Biosimilar Testing And Development Services Market Research, 2032

The global biosimilar testing and development services market size was valued at $2.5 billion in 2022 and is projected to reach $7.8 billion by 2032, growing at a CAGR of 12.1% from 2023 to 2032. The growth of the biosimilar testing and development services market is driven by a surge in the demand for biosimilars as a cost-effective alternative to biological drugs. Furthermore, the rise in the prevalence of chronic diseases globally is expected to drive the demand for biosimilar testing and development services. According to the American Cancer Society, it was estimated that in 2023, 1,958,310 new cancer cases and 609,820 cancer deaths are projected to occur in the U.S.

Key Takeaways

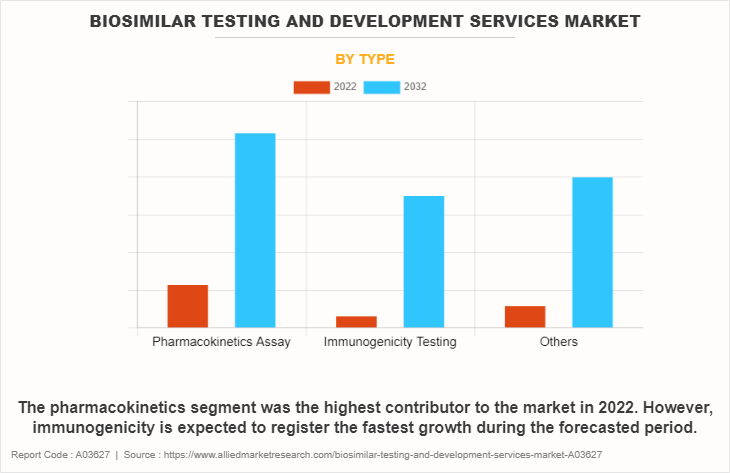

- Based on type, the pharmacokinetics segment was the highest contributor to the biosimilar testing and development services industry in 2022. However, immunogenicity is expected to register the fastest growth during the forecasted period.

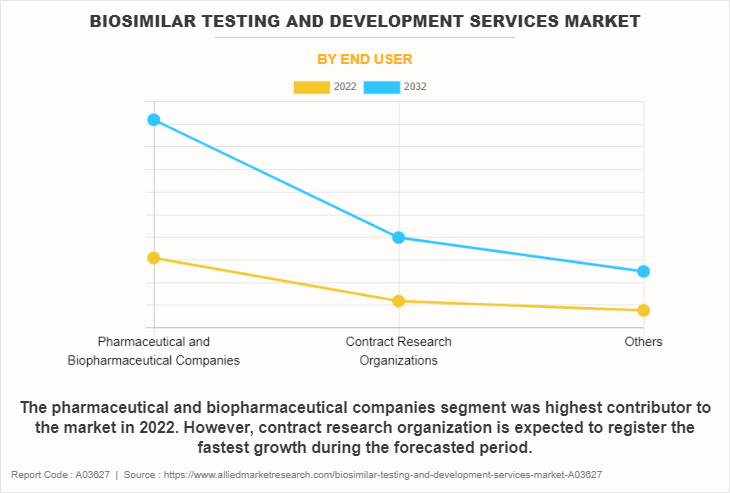

- Based on end users, the pharmaceutical and biopharmaceutical companies segment was the highest contributor to the biosimilar development services market in 2022. However, contract research organization is expected to register the fastest growth during the forecasted period.

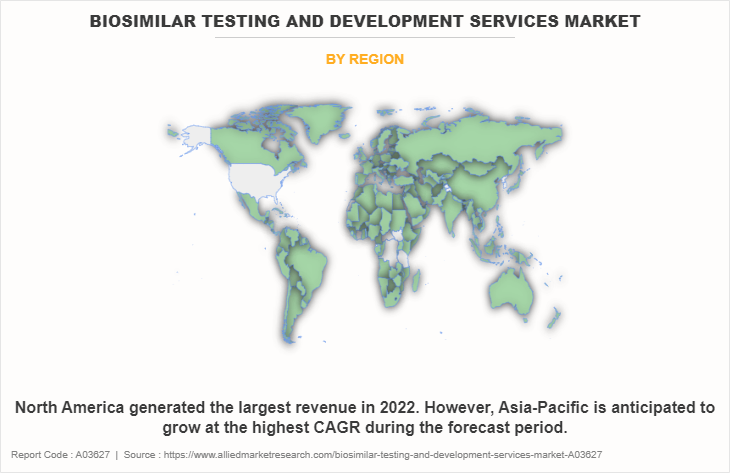

- Based on region, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Biosimilar testing and development services refer to a set of activities provided by specialized companies or organizations to support the development and approval of biosimilar products. Biosimilars are biological drugs that are highly similar to an already approved reference biologic (also known as the originator or innovator biologic). These services are essential to ensure the safety, efficacy, and quality of biosimilars before they can be brought to market.

Market Dynamics

The biosimilar testing market size is expected to grow significantly, owing to a surge in the need for biosimilar testing facilities to meet the growing demand for biosimilar medicines and the rise in outsourcing of preclinical, clinical, and laboratory testing services by pharma and biotech companies.

The biosimilar testing market size has witnessed a remarkable surge in recent years, primarily driven by the exponential growth in demand for biosimilar medicines. Biosimilars are biologic products that are highly similar to reference biologics in terms of quality, safety, and efficacy. These products have gained significant traction due to their potential to offer cost-effective alternatives to expensive biologic drugs, making healthcare more accessible to a broader population.

Furthermore, the rise in the prevalence of chronic diseases. Chronic conditions, such as cancer, autoimmune disorders, diabetes, and various inflammatory diseases, have become increasingly prevalent globally, which furtehr drive biosimilar testing and development services market growth. According to the World Health Organization, in 2020, cancer was a leading cause of death globally, accounting for nearly 10 million deaths. In addition, according to the International Diabetes Federation, in 2021, it was estimated that approximately 537 million adults are living with diabetes. Chronic illnesses such as cancer and diabetes often require long-term treatment with biologic drugs, which can be costly and place a significant financial burden on healthcare systems and patients alike. Biosimilar medicines offer a promising solution to address the rise in the prevalence of chronic diseases. Biosimilars enable healthcare providers to expand access to treatment options for patients in need by providing more cost-effective alternatives to expensive biologic therapies.

As the demand for biosimilar medicines continues to grow, pharmaceutical companies and biotech firms are facing the critical challenge of ensuring the rigorous testing and development of these products to meet regulatory standards and assure their safety and efficacy. This need for robust testing facilities has become a major driver for the biosimilar testing and development services market.

Furthermore, the surge in the need for biosimilar testing facilities is also linked to the increase in the number of patent expirations of original biologic drugs. Some other biologic drugs whose patent is expiring in coming years are Keytruda (Key patent expiration: 2028), Eylea (Key patent expirations: 2025 to 2026), Stelara (Key patent expirations: 2025 to 2026), Opdivo (Key patent expiration: 2028), Ibrance (Key patent expiration: 2027), Trulicity (Key patent expirations: 2027 to 2029), and Xgeva (Key patent expirations: 2025 to 2026). As these patents expire, it opens up opportunities for biosimilar manufacturers to enter the market and provide more affordable alternatives. Consequently, regulatory agencies are putting stringent requirements for biosimilar testing to ensure patient safety and maintain public trust in these products. The biosimilar testing and development service providers ensure that all the stringent requirements by regulatory agencies are fulfilled. Thus, the rise in demand for biosimilars to treat chronic diseases is expected to drive the growth of the biosimilar testing and development services market.

Furthermore, the rise in outsourcing of preclinical, clinical, and laboratory testing services by pharmaceutical and biotech companies has emerged as a major driver for the biosimilar testing and development services market. In recent years, the biosimilar testing industry witnessed significant growth in the development and commercialization of biosimilars. According to the U.S. Food and Drug Administration, as of May 2023, 41 biosimilars are approved. However, bringing a biosimilar to the market involves a rigorous testing and regulatory approval process to demonstrate its safety, efficacy, and similarity to the reference product.

Pharma and biotech companies are increasingly turning to outsourcing to navigate the complex and resource-intensive nature of biosimilar development. Outsourcing provides these companies with access to specialized expertise, state-of-the-art facilities, and a wide range of testing capabilities that might be otherwise difficult or costly to establish in-house. Contract research organizations (CROs) and specialized testing laboratories have risen to the occasion, offering a variety of services, including preclinical studies, clinical trials, and analytical testing, tailored specifically for biosimilar development. Outsourcing also allows pharmaceutical and biotech firms to focus on their core competencies, such as research and commercialization, while leaving the testing and development aspects to specialized service providers. By collaborating with external partners, companies can expedite the development timeline, reduce costs, and ensure compliance with stringent regulatory requirements.

Furthermore, an increase in interest in biosimilars, driven by the need for more affordable treatment options and patent expirations of reference biologics, creates lucrative opportunities for the biosimilar testing and development services market. As the demand for biosimilars continues to grow globally, pharmaceutical and biotech companies are seeking to leverage the expertise and experience of outsourcing partners to stay competitive and capture a significant share in this evolving market. In conclusion, the outsourcing of preclinical, clinical, and laboratory testing services has emerged as a vital enabler for the biosimilar testing and development services market.

However, the biosimilar testing and development services market faces a significant restraint in the form of stringent regulatory requirements. Regulatory agencies globally, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and others, impose strict guidelines and standards to ensure the safety, efficacy, and quality of biosimilars. The complex nature of biologics drugs and their manufacturing processes necessitate comprehensive testing and evaluation to demonstrate that a biosimilar is highly similar to its reference product, and any differences must not impact its safety or effectiveness. However, patent expirations are anticipated to present significant growth.

The 2023 recession has had negative impacts on the biosimilar testing and development services market. Pharmaceutical companies and research institutions are looking for ways to optimize their costs during a recession, which could budget cuts in the R&D of new biosimilars. This reduction in funding could lead to a decline in demand for biosimilar testing and development services.

However, it is important to note that the biosimilar testing and development services market has historically demonstrated resilience, as biosimilar research remains a crucial component of scientific advancements. While a recession may temporarily impact the market, the long-term demand for biosimilar testing and development services is likely to continue as researchers strive to understand diseases, develop new therapies, and improve human health.

Segmental Overview

The biosimilar development services industry is segmented based on type, end-user, and region. By type, the market is categorized into pharmacokinetics, immunogenicity, and others. The others include ligand binding assay, biomarker, and stability testing. By end user, the market is categorized into pharmaceutical and biopharmaceutical companies, contract research organizations, and others. The others include contract development and manufacturing organization, independent lab, and regulatory bodies. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

The biosimilar testing and development services market is categorized into pharmacokinetics, immunogenicity, and others. The others include ligand binding assay, biomarker, and stability testing. The pharmacokinetics segment dominated the global biosimilar testing and development services market share in 2022. This is attributed to the fact that pharmaceutical companies prioritize pharmacokinetic studies to demonstrate the similarity between biosimilars and reference biologics, fostering confidence among regulatory agencies and clinicians.

However, the immunogenicity segment is expected to register the fastest growth during the biosimilar testing and development services market forecast period owing to the need for accurate assessment and mitigation strategies to address immunogenic responses, ensuring the successful development and commercialization of biosimilar products.

By End User

Based on end-users, the market is classified into pharmaceutical and biopharmaceutical companies, contract research organizations, and others. The others include contract development and manufacturing organization, independent lab, and regulatory bodies. The pharmaceutical and biopharmaceutical companies segment dominated the biosimilar development services market share in 2022, owing to increasing demand for biosimilar drugs as cost-effective alternatives to original biologics.

However, the contract research organizations segment is expected to register the fastest growth during the forecast period owing to the strategic shift towards outsourcing various stages of drug development, including biosimilar testing.

By Region

Based on region, the biosimilar testing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Based on region, North America attained the highest biosimilar development services market share in 2022, owing to patent expiration and a rise in demand for biosimilars to treat chronic diseases. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period, owing to high approvals of biosimilars and favorable government schemes to fund research and development of biosimilar medicines

Competition Analysis

Competitive analysis and profiles of the major players in the biosimilar testing and development services market, such as Charles River Laboratories, Element Materials Technology, Intertek Group plc, Pacific biolabs, Inc, Profacgen Technologies Inc, Sartorius AG, SGS, BioPharmaSpec Ltd., Veeda Clinical Research Pvt. Ltd, and Eurofins Scientific SE. Major players have adopted acquisition and product launch, as key developmental strategies to improve the product portfolio and gain strong foothold in the biosimilar testing and development services market.

Recent Acquisition in the Biosimilar Testing and Development Services Market

In January 2023, Eurofins Scientific SE, a global scientific leader in bioanalytical testing announced the acquisition of assets to establish a fully equipped, state-of-the-art laboratory campus in Genome Valley, Hyderabad. The acquisition includes a facility, capable of supporting large global and India pharmaceutical clients as well as small biotech companies in the areas of synthetic organic chemistry, analytical R&D, bioanalytical services (for both large and small molecules), in-vivo pharmacology, safety toxicology and research and development of new pharmaceutical formulation.

Recent Product Launch in the Biosimilar Testing and Development Services Market

In May 2022, Pacific Biolabs, Inc., a contract research organization (CRO) announced the launch of in vitro services, offering in vitro, cell-based assays supporting the pharmaceutical, biopharma, and medical device industries. The addition of this group to the PBL testing portfolio strengths the testing capabilities in microbiology, analytical/bioanalytical, and in Vivo departments.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biosimilar testing and development services market analysis from 2022 to 2032 to identify the prevailing biosimilar testing and development services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biosimilar testing and development services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biosimilar testing and development services market trends, key players, market segments, application areas, and market growth strategies.

Biosimilar Testing and Development Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.8 billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 302 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Eurofins Scientific SE, BioPharmaSpec Ltd., Intertek Group plc, Veeda Clinical Research Pvt. Ltd., Element Materials Technology, Sartorius AG, SGS, Charles River Laboratories, Profacgen Technologies Inc., Pacific Biolabs, Inc. |

Analyst Review

The biosimilar testing and development services market refers to a segment within the biopharmaceutical industry that provides services related to the development, testing, and analysis of biosimilars. Biosimilars are biologic medical products that are highly similar to already approved reference biologics (originator or innovator biologics) but are not identical due to differences in their manufacturing processes. The development of biosimilars involves rigorous testing to demonstrate that they are comparable to the reference products in terms of safety, efficacy, and quality

Factors that drive the growth of the biosimilar testing and development services market include the surge in demand for biosimilars as a cheaper alternative to biological drugs, which results in a growing need for biosimilar testing and development services, and a rise in outsourcing of preclinical, clinical and laboratory testing services by pharma and biotech companies. Based on region, North America dominated the global biosimilar testing and development services market in terms of revenue in 2022, owing to the patent expiration of biological drugs provided by major players in North America region and the rise in the prevalence of chronic diseases. On the other hand, Asia-Pacific is expected to register the fastest CAGR during the forecast period. This is attributed to the rise in approval of biosimilars and government initiatives such as funding for biosimilar research and testing.

Rise in outsourcing of preclinical, clinical and laboratory testing services by pharma and biotech companies, and rise in need of biosimilar testing services to meet the growing demand for biosimilars for treatment of chronic diseases are the factors responsible for the market growth.

The pharmacokinetics segment is the most influencing segment owing to fact that understanding the pharmacokinetic profile is crucial to demonstrate bioequivalence with the reference biologic.

Asia-Pacific is expected to experience the growth rate of 12.6% during the forecast period, owing to owing to high approvals of biosimilars and favorable government schemes to fund research and development of biosimilar medicines in the region

The forcast period for the biosimilar testing and development Services Market is 2023 to 2032

The estimated industry size of biosimilar testing and development services in 2032 is $7807.7 million.

The base year is 2022 in the biosimilar testing and development Services Market.

North America is the largest regional market for biosimilar testing and development services owing to patent expiration and rise in demand for biosimilar to treat chronic diseases.

Loading Table Of Content...

Loading Research Methodology...