Bone Grafts And Substitutes Market Research, 2033

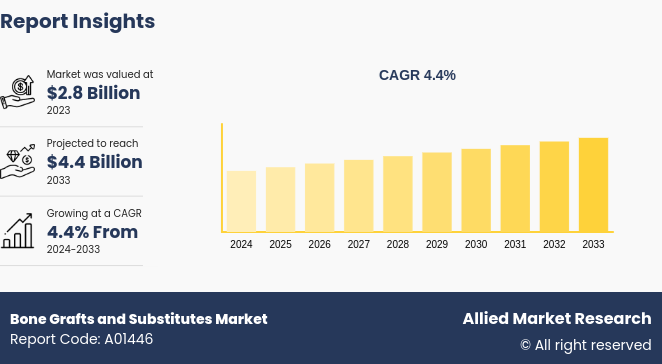

The global bone grafts and substitutes market size was valued at $2.8 billion in 2023, and is projected to reach $4.4 billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033. Rise in the prevalence of orthopedic disorders, and surge in demand for bone grafting procedures is the major driver of the market.

Market Introduction and Definition

Bone grafts and substitutes refers to materials and techniques used to replace or regenerate missing or damaged bone tissue. They are usually utilized when the injured bone cannot be adequately repaired by the body's natural healing process. In orthopedic and dental procedures, these therapies are frequently utilized to restore broken bones, fill in bone abnormalities, or promote bone growth. Increase in number of traffic accidents and joint problems, the need for dental bone grafts, and the ageing population are the main reasons propelling the expansion of the bone grafts and substitutes market growth. Bone fractures and other accident-related injuries are frequently treated with bone substitutes and grafts. Furthermore, they can frequently be utilized to replace or repair damaged bone tissue, which aids in the restoration of normal function and movement.

Key Takeaways

- The bone grafts and substitutes market size study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major bone grafts and substitutes industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives and thus creating bone grafts and substitutes market opportunity.

Key Market Dynamics

The global bone grafts and substitutes market forecast is witnessing growth due to increase in prevalence of orthopedic conditions across the globe. Orthopedic conditions such as osteoarthritis, rheumatoid arthritis, and osteoporosis, are becoming prevalent owing to factors such as an increasingly sedentary lifestyle and poor diet. These conditions often require surgical intervention, which involves the use of bone grafts and substitutes, thereby driving the growth of the market. In addition, geriatric people are prone to bone fractures, osteoporosis and other bone-related diseases which require surgical intervention, resulting in demand for bone grafts and substitute materials. Thus, surge in geriatric population coupled with orthopedic conditions is anticipated to drive the growth of the bone grafts and substitutes market.

The rise in dental disorders such as dental caries and periodontal diseases among the population is expected to increase the demand for dental surgeries, which drives the growth of the market. A dental bone graft is a surgical procedure in which bone material is added to the jaw to create a stable base for a dental implant or to support other dental procedures. Dental bone grafts are commonly performed when a patient has suffered bone loss in the jaw due to periodontal disease, injury, or other factors. Moreover, several advancements include use of growth factors, stem cell-based bone grafts, and adoption of 3D technology. Growth factors stimulate the growth of bone cells and promote healing. They are used in conjunction with bone grafts and substitutes to enhance the bone regeneration process.

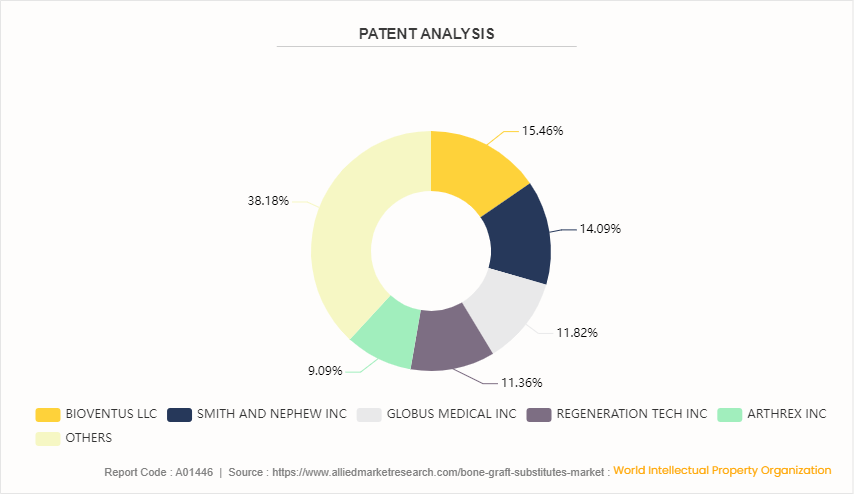

Patent Analysis of Global Bone Grafts and Substitutes Market

Although the growth of the bone grafts and substitutes market size has been more rapid in recent years, the industry can draw on the patents filed by various companies. For instance, patents filed by Bioventus LLC dominated the same with 15.5% share, Smith and Nephew Inc., holds a share of about 14.1% and Globus Medical Inc holds a share of about 14.1%.

Market Segmentation

The bone grafts and substitutes market analysis is segmented into type, application, end user and region. On the basis of type, the market is categorized into allografts, bone grafts substitute and cell-based matrices. On the basis of application, the market is divided into spinal fusion, trauma, craniomaxillofacial surgery, joint reconstruction and dental bone grafting. On the basis of end user, the market is classified into hospitals, specialty clinics and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America accounted for a major bone grafts and substitutes market share of the bone grafts and substitutes market owing to the presence of several major players, availability of advanced healthcare facilities; and high healthcare infrastructure expenditure by the government organizations in the region. Moreover, rise in prevalence of orthopedic disorders, and increase in the number of key players manufacturing bone grafts and substitutes drive the market growth. U.S. is the prime market in North America, owing to a rise in number of sport-related injuries, surge in prevalence of arthritic disorders, and presence of key players manufacturing bone grafts and substitutes. Furthermore, surge in technological advancements in bone grafts is anticipated to drive the growth of the market.

Asia-Pacific bone grafts and substitutes market share is estimated to witness the highest CAGR during the forecast period, owing to enhancements in healthcare facilities and rise in prevalence of orthopedic disorders. In addition, this region offers lucrative opportunities for bone grafts and substitutes market key players, owing to a rise in awareness about advanced bone grafts and increase in adoption of bone grafts substitutes. Another factor driving the growth of the market is the focus of major players on technological advancements in bone grafts.

Industry Trends

- In March 2024, The U.S. Food and Drug Administration issued a draft guidance for sponsors of dental bone grafting devices that offers advice on using animal studies to meet special controls requirements for such devices. The agency said the guidance is meant to augment and, in some circumstances, supersede previous related guidance. FDA laid out its special control requirements for the devices in a separate guidance entitled, Class II Special Controls Guidance Document: Dental Bone Grafting Material Devices.

- In September 2023, TherageniX, a University of Nottingham spin-out pioneering a dry powder gene therapy formulation for bone graft augmentation, and its collaborator, the University of Nottingham, have been awarded a grant from Innovate UK, the UK’s innovation agency.

Competitive Landscape

The major players operating in the bone grafts and substitutes industry include Arthrex, Inc., Johnson & Johnson, Medtronic plc, NuVasive, Inc., Stryker Corporation, Zimmer Biomet Holdings, Inc., Baxter International Inc., Xtant Medical Holdings, Inc., Integra LifeSciences, and Orthofix Holdings, Inc.

Recent Key Strategies and Developments

- In October 2023, Orthofix Medical Inc., a leading global spine and orthopedics company, announced the 510k clearance and full commercial launch of OsteoCove, an advanced bioactive synthetic graft. It is formulated to provide superior bone-forming capabilities with best-in-class handling characteristics for a wide range of spine and orthopedic procedural applications.

- In January 2022, NuVasive, Inc. announced the company received the U.S. Food and Drug Administration (FDA) 510 (k) clearance for expanded indications of use for Attrax Putty with its comprehensive thoracolumbar interbody portfolio for spine surgery.

Key Sources Referred

- National Center for Biotechnology Information

- World Health Organization (WHO)

- National Library of Medicine

- The United States Food and Drug Administration

- U.S. Department of Health & Human Services

- Centers for Disease Control and Prevention

- Eurostat

- International Osteoporosis Foundation

- Johns Hopkins Arthritis Center

- Australian Institute of Health and Welfare

- United States Bone and Joint Initiative

- Johns Hopkins Medicine

- FDI World Dental Federation

- Canadian Dental Association

- Indian Dental Association

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market forecast and opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bone grafts and substitutes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bone grafts and substitutes market trends, key players, market segments, application areas, and market growth strategies.

Bone Grafts and Substitutes Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.4 Billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Zimmer Biomet Holdings, Inc., Xtant Medical Holdings, Inc., Baxter International Inc., Arthrex, Inc, Integra LifeSciences, Orthofix Holdings, Inc., Johnson & Johnson, Medtronic plc, NuVasive, Inc., Stryker Corporation |

Analyst Review

A bone graft refers to a piece of bone obtained from either a natural or artificial source that is used to replace damaged or missing bone. The utilization of bone grafts and substitutes is expected to witness a significant rise in the near future with increase in diagnosis of orthopedic disorders and trauma cases. The bone grafts and substitutes market has piqued the interest of healthcare providers, owing to several benefits offered by these devices to treat orthopedic disorders and improve the quality of life of patients. Technological advancements in these devices to provide advanced treatment options has fueled their adoption globally. While the market is growing at a steady rate in the developed nations, Asia-Pacific and LAMEA are expected to offer potential growth opportunities to the key players.

Increase in musculoskeletal conditions, advancements in medical technology leading to a shift from autograft to allograft, rise in preference for biocompatible bone grafts are the key factors that contribute toward the growth of the global bone grafts and substitutes market. In addition, increase in cases of lifestyle disorders such as diabetes and obesity add to the risk of developing degenerative joint diseases that fuel the growth of the market. The major restraints of this market are ethical issues related to bone grafting and high cost of surgeries.

Emerging markets are gaining more importance for majority of the manufacturers and distributors in the bone grafts and substitutes market. The need for improved healthcare services in emerging nations has resulted in a significant growth in shipment of these devices, which is expected to offset the challenging conditions in mature markets such as North America and Europe. North America is expected to dominate the market, followed by Europe. This is majorly attributed to to rise in the elderly population, favorable reimbursement rates, technology innovations (such as rh-BMP), increase in incidence of orthopedic disorders, and surge in preference for an active lifestyle among the U.S. citizens.

Surge in the number of orthopedic disorders and trauma's are are the upcoming trends of Bone Grafts and Substitutes Market in the globe.

Spinal Fusion is the leading application of Bone Grafts and Substitutes Market

North America is the largest regional market for Bone Grafts and Substitutes.

The bone grafts and substitutes market was valued at $2.83 billion in 2023.

The major players operating in the bone grafts and substitutes market include Arthrex, Inc., Johnson & Johnson, Medtronic plc, NuVasive, Inc., Stryker Corporation, Zimmer Biomet Holdings, Inc., Baxter International Inc., Xtant Medical Holdings, Inc., Integra LifeSciences, and Orthofix Holdings, Inc.

Loading Table Of Content...