Breast Cancer Screening Market Research, 2033

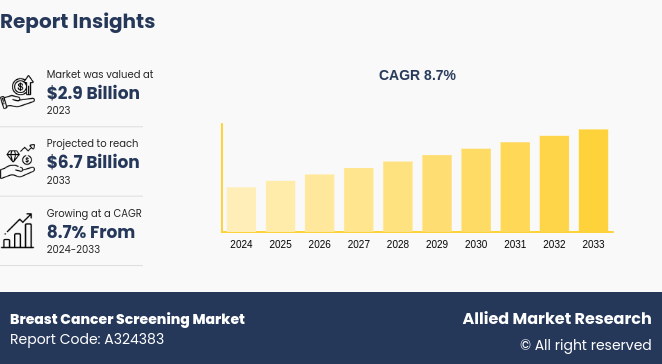

The global breast cancer screening market size was valued at $2.9 billion in 2023, and is projected to reach $6.7 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. The major factors driving the growth of the breast cancer screening market are rising prevalence of breast cancer, increasing awareness about early detection, and advancements in screening technologies. In addition, the growing adoption of digital mammography and 3D imaging techniques, which offers improved accuracy and early diagnosis, further propels market growth.

Market Introduction and Definition

Breast cancer screening is a crucial preventive measure aimed at detecting breast cancer at an early stage, often before symptoms appear. The primary methods of screening include mammography, clinical breast exams, and breast self-exams. Mammography, an X-ray of the breast, is the most common and effective screening tool, capable of identifying tumors that are too small to be felt. Regular mammograms are recommended for women aged 40 and above, although the exact age and frequency can vary based on individual risk factors and guidelines from health organizations. In some cases, additional imaging techniques like ultrasound or MRI may be utilized, particularly for women with dense breast tissue or those at high risk. Early detection through screening significantly increases the chances of successful treatment and survival, making it a vital component of women's health care.

Key Takeaways

- The breast cancer screening market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major breast cancer screening industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to breast cancer screening market forecast analysis the key factors driving the growth of the market are increase in prevalence of breast cancer, rise in awareness about the importance of early diagnosis of breast cancer, and technological advancement in cancer screening technology. Breast cancer remains one of the most common cancers globally, affecting millions of women each year. According to 2024 article by National Breast Cancer Foundation, Inc., approximately 13% of the female population in the U.S., will develop breast cancer in their lifetime. As the incidence of breast cancer rises, the demand for early detection and diagnosis becomes more critical. Early detection through regular screening can significantly improve treatment outcomes and survival rates, leading to a greater emphasis on screening programs. This surge in prevalence has prompted governments and health organizations to implement widespread screening initiatives and awareness campaigns, encouraging women to undergo regular mammograms and other screening procedures. Thus, the rise in the prevalence of the breast cancer and surge in awareness about early diagnosis of breast cancer are expected to drive the breast cancer screening market growth.

In addition, according to breast cancer screening market trends analysis advancements in screening technologies are expected to significantly contribute in the market growth. Innovations such as digital mammography, 3D mammography (tomosynthesis) , and advanced ultrasound techniques have vastly improved the accuracy and reliability of breast cancer screenings. Digital mammography offers higher resolution images and better visualization of abnormalities compared to traditional film mammography, facilitating earlier and more precise diagnosis. 3D mammography further advances this by providing a more detailed view of breast tissue, allowing radiologists to detect smaller lesions that might be missed in standard 2D mammography. Additionally, advancements in ultrasound technology, including automated breast ultrasound systems (ABUS) , have enhanced the detection capabilities in women with dense breast tissue, where mammography alone might be less effective. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into screening processes has led to more accurate interpretations of imaging data. Thus, the technological advancement in the screening technologies is expected to drive the breast cancer screening market size.

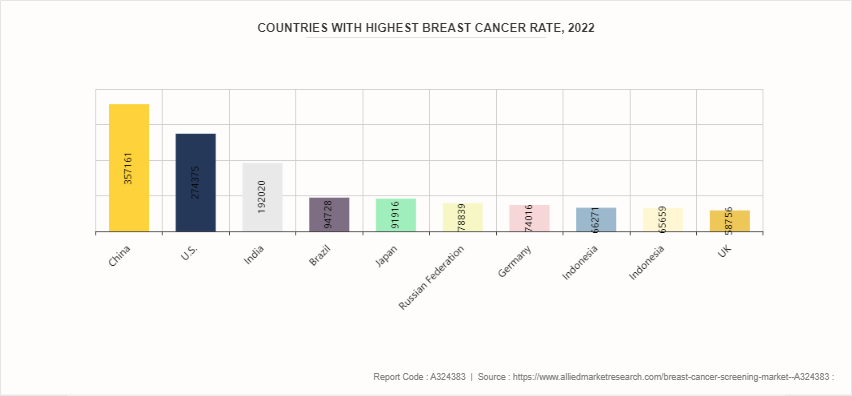

Countries with Highest Breast Cancer Rate

In 2022, China had the highest number of breast cancer cases, with 357, 161 reported. Following China, the U.S. had 274, 375 cases, making it the second highest. India ranked third with 192, 020 cases. Brazil reported 94, 728 cases, placing it fourth on the list. Japan was close behind with 91, 916 cases. The Russian Federation had 78, 839 cases, while Germany reported 74, 016 cases. Indonesia had 66, 271 cases, France (metropolitan) had 65, 659 cases, and the UK had 58, 756 cases, rounding out the top ten countries with the highest breast cancer rates in 2022.

According to breast cancer screening market analysis high incidence of breast cancer in these countries is likely to significantly impact the breast cancer screening market. As China, the United States, and India lead the list, there will be increased demand for advanced screening technologies and services in these regions. The growing number of cases necessitates early detection, driving the adoption of mammography, ultrasound, and MRI screening tools. This surge in demand will likely encourage innovations and advancements in screening technologies, including the development of AI-based diagnostic tools that can enhance accuracy and efficiency.

Market Segmentation

The breast cancer screening industry is segmented into test type, gender, end user and region. By test type, the market is divided into blood marker test, genetic test, imaging test, immunohistochemistry test. According to gender, the market is divided into male and female. As per end user, the market is divided into specialty clinics, hospitals, diagnostic centers and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the breast cancer screening market share owing to substantial research and development activities in breast cancer screening, a strong presence of major key players and well-established healthcare industry, and growing awareness about the early diagnosis of breast cancer. However, according to breast cancer screening market opportunity analysis Asia-Pacific region is expected to register significant growth in the forecast period owing to developing healthcare infrastructure, high prevalence of breast cancer in countries such as China and India, favorable government initiatives facilitating screening programs, and treatment for chronic diseases such as breast cancer.

- In an article published in 2024 by World Cancer Research Fund Organization, India recorded highest number of deaths due to breast cancer in 2022. About 98, 337 deaths occurred due to breast cancer.

- According to a 2022 article by National Library of Medicine, close to half (45.4%) of the 2.3 million breast cancers (BC) diagnosed in 2020 were from Asia.

- According to 2021 U.S. Cancer Statistics, in the U.S. around 272, 454 new breast cancers were reported in females in 2021.

- According to European Union, Denmark was the country in Europe with highest breast cancer screening rates for women aged 50 to 69 years.

Industry Trends

- According to a 2021 article by National Cancer Institute, in U.S. 75.9% of women aged 50-74 years had a mammogram within the past 2 years (2019-2021)

- According to the 2024 article by National Breast Cancer Foundation, Inc., 1 in 8 women in the U.S. will be diagnosed with breast cancer in her lifetime.

- According to European Union, in 2021, the top three countries with the highest breast cancer screening rates for women aged 50 to 69 years are Denmark (83.0%) , Finland (82.2%) and Sweden (80.0%) .

- According to 2024 article by American Cancer Society, breast cancer is the most common cancer in India, accounting for 28.2% of all female cancers

Competitive Landscape

The major players operating in the breast cancer screening market include Siemens Healthineers AG, Myriad Genetics, Metabolomic Technologies Inc, Biocrates Lifesciences AG, A&G Pharmaceuticals, Provista Diagnostics Inc, F. Hoffmann-La Roche AG, Volpara Health Limited, Quest Diagnostics and GE HealthCare. Other players in the breast cancer screening market include Agendia NV, Oncocyte Corporation, and Allengers Medical Systems Ltd.

Recent Development in the Breast Cancer Screening Industry

- In May 2022, VolparaHealth introduced updated products for its integrated platform to deliver personalized breast care at the SBI/ACR Breast Imaging Symposium 2022. Volpara's AI-driven breast software tools improve mammography quality and reporting, volumetric breast density measurements, and cancer risk assessment.

Key Sources Referred

- National Library of Medicine

- Center of Disease Control and Prevention

- U.S. Cancer Statistics

- European Union

- World Cancer Research Fund Organization

- National Breast Cancer Foundation, Inc

- American Cancer Society

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the breast cancer screening market analysis from 2024 to 2033 to identify the prevailing breast cancer screening market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the breast cancer screening market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global breast cancer screening market trends, key players, market segments, application areas, and market growth strategies.

Breast Cancer Screening Market , by Test Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.7 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Test Type |

|

| By Gender |

|

| By End User |

|

| By Region |

|

| Key Market Players | A&G Pharmaceutical, Volpara Health Limited, Biocrates Lifesciences AG, F. Hoffmann-La Roche AG, Quest Diagnostics Inc., Siemens Healthineers AG, GE Healthcare, Myriad Genetics, Inc., Provista Diagnostics Inc, Metabolomic Technologies Inc |

The global breast cancer screening market was valued at $2.9 billion in 2023

The forecast period for Breast Cancer Screening Market is 2024-2033.

The market value of Breast Cancer Screening Market is projected to reach $6.7 billion by 2033.

The base year is 2023 in Breast Cancer Screening Market

Major key players that operate in the Breast Cancer Screening Market are Siemens Healthineers AG, Myriad Genetics, Metabolomic Technologies Inc, and Biocrates Lifesciences AG

Loading Table Of Content...