Bottled Water Market Research - 2031

The global bottled water market size was valued at $301.7 billion in 2021 and is estimated to reach $515.3 billion by 2031, exhibiting a CAGR of 5.5% from 2022 to 2031. The bottled water market is driven by rise in health consciousness and shift from sugary beverages. Concerns about water quality and safety in many regions make bottled water a preferred choice. Urbanization and hectic lifestyles contribute to the demand for convenient, on-the-go hydration solutions. In addition, innovations in packaging, such as eco-friendly and reusable bottles, attract environmentally conscious consumers. The growing popularity of premium and flavored water products also diversifies market offerings. Rise in tourism and travel further fuels bottled water consumption, as travelers often rely on packaged water for its perceived safety and reliability.

Introduction

Bottled water is packaged drinking water that is purified and free from contamination. It is available in plastic and glass water bottles and is the most convenient way for the body to fulfill its hydration needs, being easily available in nearby retail stores and supermarkets.

Report Key Highlighters:

- The bottled water market report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions. Moreover, the report covers sub-segments that is studied across all the regions.

- Latest trends in global bottled water market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,500 bottled water industry-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global bottled water market.

Market Dynamics

The bottled water market is experiencing substantial growth due to multiple factors, including rise in health awareness, water quality concerns, convenience, and lifestyle changes. Health consciousness is a significant driver, with rise in the number of consumers opting for bottled water over sugary drinks and sodas. According to data from the U.S. Centers for Disease Control and Prevention (CDC), nearly 63% of American adults try to reduce their sugar intake, leading to a shift toward healthier beverages including bottled water. Governments globally have launched public health campaigns advocating for healthier drinking habits, further propelling bottled water consumption. The World Health Organization (WHO) has also emphasized the importance of hydration, indirectly supporting bottled water demand as people seek convenient sources of clean water.

However, the bottled water market faces several restraints, with environmental concerns, regulatory pressures, and consumer advocacy efforts being significant challenges. One of the primary restraints is the environmental impact of plastic waste. According to a report from the United Nations Environment Programme (UNEP), an estimated 300 million tons of plastic waste is produced each year, with a considerable portion attributed to single-use plastic bottles. Governments worldwide are taking measures to address this issue; for example, the European Union has implemented the Single-Use Plastics Directive (EU 2019/904), which aims to reduce plastic waste by banning certain single-use plastic products, including plastic bottles, unless they meet specific design criteria for recyclability. This has increased pressure on bottled water manufacturers to adopt more sustainable packaging solutions, which can involve higher production costs, thereby potentially impacting the market growth and profitability.

However, the bottled water market presents several growth opportunities, fueled by increase in consumer demand for health-conscious products, innovations in sustainable packaging, and government initiatives promoting safe drinking water. One of the most prominent opportunities lies in rise in health consciousness among consumers. As people become more aware of the adverse health effects of sugary beverages, they increasingly prefer bottled water as a healthier alternative. Government data supports this trend; for instance, the U.S. Centers for Disease Control and Prevention (CDC) reports a decrease in soda consumption and rise in bottled water intake among Americans over the past decade. This shift is also evident in Europe, where policies promoting public health, such as the European Union's "Europe Beating Cancer Plan," emphasize reducing sugar consumption. Bottled water companies can leverage these health campaigns to position their products as essential for maintaining a healthy lifestyle, thereby expanding their market reach.

Segments Overview

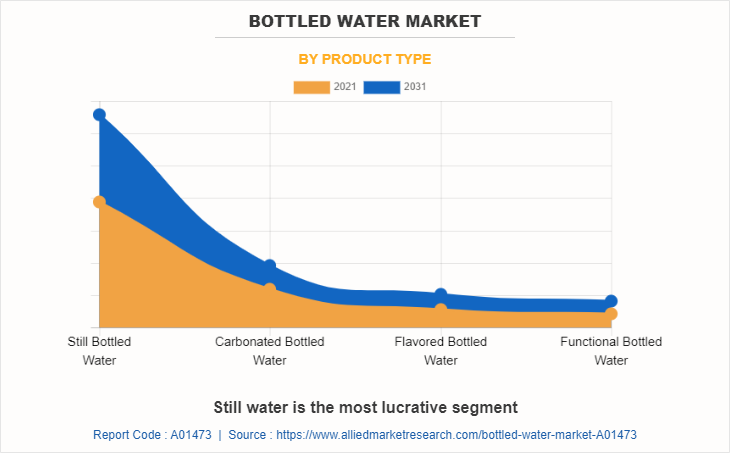

The bottled water market is segmented by product type and region. On the basis of product type, it is divided into still bottled water, carbonated bottled water, flavored bottled water, and functional bottled water. Region wise, the market is studied across North America, Europe, Asia-Pacific, South America, Middle East, and Africa.

Bottled Water Market, By Type

In 2021, the still water segment accounted for the largest revenue share of 64.3% in 2021 and is projected to grow at a CAGR of 5.4% during the forecast period. This is attributed to the rapid shift toward healthy drinking practices where water type bottled water is mostly preferred by consumers owing to its cheap rates. This factor is escalating the growth of this segment in the global bottled water market.

Bottled Water Market, By Geography

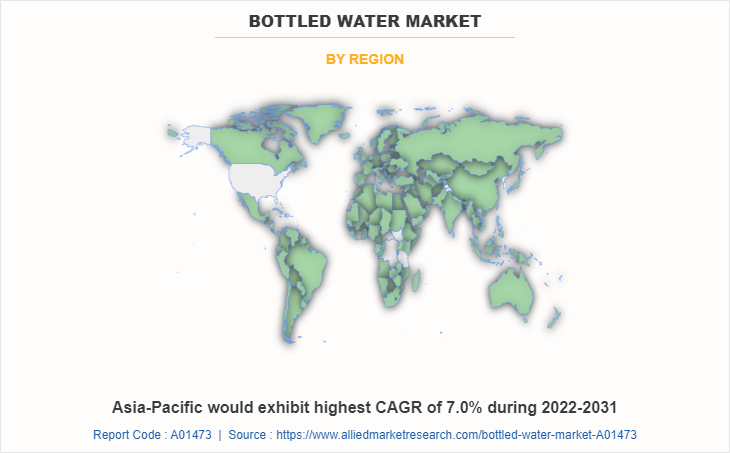

The Asia-Pacific bottled water market share is projected to grow at the highest CAGR of 7.0% during the forecast period and account for 27.0% of the market share in 2021. This is attributed to increase in demand for bottled water in countries, such as China, India, Japan, Australia, and others. China is the largest consumer of bottled water followed by countries, such as India and Japan. Furthermore, manufacturers across the globe find Asia-Pacific as an attractive market, owing to cheap labor cost, low cost of setting up manufacturing units, and low cost of bottled water. These factors drive the bottled water industry in this region.

Competitive Analysis

The major companies profiled in this report include, Danone, Hangzhou Wahaha Group CO, Ltd., Icelandic Glacial, Nestlé, Niagara Bottling, LLC., Nongfu Spring., Norland International, PepsiCo, The Coca-Cola Company, and VOSS of Norway AS.

Industry Trend

- The bottled water market witnessed several key industry trends from 2010 to 2022, with government data highlighting shifts in consumer behavior, regulatory changes, and environmental priorities. One prominent trend is rise in health consciousness among consumers, leading to a shift away from sugary drinks. According to data from the U.S. Centers for Disease Control and Prevention (CDC), there was a significant decline in soda consumption, with bottled water sales surging as a healthier alternative. Governments in Europe and North America supported this trend through public health campaigns promoting water intake, boosting the bottled water market.

- Another notable trend is the rapid growth in emerging markets, particularly in Asia-Pacific, Latin America, and Africa. Concerns over water quality and access to safe drinking water fueled demand for bottled water in these regions. For instance, data from the Indian Ministry of Drinking Water and Sanitation showed that only around 70% of the population had access to safe drinking water, driving reliance on bottled water. Governments in these regions launched initiatives to improve water infrastructure, yet the gap in clean water access continued to present a market opportunity for bottled water companies.

- Sustainability became a crucial aspect in the late 2010s, with increasing regulatory pressure to address plastic waste. The European Union implemented the Single-Use Plastics Directive (EU 2019/904) to reduce plastic pollution, prompting bottled water companies to innovate with eco-friendly packaging. Governments in countries such as Japan and Canada also introduced policies to promote recycling, influencing industry practices and consumer expectations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bottled water market analysis from 2021 to 2031 to identify the prevailing the market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bottled water market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global bottled water market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bottled water market trends, key players, market segments, application areas, and market growth strategies.

Bottled Water Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 515.3 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 216 |

| By Product Type |

|

| By Region |

|

| Key Market Players | Niagara Bottling, LLC, Nongfu Spring, PepsiCo Inc., Icelandic Glacial Inc., The Coca Cola Company, BlueTriton Brands, Inc., Nestle Waters, HANGZHOU WAHAHA GROUP CO., LTD., VOSS of Norway AS, Danone |

Analyst Review

The global bottled water market is expected to exhibit high growth potential during the forecast period. Rise in demand from end users, such as food outlets, restaurants, hospitals, and others, especially from developing countries, and spurring rise in health-conscious buyers are the key driving factors for the global bottled water market. Moreover, stringent regulations for the approval of bottled water and availability of tap water at a lower cost are some of the major hindrances observed for the growth of the bottled water market. Asia-Pacific is projected to register significant growth compared to the markets of North America and Europe during the forecast period.

In addition, there is an emerging megatrend for consuming flavored bottled water over normal sugary water owing to the rise in awareness for health benefits associated with the use of flavored bottled water. This has made customers more linear toward purchasing flavored bottled water. Sustained economic growth and development of the beverage sector have increased the popularity of bottled water

Rising demand for flavored bottled water owing to its fruit essence and artificial sweeteners contents surge the popularity of flavored bottled water among consumers.

Asia-Pacific is the largest regional market for bottled water market.

The global bottled water market was valued at $301.7 billion in 2021.

The major companies profiled in this report include, Danone, Hangzhou Wahaha Group CO, Ltd., Icelandic Glacial, Nestlé, Niagara Bottling, LLC., Nongfu Spring., Norland International, PepsiCo, The Coca-Cola Company, and VOSS of Norway AS.

Loading Table Of Content...

Loading Research Methodology...