Biosimilar Monoclonal Antibody Market Research, 2032

The global biosimilar monoclonal antibody market size was valued at $8.7 billion in 2022, and is projected to reach $64.7 billion by 2032, growing at a CAGR of 22.2% from 2023 to 2032. Biosimilar monoclonal antibodies (mAbs) are a class of biopharmaceutical products that are highly similar in terms of structure, function, and therapeutic effect to existing reference or originator monoclonal antibodies. Monoclonal antibodies are large protein molecules designed to target specific antigens or molecules in the body with high precision, making them effective in treating a wide range of diseases, including cancer, autoimmune disorders, and inflammatory conditions.

Market Dynamics

The major factors driving the growth of the biosimilar monoclonal antibody market include increase in prevalence of breast cancer, awareness regarding early diagnosis, and adoption of novel treatment options for breast cancer. In addition, biologic therapies, including monoclonal antibodies, have revolutionized the treatment of various diseases, offering higher efficacy and specificity as compared to traditional small molecule drugs. However, their high production costs result in expensive treatments, limiting access for many patients.

Biosimilar mAbs provide a cost-effective alternative, aiming to reduce healthcare expenditure while maintaining therapeutic efficacy. Further, as patents for reference biologic mAbs expire, biosimilar manufacturers gain the opportunity to enter the market with biosimilar versions of these monoclonal antibodies. This expiration leads to increase in competition, enabling healthcare systems to negotiate better pricing and providing patients with more affordable options. In addition, biosimilar mAbs cover a broad spectrum of therapeutic indications, including oncology, autoimmune disorders, and more. The diverse range of applications allows biosimilar manufacturers to target various disease areas, contributing to the overall growth of the market.

Furthermore, regulatory agencies globally have established pathways to approve biosimilar products. These frameworks require rigorous analytical, preclinical, and clinical studies to demonstrate the biosimilar's similarity to the reference product in terms of quality, safety, and efficacy. Streamlined regulatory pathways expedite the development and approval of biosimilar mAbs, encouraging manufacturers to invest in their production. Moreover, with accumulating clinical evidence demonstrating the equivalence of biosimilar mAbs to their reference products, physicians and patients are becoming more accepting of these alternatives. Trust in the safety and efficacy of biosimilars grows as real-world data supports their use, leading to a wider adoption in clinical practice.

The demand for effective targeted therapy and biosimilar mAbs is being witnessed in the developing and developed countries, such as China, Brazil, and India, which fuel the growth of the market. Moreover, increase in promotional activities by manufacturers and growth in awareness regarding cost effective treatment options among the general population is expected to fuel their adoption in the near future.

The ongoing global recession has also had a notable impact on the biosimilar monoclonal antibody market. Recessions often result in tightened budgets across industries, including biopharmaceuticals. R&D efforts in the biosimilar mAb sector could face funding cutbacks, delaying or even stalling the progression of projects. Biotech companies, especially smaller ones, are expected to struggle to secure investment as risk aversion becomes prevalent in uncertain economic times. This, in turn, could delay the development of promising biosimilar candidates, impacting the market growth potential.

Biosimilar mAb development involves rigorous clinical trials and complex regulatory approvals. Economic downturns can lead to delays in initiating or completing clinical trials due to budget constraints or difficulties in recruiting patients. Regulatory agencies may also experience resource limitations, potentially extending approval timelines for biosimilar products. The decrease in investments for development of biosimilars by biopharmaceutical companies is observed owing to recession. This can affect funding availability for biosimilar mAb projects, particularly for early-stage companies. Uncertainty in the financial market can lead to decrease in investor confidence, impacting the ability of biotech firms to secure the necessary capital for research, development, and commercialization.

However, biopharmaceutical companies might intensify their efforts to optimize the development and production processes of biosimilar mAbs. This includes refining manufacturing techniques, streamlining clinical trial protocols, and enhancing supply chain logistics. The aim is to achieve higher operational efficiency, reduce costs, and expedite time-to-market for biosimilar products. In addition, to navigate the challenges of the recession, biosimilar manufacturers could seek partnerships with research institutions, contract research organizations (CROs), and technology providers. Collaborations can facilitate knowledge sharing, access to cutting-edge technologies, and faster development timelines. These alliances can play a crucial role in accelerating the development and commercialization of biosimilar mAbs, thereby driving the biosimilar monoclonal antibody market forecast.

Segmental Overview

The biosimilar monoclonal antibody industry is segmented on the type, indication, end user and region. On the basis of type, the market is categorized into adalimumab, bevacizumab, infliximab, rituximab, trastuzumab, and others. On the basis of indication, the market is classified into oncology, autoimmune diseases, and others. On the basis of end user, the market is segmented into hospitals, cancer treatment centers and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

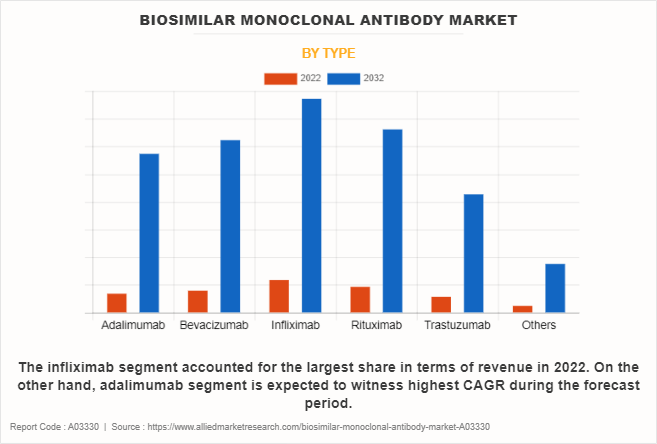

By Type

The infliximab segment accounted for the largest biosimilar monoclonal antibody market share in terms of revenue in 2022, owing to factors such as expiration of patent for infliximab enabling the introduction of biosimilar versions, offering comparable efficacy and cost-effectiveness. In addition, the increasing number of people suffering from autoimmune diseases such as rheumatoid arthritis and Crohn's disease fueled the demand for biosimilar infliximab as an accessible treatment option, thereby driving the segment growth.

However, adalimumab segment is expected to witness highest CAGR during the forecast period. This is attributed to adalimumab's wide range of therapeutic applications in treating autoimmune diseases such as rheumatoid arthritis, psoriasis, and Crohn's disease, resulting in high demand for cost-effective options, which biosimilar versions offer. In addition, rise in regulatory approvals, increase in physician confidence in prescribing biosimilar adalimumab owing to robust clinical data and rigorous comparability studies, and favorable reimbursement policies in certain regions have collectively propelled the adoption of biosimilar adalimumab, thus contributing to its substantial biosimilar monoclonal antibody market growth.

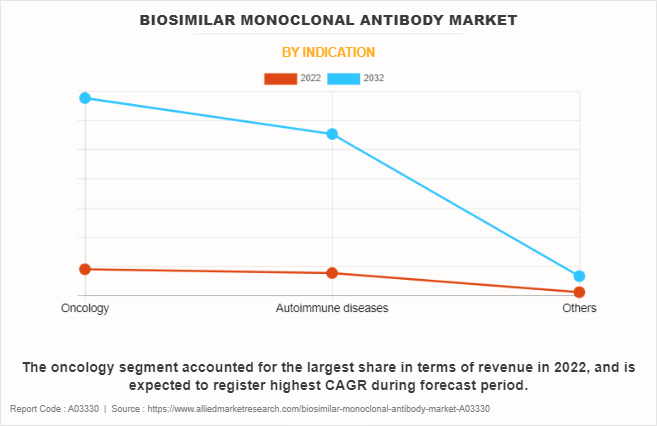

By Indication

The oncology segment accounted for the largest biosimilar monoclonal antibody market share in 2022, and is expected to register highest CAGR during forecast period. This trend is primarily attributed to the increase in the prevalence of various cancers and escalating need for economical yet potent treatments for cancer. Biosimilar monoclonal antibodies present comparable efficacy and safety profiles to their originator counterparts but at a more affordable cost. This is facilitated by factors such as patent expirations, regulatory pathways that support biosimilars, and increasing confidence in their clinical performance.

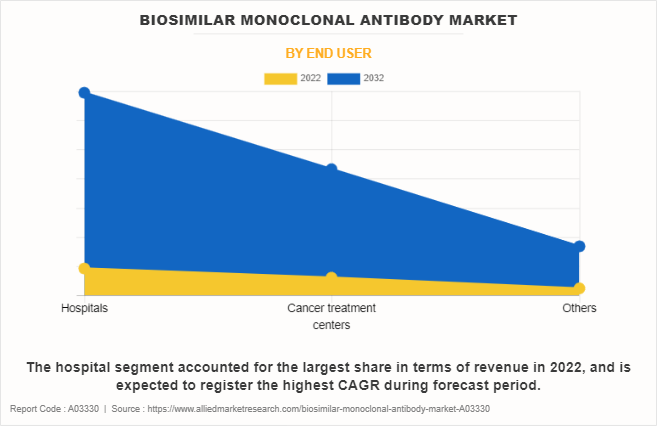

By End User

The hospital segment accounted for the largest share in 2022, and is expected to register the highest CAGR during forecast period. This is attributed to increase in adoption of biosimilar mAbs within hospital settings, driven by factors such as cost-effectiveness, expanding patient population and rise in demand for targeted therapies. In addition, hospitals offer better insurance coverage, specialized medical expertise, well equipped infrastructure for complex chronic disease treatments, and wide availability of biosimilar mAbs, thereby fueling the segment growth.

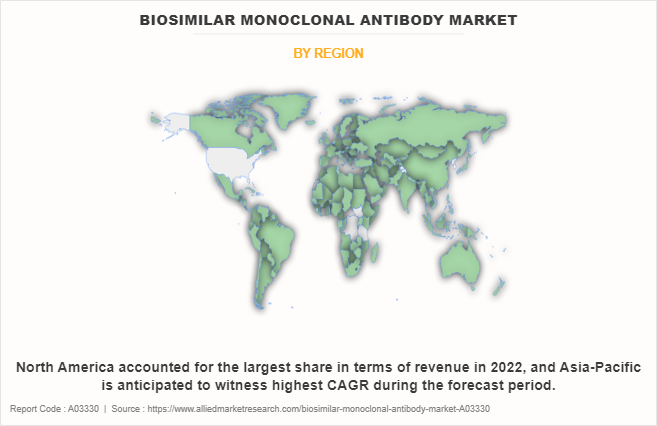

By Region

The biosimilar monoclonal antibody market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share in 2022 and is expected to remain dominant during the forecast period, owing to a well-established regulatory framework that facilitates the approval and entry of biosimilar monoclonal antibodies, robust healthcare infrastructure that streamlines distribution and adoption, high levels of physician acceptance and patient accessibility, advanced capabilities in R&D as well as manufacturing, and proactive endeavors to enhance awareness and education regarding biosimilar mAbs.

However, Asia-Pacific is anticipated to witness notable growth during the forecast period. This growth can be attributed to the escalating demand for economical treatment options, owing to a significant increase in prevalence of chronic disease, aging population vulnerable to chronic illnesses, increase in investments in biopharmaceutical research and manufacturing capacities, and collaborations between both, local and international pharmaceutical enterprises. Thus, collectively, these factors foster an environment conducive to the adoption and expansion of biosimilar mAbs within the Asia-Pacific market.

Presence of several major players, such as Novartis AG, Pfizer Inc., Amgen Inc., and Shanghai Henlius Biotech, Inc., and advancement in manufacturing technology for development of effective treatment options for chronic diseases in the region are expected to drive the growth of biosimilar monoclonal antibody market. In addition, various private organizations organize educating camps for awareness of chronic diseases and cost-effective treatment options available across the globe are expected to drive the growth of the market. Furthermore, the presence of well-established healthcare infrastructure and rise in adoption rate of new treatment options such as biosimilar mAbs are expected to drive the market growth.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to the presence of key players in the region. The Asia-Pacific region has made significant efforts in improving its healthcare infrastructure, including cancer care facilities and specialized oncology centers. The establishment of comprehensive cancer centers, advancements in diagnostic technologies, and access to modern treatment modalities have positively impacted the biosimilar monoclonal antibody industry.

Improved healthcare infrastructure enables timely diagnosis, effective treatment, and access to a wide range of biosimilar mAbs, which drive the market growth. Asia-Pacific offers profitable biosimilar monoclonal antibody market opportunity for key players operating in the market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in spending for chronic disease research, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the biosimilar monoclonal antibody market, such as Novartis AG, Pfizer Inc., Amgen Inc., Coherus BioSciences, Inc., Teva Pharmaceutical Industries Limited, Shanghai Henlius Biotech, Inc., BIOCAD, Biogen, Biocon and Celltrion Healthcare Co., Ltd., are provided in the report. Major players have adopted collaboration, product launch, agreement, clinical trial approval, acquisition, and product approval as key developmental strategies to improve the product portfolio of the biosimilar monoclonal antibody market.

Recent Product Approval in Biosimilar Monoclonal Antibody Market

In July 2020, Shanghai Henlius Biotech, Inc. and Accord Healthcare Limited (Accord) jointly announced that the European Commission (EC) approved Zercepac (HLX02), a trastuzumab biosimilar, developed and manufactured by Henlius, for the treatment of HER2-positive early breast cancer, HER2-positive metastatic breast cancer, and HER2-positive metastatic gastric cancer. The approval was based on a series of robust studies including comparative quality studies, preclinical, and clinical studies.

Recent Product Launch in Biosimilar Monoclonal Antibody Market

In January 2023, Amgen announced AMJEVITA (adalimumab-atto), a biosimilar to Humira (adalimumab), which is now available in the U.S. AMJEVITA is approved to treat seven inflammatory diseases including moderate-to-severe rheumatoid arthritis in adults, moderate-to-severe polyarticular juvenile idiopathic arthritis in patients 2 years of age and older, psoriatic arthritis in adults, ankylosing spondylitis in adults, moderate-to-severe chronic plaque psoriasis in adults, moderate-to-severe Crohn's disease in adults and pediatric patients 6 years of age and older, and moderate-to-severe ulcerative colitis in adults.

Recent Acquisition in Biosimilar Monoclonal Antibody Market

In July 2023, Biocon Biologics expanded its footprint in emerging markets by acquiring over the commercialization of biosimilars business from Viatris in 70+ countries. The existing commercialized portfolio of biosimilars, including trastuzumab, bevacizumab, and adalimumab, managed by Viatris in these markets, is now a part of Biocon Biologics’ commercial organization.

Recent Agreement in Biosimilar Monoclonal Antibody Market

In September 2021, Sandoz, a Novartis division, announced that it has entered into a commercialization agreement with Bio-Thera Solutions, Ltd. for biosimilar bevacizumab. Bevacizumab is a recombinant humanized monoclonal IgG1 antibody that targets vascular endothelial growth factor (VEGF), a key mediator of angiogenesis in cancer, and is used in combination with other treatments.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biosimilar monoclonal antibody market analysis from 2022 to 2032 to identify the prevailing biosimilar monoclonal antibody market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biosimilar monoclonal antibody market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biosimilar monoclonal antibody market trends, key players, market segments, application areas, and market growth strategies.

Biosimilar Monoclonal Antibody Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 64.7 billion |

| Growth Rate | CAGR of 22.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 293 |

| By Type |

|

| By Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | Celltrion Healthcare Co., Ltd., Teva Pharmaceutical Industries Limited, Biogen, Biocon, BIOCAD, Amgen Inc., Pfizer Inc., Coherus BioSciences, Inc., Novartis AG, Shanghai Henlius Biotech, Inc. |

Analyst Review

This section provides various opinions in biosimilar monoclonal antibody market. The global biosimilar monoclonal antibody market is expected to grow, owing to increase in demand for cost effective biosimilars and rise in investments for development of biosimilars mAbs for cancer globally. In addition, favorable government initiatives and higher spending for chronic diseases such as cancers, autoimmune diseases, and blood disorders have piqued the interest of several companies to develop biosimilar mAbs.

Furthermore, North America accounted for the largest share in 2022 and is expected to remain dominant during the forecast period, owing to well-established regulatory environment, which fosters biosimilar mAbs approvals and market entry, strong physician acceptance and patient access, advanced R&D and manufacturing capabilities, and proactive efforts to raise awareness and education about biosimilar mAbs.

However, Asia-Pacific is anticipated to witness notable growth during the forecast period. This is attributed to increase in demand for cost-effective treatments, owing to increasing prevalence of chronic diseases, presence of large and aging population susceptible to chronic diseases, and collaborations between local and international pharmaceutical companies, which all collectively foster a favorable environment for the adoption and expansion of biosimilar mAbs in the Asia-Pacific market.

The total market value of biosimilar monoclonal antibody market is $8,727.00 million in 2022.

The market value of biosimilar monoclonal antibody market in 2032 is $64,699.19 million.

The forecast period for biosimilar monoclonal antibody market is 2023 to 2032.

The base year is 2022 in biosimilar monoclonal antibody market.

Top companies such as Pfizer Inc., Novartis AG, Amgen Inc., Shanghai Henlius Biotech, Inc., Teva Pharmaceutical Industries Limited and Celltrion Healthcare Co., Ltd., held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The infliximab segment is the most influencing segment in biosimilar monoclonal antibody market owing to factors such as expiration of patent for infliximab enabling the introduction of biosimilar versions, offering comparable efficacy and cost-effectiveness. In addition, the growing prevalence of autoimmune diseases such as rheumatoid arthritis and Crohn's disease fueled the demand for biosimilar infliximab as an accessible treatment option, thereby driving the segment growth.

The major factors driving the growth of biosimilar monoclonal antibody market are increase in prevalence of chronic diseases, rise in regulatory approvals, and increase in R&D activities for development of biosimilars.

Biosimilar monoclonal antibodies (mAbs) are biological products designed to be highly similar to existing reference or originator monoclonal antibodies.

Loading Table Of Content...

Loading Research Methodology...