Bitumen Emulsifiers Market Research, 2031

The global bitumen emulsifiers market was valued at $128.4 million in 2021 and is projected to reach $184.4 million by 2031, growing at a CAGR of 3.6% from 2022 to 2031. Bitumen emulsifiers are surfactants that are used to stabilize bitumen emulsions. They increase the bitumen emulsifier’s characteristics to inhibit bitumen separation from water and improve emulsion stability. The construction sector is the primary end-use industry for bitumen emulsifiers. Bitumen emulsifiers are used for producing cold mix asphalt, which is used for mending potholes, constructing roads, and paving driveways. The increase in demand for bitumen emulsifiers industry in the construction sector, and the rise in popularity of cold mix asphalt are the primary drivers of the bitumen emulsifiers market size.

A significant barrier to the market for bitumen emulsifiers is the high price of its products. The bitumen emulsifier's overall cost is raised by the expensive raw materials required for its production. The extensive manufacturing process is another challenge for the bitumen emulsifiers market growth. A competent team is required for the difficult bitumen emulsifier production process. Therefore, new competitors find it difficult to sustain in the sector.

The economic growth of the bitumen emulsifier market ultimately benefits from the development of infrastructure. The expansion of the bitumen emulsifier market is a result of the construction of new roads in developing countries due to urbanization and the management of already-existing highways in developed and developing countries. The U.S. has the largest road system in the world, followed by China and India. The U.S. has a network of about 4.4 million kilometers of paved roads, with bitumen emulsifiers being used for both new construction and maintenance activities. According to Indian government figures, about 30 kilometers of new roads are constructed every day.

The key players profiled in the report include Indian Oil Corporation, British Petroleum, Chevron Texaco Corporation, JX Nippon Oil & Energy Corporation, Royal Dutch Shell Plc, Total S.A., Nynas AB, Marathon Oil Company, and China Petrochemical Corporation.

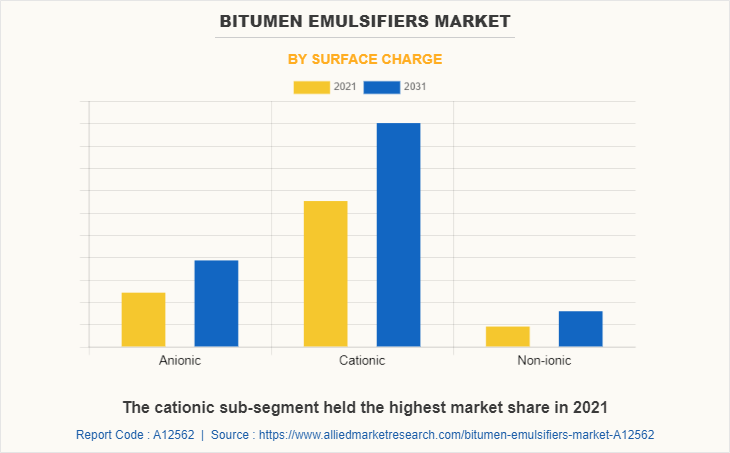

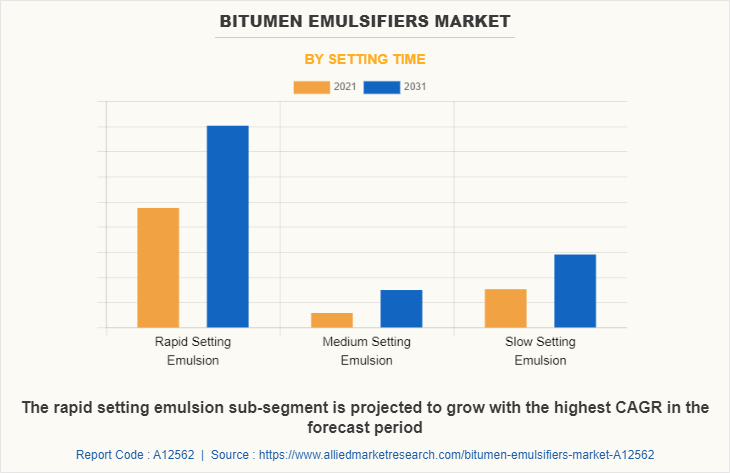

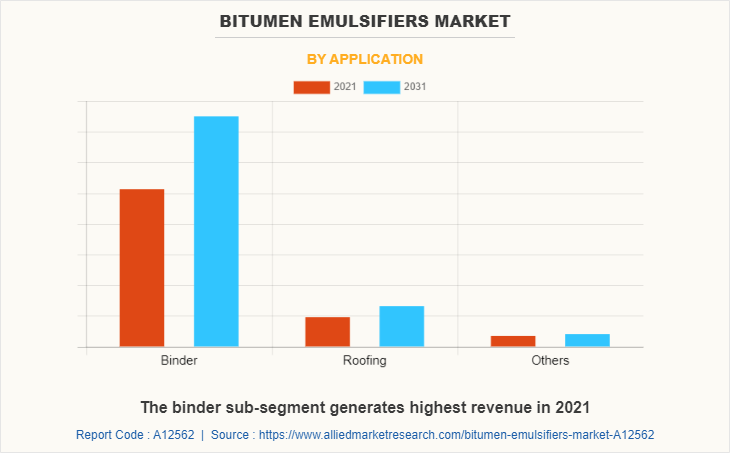

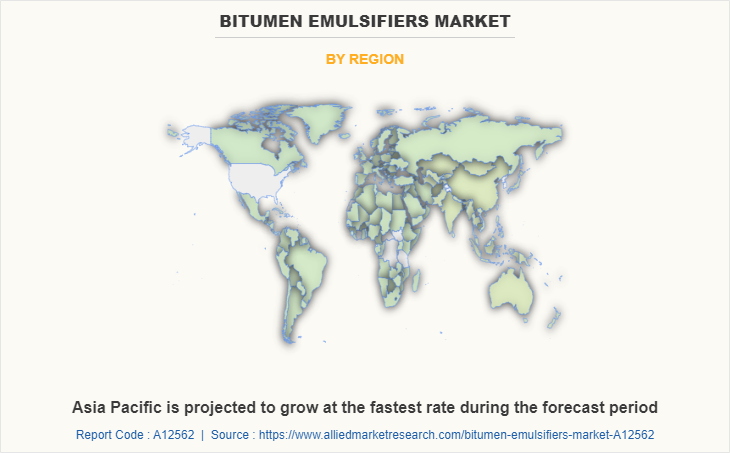

The bitumen emulsifier market is segmented on the basis of surface charge, setting time, application, and region. By surface charge, the market is divided into anionic, cationic, and non-ionic. By setting time, the market is classified into the rapid setting emulsion, medium setting emulsion, and slow setting emulsion. By application, the market divided into binder, roofing, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The bitumen emulsifiers market is segmented into Surface Charge, Setting Time and Application.

By surface charge, the cationic sub-segment dominated the market in 2021. The cationic emulsifier is also expected to exhibit significant growth during the forecasted period. For different types of road and building construction and maintenance tasks, a cationic emulsion of bitumen is a popular choice and a preferred bitumen emulsifier product. Cationic bitumen emulsifiers are suitable for use with bitumen emulsions because the majority of the components used with them are negatively charged. These factors are projected to drive the growth of cationic emulsifiers in the bitumen emulsifiers market share.

By setting type, the rapid setting emulsion sub-segment dominated the global bitumen emulsifier market share in 2021. Manufacturers of rapid setting bitumen emulsion primarily develop this quick bitumen emulsion for fixing coat applications. When rapid setting emulsion comes into contact with construction aggregate, it starts to degrade straight away. This speeds up the setting process and removes any flaws or stains from the road. The rapid setting emulsion is a water-based bitumen and aggregate emulsion. It is well recognized for its speed and is employed as a fantastic road solution. This emulsion is prominent for its quick setting time and thin consistency.

By application, the binder sub-segment dominated the global bitumen emulsifier market share in 2021. The bituminous binder should be fluxed/fluidified with a flux or plasticizer to reduce its viscosity, such as one based on solvents derived from petroleum, petrochemicals, or carbochemicals (such as light petroleum solvents like kerosene, oils from coal, or from petroleum), or one of natural origin based on renewable and non-toxic vegetable and animal fatty substances. At the user's preference, these bituminous binders, include 0.5% to 35% of fluxing agent by weight, ideally between 0.5% and 10% based on the total weight of the binder.

By region, Asia-Pacific dominated the global market in 2021 and is projected to remain the fastest-growing region during the forecast period. Due to the expansion of new infrastructure projects, particularly in developing countries, the bitumen emulsifier market is experiencing strong growth in the region. The bitumen emulsifier market share is anticipated to have significant growth opportunities in Asia-Pacific as the developing countries in the region are witnessing continuous demand for construction activities.COVID-19 has negatively impacted various industries such as chemicals that have led to a drastic decline in chemical sales. As bitumen is widely used in chemical and raw material manufacturing, there was a significant reduction in the bitumen emulsifier market demand globally.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bitumen emulsifiers market analysis from 2021 to 2031 to identify the prevailing bitumen emulsifiers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bitumen emulsifiers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bitumen emulsifiers market trends, key players, market segments, application areas, and market growth strategies.

Bitumen Emulsifiers Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 184.4 million |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Surface Charge |

|

| By Setting Time |

|

| By Application |

|

| By Region |

|

| Key Market Players | Kao Corporation, Tristate Asphalt LLC, Nouryon, Evonik Industries, RX Marine International, T-Pave International Pte Ltd., Xinxiang Tongda Road New Technology Co. Ltd., RAHA Bitumen Co., Croda International Plc., Arkema Group |

| | Kao Corporation, T-Pave International Pte Ltd, Jiangxi SIMO Biological Chemical Co. Ltd. |

Analyst Review

The increase in the need for bitumen emulsifiers in the construction sector, the rise in acceptance of cold mix asphalt, and the increase in environmental concerns are the primary factors projected to drive the bitumen emulsifier market. The main barrier to the bitumen emulsifier market is the strict environmental restrictions by the government. During the manufacturing of bitumen emulsifiers, hazardous chemicals are used, and these chemicals are emitted into the environment. The pollution of the air and water that these pollutants might produce may lead to the implementation of strict safety regulations. Emulsifiers for bitumen are substances that are added to the bitumen to regulate how it mixes with water. It is possible to dilute water with the help of an emulsifier, a surface-active chemical. In the international market, the utilization of bitumen emulsifiers has increased at a reasonable rate. The more advanced projects being undertaken in various countries are anticipated to boost the bitumen emulsifier market growth. Eventually, the country's economy benefits from infrastructure development. Road construction especially in urban areas in developing countries and the maintenance of already-existing roads in developed and developing countries are expected to drive the market growth for bitumen emulsifier.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by 2031, followed by Europe, North America, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for the leading position of Asia-Pacific in the global bitumen emulsifier market.

An increase in the application of bitumen emulsifiers in the production of green binders and in roofing is anticipated to boost the bitumen emulsifier market in the upcoming years.

One of the primary factors driving the global bitumen emulsifier market size during the forecast period is an increase in road construction activities worldwide. The expansion of the bitumen emulsifier market trend is a result of the construction of new roads in developing countries due to urbanization and the maintenance of existing highways in developed and developing countries.

Asia-Pacific will provide more business opportunities for the global bitumen emulsifier market in the future.

The major growth strategies adopted by the bitumen emulsifier market players are product development and joint ventures.

Indian Oil Corporation, British Petroleum, Chevron Texaco Corporation, JX Nippon Oil & Energy Corporation, Royal Dutch Shell Plc, Total S.A., Nynas AB, Marathon Oil Company, and China Petrochemical Corporation are the major players in the bitumen emulsifier market.

Cationic sub-segment of the surface charge acquired the maximum share of the global bitumen emulsifier market in 2021.

Chemical manufacturers are the major customers in the global bitumen emulsifier market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global bitumen emulsifier market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...