Bluetooth 5.0 Market Statistics, 2031

The global bluetooth 5.0 market was valued at $4.2 billion in 2021, and is projected to reach $11.7 billion by 2031, growing at a CAGR of 10.9% from 2022 to 2031.

Without increasing power use, Bluetooth 5 doubles the data transmission rate from 1Mbps to 2Mbps. Bluetooth 5 speeds up data transmission and reception by doubling the amount of data that devices can communicate. This enhancement allows for quick and reliable over-the-air firmware updates for mobile devices as well as quick uploading of days' worth of accumulated sensor data. This improvement gives developers the ability to create products that completely rethink how data is transmitted to devices, especially in products where speed is crucial, such as security systems and medical equipment.

The internet of things (IoT) is being revolutionized by Bluetooth 0.5, enabling engineers to lead the way in cutting-edge solutions while also promoting design engineering as a whole. The improvements of Bluetooth 5 enable more options than ever before with up to 4x the range, 2x the speed, 8x the broadcasting message capacity, and greater compatibility with other wireless and cellular protocols.

The Bluetooth 5.0 market share is expected to witness notable growth during the forecast period, owing to increasing demand for audio devices, automotive entertainment, and diagnostic devices. Furthermore, investments in sensing technology for automating and growing dependency on dual audio streaming have driven the growth of the market. However, the reduction in battery life of various smart and portable devices and the unavailability of proper data pack transmitting possibilities are the prime factors restraining the market growth. On the contrary, a surge in the adoption of quality Bluetooth technology services and wireless technology is expected to propel the Bluetooth 5.0 market growth during the forecast period.

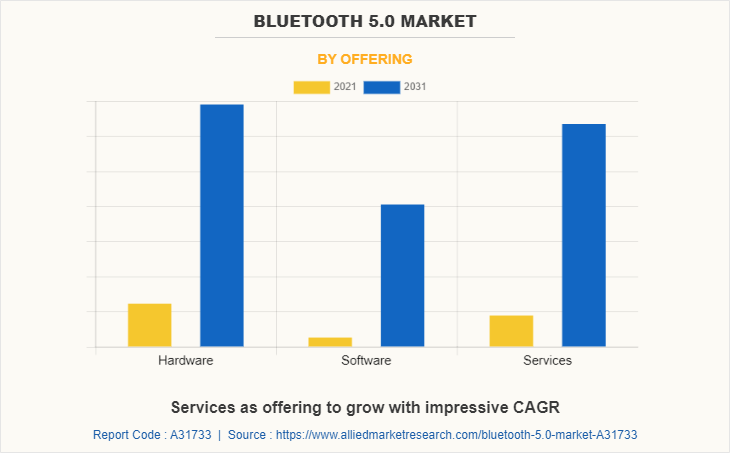

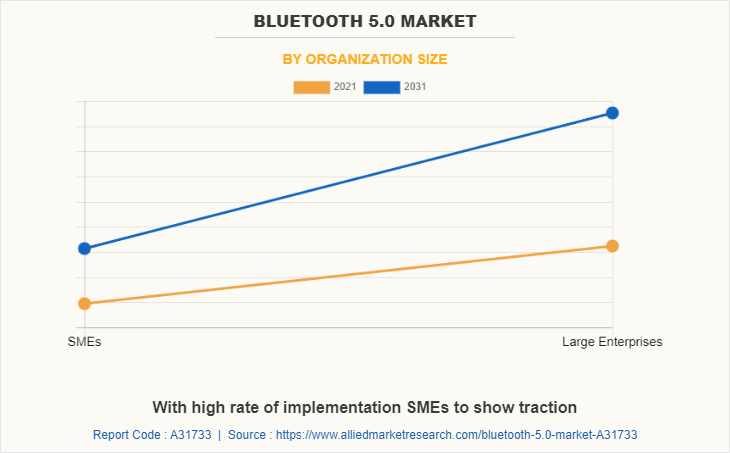

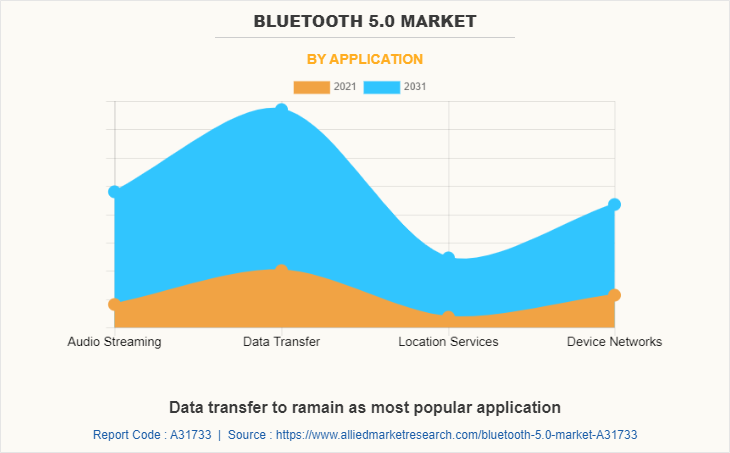

The global Bluetooth 5.0 market research is segmented into offerings, organization size, application, and regions. Based on components, the market is bifurcated into hardware, software, and services. By organization size, it is divided into large enterprises and small & medium-sized enterprises (SMEs). Based on the deployment the market is segmented into cloud and on-premise. Based on application, the market is segmented into audio streaming, data transfer, location services, and device networks.

Key players in the Bluetooth 5.0 market are shifting toward an agile supply chain network model that has multiple pathways to prevent single points of failure. It can help them balance costs with better assurance for business continuity and sustainability. Shifting from single-country hubs to more extensive regional supply networks will initiate collaborative partnerships and industry associations. Stakeholders will be investing in resources and infrastructure that can quickly enable new manufacturing and supply nodes when required.

Without increasing power use, Bluetooth 5 doubles the data transmission rate from 1Mbps to 2Mbps. Bluetooth 5 speeds up data transmission and reception by doubling the amount of data that devices can communicate. This improvement allows for quick and reliable over-the-air firmware updates for mobile devices as well as quick uploading of days' worth of accumulated sensor data. Engineers are currently better able to create solutions that completely rethink how data is transmitted to devices, especially in those cases where speed is crucial, such as security and medical equipment. Therefore, aiming for the wearable device is quicker software updates through wireless, can use of Bluetooth 5 at 2Mbps across a close range, and the device battery life won't be compromised for the end user.

Less broadcast time is needed for a data packet with up to 255 octets, which enables more effective use of the 2.4GHz band's broadcasting channels. The development, acceptance, and use of beacons will be further accelerated by these advertising extensions. The new generation of beacon-based "connectionless" services, such as location or proximity services, discovery services, way-pointing services, asset tracking services, and many more, will also benefit from the improved capacity. Beacons are inexpensive, simple to use, and very adaptable technology. Their potential is further increased by Bluetooth 5's improved capabilities.

In addition to helping things operate more smoothly for customers, Bluetooth 0.5 now provides increased speed (2Mbps) to Bluetooth low energy, which helps speed up the over-the-air updates that IoT sensors regularly require to keep them operating well and secure from hackers. Furthermore, Bluetooth 0.5 provides up to four times the range of Bluetooth 4.2 (at the expense of a significant reduction in throughput, which decreases to 125Kbps as the range is extended), making it more suitable for "whole-of-house applications" like smart lighting in large houses. To compete with competing industrial and smart home networking standards like Thread, ZigBee, and Z-Wave, Bluetooth 5 has also included the "0.9" mesh networking standard.

Mesh gives a system "self-healing" characteristics and range extension by routing packets from node to node until they arrive at their intended destination. Some smart home applications don't require mesh anymore because of Bluetooth 0.5's long-range capability, but the mesh will still be employed in many more due to its other benefits. A smartphone or PC, for instance, will be able to interact with everything on the network without having to deal with a hub thanks to Bluetooth mesh, which reduces complexity and costs. (Concurrent technologies frequently demand a hub to regulate network activities, presenting a possible weak link.) The SIG refers to a second instance as a "scene," where one user activity automatically sets off additional user actions through mesh communication.

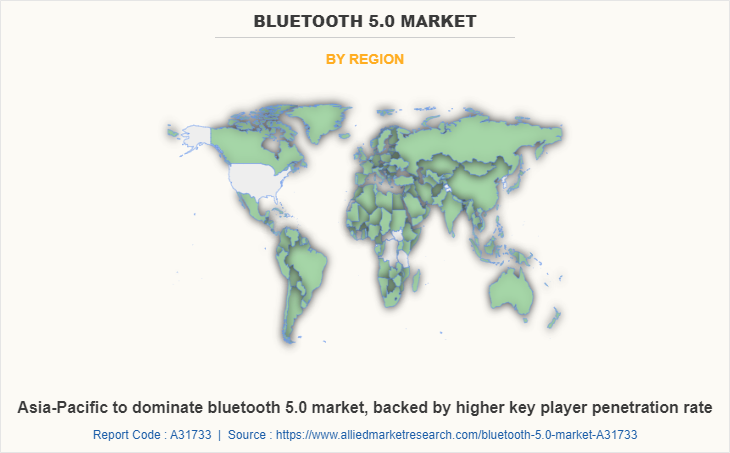

Region-wise, the Bluetooth 5.0 market trends are analyzed across North America (the U.S. and Canada), Europe (Germany, Italy, France, Spain, UK, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the global Bluetooth 5.0 industry. Major organizations and government institutions in the country have been actively using investments in sensing technology for automation.

Top Impacting Factors

Rising investments in sensing technology for automating industrial activities

With Bluetooth 5.0, some devices can be used for data transfer speeds of up to 2 Mbps which is double what Bluetooth 4.2 supports. The rising investments in sensing technology for automating industrial activities have led to the growth of Bluetooth 5.0 over the forecast period. Industrial automation sensors play a significant role in making the products intelligent and highly automatic because these sensors are vital in producing wireless Bluetooth devices intelligent and automated. The growth of this market is attributed to the rising due to surging demand for smart sensor-enabled wearable devices, and the growing technological advancements in industrial sensors.

Growing dependency on dual audio streaming

Wireless connectivity is a common notion shared amongst the improved version of Bluetooth. The latest Bluetooth 5.0 technology is no exception as it excels in wireless connectivity. However, this time it has leveled its game up a notch. In the previous versions of Bluetooth, it was possible to connect the device with a wireless headphone and now one can connect two wireless headphones simultaneously to the same device. As dual audio allows to send of media audio to two different Bluetooth devices at once it increases the demand for an enhanced version of Bluetooth such as Bluetooth 5.0 to pair two pairs of headphones at one time and also share it between two different sets of Bluetooth speakers as well.

MARKET LANDSCAPE

The U.S. and Canada are two of the top countries in this region for Bluetooth 5.0. The market's expansion is being aided by the increasing acceptance rate of cutting-edge products and systems, particularly Bluetooth 5.0 solutions. Japan is estimated to reach $1,161.3 million by 2031, at a significant CAGR of 11.6%. China and Japan collectively accounted for around 68.1% share in 2021, with the former constituting around 44.09% share. India and the Rest of Asia-Pacific are expected to witness considerable CAGRs of 14.6% and 13.2%, respectively, during the forecast period. Due to the presence of rapidly digitalizing economies such as Japan, India, and China, Asia Pacific is predicted to expand with an impressive growth rate during the forecast period.

The improved endorsement of foreign direct investment in digitalization, particularly in countries that are actively pushing digitalization in their economies, such as Germany, France, the UK, and the Rest of Europe has drawn the exposure of data integrational facilities to their productivity. As a result, the use of Bluetooth 5.0 in various digital communications in Europe has actively assisted the region in encouraging automated data integrational processes in the recent past and this trend is expected to continue during the forecast period.

The Europe Bluetooth 5.0 market was valued at $1,073.4 million in 2021 and is projected to reach $2,843.8 million by 2031, registering a CAGR of 10.4%. The rest of Europe was the highest revenue contributor, accounting for $367.1 million in 2021, and is estimated to reach $944.2 million by 2031, with a CAGR of 10.0%. Italy is estimated to reach $523.3 million by 2031, at a significant CAGR of 10.5%. The rest of Europe and Italy collectively accounted for around 52.4% share in 2021, with the former constituting around 34.2% share. Germany and UK are expected to witness considerable CAGRs of 10.6% and 10.6%, respectively, during the forecast period. The cumulative share of these two countries was 24.1% in 2021 and is anticipated to reach 24.7% by 2031.

Competition Analysis

The Bluetooth 5.0 market is fragmented in nature with many players such Broadcom Inc., Infineon Technologies AG, Microchip Technology Inc., Nordic Semiconductor, NXP Semiconductors, Qualcomm Technologies, Inc., Realtek Semiconductor Corp., Silicon Laboratories, Inc., STMicroelectronics and Texas Instruments Incorporated.

These players have been adopting various strategies to gain higher market share or to retain leading positions in the market. Product launch is the most adopted strategy by the players. Top winning strategies are analyzed by performing a thorough study of the leading players in the Bluetooth 5.0 market. A comprehensive analysis of recent developments and growth curves of various companies helps to understand the growth strategies adopted by them and their potential effect on the market.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the Bluetooth 5.0 market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall Bluetooth 5.0 market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current Bluetooth 5.0 market forecast is quantitatively analyzed from 2021 to 2031 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the Bluetooth 5.0 Industry.

- The report includes the market share of key vendors and Bluetooth 5.0 market trends.

Bluetooth 5.0 Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11.7 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 182 |

| By Offering |

|

| By Organization Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Texas Instruments Incorporated, STMicroelectronics, NXP Semiconductors, Nordic Semiconductor, Qualcomm Technologies, Inc., Broadcom Inc.,, Infineon Technologies AG, Silicon Laboratories, Inc.,, Microchip Technology Inc., Realtek Semiconductor Corp |

Analyst Review

Demand for Bluetooth 5.0 has been on a rise for the past few years and the market is expected to continue this trend in the coming years as well, owing to the rising investments in sensing technology for automating industrial activities have led to the growth of the Bluetooth 5.0 market. In addition, growing demand for audio devices, automotive entertainment, and diagnostic devices in many regions of the world is promising new opportunities for the growth of the Bluetooth 5.0 market.

Key providers of the video game software market such as Broadcom Inc., Microchip and NXP Semiconductors account for a significant share of the market. With larger requirements for quality Bluetooth and wireless technological services, various companies are establishing new products allows devices to communicate wirelessly at a more distance. For instance, in May 2020, NXP Semiconductors released availability of new devices within its KW3x family of microcontrollers (MCUs). The new KW39/38/37 MCUs add Bluetooth 5.0 long-range capabilities and expanded Bluetooth advertising channels. These enhancements are made while offering seamless migration with hardware, software and tools compatibility with the previous generation of devices, KW34/35/36. The connectivity allows Bluetooth LE devices to communicate at distances of more than a mile.

In addition, with the increase in demand for Bluetooth versions various companies are expanding their current product portfolio with increasing diversification among customers. For instance, in October 2021, Qualcomm Bluetooth audio solution was among first to deliver enhanced certified LE Audio. One of the latest innovations in the Bluetooth audio industry is LE Audio, and the new LE Audio standard enables a whole new era of listening experiences including audio sharing with broadcast audio capability.

Moreover, market players are expanding their business operations and customers by launching various technically enhanced products. For instance, in September 2020, STMicroelectronics unveiled the BlueNRG-2N Bluetooth 5.0-certified network processor, lowering power consumption and adding support for the latest Bluetooth features that increase data throughput and enhance privacy and security.

Asia-Pacific is the largest regional market for Bluetooth 5.0.

Data transfer is the leading application of Bluetooth 5.0 Market.

Rising investments in sensing technology for automating industrial activities is seen as are the upcoming trends of Bluetooth 5.0 Market.

The Bluetooth 5.0 market was valued at $4.2 billion in 2021.

The Bluetooth 5.0 market is fragmented in nature with many players such Broadcom Inc., Infineon Technologies AG, Microchip Technology Inc., Nordic Semiconductor, NXP Semiconductors, Qualcomm Technologies, Inc., Realtek Semiconductor Corp., Silicon Laboratories, Inc., STMicroelectronics and Texas Instruments Incorporated.

Loading Table Of Content...