Bleeding Disorders Testing Market Research, 2033

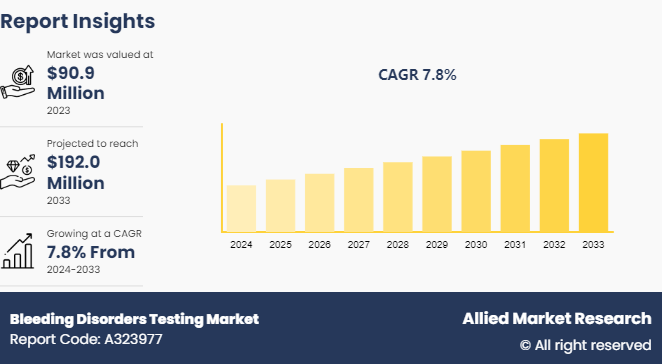

The global bleeding disorders testing market size was valued at $90.9 million in 2023, and is projected to reach $192.0 million by 2033, growing at a CAGR of 7.8% from 2024 to 2033. The bleeding disorders testing market is driven by rising prevalence of bleeding disorders, increasing awareness and early diagnosis, advancements in testing technologies, and growing healthcare expenditure. Additionally, supportive government initiatives and expanding applications of these tests further boost bleeding disorders testing market growth.

Market Introduction and Definition

Bleeding disorders testing involves a series of diagnostic procedures used to evaluate and diagnose conditions that affect the blood's ability to clot properly. These tests are critical for identifying the underlying causes of abnormal bleeding or clotting, which can stem from various genetic or acquired conditions. Common bleeding disorders include hemophilia, von Willebrand disease, and platelet function disorders. The testing process typically begins with a thorough medical history and physical examination, followed by laboratory tests such as complete blood count (CBC) , prothrombin time (PT) , activated partial thromboplastin time (aPTT) , and specific assays for clotting factors.

These tests help determine if there is a deficiency or dysfunction in the blood clotting process, guiding the healthcare provider in diagnosing the specific bleeding disorder and formulating an appropriate treatment plan. Early and accurate diagnosis through bleeding disorders testing is crucial for effective management and prevention of complications associated with these conditions.

Key Takeaways

- The bleeding disorders testing market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major bleeding disorders testing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The bleeding disorders testing market size is driven by several key factors, including the increasing prevalence of bleeding disorders, advancements in diagnostic technologies, and growing awareness about these conditions. For instance, the rising incidence of hemophilia and von Willebrand disease globally necessitates more accurate and timely diagnostic methods, fueling market growth. Innovations such as next-generation sequencing and point-of-care testing provide quicker and more precise results, further driving market expansion. Additionally, supportive government initiatives and funding for research into bleeding disorders enhance market prospects.

However, the market faces significant restraints during bleeding disorders testing market forecast, such as high costs associated with advanced diagnostic tests and limited access to healthcare facilities in developing regions. The affordability of comprehensive bleeding disorder tests remains a challenge, particularly in low-income countries where healthcare infrastructure is inadequate. Moreover, the complexity of bleeding disorder diagnostics requires specialized personnel and equipment, which can be scarce in resource-limited settings, hindering bleeding disorders testing market growth.

Despite these challenges, the bleeding disorders testing market presents substantial bleeding disorders testing market opportunity. The increasing focus on personalized medicine and the development of novel diagnostic tools tailored to individual patient profiles offer promising growth avenues. For example, personalized treatment plans based on specific genetic markers identified through advanced diagnostics can significantly improve patient outcomes. Furthermore, the expansion of telemedicine and digital health platforms can facilitate wider access to bleeding disorder testing, particularly in remote and underserved areas. These opportunities highlight the potential for innovation and expansion in the bleeding disorders testing market, addressing unmet needs and improving patient care.

Market Segmentation

The bleeding disorders testing industry is segmented into product, indication, end-user and region. On the basis of product, the market is bifurcated into reagents & consumables and instruments. Based on indication, the market is divided into hemophilia A, hemophilia B, Von Willebrand disease and others. Based on end user, the market is divided into hospitals & clinics, diagnostic centers, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has the largest bleeding disorders testing market share and is primarily driven by the increasing prevalence of bleeding disorders such as hemophilia and von Willebrand disease, which necessitate accurate and early diagnosis. Advances in diagnostic technologies, including genetic testing and next-generation sequencing, have significantly improved the accuracy and speed of testing, further boosting market growth.

Additionally, rising awareness about bleeding disorders and the importance of early detection among healthcare professionals and patients has led to an increase in testing rates. Government initiatives and funding for research and development in the field, along with favorable reimbursement policies, also play a crucial role in driving the market. Furthermore, the growing aging population, which is more susceptible to bleeding disorders, and the expanding healthcare infrastructure in the region contribute to the market's expansion.

- In April 2022, CSL Behring donated 500 million international units of coagulation factor replacement therapy to the World Federation of Hemophilia charitable aid program to help people suffering from bleeding disorders.

Industry Trends

- According to a 2022 article published by the National Center for Biotechnology Information (NCBI) , the use of artificial intelligence in hemophilia is still in its early stages, as it has several advantages, such as predicting the severity of hemophilia A by better identifying causative genes, mutated gene disease and others.

- According to the Novo Nordisk Hemophilia Foundation 2021 press release, in April 2021, a project to develop an artificial intelligence chat for hemophilia was approved in several African countries. A chatbot will be integrated into web-based mobile phones for early diagnosis and treatment. due to hemophilia.

- In January 2021, the clinical practice guidelines for the diagnosis and treatment of Von Willebrand disease were updated in collaboration with the National Hemophilia Foundation (NHF) , the American Society of Hematology (ASH) , the World Federation of Hemophilia and the International Society Thrombosis and hemostasis (ISTH) .

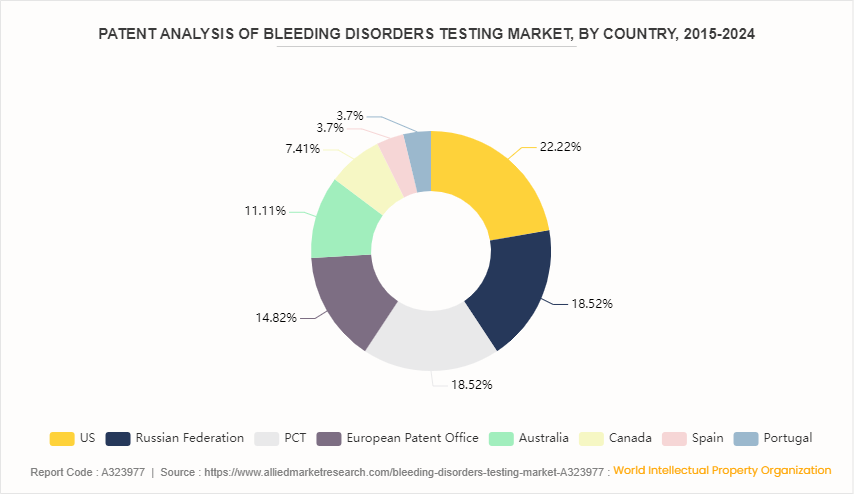

Patent Analysis, By Country, 2015-2024

U.S. witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. Russian Federation and PCT has 18.5% of the total number of patents each respectively, followed by European Patent Office at 14.8%.

Competitive Landscape

The major players bleeding disorders testing market share operating in the market include Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Bio-Rad Laboratories, Inc., Sysmex Corporation, Thermo Fisher Scientific Inc., Grifols S.A., Danaher Corporation, Medtronic plc, Novo Nordisk A/S. Other players in Bleeding disorders testing market includes Stago Group, Sekisui Diagnostics, Siemens AG, Instrumentation Laboratory (Werfen) , and so on.

Recent Key Strategies and Developments

- In March 2023, National Hemophilia Foundation launched a venture philanthropy fund named ‘Pathway to Cures’ to drive the development of transformational therapies and technologies for inheritable blood disorders.

- In July 2022, HORIBA, Ltd. rolled out new products in its Yumizen H500 and H550 hematology product family with increased benefits, new features, and enhanced performance.

- In February 2022, Sysmex Corporation established a new arm, Sysmex LLC, in Saudi Arabia with an aim to reinforce its sales and services structure in the country. The new subsidiary would focus on strengthening its hematology, hemostasis, and urinalysis markets.

- In August 2021, rHEALTH in partnership with a global biopharmaceutical company developed a highly accurate, fingerstick-based approach to measure thrombocytopenia (low platelet counts) .

- In August 2021, Siemens Healthcare GmbH as per its agreement with Sysmex Corporation launched Sysmex’s CN-3000 and CN-6000 Hemostasis Systems for mid and high-volume coagulation testing.

- In March 2021, F. Hoffmann-La Roche Ltd. launched eight new configurations for Cobas pro integrated solutions with an aim to maximize throughput and increase testing efficiency.

- In January 2020, Precision BioLogic Incorporated received the authorization to commercialize the CRYOcheck Chromogenic Factor VIII assay in Australia, New Zealand, Canada, and the European Union.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bleeding disorders testing market analysis from 2024 to 2033 to identify the prevailing bleeding disorders testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bleeding disorders testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bleeding disorders testing market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- GOV.UK

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

- Australian Institute of Health and Welfare

Bleeding Disorders Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 192.0 Million |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Product |

|

| By Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | Grifols S.A., Sysmex Corporation, Roche Diagnostics, Novo Nordisk A/S, Siemens Healthineers, Medtronic plc, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. , Abbott Laboratories, Danaher Corporation |

The Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Bio-Rad Laboratories, Inc., Sysmex Corporation, Thermo Fisher Scientific Inc. held a high market position in 2023.

The base year is 2023 in bleeding disorders testing market.

The forecast period for bleeding disorders testing market is 2024 to 2033.

The market value of bleeding disorders testing market is projected to reach $191.9 million by 2033.

The total market value of bleeding disorders testing market was $90.89 million in 2023.

Loading Table Of Content...