Bitcoin Mining Hardware Market Research, 2031

The global bitcoin mining hardware market was valued at $528.9 million in 2021, and is projected to reach $1.7 billion by 2031, growing at a CAGR of 12.6% from 2022 to 2031.

Bitcoin is one of the most popular types of cryptocurrencies, which are digital mediums of exchange that exist solely online. Bitcoin mining is the process of creating new bitcoins by solving extremely complicated math problems that verify transactions in the currency. It is a mechanism by which bitcoin and several other cryptocurrencies generate new coins and validate new transactions. It entails the use of huge, decentralized networks of computers all over the world to verify and safeguard blockchain, which are virtual ledgers that record bitcoin transactions. Computers in the network are rewarded with new coins in exchange for contributing their processing power. It is a virtuous circle where miners secure and maintain the blockchain. In return, the blockchain rewards coins, and the coins provide an incentive for the miners to maintain the blockchain.

The bitcoin mining hardware market size is expected to witness promising growth in the coming years, owing to improved data transparency and independency across payments in banks, financial services, insurance, and various other business sectors. The use of bitcoin across banking industries provides various benefits such as sending and receiving payment transparently and storing customers detail information securely for next purpose. Moreover, bitcoins are getting a significant surge among developing countries.

The countries such as China, U.S., and Brazil have witnessed significant growth in the bitcoin owing population. In addition, developing economies offer significant opportunities for bitcoin hardware to expand their business by offering easier access to capital and financial services. Therefore, these are some of the factors that propel the growth of bitcoin mining hardware market. However, lack of awareness about bitcoin mining among various emerging countries restricts growth of the market across the globe. On the contrary, developing economies offer significant opportunities for bitcoin mining hardware to expand their business by offering easier access to capital and financial services.

The report focuses on growth prospects, restraints, and trends of the bitcoin mining hardware market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the bitcoin mining hardware market.

Segment Review

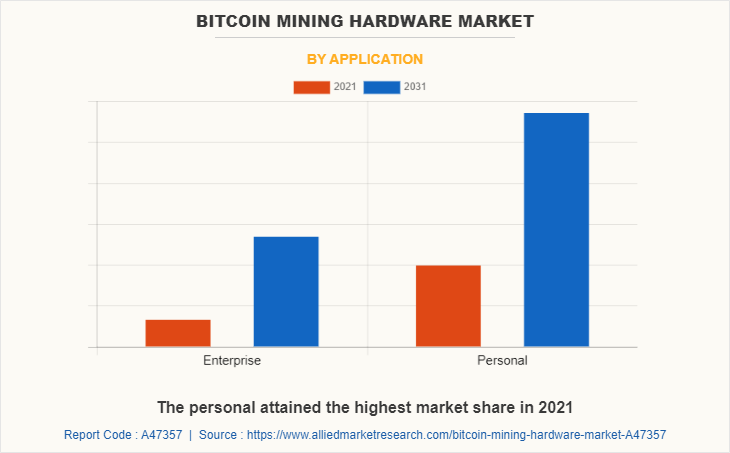

The bitcoin mining hardware market is segmented on the basis of type, security, application, and region. By type, it is segmented into application-specific integrated circuit, field programmable gate array, graphics process unit, and central processing unit. By security, it is bifurcated into, two-factor authentication, biometric security, NFC connectivity, and others. On the basis of application, the bitcoin mining hardware market is segmented into enterprise and personal. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the enterprise segment is likely to gain traction owing to the rise in demand for immersive technology. Unlike traditional processors whose programs define the sequence of instructions to be applied to arithmetic logic units, FPGA designs describe the connection of the logic gates that are available within the FPGA. This is a major growth factor for the bitcoin mining hardware market.

By region, North America attained the highest growth in 2021. This is attributed to the fact that due to an increase in demand for high transparency of distributed ledger technology across the commercial sector, bitcoin mining hardware market has grown significantly in past few years. Moreover, the increase in demand for bitcoin in the commercial sector in North America is one of the prime factors driving the growth of the bitcoin mining hardware market. In addition, the U.S. and Canada contribute significantly to the mining hardware market in this region, owing to government initiatives to legally adopt and monitor cryptocurrency systems across their commercial sectors. These are the key trends of the bitcoin mining hardware market growth in North America.

The report analyzes the profiles of key players operating in the bitcoin mining hardware market such as BetterHash, BIOSTAR Group, Bitcoin Merch, BITMAIN Technologies Holding Company, Coindesk, CoinWarz, Compass Mining, Inc., Nicehash, StormGain, Zipmex. These players have adopted various strategies to increase their market penetration and strengthen their position in the bitcoin mining hardware industry.

Market Landscape and Trends

Digitalized workplaces and simplified operations along with accelerated performance are expected to drive the growth of the global bitcoin mining hardware market over the forecasted period. Demand for enhanced process, and operational expenses, convergence, and centralization are anticipated to favour its growth.

Moreover, one of the main driving forces behind the expansion of the global bitcoin mining market is the high need for enhanced, secure and efficient process of transactions. Such services streamline the banking process, improve client satisfaction, helps for payments transactions and trading and make it simple for the operator to comprehend and monitor the data. In addition, companies are continuously attempting to reduce their capital expenditures and operational costs. Because of the current competitive environment and global economic crisis, the adoption of cost-effective strategies for restructuring existing business models has increased. Therefore, these are the major market trends for the bitcoin mining hardware market.

Top Impacting Factors

Rise in need for Transparency in the Payment System

The bitcoin mining hardware market is expected to witness promising growth in the coming years, owing to improved data transparency and independency across payments in banks, financial services, insurance, and various other business sectors. The use of bitcoin across banking industries provides various benefits such as sending and receiving payment transparently and storing customers detail information securely for next purpose. Furthermore, innovative blockchain distributed technology protocols are expected to replace the need for certain organizational solutions and allow diverse players to share payment transparently across the company. Such systems bring transparency to supply chains, helping in elimination of environmental crimes and others. This boosts the adoption of bitcoin mining hardware in the future. Therefore, rise in need for transparency in the payment system one of the major driving factor of the bitcoin hardware market.

High Growth Potential in Developing Economies

Bitcoins are getting a significant surge among developing countries. The countries such as China, U.S., and Brazil have witnessed significant growth in the bitcoin owing population. In addition, developing economies offer significant opportunities for bitcoin hardware to expand their business by offering easier access to capital and financial services. Bitcoin, the most famous of these cryptocurrencies, has already permitted many people and companies to develop and flourish, as their source of income. The economy is slowly shifting to adapt to these needs and cryptocurrencies have a great potential in satisfying them. Evolving demographics, rise in consumerism and openness toward new technologies such as IoT, Blockchain, and others provide lucrative opportunities for bitcoin/cryptocurrencies across developing nations.

According to Oxford Business Group, Nigeria is the leading country for Bitcoin and cryptocurrency adoption due to use it as a means of sending remittances. Furthermore, rise in smartphone penetration in Latin America and Africa enables mobile payment service providers to offer sophisticated services on mobile phones. This is considered as an important opportunity for the growth of the bitcoin mining hardware market.

Increase in Flow of Remittances from Foreign Countries

During the COVID-19 pandemic, bitcoins have gained a lot of attention and supported low- & middle-income countries to sustain during disruptions. Moreover, growth in number of payment methods for sending money across cross-borders rises the inflow of remittances in developing countries. Remittances are a huge source of income for low- and middle-income countries. In addition, customers are using bitcoin, more frequently for remittances as it provides real-time payment solutions, allows transactions without the need for a centralized authority, and charge meager transactional fees as compared to traditional wire or electronic transfers. Therefore, the demand for bitcoin mining hardware increases.

Moreover, the U.S.-Mexico remittance is one of the largest in the world. For instance, Bitso is a cryptocurrency exchange based in Mexico, and has witnessed an exponential growth in volume for remittances sent from the U.S. to Mexico. This factor has led to increase in flow of remittance through bitcoin from foreign countries, which fuels growth of the market.

Lack of Awareness about Bitcoin Mining Hardware Among People

Lack of awareness about bitcoin mining among various emerging countries restricts growth of the market across the globe. The global economy sector is moving toward a digital eco-system, which includes lending services, money transfer, and investment services. The newest and most promising digital payment system, which is cryptocurrency, is emerging across the globe.

Moreover, blockchain is a currency exchange platform that allows people to use cryptocurrency and bitcoin for tracking transactions and enables the transfer of information and value. Distributed ledger technology has spread from cryptocurrency to a wide number of applications in the financial and government industry. However, numerous people and financial & government industries across developing nations such as India, Africa, and Australia are less aware regarding transactions made using cryptocurrency and blockchain, which hampers growth of the cryptocurrency market across the globe.

Implementation of Various Government Regulations Against Bitcoin

Bitcoins are not legitimate tender in any jurisdiction, which is acting as a major restraint for the growth of bitcoin mining market across the globe. Moreover, the European Union has implemented new laws against holding bitcoins by banks, credit, and investment firms. In addition, the problem with regulating Bitcoin and other currencies is that they’re conducted over a P2P network. All these factors are acting as prime hurdle for the bitcoin mining hardware market.

Untapped Potential in Emerging Economies

Developing economies offer significant opportunities for bitcoin mining hardware market share to expand their business by offering easier access to capital and financial services. Bitcoin, the most famous of these cryptocurrencies, has already permitted many people and companies to develop and flourish, as their source of income. The economy is slowly shifting to adapt to these needs and cryptocurrencies have a great potential in satisfying them. Evolving demographics, rise in consumerism and openness toward new hardware services and others services such as IoT, Blockchain, and others provide lucrative opportunities for bitcoin mining across developing nations. According to Oxford Business Group, Nigeria is the leading country for Bitcoin and cryptocurrency adoption due to use it as a means of sending remittances.

Furthermore, rise in smartphone penetration in Latin America and Africa enables mobile payment service providers to offer sophisticated services on mobile phones. Therefore, this is considered as an important opportunity for the growth of the bitcoin mining hardware market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bitcoin mining hardware market forecast from 2022 to 2031 to identify the prevailing bitcoin mining hardware market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bitcoin mining hardware market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bitcoin mining hardware market trends, key players, market segments, application areas, and market growth strategies.

Bitcoin Mining Hardware Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.7 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 324 |

| By Type |

|

| By Security |

|

| By Application |

|

| By Region |

|

| Key Market Players | StormGain, BetterHash, BITMAIN Technologies Holding Company, niceHash, Compass Mining, Inc., CoinWarz, Zipmex, BIOSTAR Group, CoinDesk, Bitcoin Merch |

Analyst Review

At the root of every cryptocurrency is a blockchain, which is essentially an electronic ledger sustaining a continuously growing list of records. The blocks in the chain are basically files where data such as bitcoin transactions are recorded, including which miner successfully created that particular block. Each block also includes a hash, a unique 64-digit hexadecimal value identifying it and its contents, as well as the hash of the previous block in the chain. In order to win a block in most cryptocurrencies, bitcoin included, a miner has to be the first to guess a hash value equal to or lower than the one that Bitcoin generates for the transaction. As more miners compete, and more computing power is deployed, each miner’s chance of coming in first is reduced—the current odds are one in the tens of trillions—helping ensure a pace for creating new blocks that is currently about one every 10 minutes. This competition among miners also collectively secures the blockchain by allowing transactions and data to flow in what is known as a trustless manner, meaning that an intermediary like a bank isn’t required to ensure that a Bitcoin can’t be spent twice. Moreover, bitcoin mining is a mechanism by which new bitcoins are generate and validate new transactions. It entails the use of huge, decentralized networks of computers all over the world to verify and safeguard blockchain, which are virtual ledgers that record bitcoin transactions.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, Texas Pacific Land Corporation (TPL) has formed a strategic alliance with Mawson Infrastructure Group and JAI Energy to develop up to 60 megawatts of bitcoin mining on TPL’s surface in the western part of Texas. As per the ongoing usage of current generation bitcoin mining hardware, these new facilities, owned and functioned by Mawson, will be able to accommodate up to 2.0 Exahash of Bitcoin mining functioning capacity. Therefore, this strategy helps to grow the market.

Moreover, some of the key players profiled in the report include are BetterHash, BIOSTAR Group, Bitcoin Merch, BITMAIN Technologies Holding Company, Coindesk, CoinWarz, Compass Mining, Inc., Nicehash, StormGain, Zipmex. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The bitcoin mining hardware market is expected to witness promising growth in the coming years, owing to improved data transparency and independency across payments in banks, financial services, insurance, and various other business sectors. The use of bitcoin across banking industries provides various benefits such as sending and receiving payment transparently and storing customers detail information securely for next purpose.

North America is the largest regional market for Bitcoin Mining Hardware

The global bitcoin mining hardware market was valued at $528.91 million in 2021, and is projected to reach $1,676.18 million by 2031, registering a CAGR of 12.6% from 2022 to 2031.

BetterHash, BIOSTAR Group, Bitcoin Merch, BITMAIN Technologies Holding Company, Coindesk, CoinWarz, Compass Mining, Inc., Nicehash, StormGain, Zipmex.

Loading Table Of Content...