast period.

- By Application, In 2021, the flexible packaging segment led the global market and is expected to expand at a CAGR of 12.52% throughout the forecast period.

- By region, The Asia-Pacific bioplastics market is anticipated to witness the fastest growth, registering a CAGR of 12.46% over the forecast period.

Market Size & Forecast

- 2031 Projected Market Size: USD 18.7 Billion

- 2021 Market Size: USD 6.3 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 11.7%

How to Describe Bioplastics

Bioplastics are a category of plastics derived from renewable biological sources such as plants, algae, or microorganisms, as opposed to traditional plastics made from petroleum-based feedstocks. They are designed to offer similar performance characteristics to conventional plastics while reducing reliance on fossil fuels and minimizing environmental impact. Bioplastics can be biodegradable, meaning they break down naturally in the environment through microbial action, or they can be compostable, decomposing under specific composting conditions. Examples include polylactic acid (PLA) made from corn starch and polyhydroxyalkanoates (PHA) produced by microbial fermentation. Bioplastics aim to address environmental issues associated with plastic waste and contribute to more sustainable material management practices.

Report Key Highlighters:

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

The bioplastics market is fragmented in nature among prominent companies such as BASF SE, Biome Technologies Plc., CJ CheilJedang Corp., Corbion N.V., Danimer Scientific, Dow Inc., Eastman Chemical Company, Kuraray Co. Ltd., LG Chem, Mitsubishi Chemical Holdings, Novamont S.P.A and SKC.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

Latest trends in global bioplastics market such as undergoing R&D activities, public policies, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 3,500 bioplastics industry-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global bioplastics market.

Market Dynamics:

The bioplastics market is primarily driven by growing environmental concerns, the need to reduce dependence on fossil fuels, and government policies promoting sustainable alternatives. Governments worldwide are implementing stringent regulations on single-use plastics, pushing industries toward bioplastics. For instance, the European Union's Single-Use Plastics Directive encourages a shift to bioplastics, while India has banned single-use plastics, creating market opportunities. Additionally, policies like the U.S. Department of Agriculture's BioPreferred Program promote the use of bio-based products, including bioplastics. According to the European Bioplastics Association, global bioplastics production capacity was 2.4 million tons in 2021, with significant growth expected due to favorable policies. Tax incentives and grants for developing bioplastics production facilities further drive bioplastics market growth. The Indian government, under its National Policy on Biofuels, also promotes the use of biodegradable plastics, aligning with efforts to address waste management and environmental sustainability.

Bioplastics, derived from renewable resources like corn and sugarcane, often require more land and water, leading to concerns about food security and environmental impact. Government data from the U.S. Department of Agriculture highlights that the production costs of bio-based plastics are still higher than petroleum-based plastics, limiting their adoption. Additionally, the absence of widespread composting and recycling facilities hinders the effective disposal and management of bioplastics. For example, the European Union's waste management reports indicate that only a small percentage of bioplastics are correctly processed due to inadequate composting infrastructure. Moreover, inconsistent government policies across countries regarding bioplastics standards and labeling further restrain bioplastics market growth, as businesses face challenges in meeting varying regulatory requirements globally.

On the contrary, companies are moving toward sustainable and eco-friendly alternatives for developing and strengthening their brand image with rise in environmental concerns among consumers. For instance, leading companies, such as Coca Cola and PepsiCo, focus on the use of bio-based polyethylene, nylon, and PET plastic bottles for beverage packaging. Moreover, companies such as NEC Corporation use bioplastics in their products, which include LCD projectors and POS terminals. Increase in Corporate Social Responsibility (CSR) activities of these companies is projected to fuel the bioplastic demand and promote the investor’s interest toward the bioplastic industry. This is anticipated to increase the sales of bioplastics, thus creating lucrative opportunities for the bioplastics market.

Additionally, bioplastics offer exciting opportunities for hybrid material innovations. They can be combined with other materials, such as natural fibers, nanoparticles, or even conventional plastics, to create novel composite materials with enhanced properties. For instance, reinforcing bioplastics with natural fibers can improve their mechanical strength, while incorporating nanoparticles can enhance their barrier properties. These hybrid material possibilities open-up new avenues for bioplastics in advanced applications such as automotive parts, construction materials, and medical devices; thus, creating lucrative opportunities for the bioplastics market in the coming future.

Bioplastics Market Segment Review:

The global bioplastic market is segmented on the basis of type, application, and region. On the basis of type, it is divided into biodegradable plastic and nonbiodegradable plastic. On the basis of application, the market is classified into flexible packaging, rigid packaging, textiles, coating & adhesives, agriculture & horticulture, consumer goods, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, South America, Middle East, and Africa.

Bioplastics Market, By Type

In 2021, the biodegradable plastics segment was the largest revenue generator, and is anticipated to grow at a CAGR of 12.2% during the forecast period. Increase in government initiatives such as ban of single-use plastics has promoted the utilization of biodegradable plastics in various end-use sectors. Furthermore, industry trends are shifting toward bio-based products to reduce the dependency over conventional plastics. These factors have increased the demand for biodegradable plastics; thus boosting the market growth. Moreover, high volatility in crude oil prices (major raw material for conventional plastics) has led the plastic manufacturers become more linear toward using biodegradable plastics made from plant-based materials such as corn, potato, and wheat starch. These factors are escalating the growth of biodegradable plastic segment in the global bioplastics market.

By Type

Biodegradable plastic is the most lucrative segment

Bioplastics Market, By Application

By application, the flexible packaging segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 12.52% during forecast period. This is attributed to the fact that bioplastics protects products from moisture, UV rays, mold, dust, and other environmental contaminants that make it best-suited for flexible packaging applications. Rapid change in lifestyles has surged the demand for convenient products where bioplastics are widely used for flexible packaging applications. Moreover, increase in awareness for environment protection activities has made customers become more linear toward using bioplastics-based flexible packaging films in various end-use sectors including food & beverage, and agriculture. These factors are augmenting the growth of the flexible packaging segment in the global bioplastics market.

By Application

Consumer Goods is projected as the fastest growing segment

Bioplastics Market, By region

The Asia-Pacific bioplastics market is projected to grow at the highest CAGR of 12.46% during the forecast period and accounted for 44.56% of market share in 2021. This is attributed to the fact that China is one of the biggest markets for biodegradable plastics, owing to abundant availability of bioplastics feedstock. Increase in oil prices and rapid change in climatic conditions encourage government, private companies, and customers towards using bioplastics products in this region. Furthermore, manufacturers across the globe find Asia-Pacific as an attractive market, owing to cheap labor cost, low cost of setting up manufacturing units, easy availability of feedstock, and low cost of bioplastics.

By Region

Asia-Pacific would exhibit highest CAGR of 12.46% during 2022-2031.

Which are the Leading Companies in Bioplastics

The major players operating in the global bioplastics market. These players have adopted product launches, joint ventures, partnerships, and expansion of the production capabilities to meet the future demand for the bioplastics industry.

BASF SE

Biome Technologies Plc.

CJ CheilJedang Corp.

Corbion N.V.

Danimer Scientific

Dow Inc.

Eastman Chemical Company

Kuraray Co. Ltd., LG Chem

Mitsubishi Chemical Holdings

Novamont S.P.A and SKC.

Historical Market Trend

Between 2005 and 2015, there was a noticeable shift in market trends as bio-plastics gained wider acceptance. This period saw the introduction of government regulations, especially in Europe, North America, and parts of Asia, aiming to reduce single-use plastics. Countries began to adopt policies promoting biodegradable materials, which spurred research and development in bio-plastics. During this period, large corporations started investing in bio-plastic research, leading to the development of more durable and functional biopolymers, expanding their application range beyond just packaging.

From 2015 to 2020, the bio-plastic market witnessed rapid growth due to increased consumer demand for sustainable products and corporate commitments to environmental responsibility. Key players like Coca-Cola and IKEA began incorporating bio-plastics into their products, signaling a shift towards mainstream use. Technological advancements enabled the production of bio-plastics at a scale and cost competitive with traditional plastics, further boosting market adoption.

Currently, the bio-plastic market is in a growth phase, driven by innovations in material properties and expanding applications in sectors like agriculture, automotive, and consumer goods. With increasing investment in research and supportive policies worldwide, the market is poised for significant expansion in the coming years.

What government initiatives are promoting the utilization of bioplastics

The U.S. government promotes bioplastics through initiatives like the BioPreferred Program (2002 Farm Bill, Section 9002), which mandates federal agencies to prioritize bio-based products, including bioplastics, in their procurement. Additionally, the Renewable Fuel Standard (RFS) (40 CFR Part 80) encourages the production of bio-based materials, fostering a market for bioplastics.

Canada focuses on reducing plastic waste through its Zero Plastic Waste Strategy (2018) and the Canadian Environmental Protection Act (CEPA) 1999. CEPA includes provisions for regulating single-use plastics and promoting alternatives like bioplastics. The Plastic Waste Reduction and Circular Economy Act (Bill C-204, 2021) further strengthens initiatives to reduce plastic use, indirectly supporting bioplastics.

The European Union's Single-Use Plastics Directive (Directive (EU) 2019/904) limits specific single-use plastics and encourages the use of bio-based alternatives. The European Green Deal (COM(2019) 640 final) and the EU Plastics Strategy (2018) also advocate for the use of sustainable materials, including bioplastics, to transition to a circular economy.

Countries like India have enacted bans on single-use plastics under regulations like the Plastic Waste Management Rules (2016, amended 2021). In Japan, the Act on Promotion of Resource Circulation for Plastics (2022) encourages the production of biodegradable plastics, while China’s Plastic Pollution Control Action Plan (2020) promotes the use of bioplastics to reduce plastic pollution.

What are the Key Benefits For Stakeholders

The report outlines the current bioplastics market trends and future estimations from 2021 to 2031 to understand the prevailing opportunities and potential investment pockets

Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

The major countries in the region have been mapped according to their individual revenue contribution to the regional bioplastic market.

The key drivers, restraints, opportunities, and their detailed impact analysis are explained in the study.

The profiles of key players and their key strategic developments are enlisted in the report.

Bioplastics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

According to CXOs of leading companies, the global bioplastics market is expected to exhibit high growth potential during the forecast period. Factors such as favorable government policies for the adoption of sustainable and biodegradable products, increase in availability of renewable feedstock, and rise in consumer acceptance for eco-friendly products drive the global bioplastics market. However, higher price of bioplastics as compared to traditional plastic coupled with low performance standards hamper the market growth.

At present, consumption of bioplastics in flexible packaging is the highest and is projected to remain the highest during the forecast period on account of the properties of bioplastics such as gloss, barrier effect, and antistatic behavior, in conjunction with increase in environmental awareness among the customers.

On the other hand, CXOs are concerned about the limited enactment of bioplastics against traditional petroleum-based plastics. However, CXOs are optimistic about further advancements in the R&D activities, facilitating the reduction in the prices of the bioplastics. According to the CXOs, the production of bioplastics is highest in Asia-Pacific owing to the huge availability of renewable feedstock. CXOs further added that sustained economic growth and development of the packaging sector may increase the popularity of bioplastics.

Rise in demand for eco-friendly plastics from various end use sectors and favourable government policies for the production of bioplastics are the key factors boosting the bioplastics market growth.

The global bioplastics market was valued at $6.31 billion in 2021, and is projected to reach $18.73 billion by 2031, growing at a CAGR of 11.65% from 2022 to 2031.

include BASF SE, Biome Technologies Plc., CJ CheilJedang Corp., Corbion N.V., Danimer Scientific, Dow Inc., Eastman Chemical Company, Kuraray Co. Ltd., LG Chem, Mitsubishi Chemical Holdings, Novamont S.P.A and SKC are the leading players in bioplastics market.

Packaging, textiles, adhesive manufacturing, agriculture, consumer goods, and other sectors are projected to increase the demand for bioplastics market.

The global bioplastic market is segmented on the basis of type, application, and region. On the basis of type, it is divided into biodegradable plastic and nonbiodegradable plastic. On the basis of application, the market is classified into flexible packaging, rigid packaging, textiles, coating & adhesives, agriculture & horticulture, consumer goods, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, South America, Middle East, and Africa.

Environmental friendly properties, high consumer acceptance, favourable government policies, and renewable raw material sources are the main drivers of the bioplastics market.

Applications such as flexible packaging, rigid packaging, textiles, coating & adhesives, agriculture & horticulture, consumer goods, and others are expected to drive the adoption of bioplastics.

The bioplastics market will have little impact owing to supply chain disruptions due to irregular transport facilities. Furthermore, countries such as China have started the production of bioplastics in limited capacity; thus the material price for bioplastics is expected to increase. Moreover, Industry players are focusing to extend the lead time to avoid such high material price. This is predicted to enhance the performance of the bioplastics market in 2022.

Loading Table Of Content...