Biosimulation Market Research, 2032

The global biosimulation market size was valued at $2.5 billion in 2022, and is projected to reach $10.6 billion by 2032, growing at a CAGR of 15.8% from 2023 to 2032. Biosimulation, referred to as modeling and simulation (M&S) models is anticipated to be used in a range of different ways to help determine drug safety and efficacy, including drug identification, human dosing measures for different populations, drug-drug interactions (DDI), clinical trial design, and comparative effectiveness between drug candidates. In addition, biosimulation models use AI and machine learning (ML) to find patterns and evaluate relationships between drugs, patient populations, and clinical trial parameters.

Market dynamics

Surge in demand for personalized medicine due to change in shift from the conventional medical treatment to personalized, or precision, medicine, rise in prevalence of cancer and chronic disease and surge in technological advancements for providing virtual clinical trials tools are the major factors that propel the biosimulation market size. In addition, the increase in the number of key market players that provide biosimulation software and services and the strategies they adopt to improve the product portfolio of the biosimulation are the factors that propel the growth of the market. For instance, in July 2022 Cadence Design Systems, Inc. had entered into a definitive agreement to acquire privately held OpenEye Scientific Software, Inc., a leading provider of computational molecular modeling and simulation software being widely and increasingly used by pharmaceutical and biotechnology companies for drug discovery.

The addition of technologies and experienced team of OpenEye with its deep scientific expertise is anticipated to accelerate Intelligent System Design strategy of Cadence and expand its total addressable market (TAM), bringing computational software expertise of Cadence to apply proven algorithmic, simulation and solver advances to life sciences.

In addition, biosimulation services are often considered a more cost-effective and time-efficient alternative by allowing researchers to explore different scenarios virtually, reducing the need for extensive experimentation.

Moreover, rapid development and adoption of digital health infrastructure, including (AI) (ML), helped to de-risk R&D decisions by providing meaningful actionable insights much earlier in the drug development process with unprecedented accuracy and scalability are the factors that increase the biosimulation market share.

Furthermore, the high failure rate of clinical trials and increase in need to curtail the high costs of drug development are the key factors that boost the growth of the market. For instance, according to an article published in Archives of Pharmacy Practice in 2021 the entire process of drug development takes around $2-2.5 billion and a time of 12-15 years to complete. Around 50% of investigational compounds fail during the development phase of clinical trials. Many clinical trials fail to develop new, safe, and effective drugs despite numerous scientific and technological advancements in research and development. Approximately, 70% of clinical trials fail in phase 2; whereas the failure rate of confirmatory trials (phase 3) is around 50%.

Thus, increase in the number of R&D activities globally and increase in the failure rate of drugs in clinical trials are anticipated to increase the demand for biosimulation software that provide lucrative opportunities during the biosimulation market forecast.

Segmental Overview

The global biosimulation market share is segmented into product, application,delivery model, end user, and region. On the basis of product, the market is segmented into software and services. On the basis of application, it is segregated into drug development, drug discovery and others. On the basis of delivery model, the market is segmented into subscription model and ownership model. On the basis of end user, it is bifurcated into pharmaceutical and biotechnology companies, CROs and academic research institutes. On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

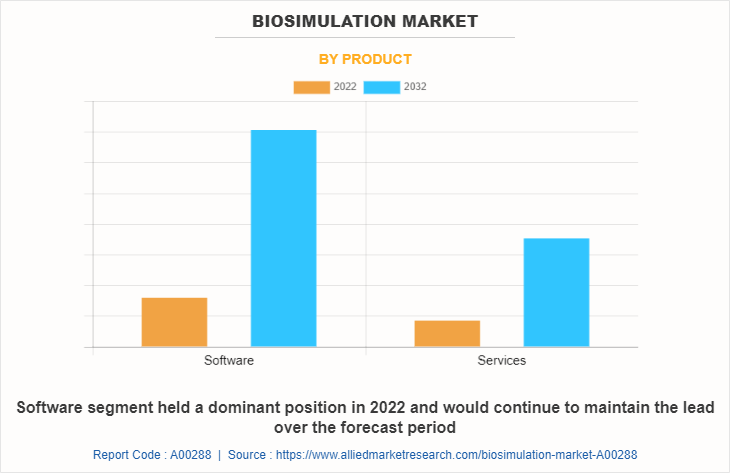

By Product

The biosimulation market is segmented into software and services. The software segment generated maximum revenue in 2022, owing to surge in technological advancement and increase in demand for advanced tools that can accommodate the complexity of biological systems, support interdisciplinary research, streamline drug development processes, and provide accurate predictions and insights for various applications in the life sciences.

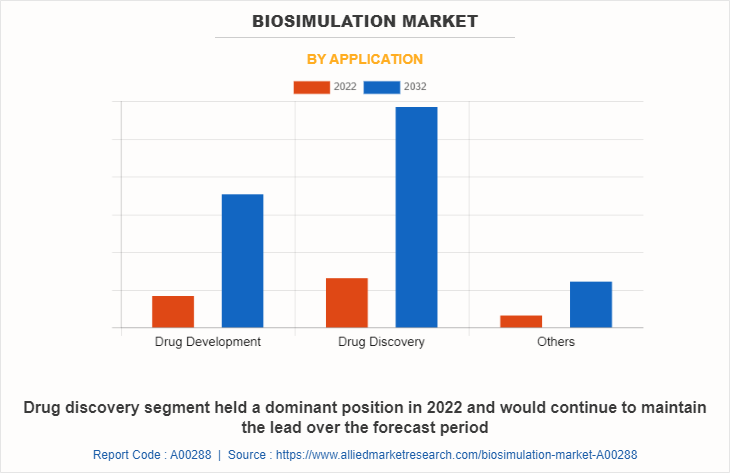

By Application

The biosimulation market is segregated into drug development, drug discovery and others. The drug discovery segment dominated the market in 2022, owing to owing to the convergence of advanced technology, computational capabilities, regulatory support, and a growing need for more efficient drug development processes.

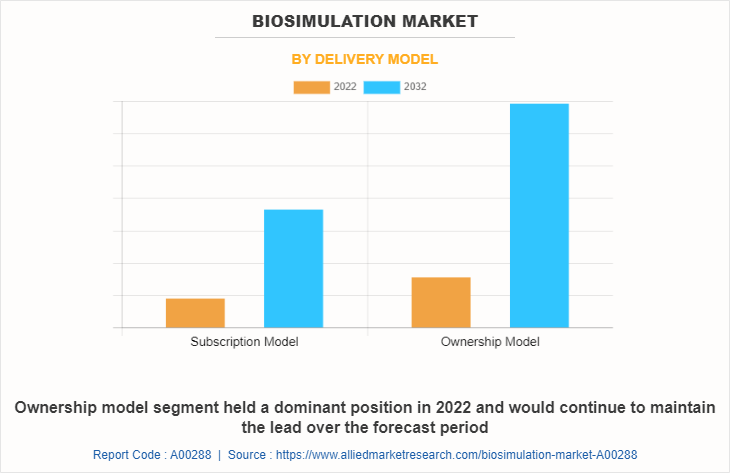

By Delivery Model

The biosimulation market is segmented into subscription model and ownership model. The ownership model segment generated maximum revenue in 2022, owing to the benefits offered by ownership model such as, ownership models come with fewer usage restrictions, allowing organizations to use the software for a variety of purposes without concerns about usage limitations imposed by subscription agreements.

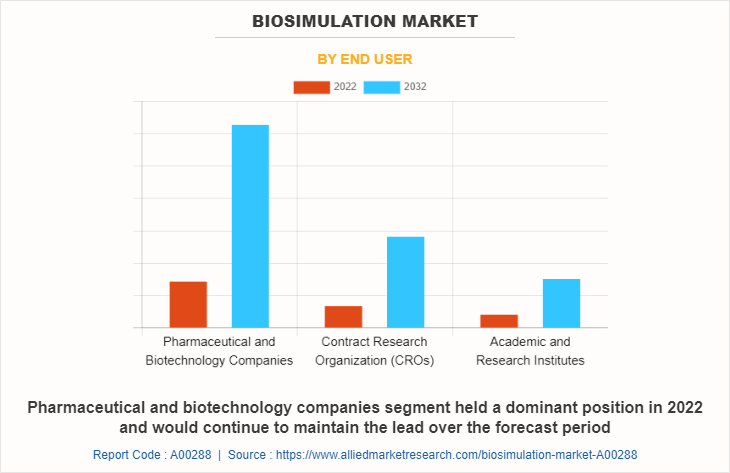

By End User

The biosimulation market is segregated into pharmaceutical & biotechnology companies, contract research organizations (CROs) and academic & research institutes. The pharmaceutical & biotechnology companies segment dominated the market in 2022, owing to increase in prevalence of chronic disease such as cancer, diabetes, Alzheimer's, cardiovascular disease, kidney disorders, increase in number of R&D activities and surge in demand for personalized medicines.

By Region

The biosimulation market growth is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the biosimulation market in 2022 and is expected to maintain its dominance during the forecast period. This is attributed to the presence of key players, increase in digitization in healthcare, and the rise in prevalence of chronic health issues. Moreover, the adoption of in-silico models during the enforcement of regulatory policies to ensure high patient safety and treatment standards has further contributed to the regional market growth.

Asia-Pacific is expected to grow at the highest rate during the forecast period due to increase in the number of CROs, a significant rise in healthcare IT spending, and expanding healthcare infrastructure of developing countries such as China, India, and Japan. In addition, consistent improvements in healthcare infrastructure and increased R&D activities in developing countries are expected to drive the growth of the biosimulation market in the region in the coming years.

Competition Analysis

Competitive analysis and profiles of the major players in the biosimulation industry such as Dassault Systemes, VeriSIM Life, Certara Inc, Genedata AG, SimBioSys, Physiomics PLC, INOSIM Software GmbH, Schrodinger, Inc. Simulation Plus Inc, and Cadence Design Systems, Inc. are provided in the report.

The keyplayers in the biosimulation industry such as Simulation Plus Inc, Cadence Design Systems Inc, VeriSIM Life, Certara Inc, Schrodinger Inc, and Genedata AG have adopted product launch, acquisition, collaboration, partnership, and business expansion as major developmental strategies to improve the product portfolio.

Recent Product Launch in the Biosimulation Market

In July 2023, Simulations Plus, Inc. a leading provider of modeling and simulation solutions for the pharmaceutical and biotechnology industries, announced the release of ADMET Predictor 11, its flagship machine learning modeling platform.

In March 2023, Certara, Inc. announced the release of Simcyp Simulator Version 22, which includes new capabilities and updated features to the population-based modeling and simulation platform of the company. The Simcyp Simulator has proven use cases across drug development, including first-in-human dosing, extrapolation to special populations, bioequivalence testing, optimizing clinical study design and predicting drug-drug interactions (DDIs).

In June 2022, Certara, released the new versions of immunogenicity (IG), immuno-oncology (IO) and vaccine simulators to help predict how drugs work and address key questions in the development of novel biologic therapies.

Recent Acquisitions in the Biosimulation Market

In July 2022, Cadence Design Systems, Inc. had entered into a definitive agreement to acquire privately held OpenEye Scientific Software, Inc., a leading provider of computational molecular modeling and simulation software being widely and increasingly used by pharmaceutical and biotechnology companies for drug discovery.

In May 2022, VeriSIM Life (VeriSIM) announced the acquisition of Molomics Biotech, a privately held drug discovery company that leverages proprietary AI technology to design more efficacious and safer therapeutics to achieve higher successes in clinical trials.

Recent Collaborations in the Biosimulation Market

In March 2023, Simulations Plus, Inc. announced that it established a strategic research collaboration with the Sino-American Cancer Foundation (SACF). This collaboration is expected to staff and Artificial Intelligence-driven Drug Design (AIDD) technology of leverage Simulations Plus in the ADMET Predictor software platform to support the discovery and design of novel inhibitors of methylenetetrahydrofolate dehydrogenase 2 (MTHFD2), an emerging cancer target.

In March 2020, Schrödinger announced an expanded collaboration with AstraZeneca focused on refining a biologics modeling solution with the aim of speeding up the development of antibody and protein-based therapeutic candidates. The new collaboration is aimed at enhancing Free Energy Perturbation (FEP+) technology of Schrödinger for the optimization of key properties of biologics, such as affinity and selectivity, with particular focus on binding affinity.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biosimulation market analysis from 2022 to 2032 to identify the prevailing biosimulation market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biosimulation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biosimulation market trends, key players, market segments, application areas, and market growth strategies.

Biosimulation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.6 billion |

| Growth Rate | CAGR of 15.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 435 |

| By Product |

|

| By Application |

|

| By Delivery model |

|

| By End User |

|

| By Region |

|

| Key Market Players | Dassault Systemes, Simulations Plus, Inc., Cadence Design Systems, Inc., Schrodinger, Inc., Physiomics Plc, INOSIM Software GmbH, SimBioSys, Genedata AG, VeriSIM Life, Certara, Inc. |

Analyst Review

Biosimulation is the study and analysis of biological systems and processes using computer models and simulations. It is an interdisciplinary field that incorporates ideas from biology, physics, math, and computer science to produce digital images of biological occurrences. Biosimulation helps researchers to acquire insights into complicated biological processes, forecast outcomes, and comprehend the underlying mechanisms by mimicking the behavior of biological systems.

The rise in incidence of drug relapse cases due to drug resistance in diseases including cancer, tuberculosis, and other bacterial infections and increase in the trend of virtual clinical trials with the help of biosimulation software are anticipated to boost the growth of the market. For instance, in May 2023 Aragen Life Sciences (Aragen), a leading Contract Research and Development Organization (CRO), and FAR Biotech (FAR), a US-based, AI-driven, computational drug discovery company, have announced a collaboration to advance preclinical programs in neurodegeneration. Aragen is expected to deploy its proven experimental discovery platform to help FAR advance its small molecule program toward an important milestone in neurodegeneration, As part of the collaboration.

For instance, in October 2022, Applied BioMath the industry-leader in providing model-informed drug discovery and development (MID3) support to help accelerate and de-risk therapeutic research and development (R&D), announced a continuation of their collaboration with Celsius Therapeutics for the development of a systems pharmacology model of a monoclonal antibody for the treatment of inflammatory bowel disease (IBD). In this continued collaboration, Applied BioMath is anticipated to develop an in vitro and human systems pharmacology model to support human dose predictions.

Biosimulation uses computer-based mathematical simulations to replicate biological processes, dynamics, and systems. Model-based predictions software such as biosimulation allow researchers to gather important data about how biological systems behave without having to conduct such tests in living organisms, including humans and animals.

The total market value of the biosimulation is $2,452.31 million in 2022.

The forecast period for biosimulation market is 2023 to 2032

Yes, the competitive landscape is included in the biosimulation report.

Increase in demand to curtail drug discovery and development costs, technological advancements in biosimulation software and growth in adoption of biosimulation software

Top companies such as Dassault Systemes, VeriSIM Life, Certara Inc, Genedata AG, SimBioSys, Physiomics PLC, INOSIM Software GmbH, Schrodinger, Inc. Simulation Plus Inc, and Cadence Design Systems, Inc held a high market position in 2022.

North America is anticipated to witness lucrative growth during the forecast period, owing to presence of key market players such as Certara Inc, and Simulation Plus Inc, in this region and significant increase in the prevalence of chronic disease in the U.S.

Software segment dominated the global market in 2022, and expected to continue this trend throughout the forecast period.

Loading Table Of Content...

Loading Research Methodology...