Blockchain Market In BFSI Sector Statistics, 2026

The blockchain in BFSI market size was valued at $277.1 million in 2018 and is projected to reach $22.46 billion by 2026, growing at a CAGR of 73.8% from 2019 to 2026. Blockchain enables the distributed ledger transactions in a blockchain network that maintains identical copies of transaction on multiple computer systems. And, any person that is involved in that network can review the transaction. Moreover, once the transaction is recorded it cannot be erased, however blockchain can be updated with the consent of majority of the participants. The traditional way of cross-border payments involves several issues such as high transaction costs, many intermediaries, and longer duration for completion. On the contrary, blockchain based process doesn’t involve any intermediaries, incurs less transaction cost, and allows quick transfer of money.

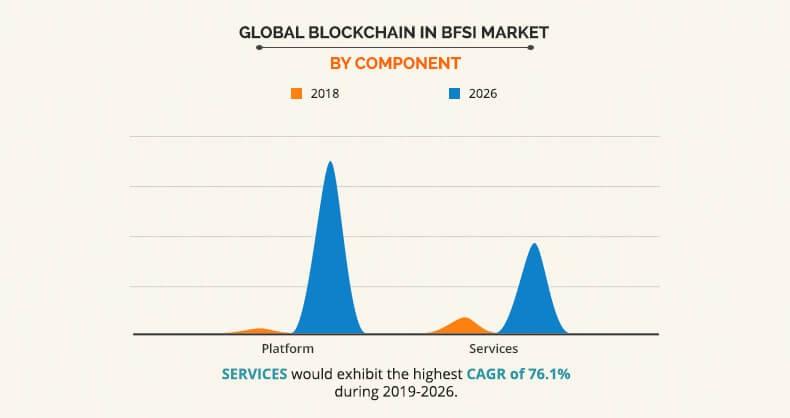

The platform segment is expected to garner major market revenue in 2018 and is expected to remain dominant during the blockchain in BFSI market forecast period. The growth of this segment is mainly attributed to the growth in adoption of blockchain software and cloud computing across the enterprises.

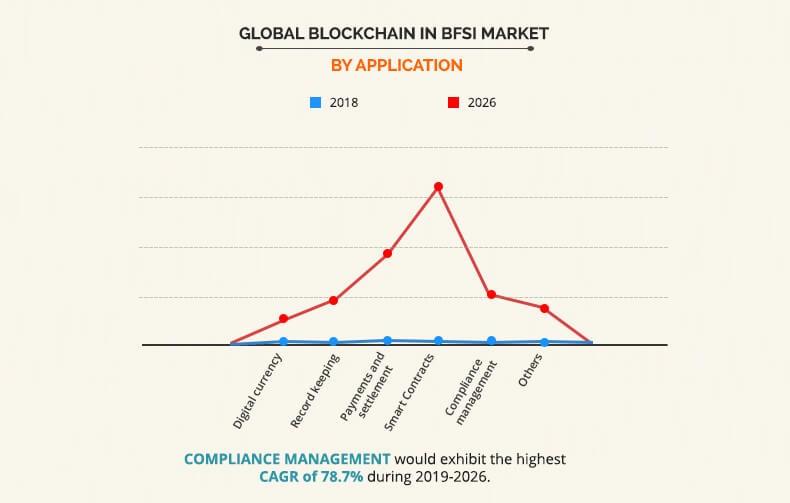

The smart contracts segment dominated the overall blockchain in BFSI market in 2018 and is expected to generate highest revenue during the forecast period. The growth of this segment is mainly attributed to increase in need for self-executing contracts across banks.

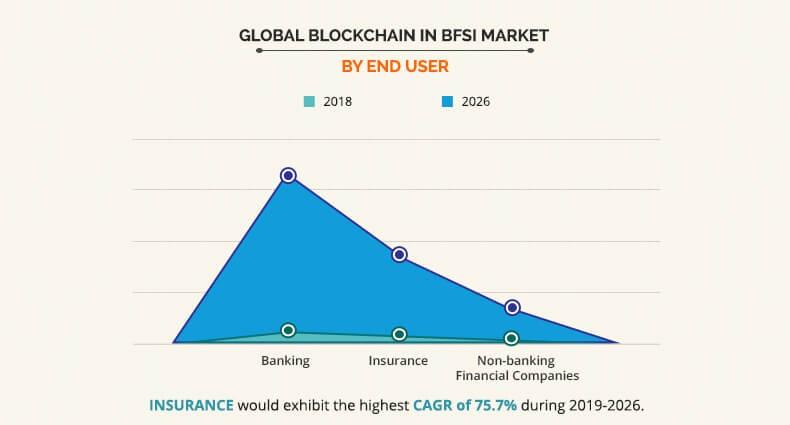

The banking segment generated the highest revenue for blockchain in BFSI market share in 2018 and is expected to dominate throughout the forecast period. Increase in need to streamline the banking processes with distributed ledger technology is the major factor that fuels the growth of this segment.

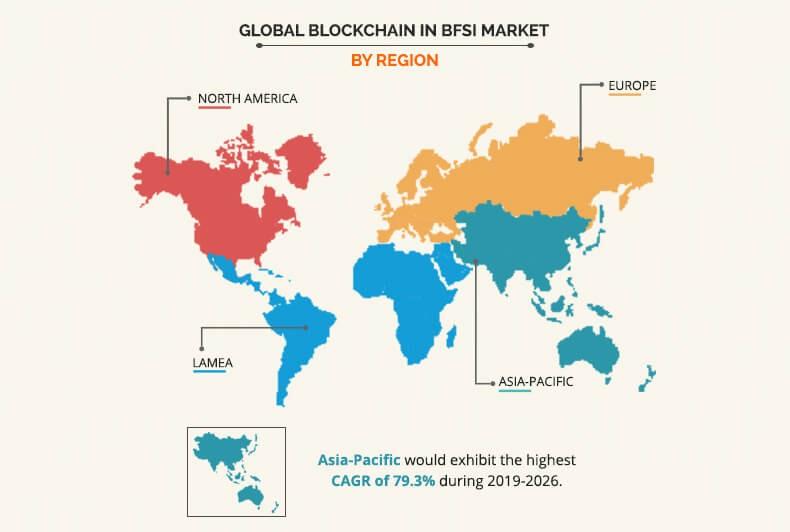

North America dominated the overall blockchain in BFSI market in 2018 and is expected to remain dominant during the forecast period due to presence of major market players and on-going developments in blockchain technology in this region.

The report focuses on the growth prospects, restraints, and trends of the blockchain in BFSI market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market.

Segment Review

The global blockchain in BFSI market is segmented on the basis of component, application, organization size, industry vertical, and region. Based on component, the market is bifurcated into platform and services. Based on application, the market is divided into digital currency, record keeping, payments & settlement, smart contracts, compliance management, and others. Based on organization size, the market is classified into large enterprises and small & medium enterprises. Depending on industry vertical, the blockchain in BFSI industry is fragmented into banking, insurance, and non-banking financial companies (NBFCs). Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global blockchain in BFSI market is dominated by the global blockchain in BFSI players such as Alphapoint, Auxesis Group, Amazon Web Services, Inc. (AWS), Bitfury Group Limited., Hewlett Packard Enterprise Development LP (HPE), International Business Machines Corporation (IBM), Infosys Limited, Microsoft Corporation, Oracle Corporation, and SAP SE.

Top Impacting Factors

Current and future blockchain in BFSI market trends are outlined to determine the overall attractiveness of the market. Top impacting factors highlight the blockchain in BFSI market opportunities during the forecast period. Factors such as increase in need for transactions transparency and accountability, and greater adoption in cross-border payments drive the global market growth. However, scarcity of skilled workforce is expected to impede the market growth during the forecast period. Furthermore, growth in demand for increased scalability, transaction speed and reduction in processing costs are expected to provide major growth opportunities for blockchain in BFSI market in the upcoming years.

Increase In Need for Transactions Transparency And Accountability

Blockchain technology reorganizes the transaction management by replacing mediators with secure digital records. In addition, in the banking network it allows all the parties to share and settle upon vital business information and transactions. It further offers faster transaction processing speed along with transaction and information traceability to all the entities involved in the network, which is expected to the blockchain in BFSI market growth. Furthermore, blockchain is typically known for its enhanced security as it provides cryptographic security for its databases and transactions which is also the key factor that adds transparency and helps in fraud reduction hence, is expected to boost the market growth.

Greater Adoption In Cross-border Payments

Architecture boundaries of the global payments system and numerous combination of policies & processes are acting as major drivers for the blockchain in BFSI market. For instance, according to survey of 300 professionals from international businesses, 64% people are looking for real-time payments tracking and 42% are looking for instant payments. Blockchain technology provides increased transaction speed which helps in creating efficient and real-time global payment system which supports monetary policy and other compliances and privacy.

Growth In Demand for Increased Scalability, Transaction Speed, And Reduction In Processing Costs

Blockchain technology in banking and finance sector is disrupting with its enhanced cryptographic security and transparency. As according to a study, 45% of financial institutions are vulnerable to financial crimes regularly, which is one of the major factors that banks and financial institutions are shifting towards blockchain solutions. Transactions performed through blockchain can eliminate third-party payment gateways resulting in fast-paced financial transactions. Thus, such factors are expected to provide major opportunities for the market growth in the upcoming years.

Key Benefits for Blockchain In BFSI Market:

- This study presents the analytical depiction of the global blockchain in BFSI market trends and future estimations to determine the imminent investment pockets.

- A detailed analysis of the blockchain in BFSI market segment measures the potential of the market. These segments outline the favorable conditions for the market.

- The report presents information related to key drivers, restraints, and opportunities.

- The current blockchain in BFSI market is quantitatively analyzed from 2018 to 2026 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the industry.

Blockchain in BFSI Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Organization Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Oracle Corporation, International Business Machines Corporation, Amazon Web Services, Inc., Infosys Limited, Microsoft Corporation, Bitfury Group Limited, Hewlett Packard Enterprise Development LP, AlphaPoint, SAP, Auxesis Services & Technologies (P) Ltd. |

Analyst Review

The global blockchain in BFSI market in Europe and Asia-Pacific regions is experiencing rapid growth rate owing to immense scope for enhancement. Also, there is positive return on investment in the blockchain technology as there is a strong opportunity for the improvement in existing blockchain platform and solutions. Majority of market players that are operating in this space are collaborating with numerous government entities and banking institutions globally. In addition, growth in demand for increased scalability and reducing the transaction processing costs offers major opportunities for the market growth. Moreover, the increase in adoption of cross-border payments drives the market growth for blockchain in BFSI.

Blockchain also referred as distributed ledger technology (DLT) has numerous benefits in banking sector and governments across the globe are exploring this emerging technology to boost their economy and stop financial frauds. On the contrary, many governments are seeing virtual currencies as a threat due to huge volatility in their rates and restricting banks and individuals from investing & operating in them.

Blockchain technology is in its initial stages of development and needs to prevail over some technical as well as regulatory risks and challenges before it attains widespread adoption. Furthermore, the blockchain in BFSI market is a consolidated market as players such as, International Business Machines Corporation (IBM), Microsoft Corporation, Amazon Web Services, Inc. (AWS), Hewlett Packard Enterprise Development LP (HPE), Infosys Limited, Oracle Corporation, SAP SE, and others hold major share globally. However, market is expected to become fragmented in near future, as many players in developing countries are evolving in this area and coming up with enhanced and innovative blockchain solutions and strategies.

The key players operating in the global blockchain in BFSI market include Alphapoint, Auxesis Group, Amazon Web Services, Inc. (AWS), Bitfury Group Limited., Hewlett Packard Enterprise Development LP (HPE), International Business Machines Corporation (IBM), Infosys Limited, Microsoft Corporation, Oracle Corporation, SAP SE. The key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their blockchain in BFSI market share, and to increase their market penetration. For instance, on March 2019 IBM launched a global network blockchain that is expected to help for payment transactions across the borders. This blockchain will include stable coin backed by U.S. dollars and cryptocurrency for financial transactions across the borders.

The global Blockchain in BFSI market was valued at $277.1 million in 2018, and is projected to reach $22,464.4 million by 2026, registering a CAGR of 73.8% from 2019 to 2026.

The forecast period in the Blockchain in BFSI Market would be 2019-2026

The market value of Blockchain in BFSI Market in 2019 is estimated to be $469.7 million

The base year calculated in the Blockchain in BFSI Market report is 2018

The companies are selected based on the product offerings, organic and inorganic strategies adopted and Georgraphic footprint.

The Companies such as Alphapoint, Auxesis Group, Amazon Web Services, Inc. (AWS), Bitfury Group Limited., Hewlett Packard Enterprise Development LP (HPE), International Business Machines Corporation (IBM), Infosys Limited, Microsoft Corporation, Oracle Corporation, and SAP SE holds the major share in the Blockchain in BFSI Market.

In terms of application, payments and settlement is the most influencing segment in Blockchain in BFSI market, growing at a CAGR of 73.7% during the forecast period.

Yes, the Blockchain in BFSI Market market report provides Value Chain Analysis

Loading Table Of Content...